Hemingway famously wrote that there are two ways to go bankrupt: gradually, then suddenly. In many ways, the impact of technology on our day-to-day financial choices has followed a similar trajectory. Fintech has been a gradual, but enormously consequential force of change in financial services over the past decade. But the emergence of COVID-19 suddenly catapulted the digitization of finance into overdrive—and scrambled many consumers’ typical budget. Though that leap has frequently been described in the abstract over the past six months, we were interested in portraying that historic shift in tangible terms.

To examine what exactly has changed in the world of finance—as well as weird and noteworthy patterns of consumer behavior, more broadly—we partnered with Glimpse, a software company that culls millions of online signals to identify surging trends. At a16z, we’re accustomed to closely tracking engagement, retention, and financial metrics to measure growth; in this post, we analyze growth potential through another lens: public online activity. People click, review, discuss, comment, like, search, tag, download, share, and purchase. Looking at these actions across all keywords allows us to understand the rise of a trend.

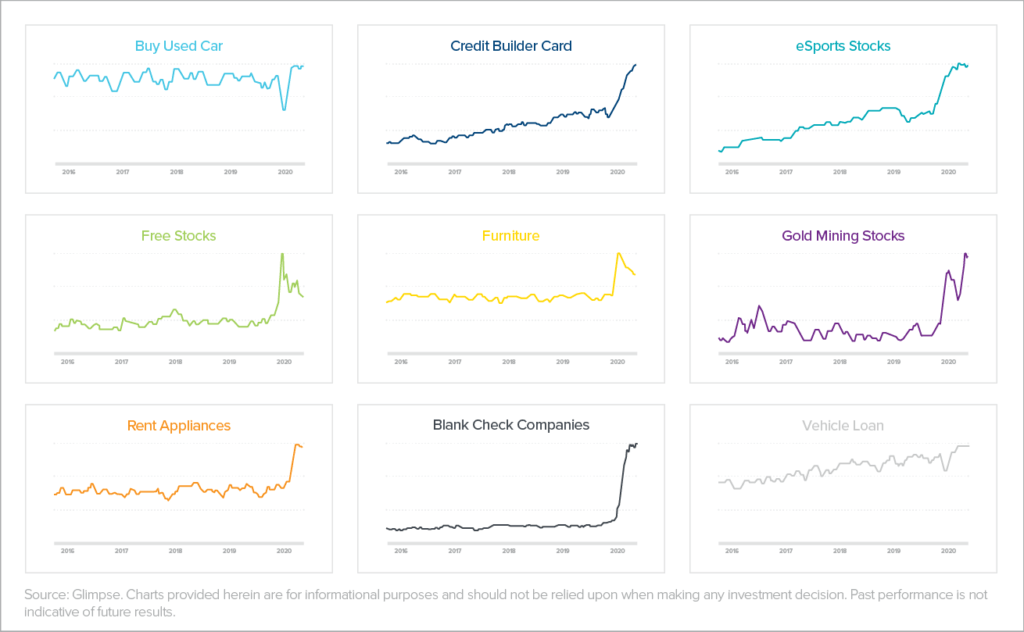

The resulting data uncovered a trove of insights across liquidity and lending, trading, small business impact, and consumer banking, all of which we delve into below. Plus: from the spike in RV loans and pool financing to the budding market for used golf balls (you read that right), it’s clear that our collective boredom is driving a slew of new consumer behaviors.

