At its core, wealth management is fairly straightforward: an advisor helps a customer optimize their tax and investment strategies to maximize wealth creation and preservation. But while this premise may seem simple, its execution is growing increasingly complex, especially as wealth management customers and their needs change. New customer classes like millennials have started to amass wealth through emerging alternative asset classes like crypto and collectibles and through intricate equity structures like options and RSUs (restricted stock units). Wealth management customers of all ages also increasingly manage their finances and investments through digitally native startups, such as Robinhood and Titan, rather than traditional institutions.

As the customer changes, so does the playbook for wealth management, making this an interesting time to build in the space. A wave of new investing tools have created market opportunities for new wealth management solutions for both consumers and independent advisors. In this post, we identify some of the most promising initial wedges—narrow product offerings that allow a foothold in the market—for consumer and advisor-driven wealth management startups.

Consumer Wealth Management Strategies of the Future

Historically, the wealth management industry has been an asset-accumulation game where players wage war to build the largest asset base possible. The playbook has been defined by asset accumulation, usually a cost center, and then asset deployment, usually a profit center. Vanguard, for instance, offered rock-bottom prices for accumulation (cost), and then monetized off small fees on their mutual funds (profit). At the high end of the market, Goldman’s private banking services (cost) created one of the most notable status symbols in financial services, while their proprietary funds and management fees (profit) created the profitable wealth management empire they have today.

