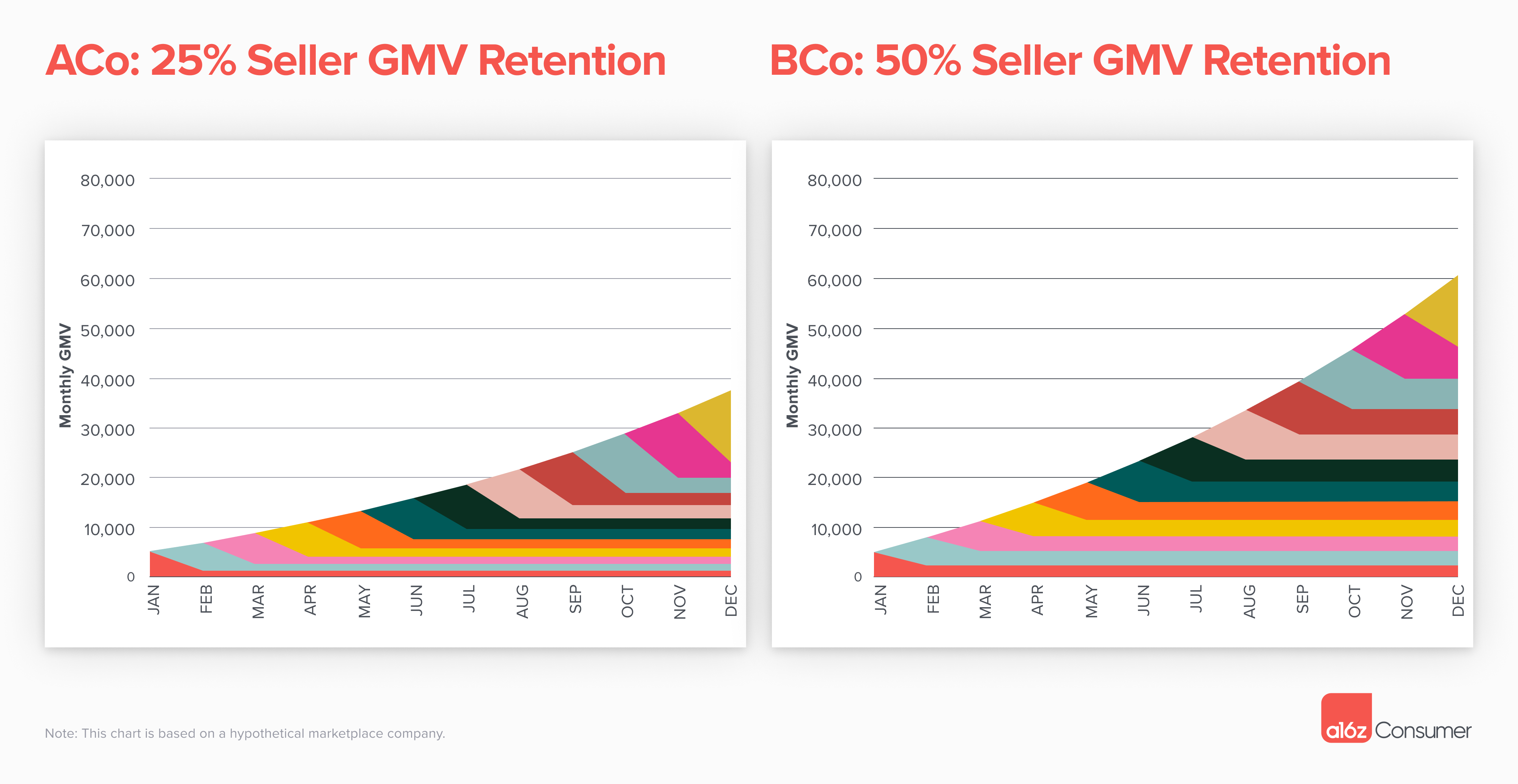

Imagine you’re running a marketplace startup — let’s call it ACo — that allows consumers to sell spare items they have around the house. You notice after a few months that only 25% of your new sellers are coming back each month, but they’re selling just as much as they did in that first month. Pretty good, right?

Then, you hear about a competitor: BCo. They launched at the same time as you, are growing new revenue at the same rate each month, and also see 25% of sellers come back. But the sellers that they retain double their monthly sales on the platform. And by the end of the year, BCo is nearly 2x your scale!