Liquidity and lending: We’re saving and paying down debt—for now

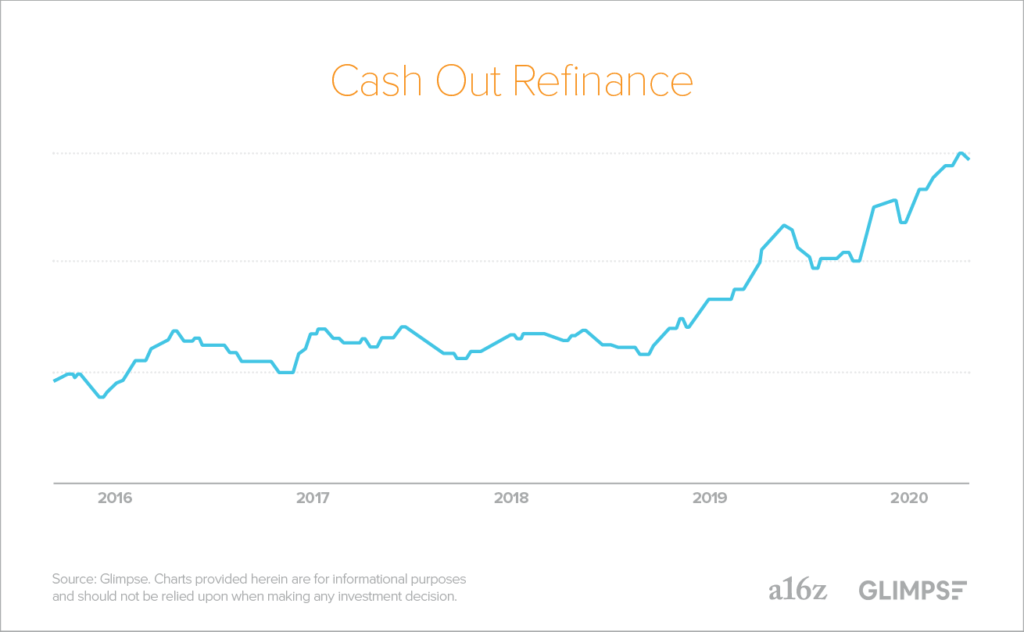

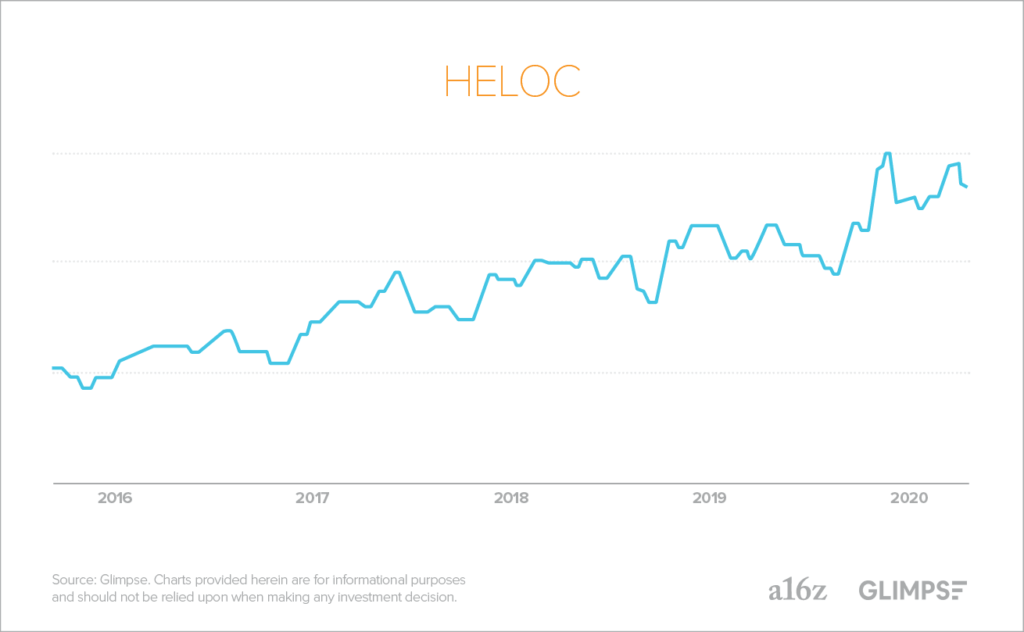

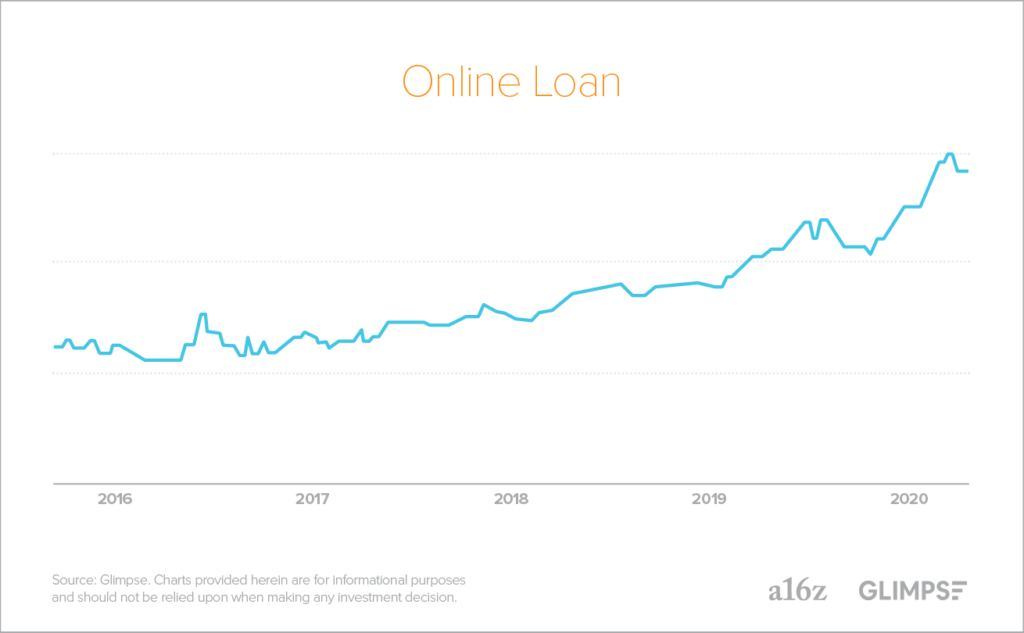

One key category in flux is liquidity and lending. We’ve seen a shift in behavior around online loans, as stimulus measures provide some cushion; meanwhile, mortgage and refi rates are at all-time lows.

For those fortunate to keep their jobs, there has never been a better time to be a borrower—rates are at historic lows. Home loan financings have surged for refinances, cash out refis, and home equity lines of credit (HELOCs), even as overall mortgage forbearance rates also spiked to post-recession highs. Savings rates have spiked, since there is little to spend money on in a lockdown economy.

Somewhat surprisingly, for the less fortunate loan charge-offs have yet to materialize. A charge-off occurs when a consumer fails to make payment for a period of time—usually six months—and the lender writes off the debt as unlikely to be repaid. Although banks have set aside massive loan loss provisions, charge-offs actually declined in the month of June. However, that encouraging trend may be short-lived. It’s likely that government stimulus measures have simply delayed the inevitable cliff, unless we are able to return to normalcy soon (or pass another extension). Surveys of borrowers show that a meaningful chunk of stimulus checks—approximately 25 percent—went to paying down debt. As a result, interest in online loans waned in recent months.

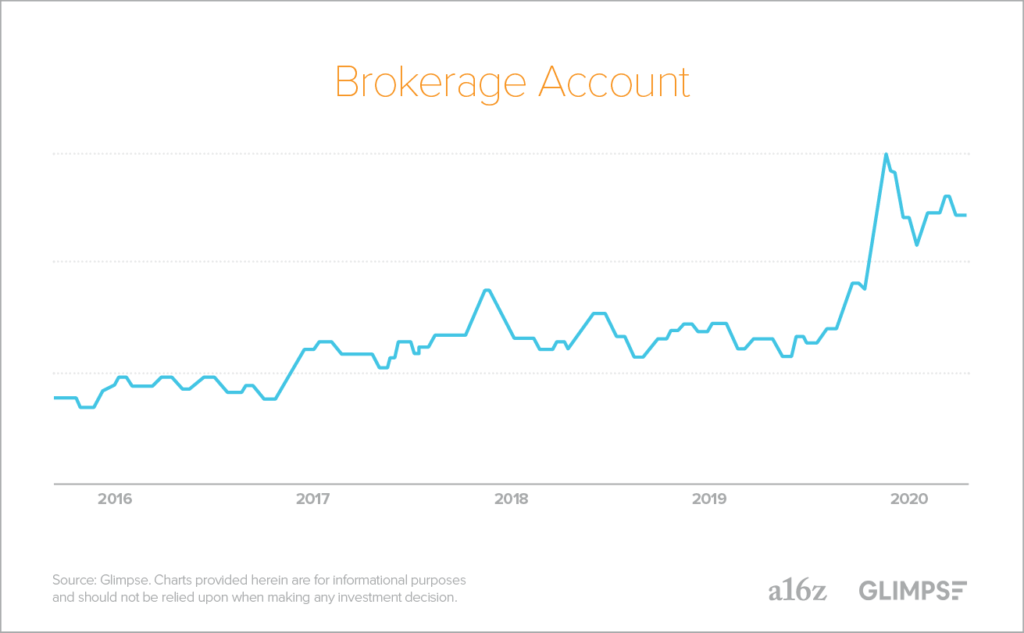

Trading: We’re easing into the stock market, for better or worse

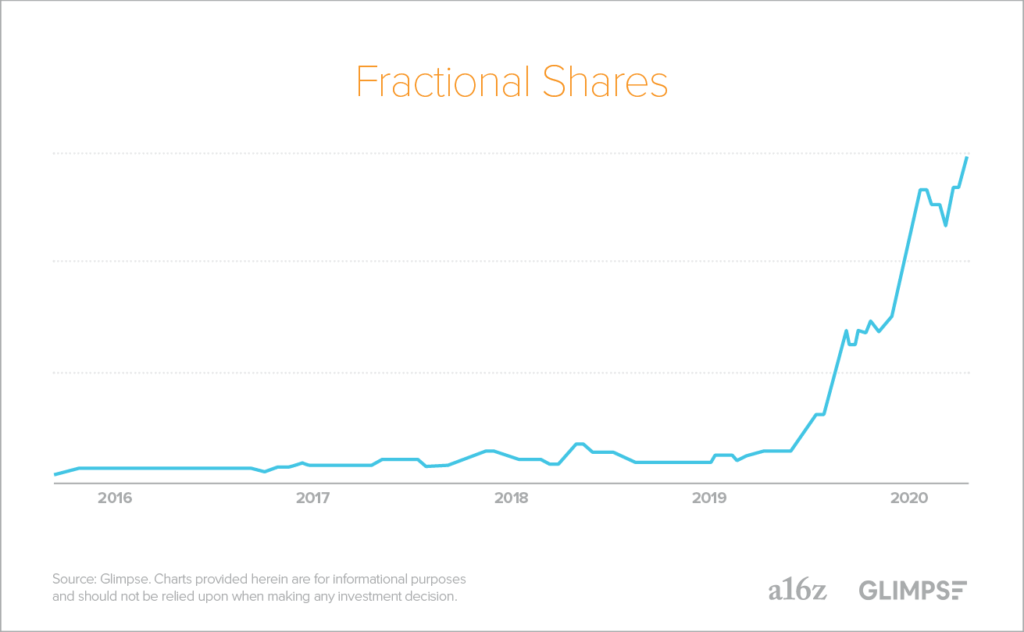

After more than 10 years of a steady growth in the stock market, 2020 has been one of the most tumultuous years of trading activity in the public markets. We’ve ricocheted from daily all-time highs in the first few months of the year to a sharp, 35 percent drop in the market in March, back to all-time highs in August. Trading platforms such as Robinhood, Stash, and others are making a play for young and first-time traders with commission-free, mobile-first, easy to use products. And older brokerages are eager to compete by offering perks like fractional shares and free trades. As a result, the major brokerage platforms have seen significant growth in both trading volume and new account creation over the past six months.

