The back-to-school season has been a challenging process for teachers, parents, and students across the country. While some have embraced the freedom of learning at their own pace (in their own space), many have struggled. The pandemic has cast the relationship between education and wealth—in terms of quality and access—in stark relief.

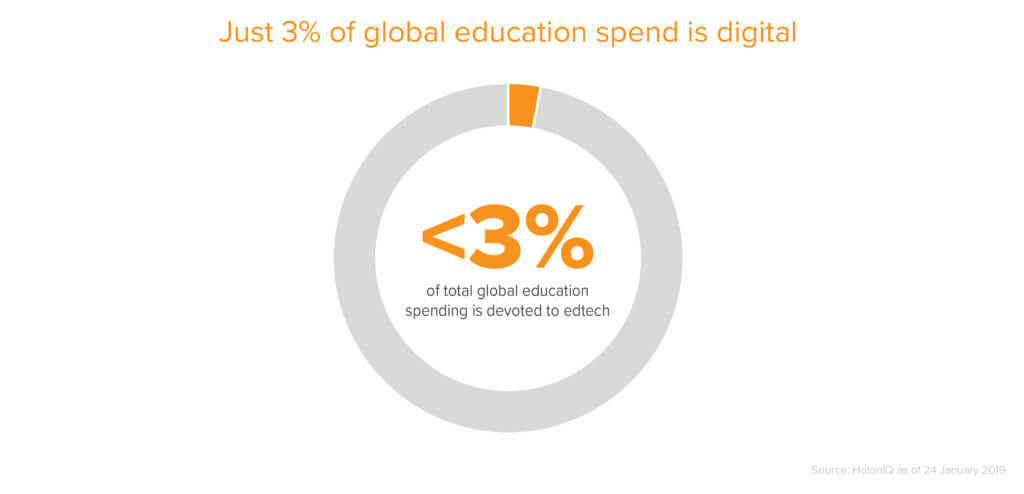

For decades, many educators and software developers have been pursuing the vision of a high-quality, affordable education delivered through technology, to varying degrees of success. Surprisingly, the amount of money spent on digital education in the U.S. still makes up a minuscule sliver of most state and school budgets, which are shrinking and famously tangled in bureaucracy. By comparison, we’re running behind countries like India and China. In China, online education is a $50+ billion industry, according to Deloitte, and is projected to more than triple in the next three years.

Meanwhile, in the U.S. COVID has brought renewed urgency to the mission to make our education system more digital and accessible. For many teachers and parents, the status quo—Zoomed-out kids passively watching teacher lectures—is sorely lacking.