ACo and BCo differ in terms of one major metric: GMV (gross merchandise value) retention. I would argue that this is the most predictive metric of whether you’re building a marketplace business that’s just OK or truly great. It determines whether your business resembles a “layer cake” or a “leaky bucket.” But it’s also one of the most ignored metrics — many founders don’t even track it.

In this post, I’ll cover what GMV retention is — including a spreadsheet template for how to calculate it — why you should care about it, and the benchmarks our team at a16z uses to analyze marketplace performance.

TABLE OF CONTENTS

What is GMV retention? (And how to build your “spaghetti charts”)

TABLE OF CONTENTS

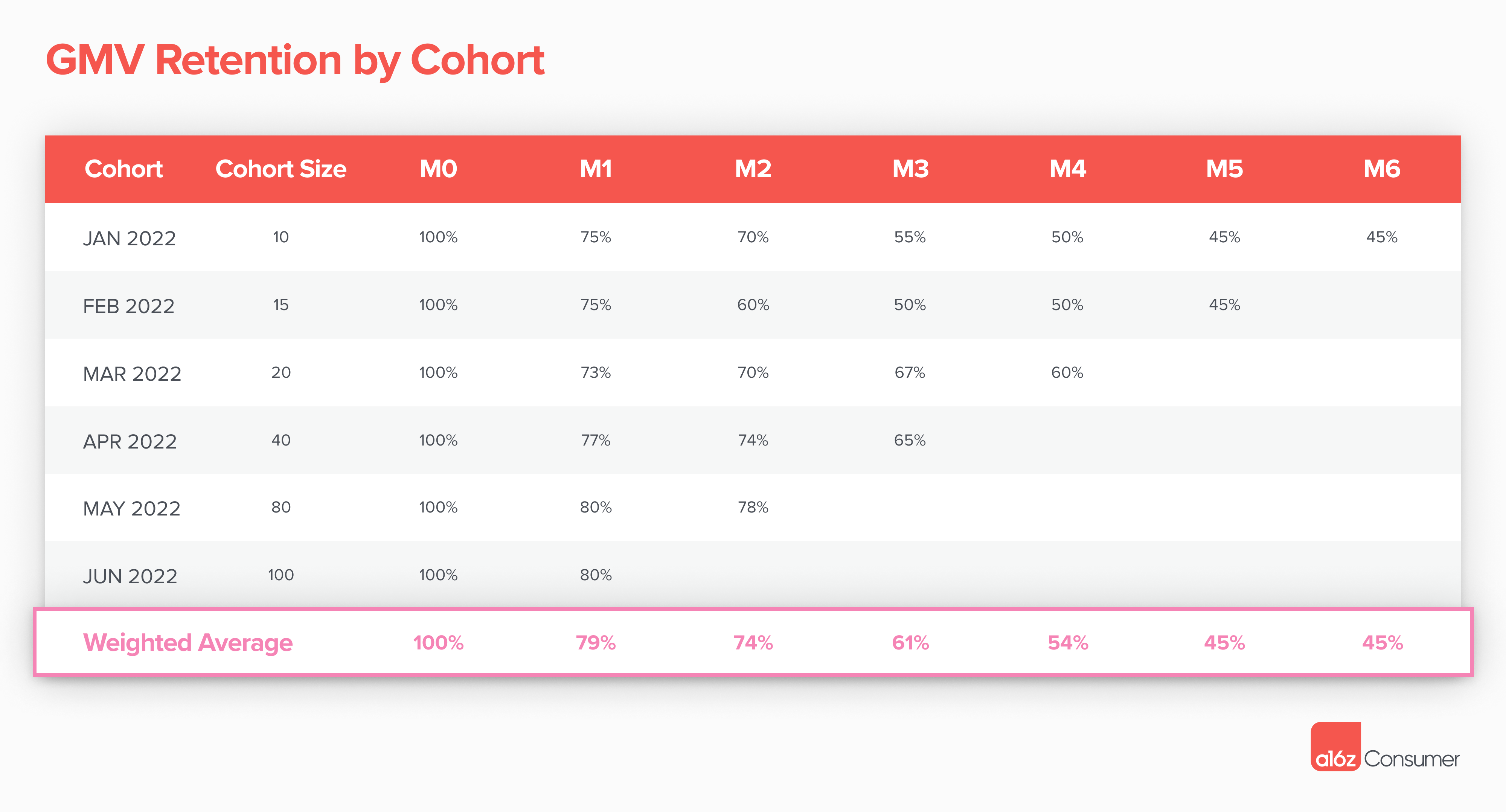

GMV retention is a cohort-based way of looking at how healthy each side of your marketplace is.

