image: Freenome

We frequently hear scientists are actively looking for a cure for cancer. But where are they looking? The cure to cancer isn’t going to be simply found in another drug. Indeed, there are already many drugs for cancer, with multiple drugs often available for a given type of cancer. Moreover, the five-year survival rates for many types of cancer patients — including breast, ovarian, colorectal — significantly improves (up to 80% and in some cases 100%) with curative surgery or existing drugs administered before the tumor has had a chance to spread.

But there’s a catch: In order to increase those survival rates, cancer has to be caught early. And therein lies the problem.

Catching cancer early has been an unrealized dream for many years. This is a classic easier-said-than-done scenario with many technical hurdles: In particular, identifying the type of cancer, detecting it early enough to stop it, and at a cost low enough that allows everyone to test frequently and with high accuracy. That’s a pretty tall order.

Software will play a major role in delivering what’s missing

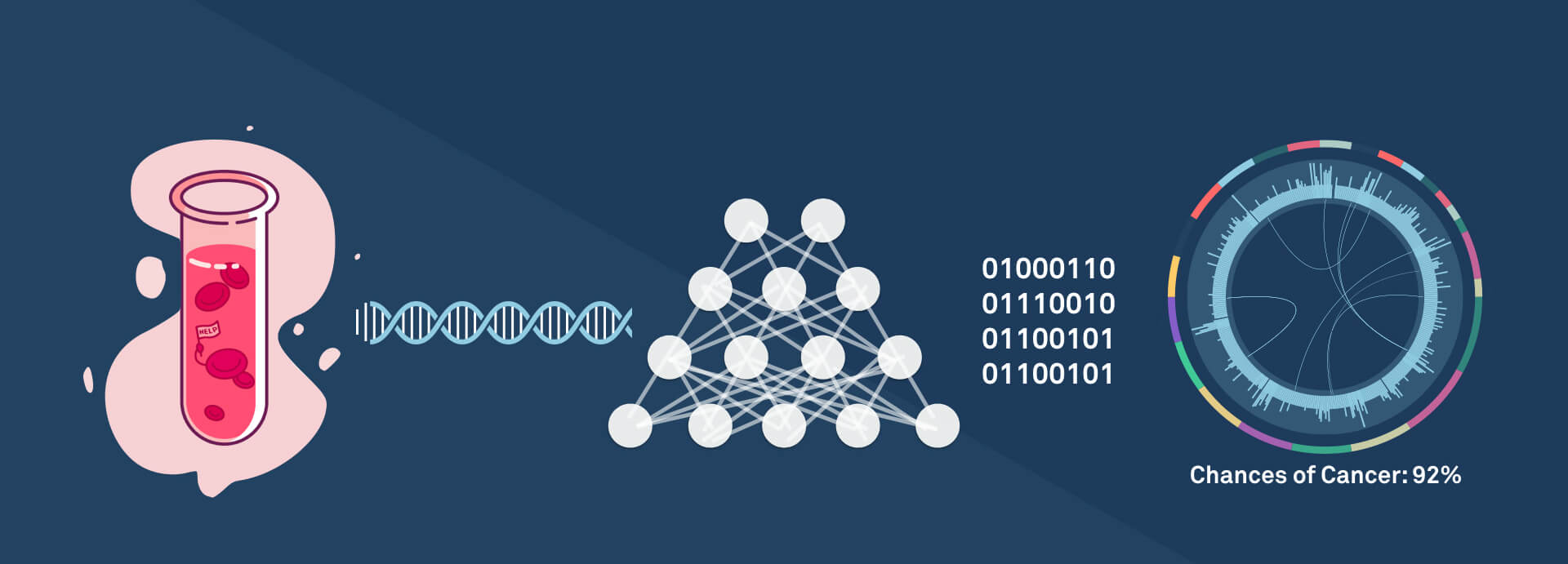

First off, a key challenge lies in how we perform cancer biopsies. Traditionally, one must extract tumor tissue (i.e., extracting part of the lung for lung cancer patients). This is not only expensive, it’s rife with potential adverse effects (e.g., about 1 in 7 people suffer a partial lung collapse from biopsy). Moreover, this is a classic chicken-and-egg problem: You can’t perform a biopsy unless there’s reason to suspect the patient has cancer. All too often, this comes too late. Liquid biopsies represent a solution to this catch-22; they work by realizing that tumors give off extra-cellular DNA that can be found in blood. Thus, instead of removing tissue, a liquid biopsy test involves just the (essentially) non-invasive procedure of drawing blood.

However, this leads us to a second challenge — how do we detect cancer from DNA? Genomic sequencing is a natural approach, but traditionally has been cost prohibitive. Indeed, the first human genome sequenced in 1997 cost billions of dollars. Just a decade ago the cost was millions of dollars. The cost of sequencing is exponentially decreasing, often faster than Moore’s law (its compute sibling), with the cost now in the hundreds of dollars; and with novel machine learning tricks, soon to be under a hundred dollars. The cost part of the equation is not to be underestimated: For this approach to be a cure to cancer, we need a test that can be taken relatively frequently. At a few $100s/year, one could imagine insurance companies paying for this for even low- to medium-risk patients. At a few $10s/year, it would be a no-brainer out-of-pocket expense.

We are on the heels of a major milestone: We’re finally at the point where the cost has reduced so much that genomics can go from cutting-edge scientists in special facilities into the hands of doctors everywhere.

Beyond cost however, another key challenge in medical testing is accuracy. That’s the final hurdle here. When accuracy isn’t sufficiently high, there can be many false positives, which not only leads to a major financial drain on the system but a great emotional toll on patients. The AMA recently changed its guidelines around mammograms for this very reason.

And that’s where Freenome enters the picture. The Freenome team — co-founders Gabriel Otte, Charlie Roberts, and Riley Ennis — has deep expertise in both the biology and the computer science involved, allowing them to develop software technology that can leverage liquid biopsies and genomics to develop a test that can detect cancer early.

We are in an unprecedented age in terms of the power of machine learning and data science. So it’s natural that novel techniques such as deep learning could take data sets and make high accuracy predictions even on challenging test cases. If we could harness this technology and apply it to the space of cancer genomics, we could finally solve this problem. This would allow genetic testing of tumors to go way beyond existing biomarkers and make predictions that couldn’t be possible today. Bringing together large patient data sets creates massive data network effects, a flywheel effect where gaining more customers leads to better predictions for those customers which in turn leads to better products which in turn leads to more customers and so on.

The early results are very promising. In our own diligence, Freenome was able to predict five samples perfectly — including negative controls and a very early-stage sample. For these reasons, we’re excited to announce that we’re making an investment in Freenome, helping them push this plan forward.

What will the cure to cancer look like? Clearly drugs and biological assays will play an important role, but not on their own: It will likely be advances in software (and in particular machine learning) that will be the critical last missing piece of the cure.

Moreover, I expect that this is only the beginning. We ask too much from medicine — that medicine heal us when disease has already progressed way too far (late-stage cancer, heart disease, type II diabetes). While prevention has always been seen as the best cure, it’s never been viable in key disease areas. I expect that through analyzing new data sources (genomics, information from wearables, etc.), machine learning will usher in a new era of prevention, an era where software will play a key role in healing the world.