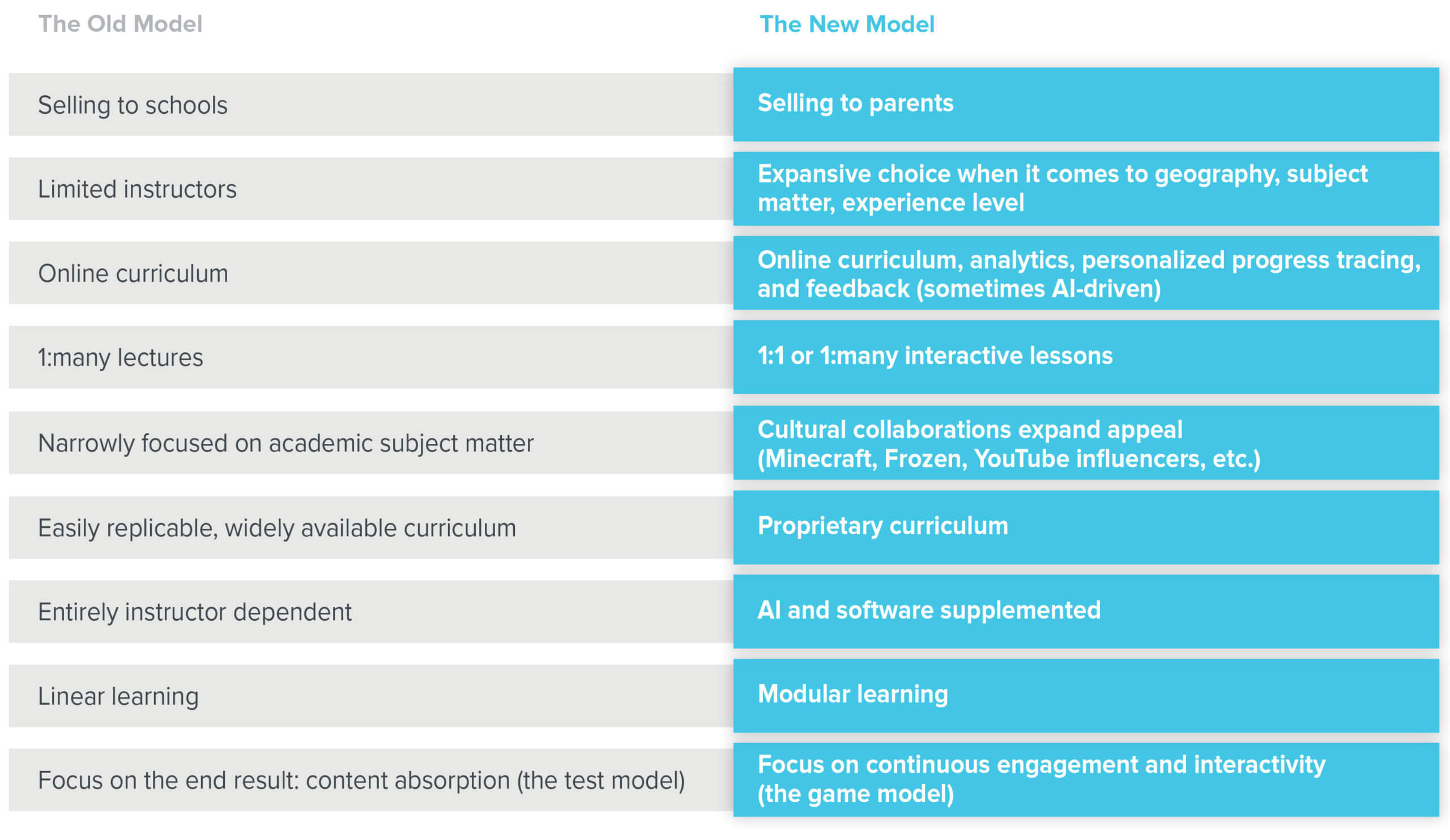

Today, a new wave of edtech companies is taking cues from gaming, entertainment, and abroad to reinvent the experience of online education entirely. If the past was marked by massive onscreen lectures, static, pre-recorded content, and a limited pool of teachers, the future of education technology will be consumer- and product-led: interactive, engaging, and propelled by a global pool of instructors and peers.

While previous generations of edtech largely focused on in-school content distribution, more recently founders have turned their attention to after-school and out-of-school education. There’s a lot left to build. We believe post-COVID online education will differ from the past in key ways.