There are a couple likely factors behind the piqued interest in brokerage accounts. First, trading activity and volatility are spiking like we haven’t seen since the 2008 crisis. When the markets are uncertain—especially when the market drops 35 percent in a short period of time—people tend to spend more time looking at their portfolios and checking their brokerage to monitor their positions. In addition, when interest rates are low (they dropped to zero in March), returns on bonds and savings accounts are low and cash yield is zero. Thus, investors spend more time looking for alternatives to invest more of their capital into the markets. While trading activity spikes are more often a reflection of the movements of large institutional players, rather than retail investors, we’ve also seen a jump in trading from the latter group this year.

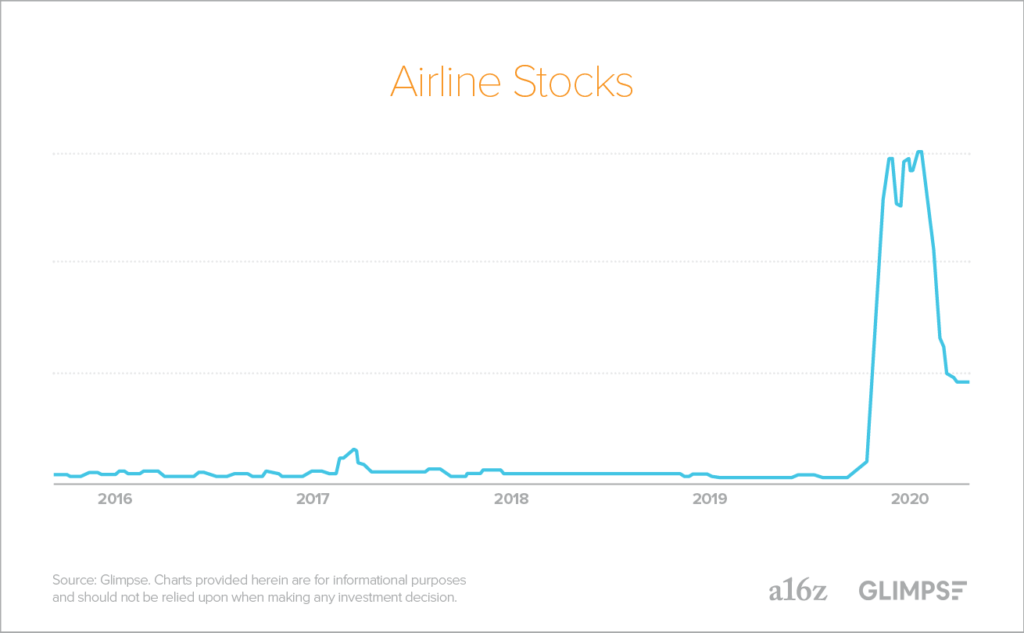

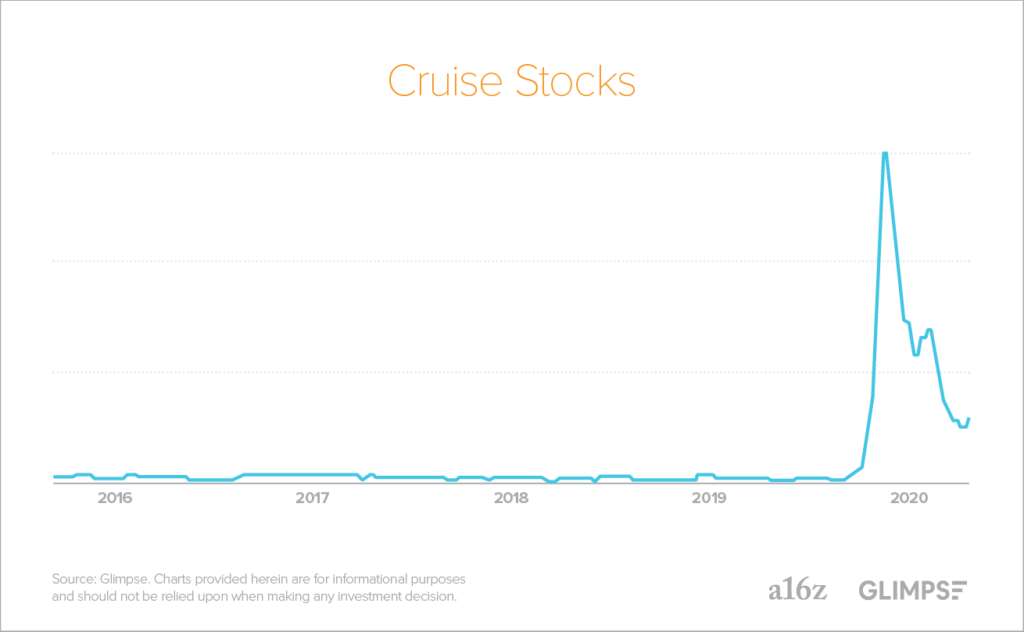

The airline and the cruise stocks were front and center at the height of the crash. Given their grim projections and undercapitalized balance sheets (Norweigan Cruise Line declared bankruptcy in March), investors were understandably bearish on their financial prospects. Even Warren Buffet famously sold out the entirety of his airline stocks. Many retail investors, on the other hand, made long term bets that they’d rally. The airline and cruise industries—almost completely overlooked, prior to 2020—have seen a recent spike in interest by retail investors, for better or worse. But after optimism this spring, there’s evidence that the trend is turning.