Many companies measure user retention, which shows the frequency with which users return to your product. Let’s say ten users transact on ACo for the first time in January 2022. Five of them come back and transact in February 2022, and three come back in March 2022. Your one-month (“m1”) user retention for this cohort is 50% (5 /10 initial users), while your m2 user retention is 30%.

GMV retention takes this a step further by measuring how much of each cohort’s spend you retain over time. Say those ten users spend $10,000 on the platform in January, and the five that come back in February spend $7,500. Your m1 user retention may only be 50% – but your m1 GMV retention is 75%! ($7,500 / $10,000).

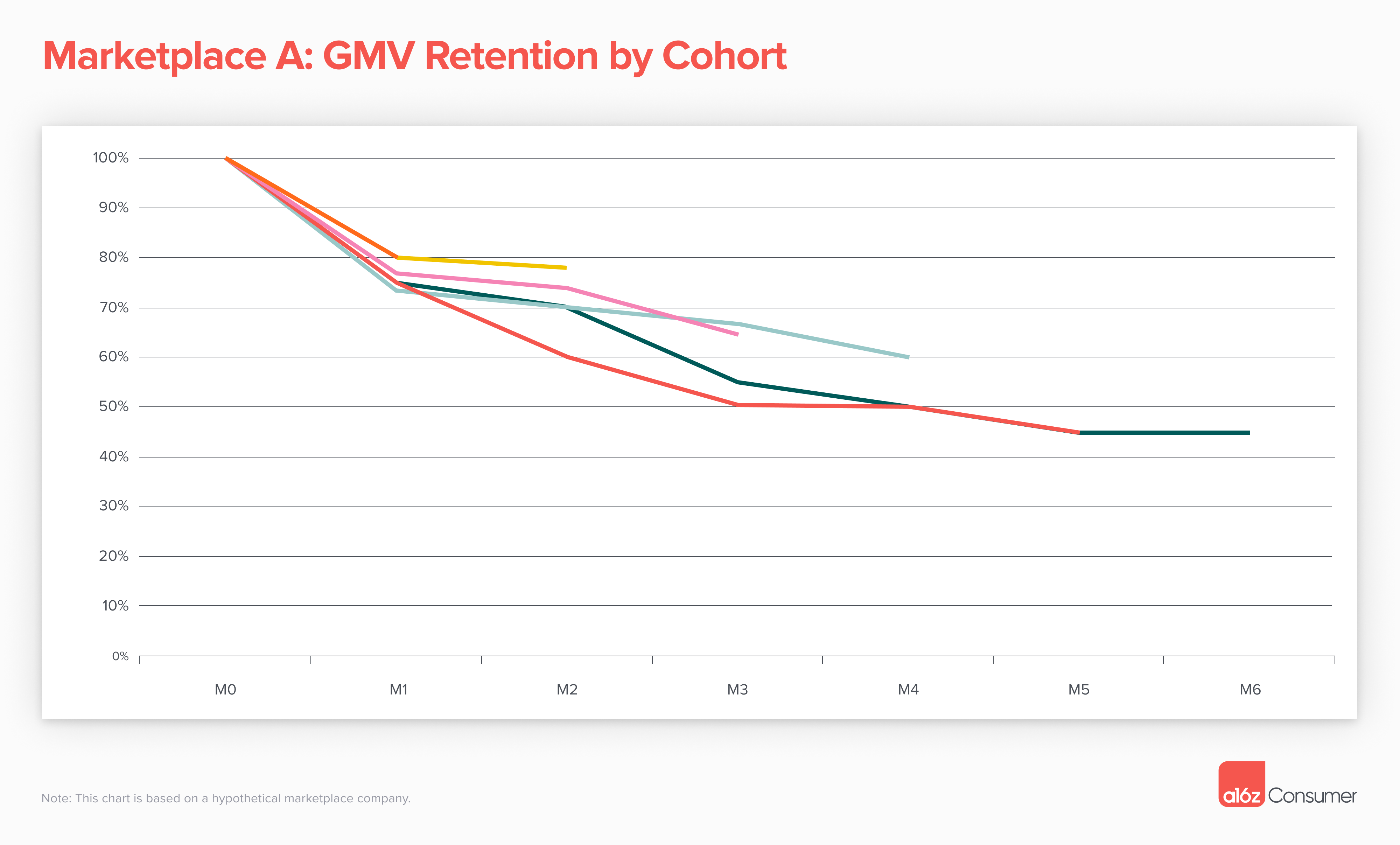

Like user retention, GMV retention is often displayed in tables and “spaghetti charts.” I’ve uploaded a full template here for how our team calculates these numbers; the “output” for that sample company is displayed below.

GMV retention can range from 0% to 100%+ (sometimes, it’s far above 100%) for each cohort each month. Typically, one side of a marketplace’s GMV retention is much stronger than the other; often, this is the supply side.

Why? Ideally, suppliers find enough value to build a business on the platform, while individual consumers transact less frequently. An example of this is Airbnb. You may only book one or two per year, but ideally your host is filling the property every week. Some marketplaces see strong GMV retention on both sides: for example, Uber and Lyft. The supply side is likely still more active, but consumers may also transact on the platform weekly or monthly.

TABLE OF CONTENTS

Why should you measure GMV retention?

TABLE OF CONTENTS

There’s a few reasons why you should care about GMV retention:

- It’s an indicator of product-market fit. High GMV retention can reflect one of two things: (1) most of your users retain and continue to transact over time; or (2) only some of your users are retaining, but they’re transacting much more on the platform over time. Either of these scenarios is pretty positive when it comes to product-market fit, showing that a non-negligible percentage of users are finding value from your product.

- It makes it easier to hit growth targets. When your existing suppliers (or buyers) are expanding GMV, it requires fewer new users to reach your growth goals. Remember the story of ACo and BCo: the higher your GMV retention, the more your existing customers are fueling the growth of the business versus having to acquire a huge volume of new customers.

- It gives you more “wiggle room” on marketing spend. Many investors will calculate lifetime value (LTV) versus customer acquisition cost (CAC) for both sides of the marketplace. In many cases, they’re looking for a 4x+ ratio. Higher GMV retention means the lifetime value of a user is also higher — they will generate more GMV (and therefore more revenue) for you over time. This allows you to spend more on marketing to acquire users and keep a healthy ratio.

- It can show you how customer health is trending over time. GMV cohorts paint a picture of how “healthy” your marketplace is as it grows. This can be hard to grasp by looking at overall growth, as each new cohort of users is hopefully bigger and spending more (which sounds great). But if, for example, your m6 GMV retention drops from 75% for older cohorts to 30% for new cohorts, this may be a sign that the value prop for your early adopters isn’t translating to a broader user base.

TABLE OF CONTENTS

TABLE OF CONTENTS

What does “great” GMV retention look like — and how do you reach it?