Background and drivers

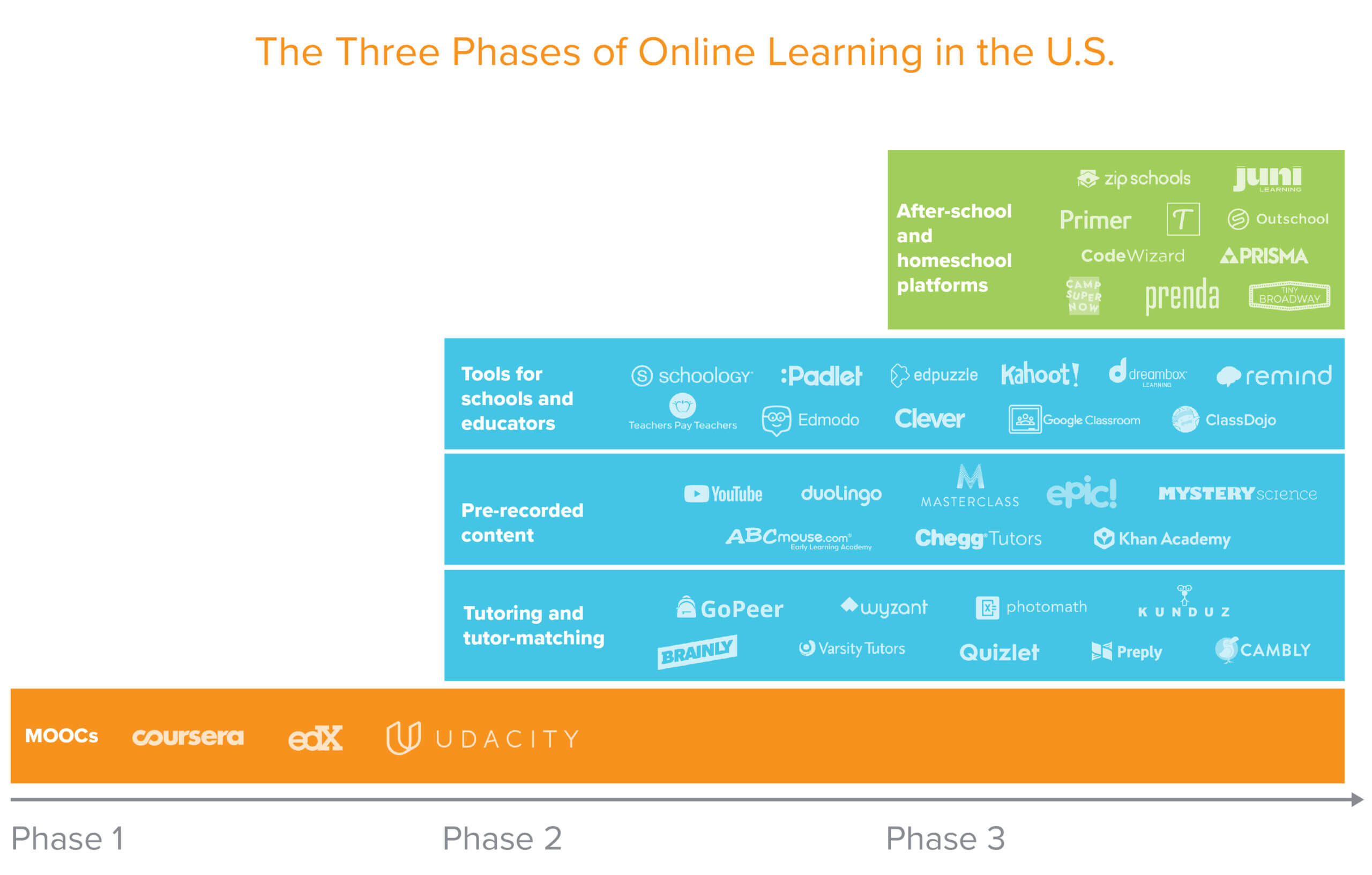

Though edtech has been decades in the making, founder philosophies have shifted over the years.

The first wave of modern edtech was dominated by MOOCs: free online courses, often in partnership with leading universities and professors, that anyone could enroll in from anywhere in the world to learn at their own pace. In the next phase, many founders built tools and resources for schools that were supplementary to in-person educators. In the current phase, many edtech founders have shifted their focus to after-school and out-of-school supplemental learning.