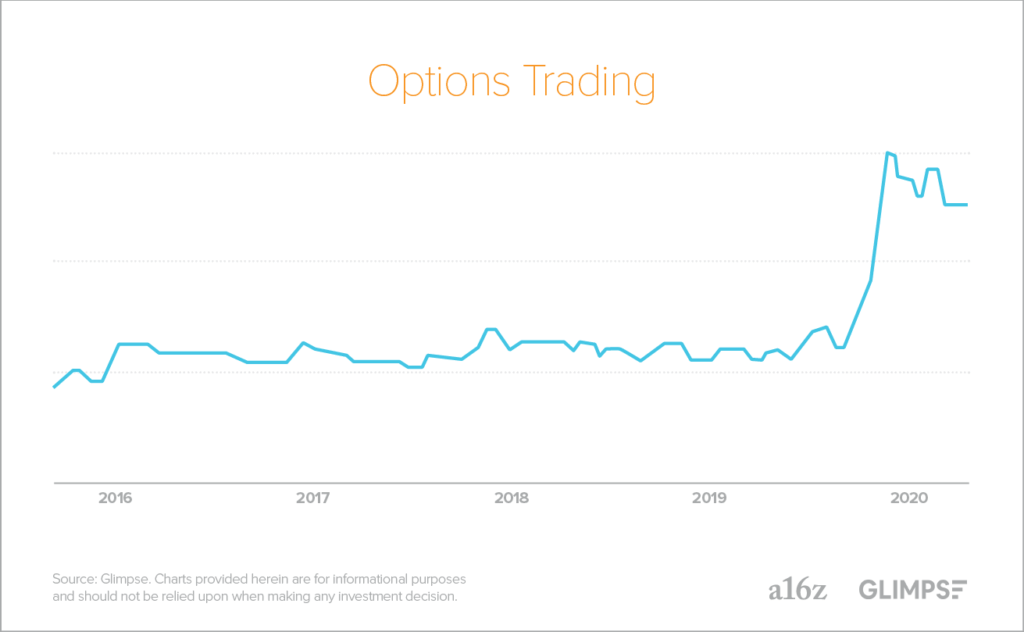

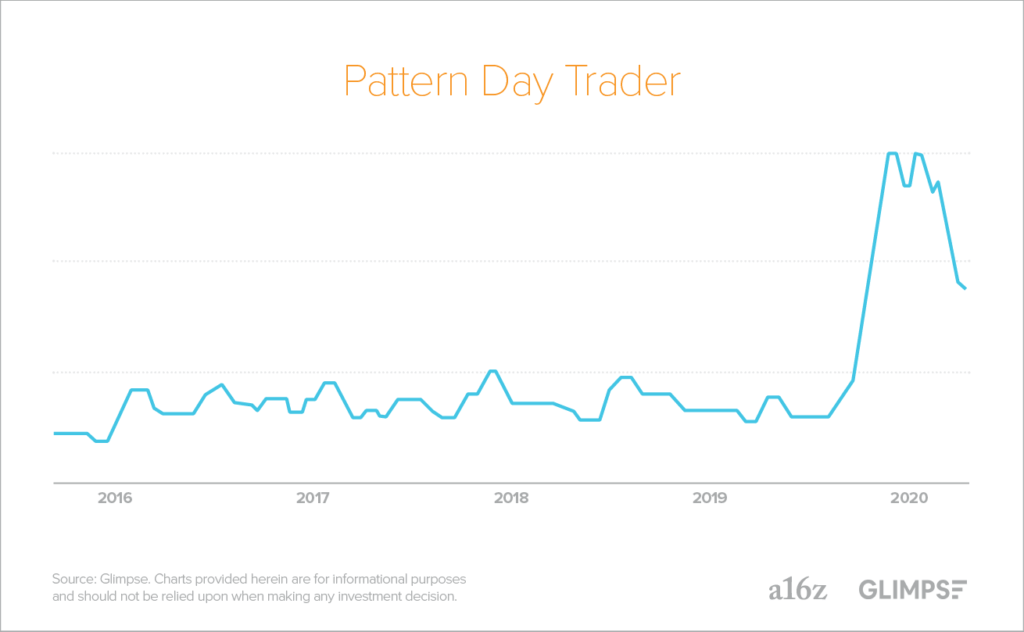

Day trading has typically been (rightfully) left to professionals who spend their careers understanding stocks and making shrewd timely bets around events. But this year, retail investors were much more apt to make short term bets on the market—and trade much more frequently. Obviously, day trading and options trading thrive in periods of high volatility, which explains some of the interest and spikes. Another possible culprit is the fact that sports (and, by extension, sports betting) and casinos were closed for a large part of the year. As a result, trading options became the closest thing available to gambling. In any case, whereas options and short term investing by retail traders was previously on a steady decline in comparison to long term strategies of “buy and hold,” the pandemic seems to have sparked a resurgence.

Fractional shares and zero cost trades are some most important developments for democratizing access to the stock market, which in turn unlocks social trading and experiences. Fractional shares mean anyone can participate in the ownership economy with as little as a dollar. This trend is even more interesting globally. Whereas approximately 60 percent of households in the US already own stocks, in India, for example, that number is less than 1 percent. In the next few years, we expect global participation in the stock market to skyrocket due to fractional shares.

Small business impact: We’re exploring our options with side-gigs and supplemental income

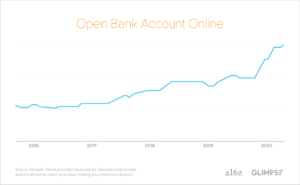

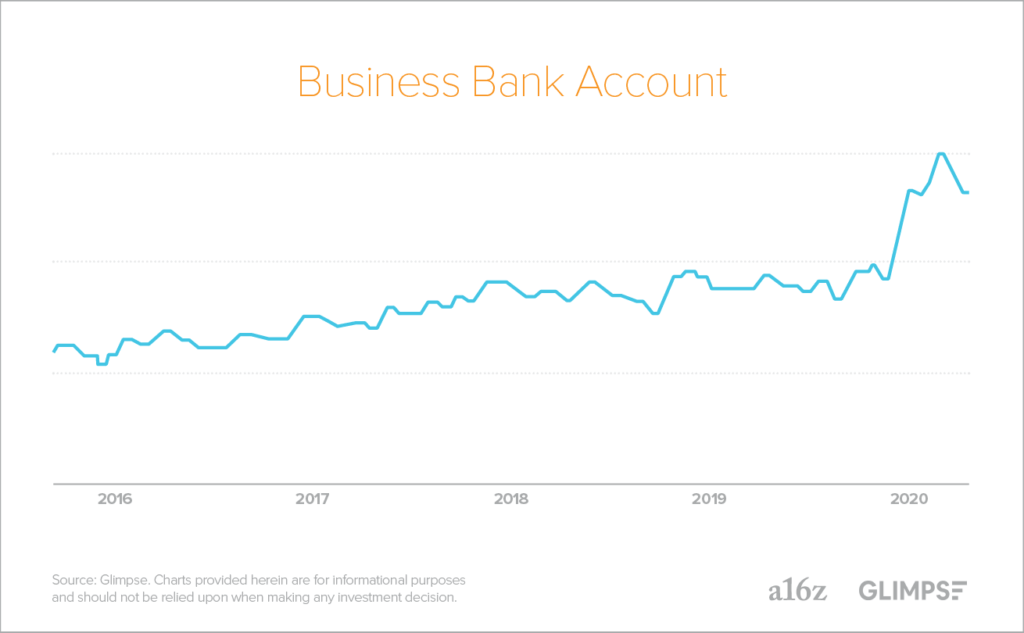

Many small business owners and entrepreneurs are navigating uncharted waters amid widespread economic uncertainty. Somewhat surprisingly, the data shows an uptick in new business bank accounts.

Since so many lost their jobs in March and April, it’s tempting to attribute this rise in business bank accounts to an increase in entrepreneurship. But it’s likely due to a combination of factors. Of course, those who couldn’t go to a branch needed to open up an account online. In addition, due to the forgiveness terms behind Paycheck Protection Program (PPP) loans, which are intended to help small businesses weather the economic impact of the lockdown, many small businesses have opened a second bank account to track their expenses. For the loan to be forgiven, PPP stipulations state that the recipient can only use the loan proceeds to pay for specific items: payroll (60 percent of the loan), as well as rent, utilities and interest on debt (no more than 40 percent). Having an additional, separate account ensures that the small business can separately track how they spent the loan—and have proof for their lender at the time of loan forgiveness.

This phenomenon presents an interesting opportunity for SMB-focused fintech companies like Azlo, which offer deposit accounts to attract new customers, as well as a number of SMB software companies like Intuit and Shopify, which recently embedded bank accounts into their software.

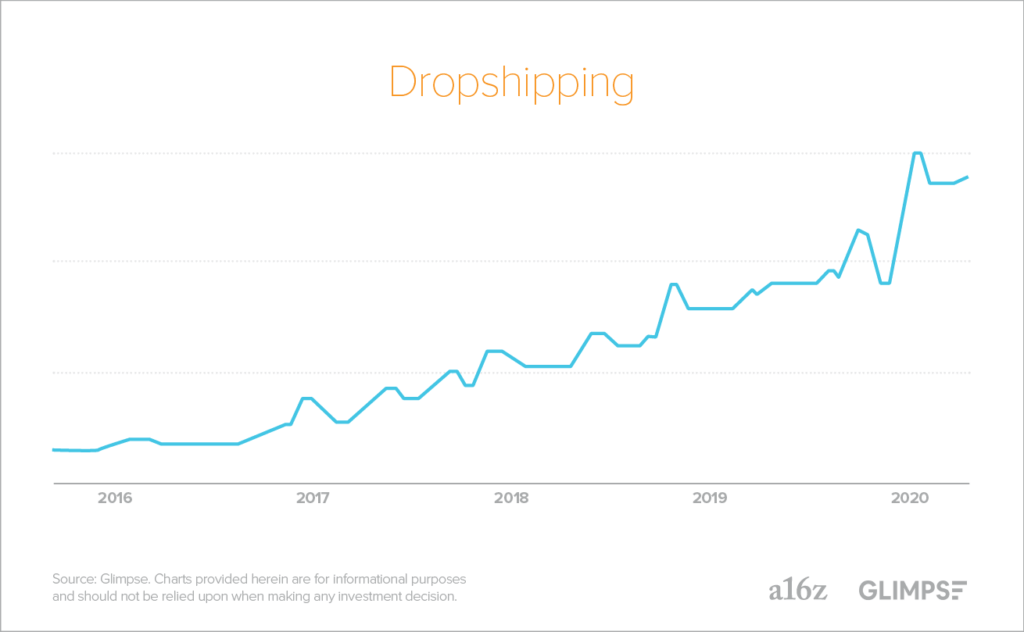

Many Americans are launching side hustles to supplement diminished or lost income from layoffs or furloughs. According to a TD Ameritrade survey this spring, 64 percent of Americans dealing with unemployment or reduced hours either had a side hustle or planned to start one. One increasingly common avenue is to set up an ecommerce store through a platform like Shopify. To do so, individuals use dropshipping, which allows them to sell a product directly from the manufacturer without needing to bear the cost and maintenance of storing inventory. It’s an obvious solution for those running a business from their homes.

