If you look closely at what’s happening in AI app generation, you’ll notice something interesting. The platforms emerging in this space aren’t locked in zero-sum battles — they’re carving out differentiated spaces and coexisting. And this actually shouldn’t surprise us, because we’ve already seen this exact pattern play out in foundation models.

There were two incorrect assumptions about foundation models that were widely held in 2022. First, people assumed these models were basically substitutes for each other, like interchangeable cloud storage solutions — if you’ve picked one, why bother with another? Second, the logic went: if the models were substitutes, competition would force prices into the ground. The only way to win would be to charge less.

But that’s not what played out. Instead, we saw an explosion in different directions. Claude started going deep on code and creative writing. Gemini has been uniquely capable in multi-modality and providing high-performing models at a low price point. Mistral leaned hard into privacy and on-prem deployment. And ChatGPT doubled down on being the “home base” for anyone wanting the broadest, most useful general assistant. Instead of one winner, the market kept opening up — more models, more diversity, more innovation. And, prices went up, not down. Grok Heavy, with exceptional AI code features and a viral text-to-image model, for example, is $300 a month — unheard of for consumer-grade software just a couple years ago.

We’ve seen similar patterns in other categories. Think back to image generation. In 2022, people said it was zero-sum, or “one model takes all.” But now you see Midjourney, Ideogram, Krea 1, BFL, and more — all successful, all coexisting because each leans into a different style or workflow. These models aren’t “better” or “worse” — they’re artistically and functionally opinionated, serving different creative tastes and needs.

If you look closely, you see these models aren’t competitors at all — they’re actually complements. It’s the opposite of a race to the bottom. It’s a positive-sum game: using one tool increases the odds you’ll pay for and use another.

We believe the same thing is happening now in the world of app generation, tools that help you build full apps with AI. It’s easy to get caught up in the drama — Lovable vs. Replit vs. Bolt, and so on. But the truth is, this isn’t winner-take-all. The market is massive and getting bigger, with space for multiple breakout companies, each carving out its own niche.

Here’s one way the market is segmenting already, with platforms that uniquely “spike” in each of the below:

- Prototyping — tools for trying out quick ideas. These products need to deliver on aesthetics, prompt adherence, and fine-grained visual manipulation, along with quick and dirty implementations of business logic.

- Personal software — apps just for you and your workflow. These products will likely serve the least technical users, and will need to be “off the shelf” usable — perhaps even with a comprehensive library of templates that are easy to edit.

- Production apps — ready for teams or the public. These platforms need to come with a suite of essentials built-in — integrations for authentication, databases, model hosting, payments — and be turnkey to scale.

And within each of those categories, there will hypothetically be platforms tailored to every level of user — from everyday consumers to semi-technical product managers, all the way to hardcore developers. In other words, for every type of app, there’s going to be a range of solutions depending on how hands-on or technical you want to get.

