With the goals of encouraging innovation in cryptonetworks and yet protecting retail investors from fraudulent activity, many government regulators — from the SEC to state regulators — have been considering how best to strike the right balance. There are many considerations involved here, but one frequently asked question that’s top of mind is: How does one protect individual (“retail”) investors from bad actors, so they can still partake in the capital markets without being taken advantage of?

Put another way, if crypto tokens are regulated as commodities and not securities (once the networks are decentralized) — along the lines of the SEC’s latest pronouncements about bitcoin and ethereum — do we risk creating a “regulatory gap” that exposes more vulnerable retail investors? The answer is no, and below I share why, as well as some of the agencies and players involved in these regulations.

* * *

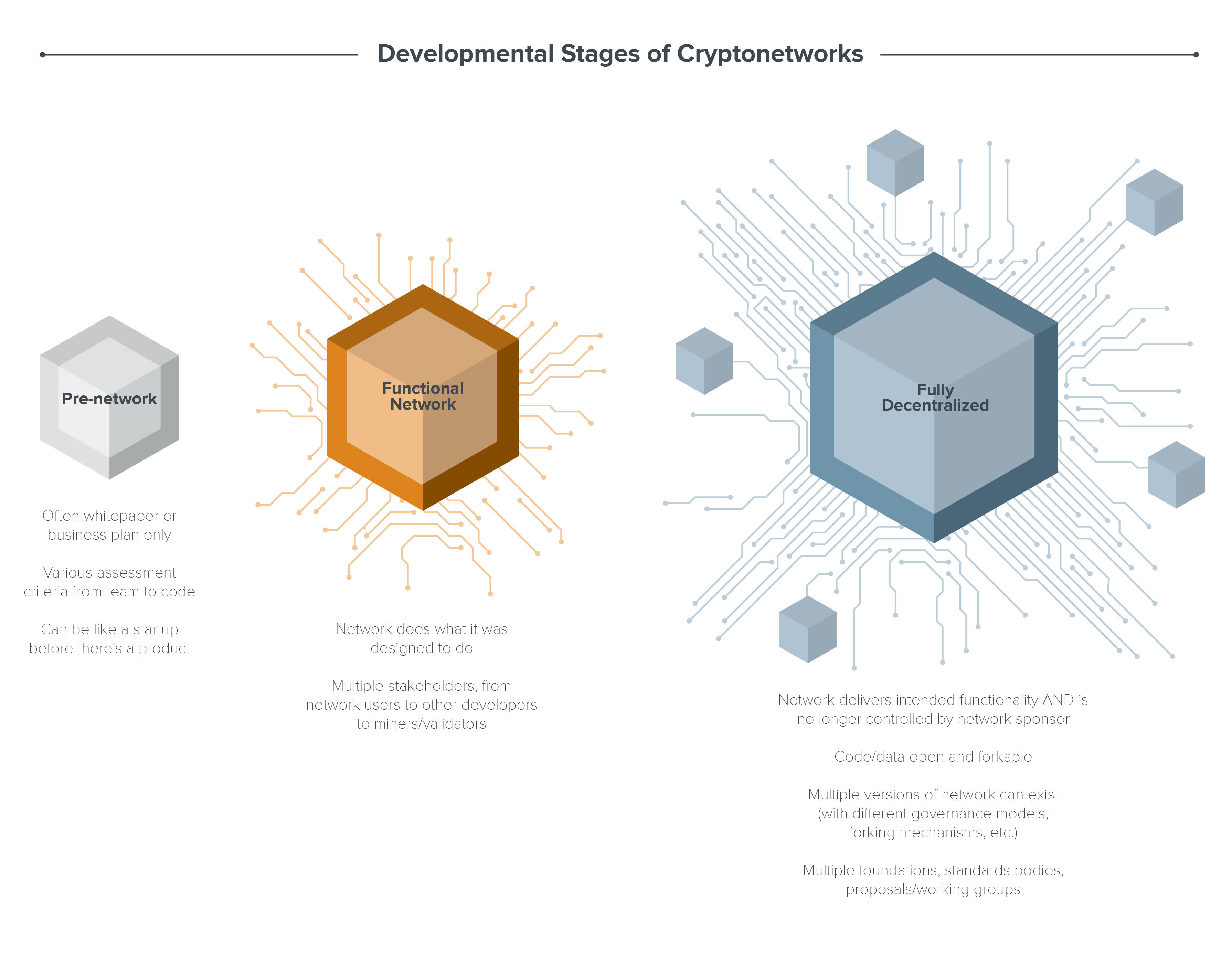

First, it’s important to remember that there’s a developmental lifecycle of cryptonetworks to consider, and that individual investors are most vulnerable in the pre-network phase:

The potential lifecycle of cryptonetworks, from early to mature phases

Under the classic Howey Test (full analysis here), offers to sell tokens in the pre-network phase before launching the network are likely securities, and thus fully regulated by the SEC. Given that the buyer is entirely reliant on the network sponsor to build the network, this makes sense: If the network sponsor fails to build anything, there’s no viable opportunity to realize value from the investment. It’s also far riskier for lay investors since there is often only a whitepaper on which to make an investment decision: Not only do the details shared in these papers vary greatly, as well as the expertise required to assess what’s in them, but fraud can even occur in the form of people faking code to make things look more promising than they actually are. Finally, since there’s no secondary resale market yet, there is no place for the investor to offload shares if the network never gets built. Those investors are stuck with nothing more than the paper that got them there in the first place.