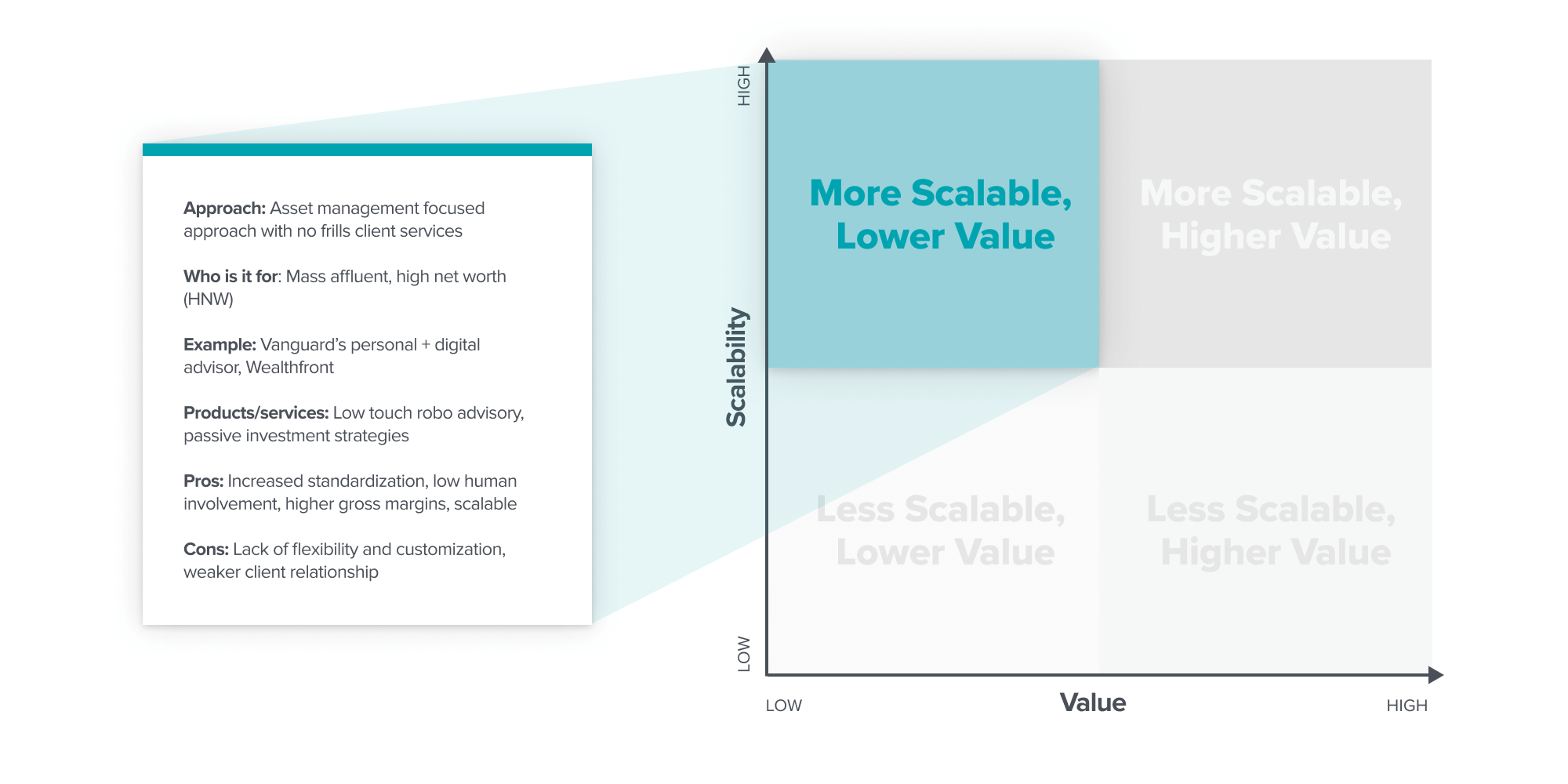

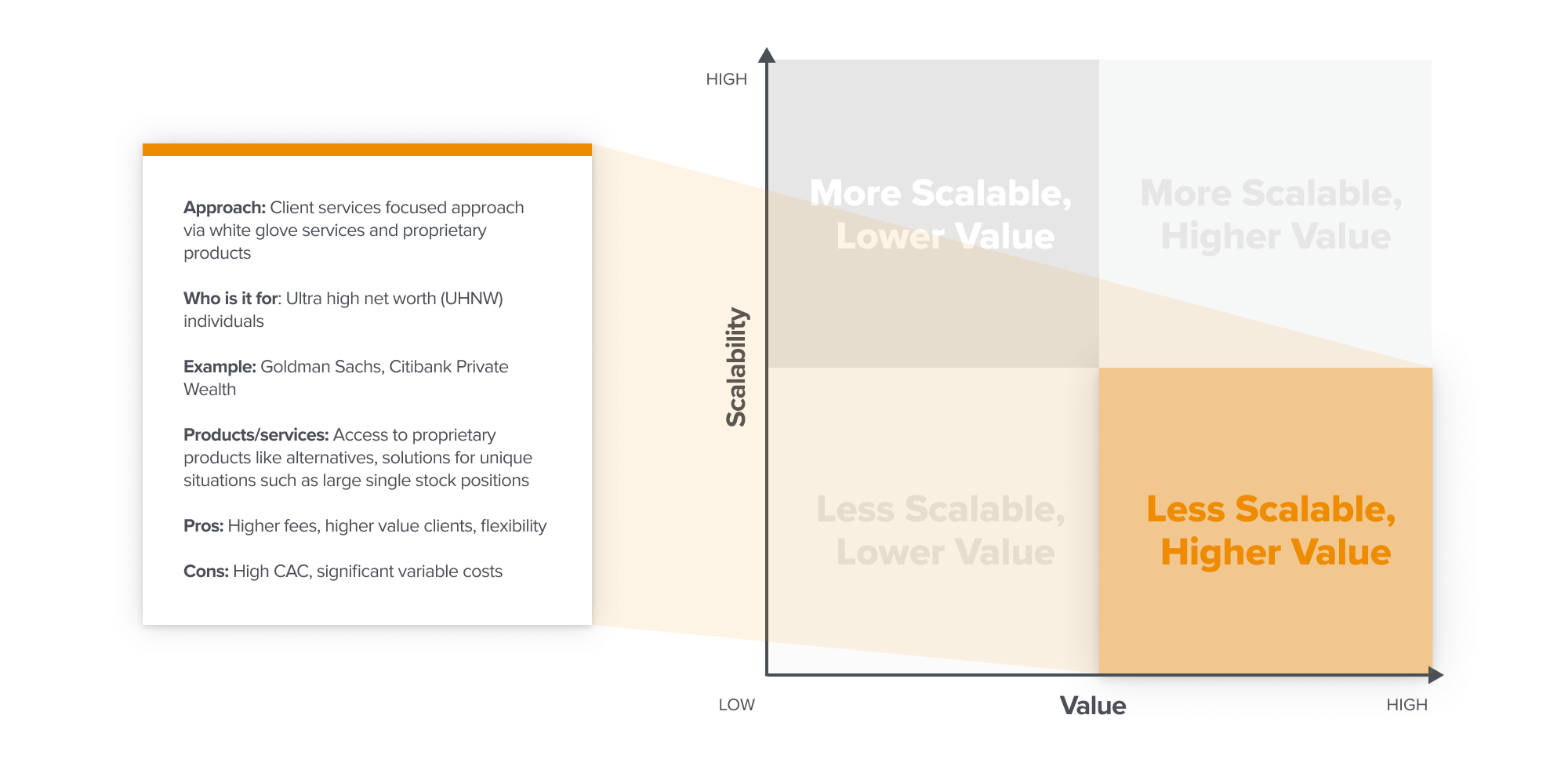

The difference between Vanguard’s approach and Goldman’s highlights two traditional wealth management business strategies: offering scalable but lower-value services (Vanguard), and offering less-scalable, but higher-value services (Goldman). The trickiest part for any wealth management business is figuring out how to make the unit economics work, while waiting for increasing returns to scale. For example, Vanguard needed ~20 years (from its establishment in 1974 to 1994) to reach $100B+ in assets under management (AUM). Meanwhile, for companies offering less scalable, but higher-value services, the challenge is often how to reliably hire high-quality people to deliver high-value service experiences.