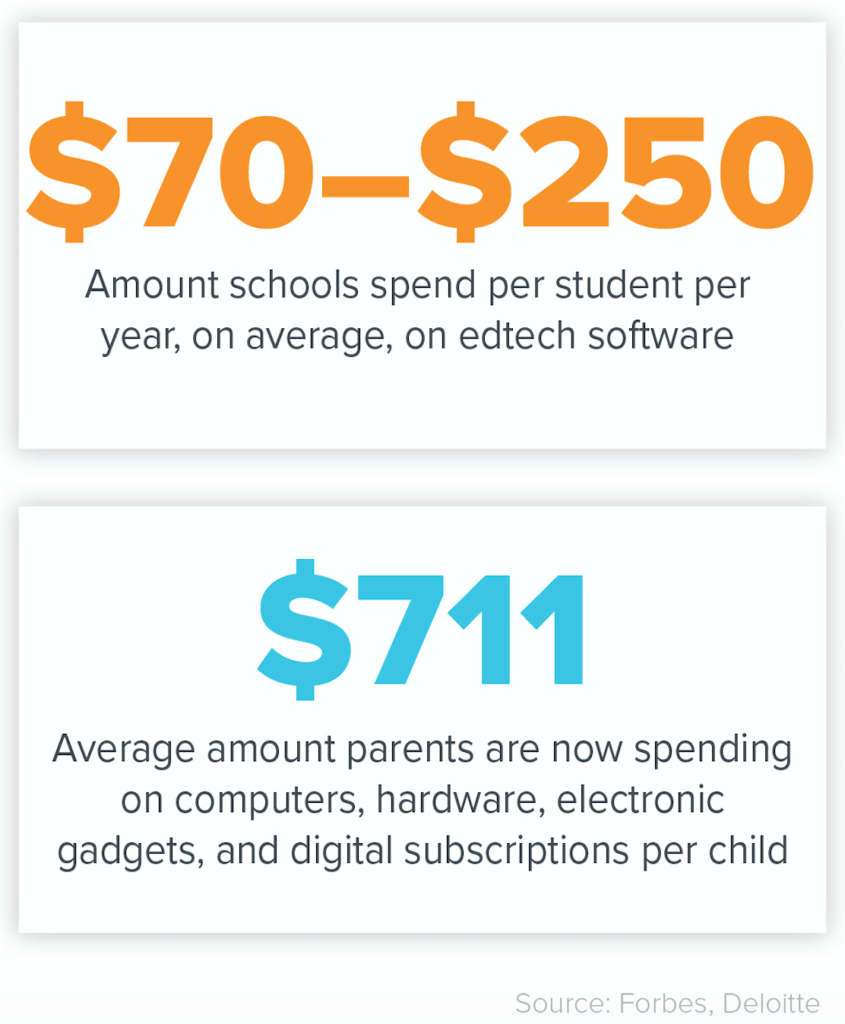

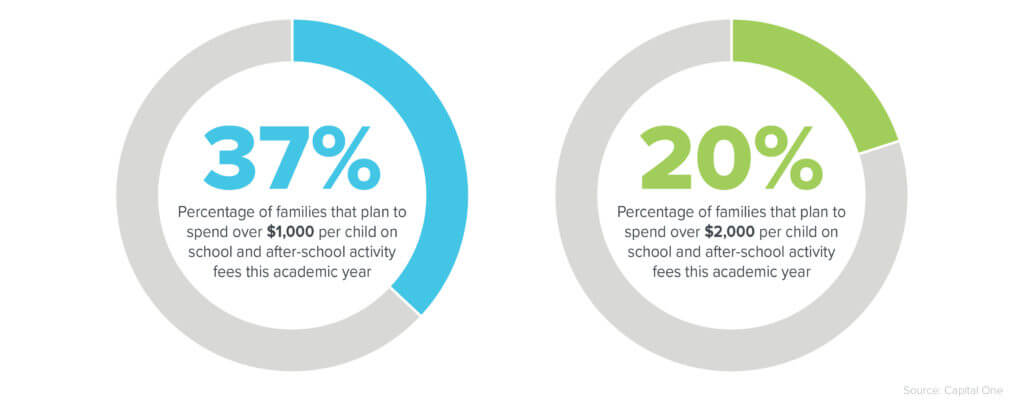

While some would argue that YouTube has become an online school in its own right, there’s huge opportunity to offer curated, high quality, live educational experiences. Many parents are taking an increasingly pronounced role in the academic experience, and we’ve seen the emergence of new platforms for supplemental education and homeschooling. In addition, edtech companies are tackling areas that have often been overlooked or underserved by public school budgets, such as the arts, sports, study abroad opportunities, technology literacy, and vocational skills. Of course, the hurdles to modernizing our education system at scale are significant. Prior to COVID, edtech companies largely sold to schools, with mixed results. There are many reasons the B2B model didn’t penetrate—a misalignment of stakeholders (not to mention the many degrees of separation between the buyers and the actual teachers), dispersed financial decision-makers, and long sales cycles among them. But the primary reason selling to schools didn’t catch on more widely? Funding. That shortfall amplified by COVID-19.

Of course, the hurdles to modernizing our education system at scale are significant. Prior to COVID, edtech companies largely sold to schools, with mixed results. There are many reasons the B2B model didn’t penetrate—a misalignment of stakeholders (not to mention the many degrees of separation between the buyers and the actual teachers), dispersed financial decision-makers, and long sales cycles among them. But the primary reason selling to schools didn’t catch on more widely? Funding. That shortfall amplified by COVID-19.