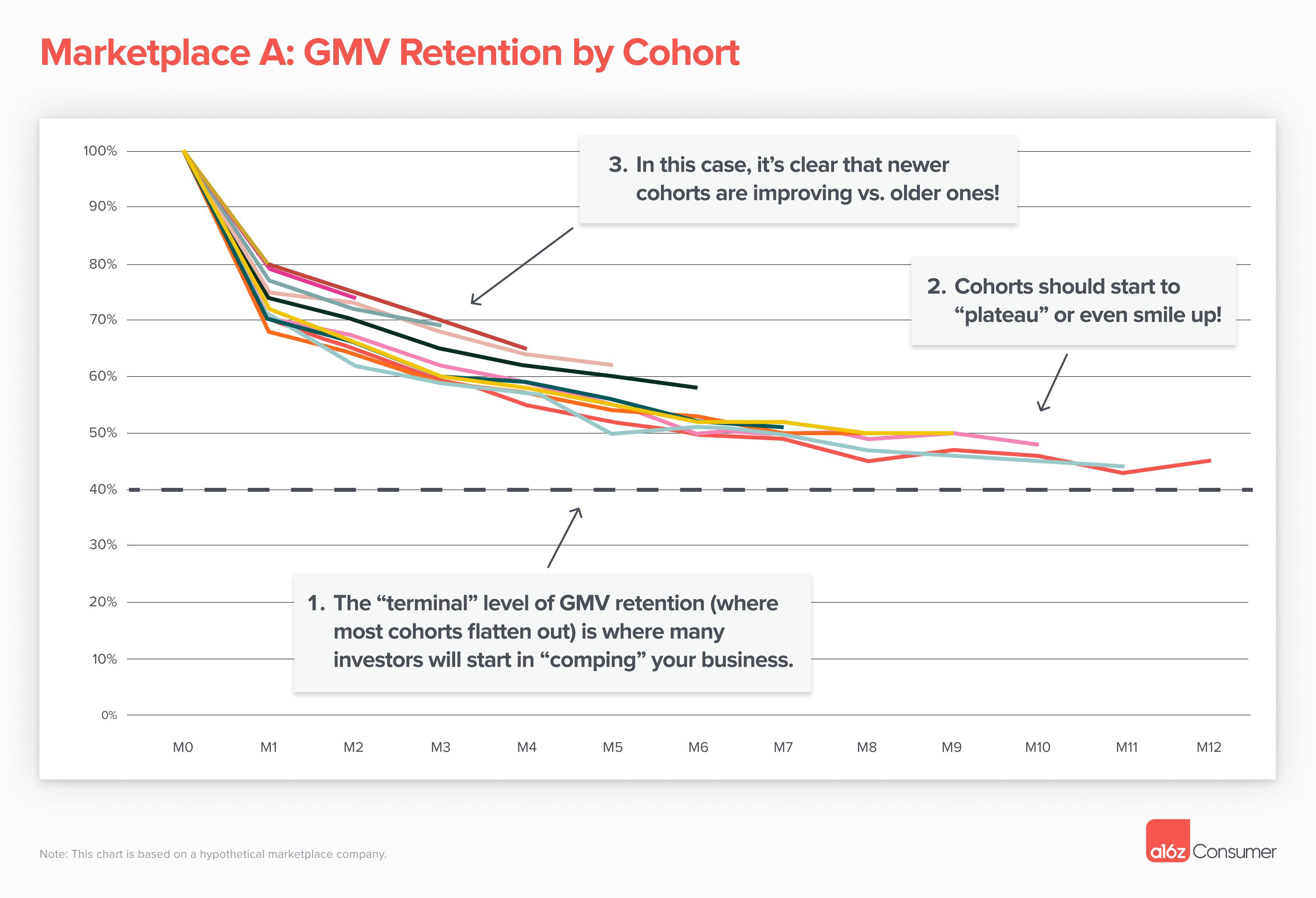

In our analysis of GMV retention cohorts, we’re looking for a few things:

- How does GMV retention benchmark vs. other marketplaces? More on this below! Investors will “comp” (or compare) the retention for your marketplace versus similar companies.

- Do the curves plateau or “smile”? Retention curves ideally flatten over time, often between m6-m12. In some cases, they actually start to “smile” (curve back up) as churned users reactivate or retained users continue to expand.

- How are cohorts trending over time? Ideally, newer cohorts look just as good as or even better than older ones. On a spaghetti chart, this typically appears as all of the lines bunched fairly closely together.