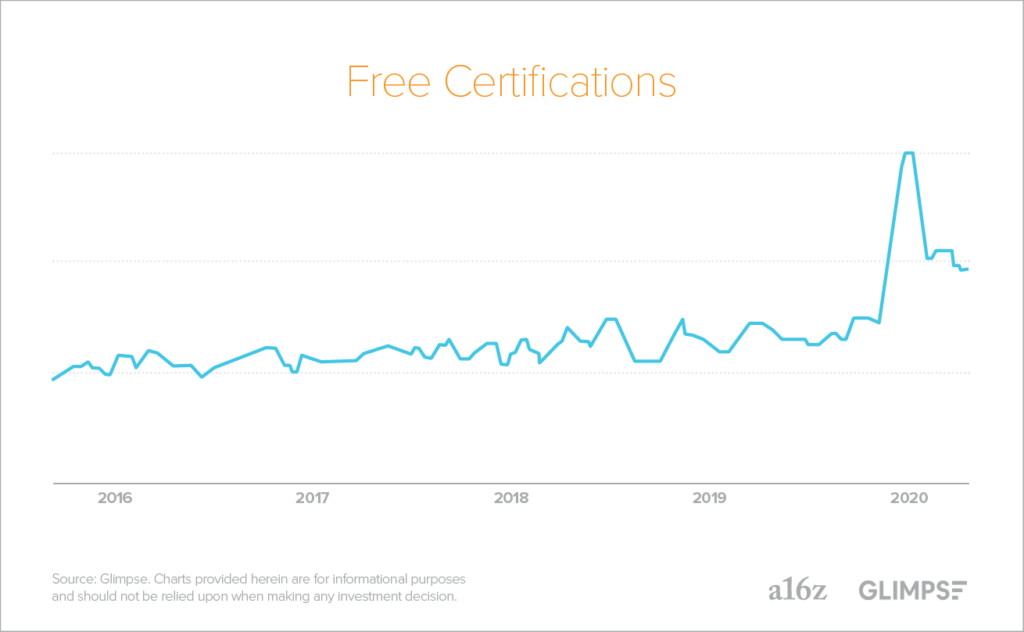

Millions are unemployed and looking for ways to be rehired into the workforce; others are seeking ways to fill the hours freed up by business shutdowns and social distancing. This might explain why many are turning to online courses and certifications as a way to bolster their job prospects and potentially make more money.

Consumer banking: We’re expecting more from our financial institutions

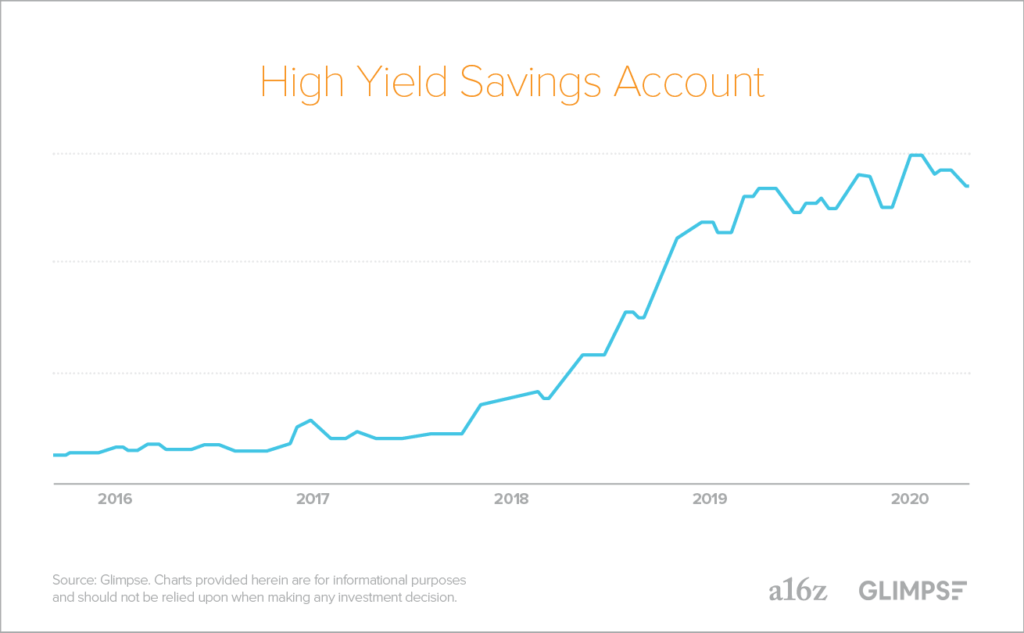

We continue to see the “barbelling” of products in consumer banking, largely split between those targeting the wealthy (such as high-yield savings accounts) and the working poor (overdraft accounts, paycheck advances, secured cards). But over time, the nature of these products, and the mindset of the customers using them, has evolved.

High-yield savings accounts were originally a product geared at super-prime customers. But they’re being increasingly adopted by “millennial savers,” who cover a much broader financial spectrum. The rate of savings in the US has been increasing during COVID, and consumers have become more savvy about seeking better returns on their deposits. All of this is good news—the days of the banks profiting from lending against deposits while paying consumers very little are (hopefully) behind us. Consumers building their nest eggs are consciously ensuring that those nest eggs are compounding as quickly as possible. Though the drop in the fed funds rate has caused APYs to drop once again (and driven some consumers to creative sources of yield), the broad trends of increased savings and awareness of yield are positive indicators of a prosperous (future) middle class.