Public K-12 schools are funded mostly by state governments, and state revenues have been drastically impacted by recent business shutdowns: This spring, New York schools received a temporary budget reduction of 20 percent; Colorado plans to spend 15 percent less on education next year. Georgia cut its education budget by $950 million, and Ohio by $300 million amid the recent economic fallout.

Public schools’ budget limitations have created a surge in alternative avenues of education, for those who can access them: private schools, homeschooling, and supplemental education. Edtech companies targeting this market combine software and online distribution to help make teachers’ jobs easier and learning more engaging.

Six ways post-COVID edtech will differ from the past

The latest wave on online education companies builds on previous efforts in key ways:

Parents cut through red tape

While educators around the country adapt to the challenges of virtual classrooms, many parents have become increasingly involved in their kids’ education—whether out of enthusiasm or necessity. According to a July Deloitte survey of 1,200 parents with children in grades K-12, 51 percent report spending more on internet-based learning resources such as virtual tutors, subscriptions to e-learning platforms, and online classes. Edtech companies have also introduced a variety of business models to cater to neighborhood-based or remote education “pods,” from monthly subscriptions to class packs to a-la-carte lesson marketplaces. These solutions often focus on small-group, project-based learning and cover subjects beyond the usual standardized testing curriculum. In addition, the increased role of parents in their kids’ education during COVID has led to the rise of “flipped” classrooms, in which students are introduced to content at home by parents and then practice applying it at school (instead of the other way around). While present in the past, these methods are rapidly becoming more prevalent.

Teachers will be free agents

Edtech platforms give everyone access to the most talented, experienced, and innovative teachers, unconstrained by geography (or public school salary caps). On new and established platforms like Teachers Pay Teachers, Padlet, and Numerade, educators across the country can share and collaborate with one another on the best resources and methods for a particular topic, rather than following a pre-established playbook. Teachers Pay Teachers is a marketplace for teachers to buy and sell resources for any subject area and grade level, from lesson plans to presentations. Padlet is a digital multimedia whiteboard where teachers can showcase content—be it YouTube videos, websites, text, or their own audio clips—that can then be saved, shared, or commented on. And on Numerade, educators provide step-by-step explainer videos for high-school and college-level STEM problems.

Where these types of activities were possible in the past, there is more depth and optionality to online marketplaces than ever before. Parents can seek out the best instructors for specific topics—tailored to the needs of each individual child. Kids get access to a wider variety of learning resources and teaching styles. And educators are less constrained in their curriculums (previously defined rigidly only by districts) and can share and monetize their talents with a wider audience. These models can also expand the talent pool of instructors and assortment of subjects taught: on the supplemental education marketplace Outschool, for instance, anyone with expertise can create a class.

MOOCs get a makeover

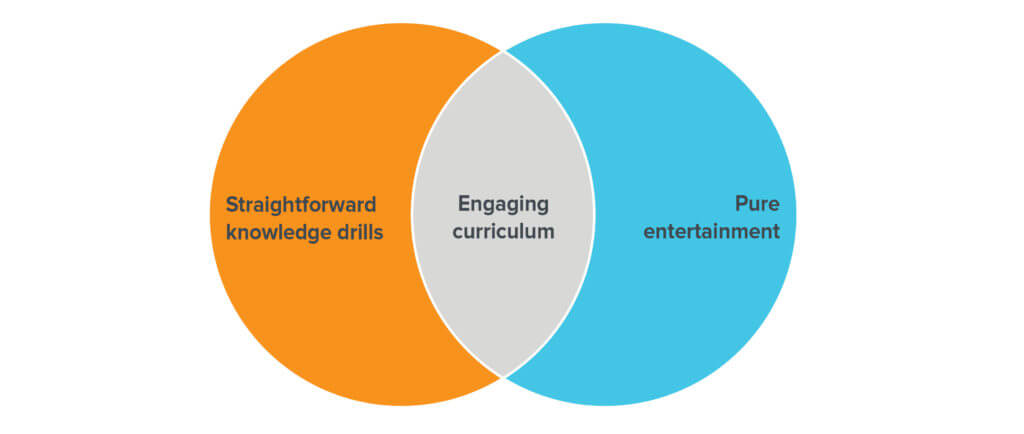

Massive open online courses, or MOOCs, have been decades in the making. And while they’re adept at distributing content widely, MOOCs have been plagued by low completion rates. The next iteration of one-to-many lessons will be more community-based, “gamified,” and interactive.