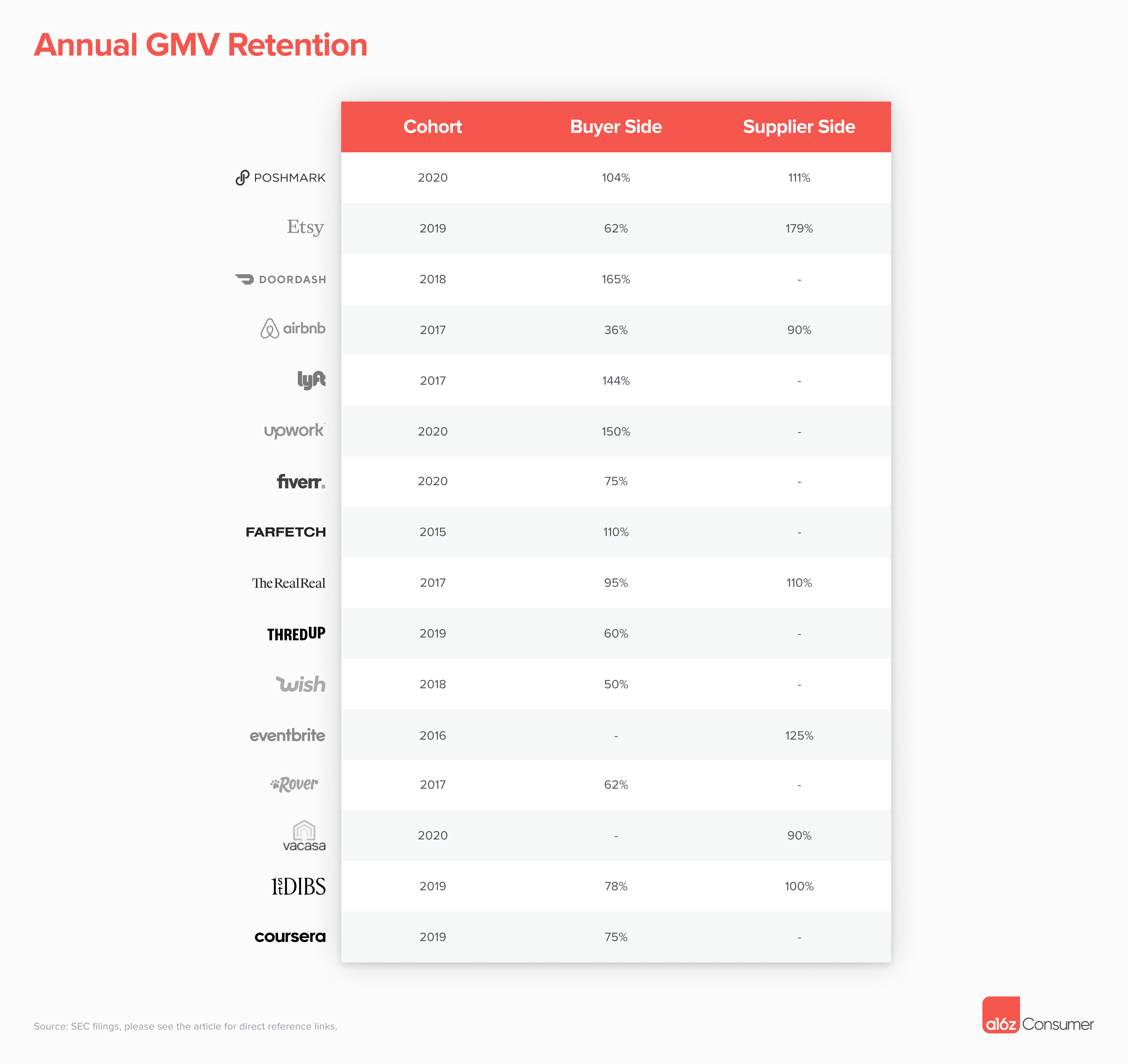

The best examples of top-tier GMV retention come from marketplaces that have made it to IPO. These companies report GMV retention on an annual basis — the data below shows retention for a cohort’s second year on a marketplace versus their first year. This is often reported at IPO, but not necessarily after, so I’ve included the most recently reported cohort for each company.