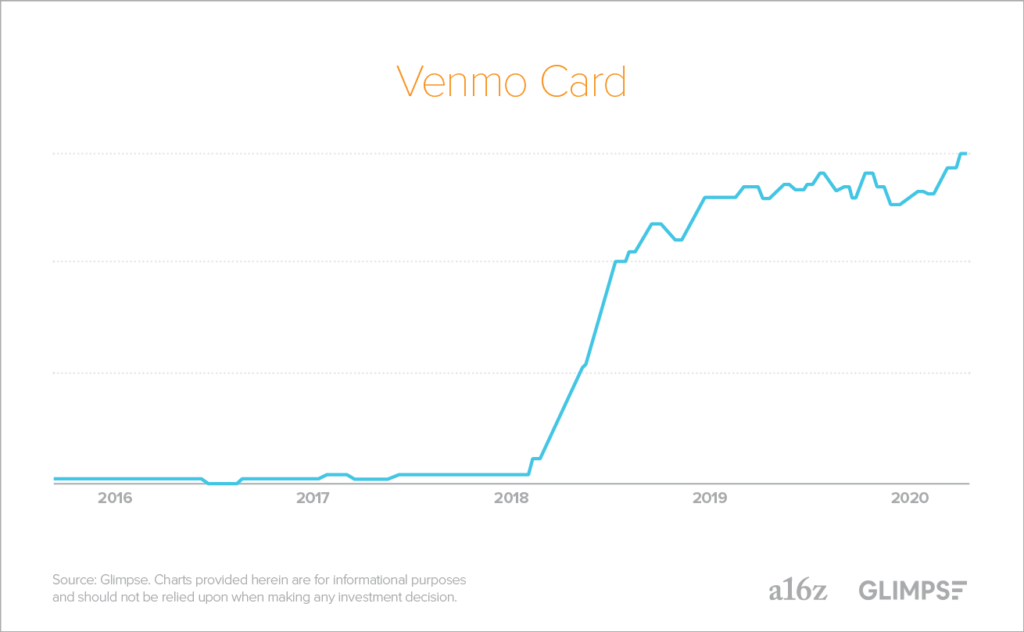

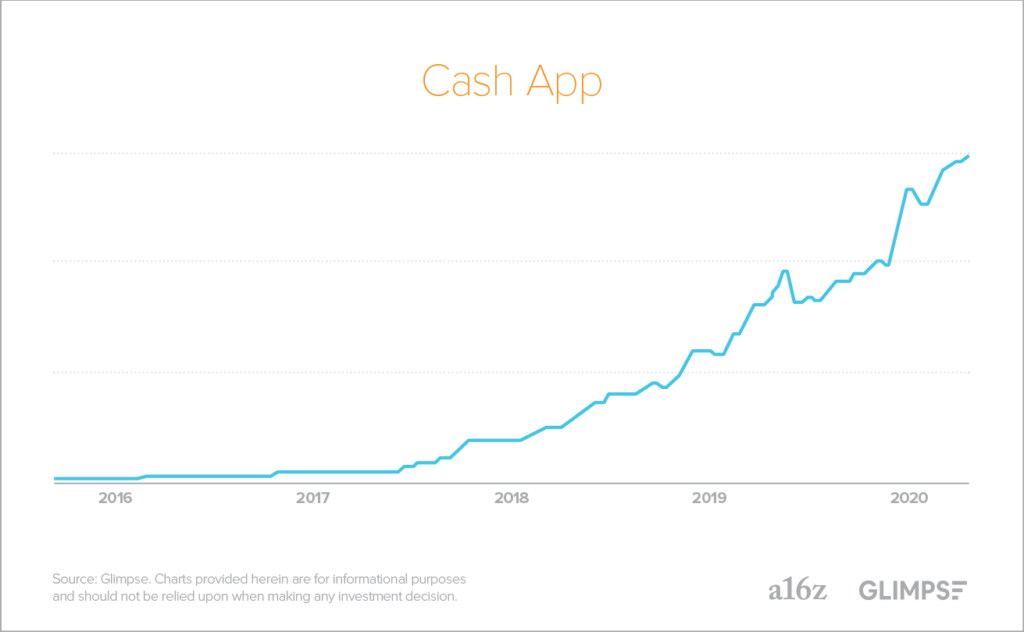

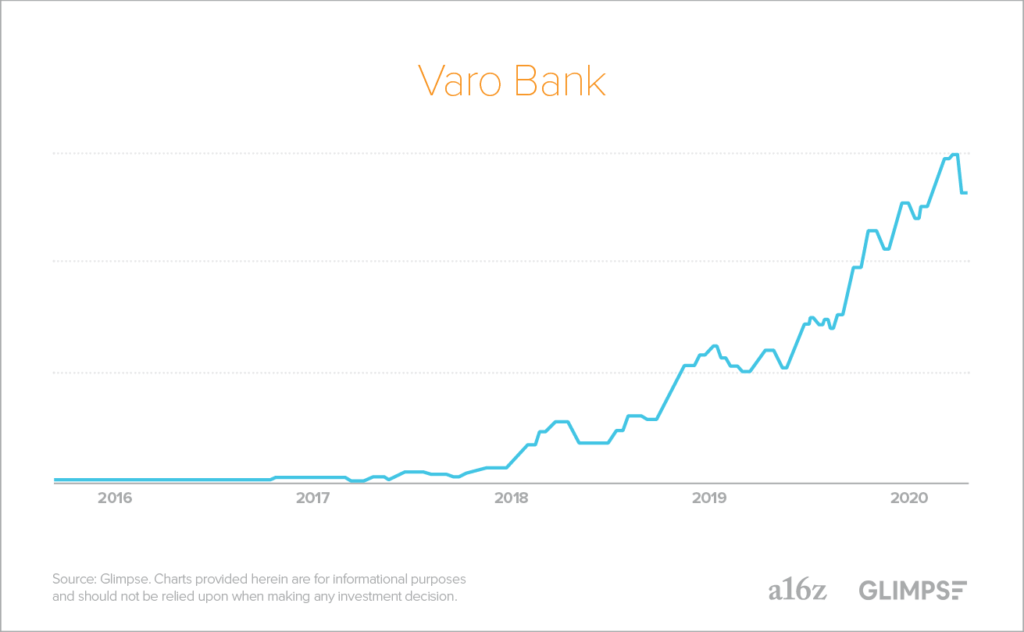

Unsurprisingly, products that can provide short term liquidity, like overdraft accounts and paycheck advances (Cash App, Varo) have seen a spike in demand. However, despite the cash crunch, stimulus relief measures mean that many consumers are actually receiving more money than they were earning, pre-pandemic. Some are using that newfound liquidity to repay short term debt, like overdrafts. And in looking at the data for the top 100 banks, we’re not seeing any significant increase in credit card charge-offs, which is often a canary in the coal mine for bankruptcies. It’s a stark divergence from the last recession—bankruptcies tripled from 2007 to 2010. This time around, the data gives us reason for hope.

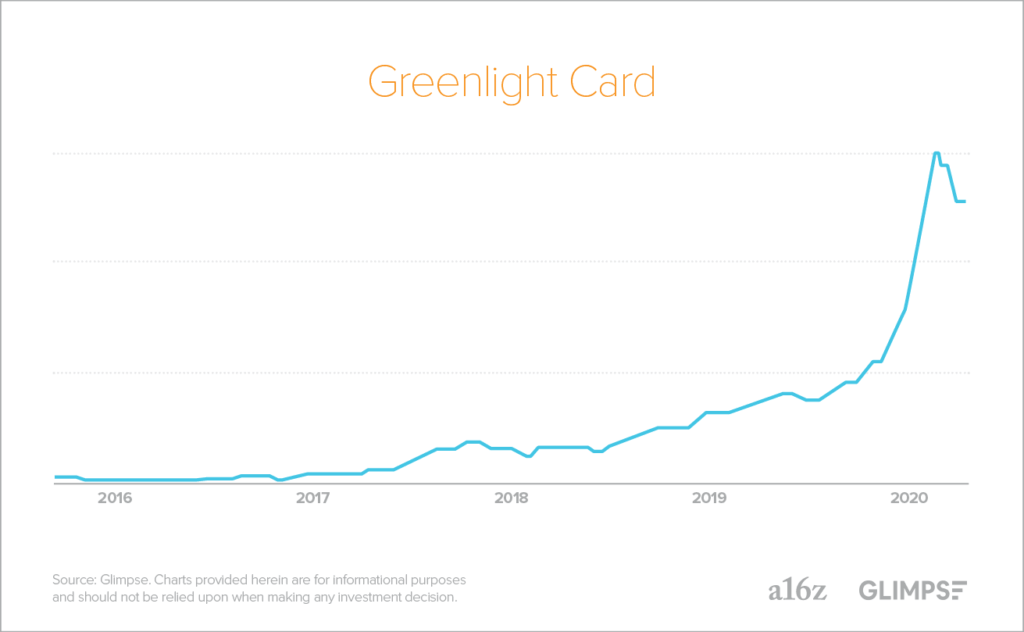

The 2008 financial crisis prompted a disillusioned generation to seek financial services from an emerging set of startups, rather than the traditional financial system. Today, many of those individuals are now the parents of young children, and are all too aware that their kids will have to navigate an alternative path to financial progress. We’re seeing enormous growth in fintech products designed to help kids establish credit, understand debt, and benefit from their spending. This trend is captured in the growth of Greenlight Card, a prepaid debit card that enables kids (and their parents) to track spending and incentivizes them to save. Similarly, Gen Z focused companies like Step and Current also show promise.