Through the next generation of Bill Nyes—on platforms like Age of Learning (ABC Mouse), Mystery.org, and Tappity—kids can interact with teachers through choose-your-own-adventure-style lessons. This element of personal agency helps hold kids’ attention and makes them feel like they’re part of the journey. In addition, live group educational experiences featuring cartoon characters are on the rise: ZipSchool offers after-school, STEM-focused live experiences, while Tiny Broadway focuses on the performing arts.

The large group, community-based approach also extends to high school test prep. The livestreaming test prep platform Fiveable, for instance, was founded by a successful advanced placement teacher in Oakland, California. Now AP teachers around the country conduct live sessions on the platform with thousands of students in attendance. While one-to-many online teaching is by no means new, modern platforms are harnessing technology to make learning increasingly interactive. Students are incentivized to engage with both the subject matter and the community.

Math meets Minecraft (and Mickey)

Entertainment and kid culture is creeping into all aspects of education, beyond just “for kids.” One example is EduHam, an educational program spun off the hit Broadway show, which launched a fully virtual experience that guides students through the Hamilton creation process. At the conclusion, students create and perform their own musical theatre pieces. In a similar vein, iPad-based Osmo draws on Mickey Mouse and Disney princesses to teach kids lessons in coding, drawing, and math. But unlike the animated educational games of the past, these meld the digital with the tactile, combining an interactive video experience with physical word and number tiles, coding blocks, tangrams, and more.

Taking the trend a step further, companies like Legends of Learning create educational games to teach STEM subjects and offer real-time analytics on student performance. The aim is twofold: to make learning more fun and give teachers deeper insight into student comprehension and retention.

Legends of Learning uses educational games to teach K-8 STEM concepts.

YouTube gets unbundled

Through user-generated videos, YouTube pioneered a popular online educational format—half of YouTube users have used the platform for learning purposes, and a third of parents let their kids watch YouTube regularly, making it more ubiquitous than many edtech platforms and tools. Now, verticalized startups are carving off niche subjects to provide a variety of learning styles for various interests and budgets. Sora’s personalized curriculums meld live and independent learning and are driven by individual student curiosities, such as planetary science or multicultural literature. Juni Learning creates high-quality curriculums on subjects like coding and computer science, while CodeWizards provides both live online coding classes and internship matching. Platforms like Primer and Prisma focus on project- and application-based learning for at-home schooling. In many cases, online curricula is becoming more narrowly focused and tailored to students’ specific interests and learning styles. These platforms strive to make connections outside the classroom to boost relevancy and retention.

Software frees teachers from after-school drudgery

AI isn’t coming for teachers’ jobs—it’s coming for their busywork. A range of companies are working on tools to assist with in-person teaching and classroom management, allowing teachers more time on the high-value activities: lesson planning and teaching. Single-sign in platform Clever enables instructors to access all their teaching apps and tech resources, providing a secure pipe to school district data and applications. Companies like ClassDojo, Remind, and Edmodo help teachers to build better classroom communities through awards, incentives, and increased parent-teacher communication. Google Classroom and Microsoft Teams allow teachers to digitally manage homework submissions that previously had to be printed, hauled back and forth to school, and manually tracked. Paper is a 24/7 educational assistance chat line for students to get tutoring on-demand. This segment of edtech isn’t solely about content, it’s also about software-enabled tools that work to streamline teachers’ mountain of tasks, beyond instruction.

* * *

Many parents, students, and instructors have struggled—and continue to struggle—with the abrupt transition to remote learning spurred by COVID. But we are optimistic that through the work of talented teachers, entrepreneurs, and technologists, we’ll emerge from this pandemic with significantly better tools and resources for online learning than ever before. The virtual classrooms of the future will have classroom-specific features, rather than using general video conferencing software. Thanks to advances in software, AI, livestreaming, and video tools, we believe this generation of edtech platforms will be more engaging, interactive, and accessible than the past. There’s still a lot of opportunity to build in this space. We’re excited to meet the new wave of edtech founders.