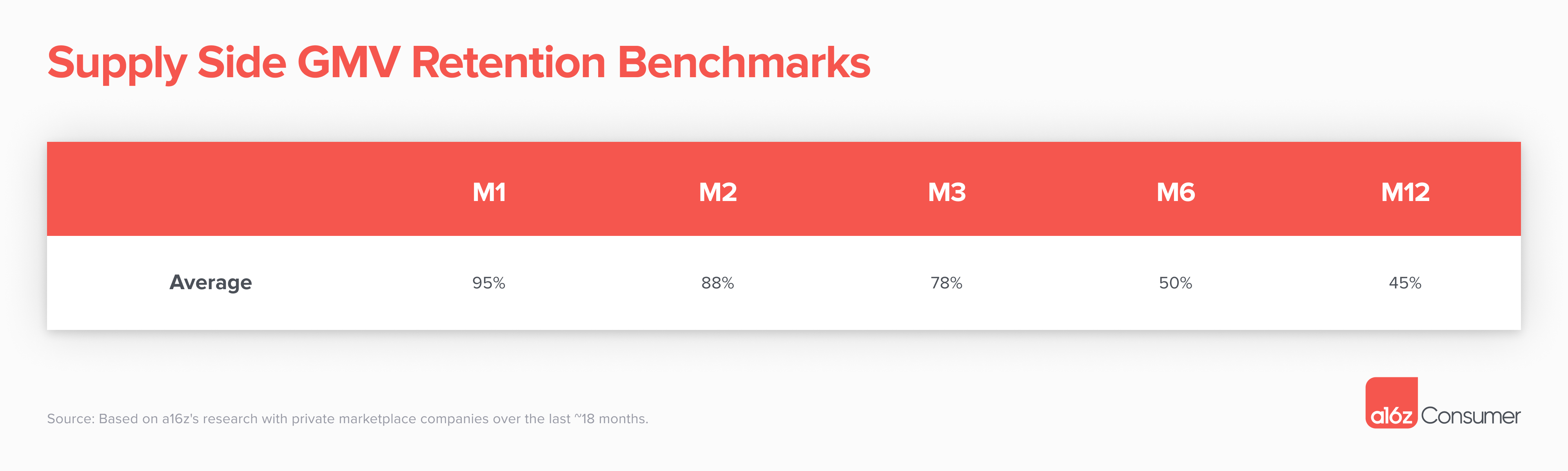

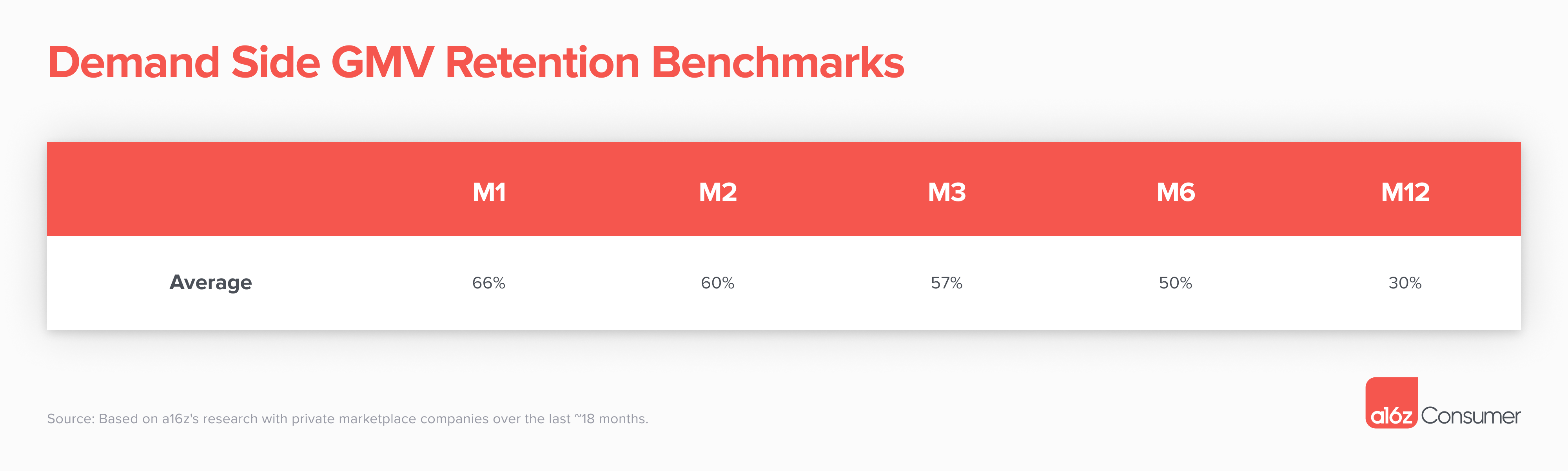

Private comparables come in somewhat below these numbers. Below are general benchmarks for consumer marketplaces our team has seen over the last ~18 months. These metrics are for companies we’ve spent significant time with at the seed through Series B, so they’re likely a bit higher than the true “market” average.

Supply Side

Best-in-class consumer marketplaces see supply side GMV retention at or above 100% through m12 and beyond. This doesn’t mean that 100% of suppliers retain — more frequently, we see that 50-70% of suppliers retain, but expand their GMV 2-3x+ over time.

We’ve observed, however, that the average marketplace retains supply side GMV closer to 80-95% in the first three months – and then plateaus around 45-50% by m12.