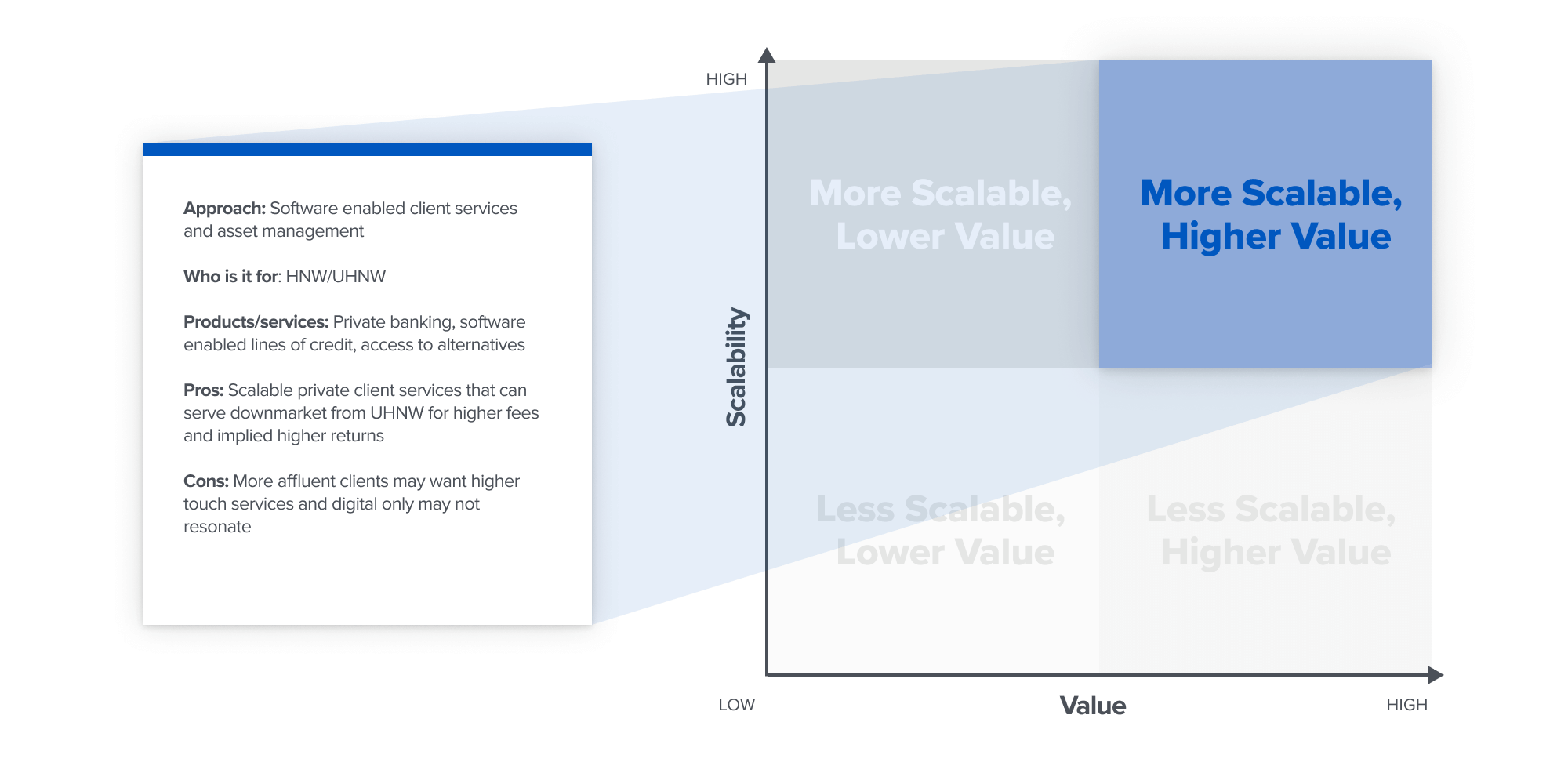

We’re excited for technology to solve this problem and perhaps unlock a third bucket of scalable, high-value services. For example, we’re seeing startup activity in some hard-to-crack areas, like lending, estate planning, alternative assets, and tax—all areas where traditional wealth management providers have needed to hire linearly to scale their offerings.

We believe the best startups that exemplify this new potential high-scale, high-value bucket are those whose offerings have urgency and significance. In this case, by urgency, we mean a startup’s product is so enticing that after a consumer encounters the product—through, for example, an ad—they immediately want to sign up. By significance, we mean that when a customer signs up for the product, they reap rewards that don’t mirror traditional solutions.

For example, Chime, the neobank that offers no-fee banking, created urgency for its customers to sign up through its get-paid-early program, and then added significance by eliminating overdraft and other hidden fees commonly charged by incumbents.

The Rise of Breakaway Advisors

Beyond consumer-side opportunities, there are additional opportunities to provide products to a new class of wealth advisors: independent breakaway advisors. As technology improves and governments propose new fintech regulations, many advisors that historically sat on Wall Street now run their own independent businesses and rely on a robust technology ecosystem to help them meet their clients’ needs.

