I’m going back to Cali, Cali, Cali

I’m going back to Cali…hmm, I don’t think so

—LL Cool J, Going Back to Cali

Lately, everybody seems to be talking about a new technology bubble. Many very smart CEOs, VCs, reporters, and analysts can’t seem to stop worrying about the second coming of the dot com bust. Are the prognosticators correct? Will we head mercilessly into another crash? I don’t think so.

A Comparison Between Today’s “Bubble” and the Last Tech Bubble

Since so many distinguished people report a broad variety of qualitative bubble signs, let’s attempt to pattern match the quantitative data. As we do so, keep in mind that the relevant bubble statistic is not valuation. It’s the valuation:value ratio. High valuations are fine if the underlying value is there. Let’s look at public market comparables and venture capital flows to see if we can find a match.

1. Public market comparables

In the great bubble of 1998-2000, the boom in public valuations mirrored the boom in private valuations. Similarly, in recent high profile private financing rounds for private technology companies with valuations over $1B, the valuation multiples were at or below corresponding multiples for publicly traded companies such as Google. This has generally been the case for the bulk of deals that we’ve seen at Andreessen Horowitz. If publicly traded technology companies are not at bubble-like prices, then private technology valuations aren’t either because they are roughly equivalent.

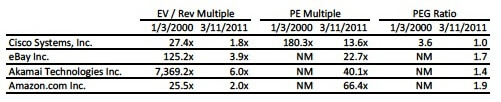

To find out whether or not today’s public technology companies have hit bubble valuations, let’s compare some companies that survived the great bubble with their bubble era valuations:

The Enterprise Value-to-Revenue multiple (EV/Rev) and Price-to-Earnings multiple (PE) are commonly used metrics to tell the valuation:value story. Companies that produce little value today might still receive high valuations due to high growth expectations. The PEG Ratio normalizes the valuation:value ratio for growth expectations by tracking the valuation:value ratio per unit of expected earnings growth.

Bubble era valuation multiples were more than 10 times higher than current comparable multiples. As you can see, not all of these multiples are comparable as some of the bubble era multiples were NM—not meaningful—due to negative earnings. This means that the valuations ascribed to these companies were not quantitatively based on the earnings they were generating or projected to generate.

The valuation:value ratio of today’s private and public technology companies look nothing like the bubble ratios.

2. Venture capital flows

A basic driver for a private technology market bubble is the over-supply of venture capital into the sector. If too much venture capital hits the streets, valuations will bubble up. The inflation-adjusted data from the last bubble tells the story:

In the 3-year period from 1998-2000, venture capital firms raised more than $200 billion, which represented about 0.55% of the national GDP. To put that in perspective, that’s more money than the entire venture industry raised collectively over the prior 18 years.

Flush with lots of capital, venture capital firms naturally invested at historically high rates—from 1998-2000 alone, venture capital investments also topped $200 billion. Again, more dollars were invested in this single 3-year period than in total over the prior 18 years.

Now let’s take a look at the current version of the same inflation-adjusted data:

Total venture capital raised from 2008-2010 was just shy of $55 billion, about 0.12% of the national GDP, with the trajectory of capital raising declining in each year. In fact, 2010 venture capital fundraising is at the same level as it was in 1995 and 1996.

Approximately $90 billion has been invested by the venture capital industry from 2008-2010—less than half of the 1998-2000 level. More significantly, total capital invested should continue to remain constrained in light of the significant reduction in new venture capital dollars raised over the last 3 years. Keep in mind that because the life of a venture capital fund is generally 10 years, it takes a while to see the impact of lesser fundraising on total dollars invested.

The inflows don’t actually look that bubblicious.

The Long Awaited Arrival of the Internet Boom

Looking at the numbers in the previous section, you may be wondering: “how in the world did people get so totally out of control in the last bubble?” The short answer is that the expectations of the great Internet boom vastly outstripped the actual activity. Specifically, the market wasn’t nearly as big as anticipated and the products were not nearly as good as imagined—at the time.

When Netscape peaked in the late 90s, we had 90% market share and 50 million users. The total Consumer Internet market was 55 million people. That’s about 36X smaller than today’s 2B. Worse yet, over ½ of those 55 million were dialup users. In addition, to horrible bandwidth and latency, the technology products were very crude in other ways. Programming languages were radically less functional, hardware was literally a hundred times more expensive, and there was no virtualization or cloud computing or AJAX. Constrained by such an early and weak technology platform, companies built poor applications. As a result, the expectations of what the Internet would be radically outstripped the reality of what it was. And hence the great crash of 2000 and 2001.

Since then and over the last 10 years, everything has gotten better. Much better. Servers moved from proprietary systems made by Sun, IBM, and HP to commodity hardware at a fraction of the price while radically improving in performance. The open source movement dramatically reduced the cost and improved the quality of systems software. Average consumer bandwidth increased 100 fold due to cable modems, DSL, and high-speed wireless networks. Cloud computing, which was not available then, now enables companies to build massively scalable products with very little initial capital outlay. The combination of the Internet and open source transformed the functionality in modern programming tools, increasing developer productivity 10 fold. The resulting applications have been so easy to use that even older generations of consumers now rapidly adopt new technology like Facebook. And there are 2 billion people on the Internet. All of these factors have led to an exciting new set of leading companies, including a special few which grew to over a billion dollars in annual revenue in less than 5 years. Welcome to the great Internet Boom of 2011.