What drives high supply GMV retention? There are two keys:

- Create a positive first sale experience – this can be in terms of price (do sellers feel like your offer is close to “market” price?), time to sale (how fast does inventory turn over?), and process (how easy is it to get the product to the end consumer?). This often requires doing things that don’t scale when kickstarting the marketplace. For example, sneaker marketplace StockX famously bid on every early listing themselves, so that sellers would come back to sell again!

- Help sellers expand their business – the most successful marketplaces not only become a significant channel for their sellers (think 50%+ of their revenue), but also help sellers build a bigger business than they thought possible. As a marketplace, you can encourage this via tools to help your power sellers understand and analyze demand, optimize their listings, and even finance inventory. You’ll know this is happening when sellers develop special products or services just to sell with you! One example of this is car share marketplace Turo, with some sellers upgrading from renting their one personal car, to buying an entire fleet of cars just to list on the marketplace.

Demand Side

Demand side GMV retention tends to be lower than supply side, as discussed above — but it’s still important. This retention helps determine the rate of new user growth required to hit your overall growth goals. Poor demand side retention can also yield poor supply side retention, as suppliers who aren’t getting transactions will churn.

What drives high demand GMV retention?

- Help buyers find their “match.” Some users arrive at a marketplace knowing exactly what they’re looking for, but many struggle with decision fatigue. How can you combat this? You can show top quality suppliers first, allow for precise filtering based on preferences, or even make the consumer jump through a few hoops (and share more on their preferences) before seeing options. Managed marketplaces for services tend to do this very well. Think about the consumer experience on Zocdoc: the list of recommended providers you receive is already filtered for doctors who take your insurance and who have openings at times you’re free.

- Build loyalty via unique inventory and perks. It’s getting easier for suppliers to “multi-tenant” across marketplaces – and buyers will follow them! One way to retain buyers is providing supply they can’t get elsewhere, through unique and even niche sellers that list exclusively with you. The early days of Depop were a good example of this: sellers built an identity on the platform, and Depop became the go-to place for secondhand vintage goods you couldn’t find anywhere else. For products and services that act more like a commodity, you can also build loyalty directly with buyers through a rewards program. Uber and Lyft have both launched these for riders – and subscriptions like DoorDash’s DashPass are another good example. If a consumer is paying for special service with you, they’re unlikely to go transact somewhere else.

For founders building early to late stage marketplace startups, GMV retention is a critical metric to track. If you’re an early stage founder, you can reach me at @omooretweets.

SEC filings used for calculating public company GMV retention:

Poshmark: https://investors.poshmark.com/news/news-details/2022/Poshmark-Inc.-Reports-Fourth-Quarter-and-Full-Year-2021-Financial-Results/default.aspx

Etsy: https://www.sec.gov/ix?doc=/Archives/edgar/data/1370637/000137063722000024/etsy-20211231.htm

DoorDash: https://www.sec.gov/Archives/edgar/data/1792789/000119312520292381/d752207ds1.htm

Airbnb: https://www.sec.gov/Archives/edgar/data/1559720/000119312520294801/d81668ds1.htm

Lyft: https://www.sec.gov/Archives/edgar/data/1759509/000119312519059849/d633517ds1.htm

Upwork: https://investors.upwork.com/static-files/13cc0abe-5577-4f83-b260-a95811318078

Fiverr: https://www.sec.gov/ix?doc=/Archives/edgar/data/0001762301/000117891322000725/zk2227154.htm

FarFetch: https://www.sec.gov/Archives/edgar/data/1740915/000119312518252315/d532260df1.htm

The RealReal: https://www.sec.gov/Archives/edgar/data/1573221/000119312519163007/d720814ds1.htm

Wish: https://www.sec.gov/Archives/edgar/data/1822250/000119312520298630/d82777ds1.htm

Eventbrite: https://www.sec.gov/Archives/edgar/data/1475115/000119312518255960/d593770ds1.htm

Rover: https://www.sec.gov/Archives/edgar/data/1826018/000095012321002084/ck0001538533-s4.htm

Vacasa: https://www.sec.gov/Archives/edgar/data/1840927/000110465921097288/tm2123195d2_425.htm

1stDibs: https://www.sec.gov/Archives/edgar/data/1600641/000119312521162999/d244039ds1.htm

Coursera: https://www.sec.gov/Archives/edgar/data/1651562/000119312521071525/d65490ds1.htm