Luckily, the SEC — whose stated mission is to protect investors; maintain fair, orderly, and efficient markets; and facilitate capital formation and market trust — is taking care to ensure that laws are followed for any early crypto offerings governed by securities regulations. And as reiterated most recently, their enforcement division will continue to focus on eliminating bad actors from this market. (Note there are also a number of other players in the regulatory landscape who play important roles, which we don’t share in detail here.)

So how are individual investors protected when a network is more than just a whitepaper — and is functional, and even fully decentralized?

That’s where the CFTC (U.S. Commodity Futures and Trading Commission) comes in. Like the SEC, it’s an independent government agency that regulates the markets but focuses on futures and options — including cryptonetwork derivatives markets, and anti-fraud and anti-market manipulation in crypto spot markets. We recently saw the exercise of this authority with the Justice Department’s launch of an investigation into allegations of spoofing and wash trading in the bitcoin and ether markets. In “spoofing”, traders submit a number of orders for a cryptocurrency and then, once the price moves in the desired direction, they cancel them. “Wash trades” are buy and sell orders that traders execute with themselves in an attempt to make other market participants believe that there’s significant trading activity happening in the market. Both of these activities are manipulations to contort the actual value of a commodity.

Since bitcoin has been declared a commodity — and, as of June 15, the SEC’s Head of Corporate Finance declared that ether is not a security — the CFTC has jurisdiction for that particular behavior. Assuming other tokens are ultimately also declared commodities, the CFTC will continue to have similar jurisdiction to help protect retail investors in cryptocurrencies. (Again, I’m glossing over here the many other regulatory players in the broader landscape — at both a federal and state level, as well as regulatory vs. enforcement — but for now, these are two to know of.)

So where’s the “regulatory gap” then? Going back to our diagram, we’re still only talking about the two extremes of the market lifecycle of a cryptonetwork: the early and more mature phases. Everything in between is a potential gap in regulation, where we have functional utility and trading of tokens, but the network is still young and may not yet be fully decentralized.

Luckily, there are two existing analogies in the capital markets today from which we can draw some insight for how to address this protection gap:

Lock-ups. When any company goes public, all major shareholders and insiders are required to sign a “lock-up” agreement, which generally prohibits those shareholders from selling their shares for the first six months after a company’s initial public offering (IPO). Why? During this time, trading is still being stabilized for the new entity; the stock price is still being “seasoned” by new investors; and all the information about the company should be incorporated into the stock price.

The concern is that major shareholders and insiders that sell before all of the above settles into place might do so because they have asymmetric information not generally known to the market — for instance, if an announcement about a bad breach will come out publicly in a couple months it may cause the share prices to tank! That’s why securities laws — and any open, free market for that matter — are built around a disclosure regime; the entire IPO registration process is intended to help mitigate such asymmetries. It’s therefore significant that the SEC’s Head of Corporate Finance said that “material information asymmetries” recede when “the efforts of the third party are no longer a key factor for determining the enterprise’s success” — as with tokens in “sufficiently decentralized” networks.

The asymmetry and disclosure problem can be addressed in crypto just as with an IPO (in this sense, the riff on “ICO” is not accurate), by prohibiting for a specific period insiders and early major investors from selling too early in newly “trading” networks. Retail investors who want to purchase tokens would thus be protected from the possibility that those early investors and insiders have additional information not available to the general public, and the market price of tokens would have time to be seasoned while all relevant information is incorporated into the token trading price.

Resale. Similarly, there’s an existing rule in public markets that applies to secondary trading: SEC Rule 144, which governs the public re-sale of unregistered securities.

Among other things, Rule 144 restricts “affiliates” — basically insiders and major shareholders — on the volume of shares they can ultimately sell in any given three-month period. The rationale behind this limit is similar to that behind IPO lockups: Affiliated investors should not be able to dump too many shares at once given potential information asymmetry relative to the buyers of those shares. Insiders and early investors can therefore only sell after satisfying certain restrictions, including a limitation on the volume of sales — that is, they have to “dribble” out the shares over time, which is why these are called “dribble rules”.

Applying a similar dribble rule to secondary trading of newly issued cryptotokens could have similar benefits as they do with other entities in the public market. If combined with hard lock-up periods, such rules would subject affiliated investors to both time period and volume restrictions — thus providing additional protections for individual investors.

* * *

While cryptonetworks represent a new breed of technology — with many opportunities and benefits beyond the financial aspects alone — in many ways they also fit neatly into much of the existing regulatory frameworks that the SEC and CFTC (among others) have been developing for decades. But in other ways, the blockchain — and the ability to both encode and enforce compliance rules through software — can also aid regulators themselves. For example, enforcing lock-ups and Rule 144 restrictions in today’s traditional security world is time-consuming, costly, and complex, involving multiple parties (Rule 144 alone requires stockholder, issuer, transfer agent, and each of their counsel). But encoding those restrictions into the tokens themselves — after all, tokens are simply programmable software — would allow the restrictions to be self-executing, thus reducing cost and ensuring compliance with the appropriate regulatory rules. In this sense, software itself could aid regulators and help further close the regulatory gap as well.

Ultimately, however, all these frameworks should enable the dual goals of protecting investors from bad actors while still ensuring capital formation around emerging technologies… with the goal of supporting further innovation.

The content provided here is for informational purposes only, and does not constitute an offer or solicitation to purchase any investment solution or a recommendation to buy or sell a security; nor it is to be taken as legal, business, investment, or tax advice. In fact, none of the information in this or other content on a16zcrypto.com should be relied on in any manner as advice. Please see https://a16zcrypto.com/disclosures/ for further information.