At this point, you may still be worried about the startling rise in valuations of privately held technology companies. As I mentioned before, privately held technology companies trade at reasonable valuations vs. publicly traded comparable companies. These public companies trade at reasonable valuations vs. historical precedents.

In addition, these companies are significantly more mature—in terms of revenue and profit generation—than their counterparts in the last bubble. For example, the 1998 IPO class had average revenue of $120 million (and net losses of $65 million to boot). If you just look at the tech IPOs that have been completed year to date from 2010, the average revenue of this group is north of $300 million.

What about companies with reportedly very little revenue and very high valuations such as Twitter? A good investing rule of thumb is that any company that simultaneously saves Charlie Sheen’s career and starts a revolution in Egypt may be on to something. While Twitter doesn’t make that much money yet, historically media companies that capture hundreds of millions of highly engaged users tend to be make money.

Where do we go from here?

You still may be thinking that Twitter and Zynga are great, but now it’s really over—there is no new opportunity. If you think that, you’d be wrong again.

In addition to the unprecedented number of people now reachable via the Internet, we are at the very beginning a gargantuan new technology cycle: the move from Web/PC computing to cloud and mobile.

Back when I was a youngster in the early 80s, the technology landscape shifted from Mainframe to Client/Server computing. Interestingly the biggest opportunity wasn’t investing in the lighter weight computers that replaced the mainframes, but rather in new products created due to other results of the change. When you don’t have to pay for computing cycles on a MIP/minute basis, developers can change the way they program. The first major change was the move to relational database technology. Relational databases notoriously wasted CPU cycles vs. the old hierarchical databases such as IMS. However, if you didn’t care about CPU cycles, then you could easily cut your database development time by a factor of 10 or more and radically reduce the level of expertise required. By moving to the relational model, developers were released from the tedium of navigating hierarchical databases and used their new found freedom to rewrite every existing application from financial systems to HR applications and wrote a whole set of new systems like Customer Relationship Management. The relational database and application boom created hugely valuable new companies such as Oracle, Siebel Systems, and PeopleSoft. It didn’t stop there. As a result of the shift in application architecture, the old computing infrastructure became inappropriate and created new companies in Networking, Storage, and Management Software like Cisco and EMC.

The shift to cloud computing will have a more profound impact on the computing ecosystem than the shift to client/server. As with client/server, one of the first technologies to break has been the database. Application developers, no longer constrained by the massive administrative costs to set up servers, can solve previously impossible problems by seamlessly adding more hardware—except at the database layer. As a result, dozens of new exciting companies have emerged to replace the old “scale up” relational technology with new scale out solutions. Moving up the stack, everything about today’s application architectures suffers from the performance, scale, and programming model constraints of relational databases. Much like in the days of hierarchical databases, there is a large and important set of functionality that developers dare not tackle due to these limitations. New application companies like WorkDay and Proferi that take advantage of the cloud to deliver never-before-possible solutions, will devastate their old school RDBMS-based competitors.

While server virtualization enabled cloud computing on the server tier, it broke the current networking and storage architectures leading the way for the next generation of decabillion dollar companies in those categories. In the cloud, where applications have been completely decoupled from the underlying infrastructure, the old network and systems management software no longer works leading to an opportunity for a new company to grab that $30B market.

The greatest beneficiary of the mainframe->client/server shift was a software company called Microsoft which took full advantage of the switch from dumb ASCII terminals to personal computers. Microsoft broke the mold by delivering solutions to both consumers and enterprises and leading the original consumerization of the enterprise. As today’s clients move from PCs to mobile devices, a huge set of opportunities will emerge for new companies to solve important problems.

The very largest opportunities will likely come from companies for which there are no analogy or precedent. Profound new platforms open the market to ideas never before imaginable.

Conclusion

While we can see many signs of a bubble these days, it’s important to keep in mind that signs of a bubble look almost exactly the same as signs of a boom. In fact, it’s usually not a bubble until everyone agrees that it’s a boom. As Warren Buffett said about the housing bubble:

The basic cause was, you know, embedded in, partly in psychology, partly in reality in a growing and finally pervasive belief that house prices couldn’t go down. And everybody succumbed, virtually everybody succumbed to that. But that’s, the only way you get a bubble is when basically a very high percentage of the population buys into some originally sound premise—and it’s quite interesting how that develops—originally sound premise that becomes distorted as time passes and people forget the original sound premise and start focusing solely on the price action. So the media, investors, mortgage bankers, the American public, me, you know, my neighbor, rating agencies, Congress, you name it. People overwhelmingly came to believe that house prices could not fall significantly. And since it was the biggest asset class in the country and it was the easiest class to borrow against it created, you know, probably the biggest bubble in our history. It’ll be a bubble that will be remembered along with South Sea bubble.

Will all the excitement around the opportunities created by the Internet and the shift to cloud/mobile computing eventually lead to a bubble? Absolutely. Are we in a bubble today? I don’t think so.