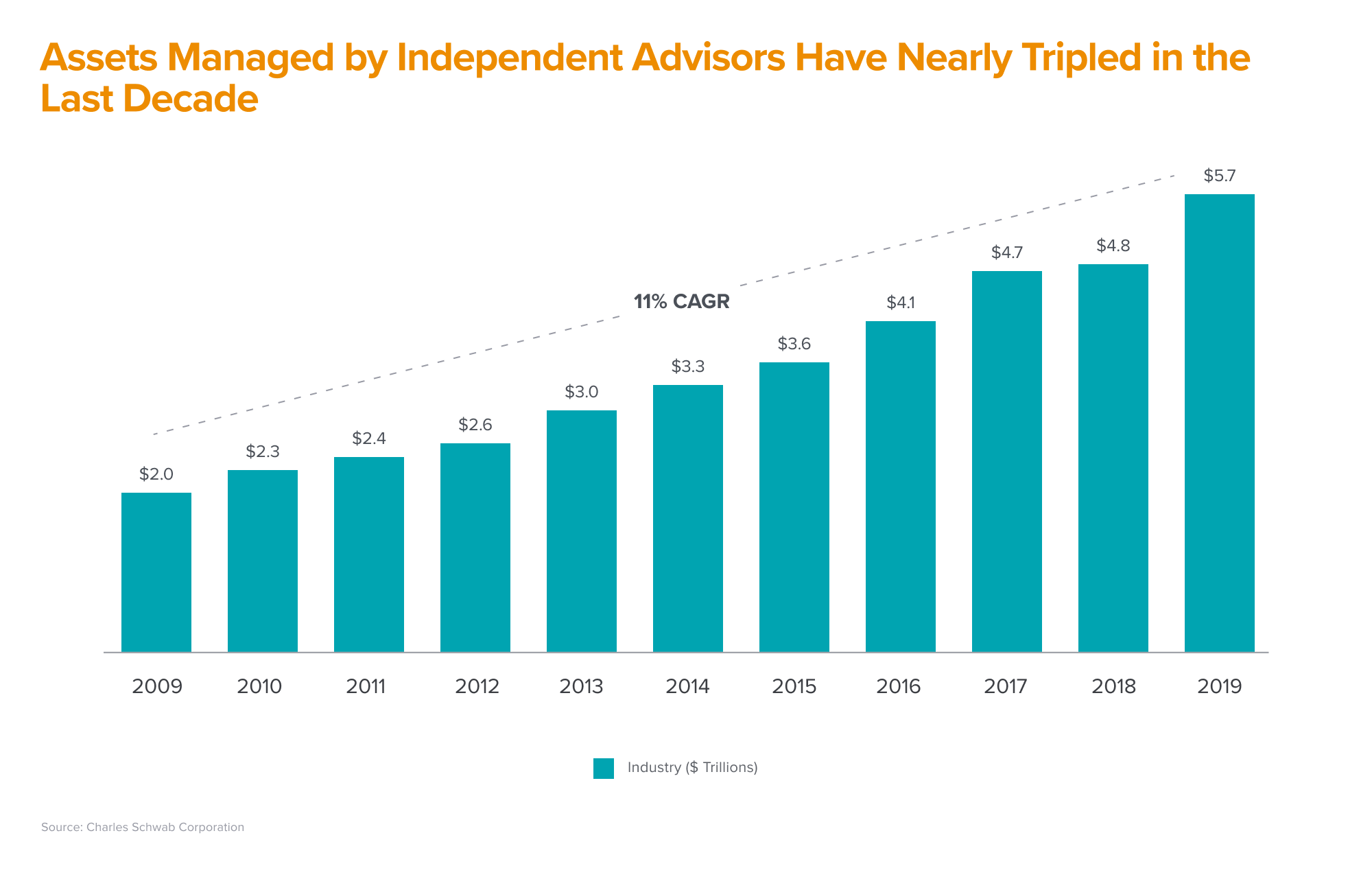

This trend, colloquially described as the rise of breakaway advisors, is perhaps the most important trend over the past decade in wealth management. This shift has only accelerated over the past decade, as assets managed by independent advisors have grown nearly 300% (see below).