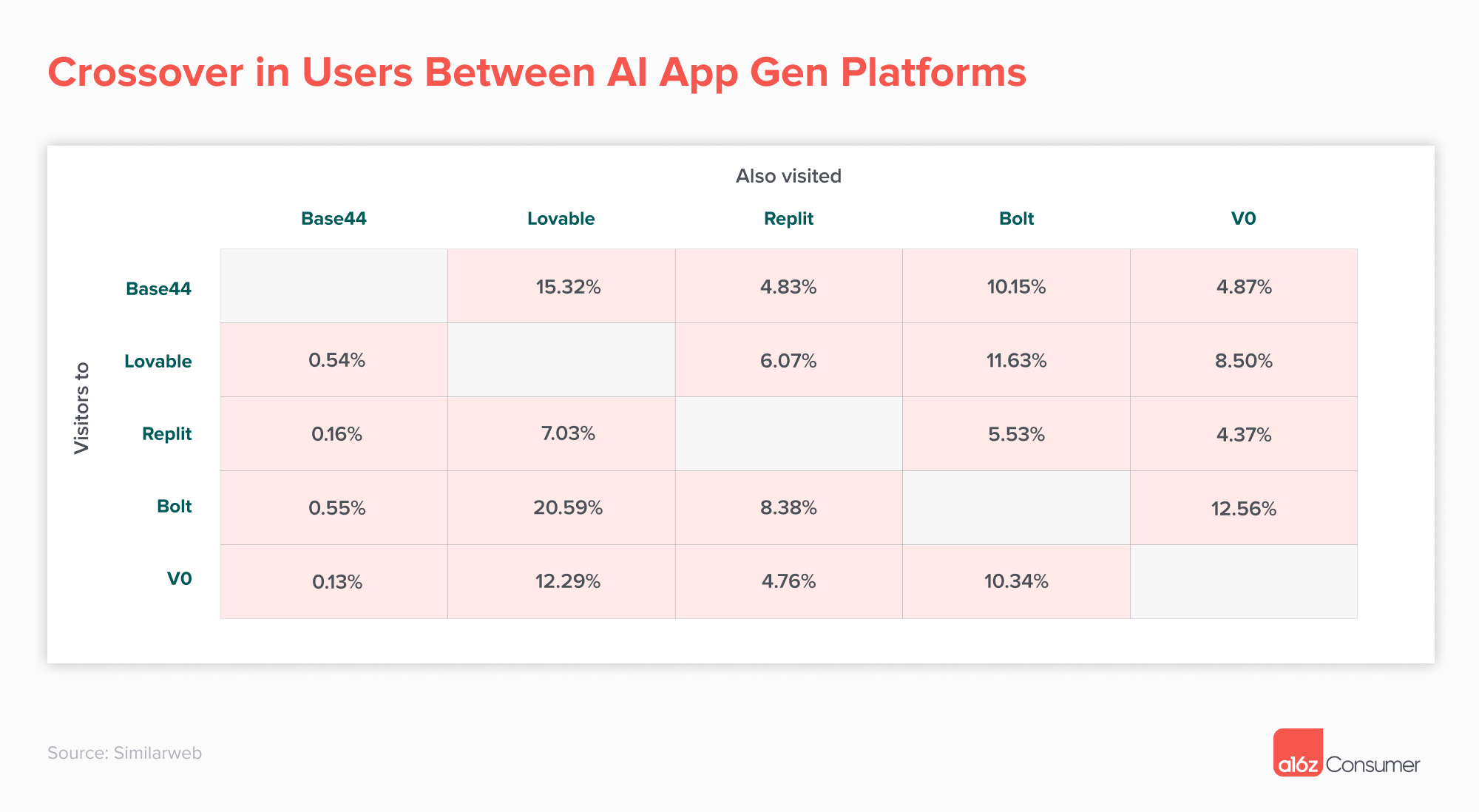

While it’s still early, this is already coming through in the cross-browsing behavior of the core set of app generation platforms (Lovable, Bolt, Replit, Figma Make, v0, and Base44). Two types of users have emerged, based on Similarweb data.

The first are users who are loyal to one platform. For example, over the last three months, 82% of Replit users and 74% of Lovable users visited just Replit or Lovable, of the group above. These users might find the app generation platforms functionally similar right now, but pick just one to primarily use — likely because of either marketing, UI, or specific features they care about. Empirically, Lovable seems to be used for aesthetic web apps and prototyping, while Replit seems to be the platform of choice for more sophisticated backend-heavy apps.

The second are users who are active across several app generation platforms. As an example: nearly 21% of Bolt users also browsed Lovable over a three month time period. And, 15% of Base44 users also checked out Lovable. These are (we suspect) the power users who are very active on these platforms — and use them in a complementary way.

Note: Because Figma Make is a subdomain of Figma, we’re unable to isolate its unique traffic via Similarweb. However, given how well received it has been, we expect it to follow a similar pattern of success.

Specialization is next

It turns out that when it comes to tools that help users build scalable apps, constrained beats unconstrained. Being great at developing one type of product is likely better than being just OK at generating them all. And it’s unlikely that the app gen platform that excels at internal tools that integrate with SAP will also be the one that makes the most accurate flight simulator app!

Here are some examples of categories that imply very different integrations and constraints for the underlying app gen platforms:

Data/Service Wrappers — Apps that aggregate, enrich, or present large existing data services or third-party services, like LexisNexis or Ancestry. The infrastructure must support manipulation of large data sets.

Utilities — Single-purpose, lightweight apps solving highly specific needs. Think PDF converters, password managers, or backup tools. Most of the horizontal platforms already do a great job generating these apps.

Content Platforms — Apps built for discovering, streaming, or reading content. Think Twitch or YouTube, with specialized infrastructure to support content delivery.

Commerce Hubs — Platforms that facilitate and monetize transactions, focusing on logistics, trust, reviews, and price discovery. These will require integrations to support payments, refunds, discounts, and more.

Productivity Tools — Apps that help users or organizations complete tasks, collaborate, and optimize workflows, often with heavy integrations with other services.

Social/Messaging Apps — Platforms that enable users to connect, communicate, and share content, often forming networks and communities. The infrastructure must support real-time interactions at high scale.

As more focused app generation platforms emerge, we suspect the space will unfold along the lines of what we’ve seen so far. Each product will have its own, non-overlapping (exclusive) set of users. And, they’ll attract a portion of the more serious group of app generation power users who work across multiple platforms, and switch products as they need to specialize.

This will leave room for not just one massive app generation platform, but several. The app generation market in the near future will look a lot like the foundation model market today: a lot of specialized, opinionated products that are complementary and successful in their respective categories.

-

Anish Acharya Anish Acharya is an entrepreneur and general partner at Andreessen Horowitz. At a16z, he focuses on consumer investing, including AI-native products and companies that will help usher in a new era of abundance.

-

Justine Moore is a partner on the investing team at Andreessen Horowitz, where she focuses on AI — both foundation models and applications.