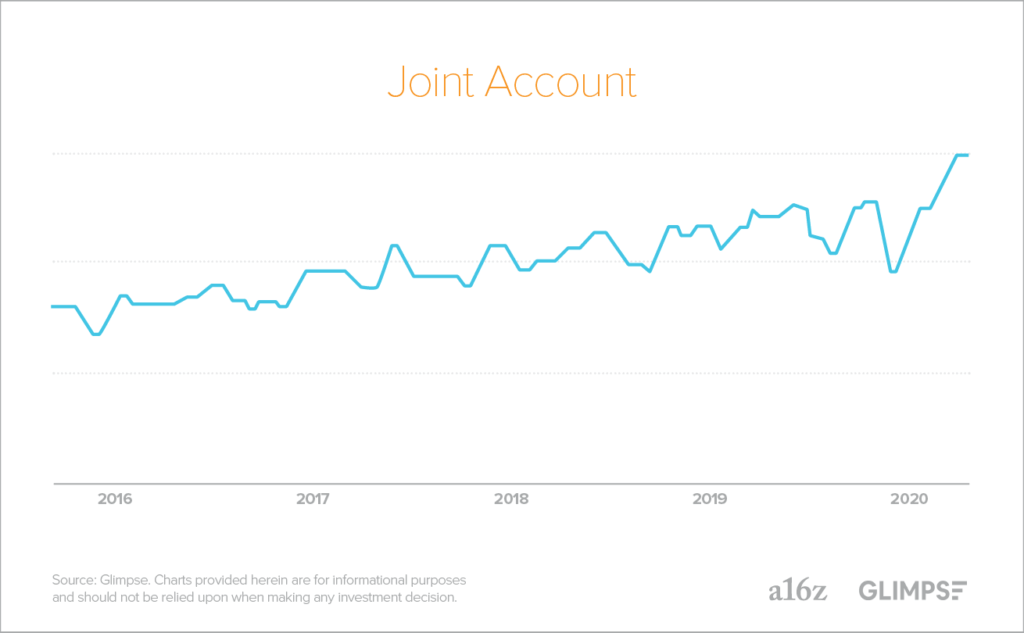

Social interaction is pervading every aspect of finance, from payment platforms like Venmo to trading apps like Robinhood. One area where social hasn’t yet taken root is around the core banking account—but the demand is clear. As opposed to Venmo or Robinhood, social for core banking doesn’t mean “share it with the world”; rather, it’s sharing with a small group of close acquaintances, like roommates, friends, a spouse, or an ex. The ability to layer in social for core banking is an intriguing opportunity. Many of the top five banks currently allow online account opening, but if you want a joint account, both people still have to show up in a physical branch. Startups like One Finance are enabling new and easy ways to create a shared banking experience.

…we’re bored AF

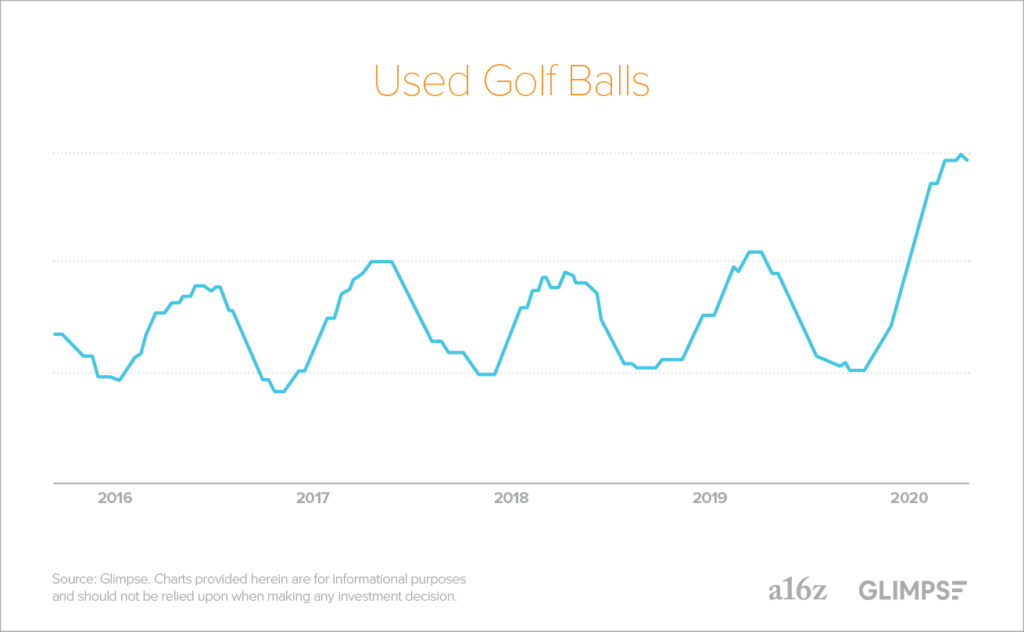

When some states recognized golf as one of the few group sports that can be played outdoors while maintaining social distance, a new wave of bored, homebound amateurs threw on polos and hit the links. Since May, almost 98 percent of U.S. courses have opened, spurring a significant monthly increase over 2019’s numbers. Still, golf is not an inexpensive hobby. Due to this flood of newbies who are eager to leave the house—but perhaps not yet willing to shell out significant cash for their newfound hobby—there’s evidence of a growing market for used golf balls. As consumers seek budget-friendly ways to shop (and may be avoiding physical retail stores), we’ve seen an uptick in interest for certain niche secondhand goods.

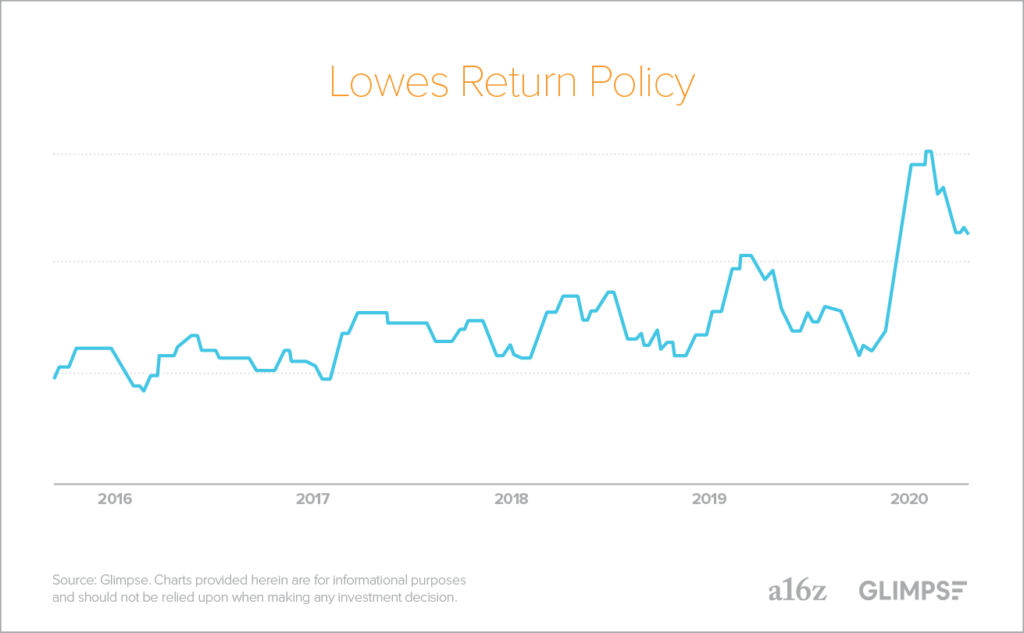

When you’re stuck at home, you become hyper-aware of all the stuff that drives you nuts about your house. Since the pandemic, home improvement projects have spiked—as has foot traffic at Lowes and Home Depot, in stark contrast to other retailers. So why the interest in return policies? There might be a couple of factors. Despite our newfound passion for home improvement, employment in many industries remains uncertain. Many Americans recognize that they might need to stretch their savings, should their circumstances change. Others may have overbought (we see you, stockpilers) early in the pandemic.