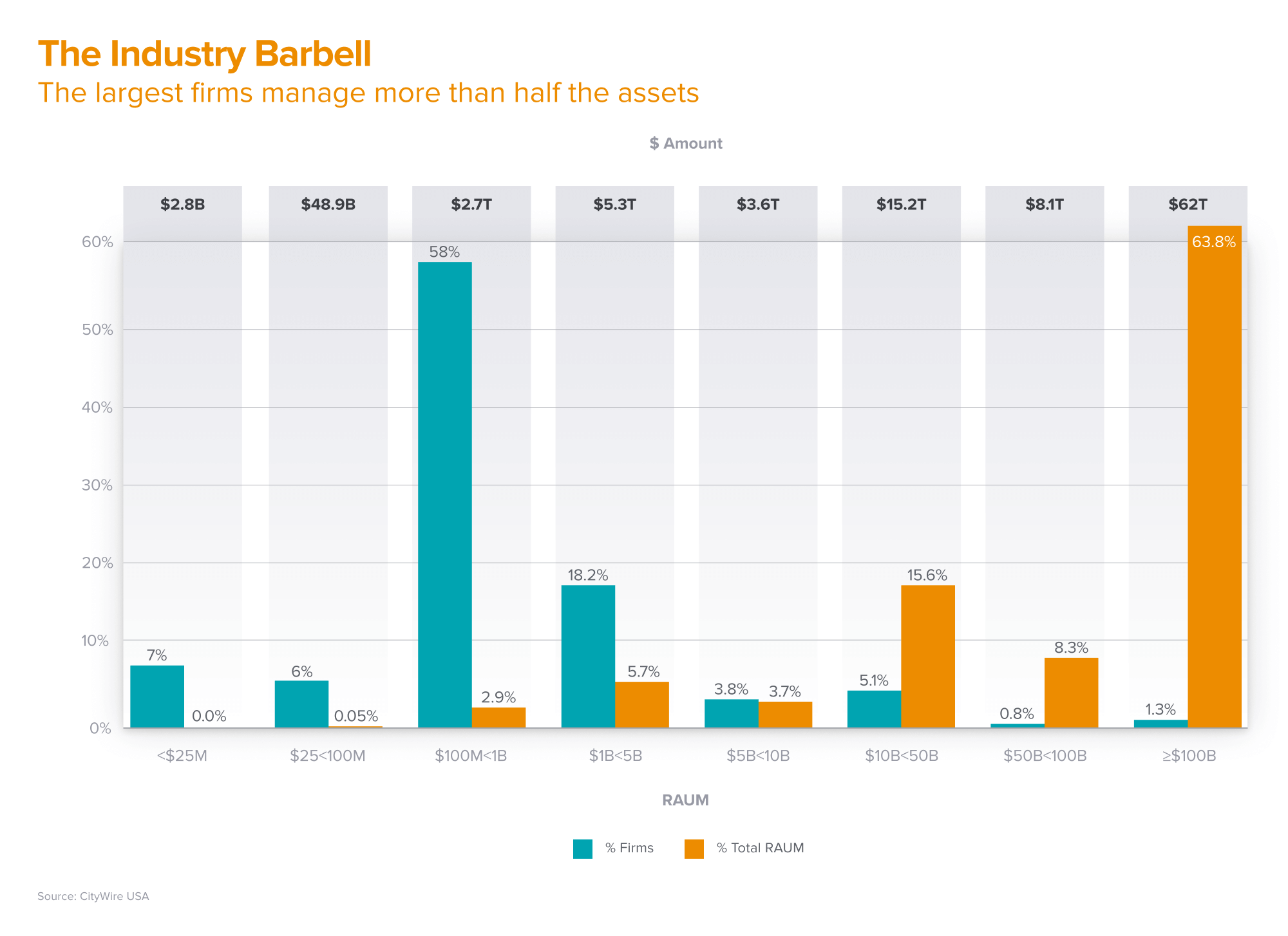

That being said, many independent advisors are part of a larger RIA or broker-dealer, and the majority of assets still reside either within a large independent or wirehouse today. In other words, despite the rise of breakaway advisors, consolidation at the top of the market hasn’t changed.

However, we’re still in the early days of this shift, and there are a few opportunities to provide breakaway advisors with the tools they need to independently manage more wealth. Specifically, we are looking at tools that address compliance, alternatives, and aggregation models, all of which can help independent advisors operate as solopreneurs.

Vertical Solutions for Compliance

Today’s laws governing wealth management date back to the Securities Exchange Act of 1934 and the Advisers Act of 1940, which named and created standards for investment advisors (e.g., fiduciary responsibility and standard of care). These regulations have been modified several times, most recently in 2019 with Regulation Best Interest, or Reg BI, enhancements to legal requirements and mandated disclosures.

These new regulations create an interesting wedge for businesses to be built around compliance and disclosure workflows. One area we’re following is the proposal process, or where the sale is actually made. Capturing data here can lead to simpler tracking of what products are being presented, which creates the evidence needed to comply with Reg BI and helps drive more sales for the advisor. CapIntel in Canada and Stratifi in the U.S. are two examples of businesses we’ve seen building in this space.

Vertical Solutions for Alternatives

Although consumers, largely driven by interest in crypto and web3, have flooded into alternatives over the past several years, there are only a few services that streamline the experience of accessing these types of investments through a financial advisor. Issues can arise across the entire stack, from sourcing and evaluating new investment opportunities, coordinating capital calls, and entering into new alt positions, to tracking and reporting on these investments. In many cases these types of positions can also complicate tax and estate planning, creating an even bigger issue—and opportunity for startups.

In response, many larger advisors are hiring additional operations people to help manage this process, while smaller advisors aren’t offering these services at all. Offering access to this type of investment opportunity will be table stakes for advisors in the future, making this a unique moment in time to build solutions around this need.

Reimagining Aggregation

A variety of new aggregation models lets breakaway advisors do what they do best—client interaction—while digitizing the back-office solutions required to run an independent advisory firm. Some of these new aggregation players innovate by improving how fast advisors are paid for products, which can be a strong wedge to sell into a cash-constrained small advisory firm.

These aggregation layers often participate in the fee structure of the advisors rolling up to them, and there are interesting volume-based dynamics that can drive increasing returns to scale. Increased volume can yield increased compensation, and independent advisors can, in some cases, earn more as a part of the collective than as a solo operator. Some firms, like Dynasty Financial and Crump, have historically run variations of this playbook and built great businesses. Others, such as Farther and Savvy, are reimagining what a business-in-a-box for an independent advisor might look like, while Signal Advisors is changing the dynamics around cash flow and access to retirement products.

As wealth management continues to grow and evolve, we’re excited to meet and partner with teams that are building new, digitally native consumer experiences, as well as solutions that serve traditional financial advisors.

-

Joe Schmidt is a partner at Andreessen Horowitz, where he focuses on software, fintech, and insurtech investments.

-

Anish Acharya Anish Acharya is an entrepreneur and general partner at Andreessen Horowitz. At a16z, he focuses on consumer investing, including AI-native products and companies that will help usher in a new era of abundance.