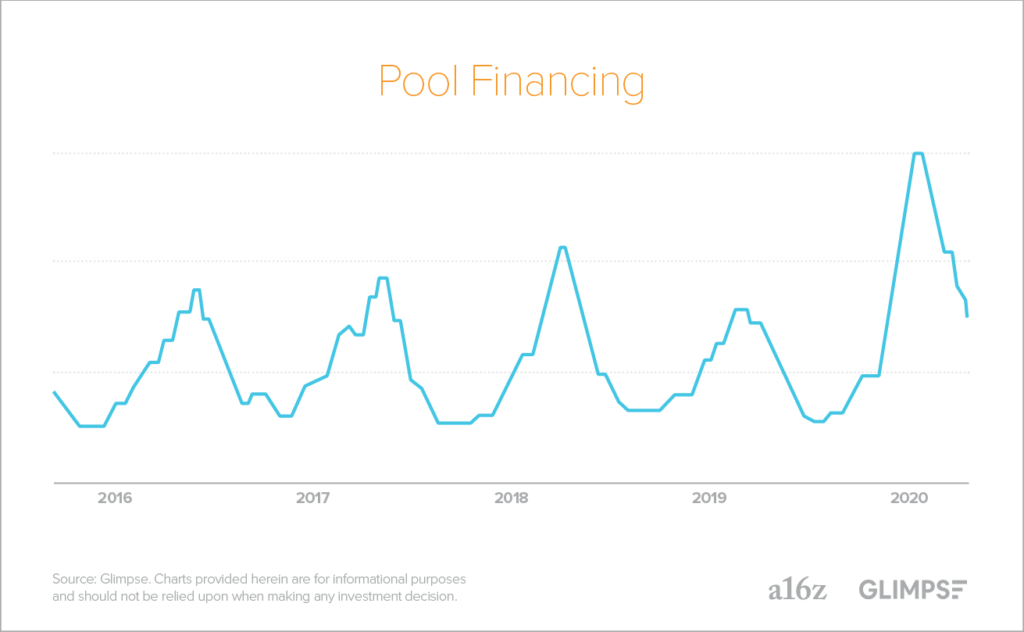

Public pools and beaches are closed. Many summer vacations—at least those reached by plane—have been nixed. Families are desperate for safe ways to have fun at home during COVID, as evidenced by the surge in demand for pool construction companies. But building an in-home pool typically costs between $25,000 to $50,000; most families don’t have that much cash readily available.

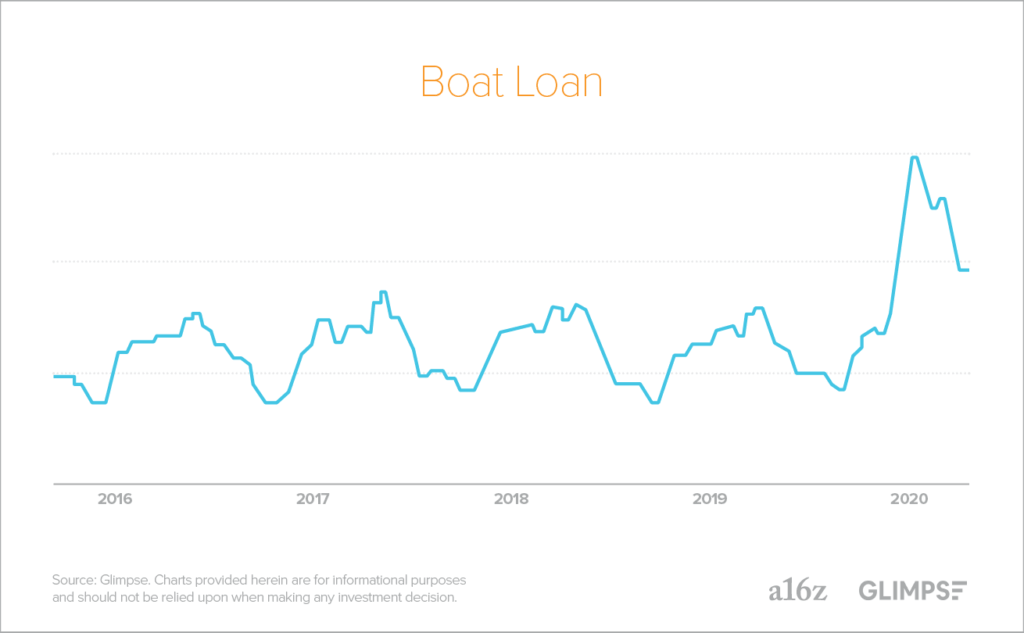

Similar to pool financing, families are looking to boats as a way to have socially-distant fun during the pandemic.

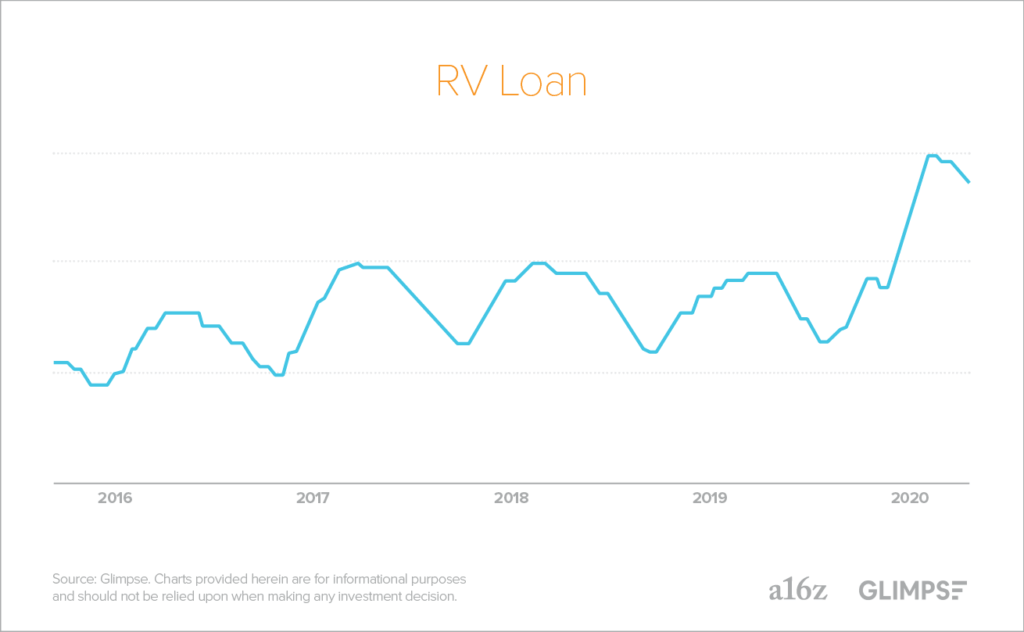

Then there are RVs. Historically, RVs have traditionally been the quintessential pro-cyclical business. Demand for RVs tanked in past recessions, and RV loans are typically the first thing consumers stop paying when they’re strapped for cash (you need your house and your credit card, but not your RV!). But in the era of social distancing, RVs have become counter-cyclical: more Americans are taking to the open road.

Get a PDF of this post—plus, extra trend graphs—in your inbox

For additional Glimpse x a16z trend graphs on credit builder cards, vehicle loans, esports stocks, and more, sign up for our fintech newsletter.

Get the PDF