Important Disclosures

This post, part 1 of 2, explains how platforms can help influencers monetize through digital goods and ecommerce. Part 2 will focus on platform memberships sold directly to end users.

In the US, social networks are buttressed by influencers and celebrities. These online personalities fill the void when content from our friends falls short, whether on YouTube, Instagram, Twitter, or Snap. Thus, the biggest existential threat to social platforms is the loss of influencers, whether they jump to a new platform or sign off entirely. Case in point: This August, Microsoft poached Ninja, the world’s #1 streamer, from Twitch for upwards of $30 million. He hit 1 million subscribers on Microsoft’s platform in less than five days. In an era of fierce competition and shifting demographic loyalties, it’s more important than ever for social platforms to keep their influencers engaged.

Sponsorships and ads are no longer sufficient—it’s time for social networks both new and old to focus on building tools to allow influencers to make money on-platform. Becoming an influencer can take a lot of time, money, and energy; at some point, influencers will expect a positive return on that input. (After all, one cannot live on followers alone.)

When influencers can monetize, platforms benefit:

- The defensive play: It keeps influencers engaged. Though these personalities may not be a huge driver of revenue for platforms, on-site monetization can prevent influencers from jumping ship.

- The strategic play: It collects payment information. Social companies, especially those that make money via ads, typically lack user payment credentials. When influencers sell physical products, platforms have a reason to collect payment information and eliminate the friction for that user’s future purchases.

- Fun for fans: It caters to users, not advertisers. Turns out advertising is not the most consumer-friendly monetization model. YouTube videos are growing increasingly longer to optimize for ad dollars, not fans. Fans can find their tribe online—and potentially interact with their idols.

- A new metric: It allows creators to track not only their followers, but also their superfans. Number of views is less important than the depth of engagement. And when followers become commodities, superfans are what counts. Earlier this year, Instagram began testing removing likes for individual posts. And in China, video-streaming platforms such as iQiyi and Youku no longer show video views, and instead choose to rank videos based on number of interactions.

This is not a new concept. Back in 2008, Kevin Kelly argued that anyone should be able to make a living by engaging just 1,000 true fans. A decade later, influencers on Western social networks still rely on ads and sponsorships. This type of monetization is usually priced based on the number of fans or simple content engagement—primitive metrics that don’t capture the intensity of fandom. Even millions of followers don’t necessarily translate into influence, or money, for that matter.

In China, where influencer culture is as strong as the US, the social networks have evolved to enable influencers to monetize their fan bases by selling paid subscriptions. Imagine visiting someone’s channel on Instagram—similar to how you subscribe to YouTube channels—and paying for exclusive access to premium posts and fan groups. The “Twitter of China,” Sina Weibo, offers this type of paid subscription product, with a 70-30 revenue share. According to Techweb, in 2018 these channel memberships amounted to $35 million in creator payouts, with over 1.75 million cumulative paid subscribers. And like all influencer products, there’s a long tail, meaning most influencers still need alternate income on top of these subscriptions.

By allowing influencers to sell all-access passes, Weibo has tapped into a new trove of premium essays, Q&As, and chats. Influencer memberships typically range from $3 to $30 per 6 months, though wealth management groups can exceed $1,000 per year. Creators can choose to offer their fans private chat groups and/or paid content in the form of articles, posts, Q&As, and livestreams.

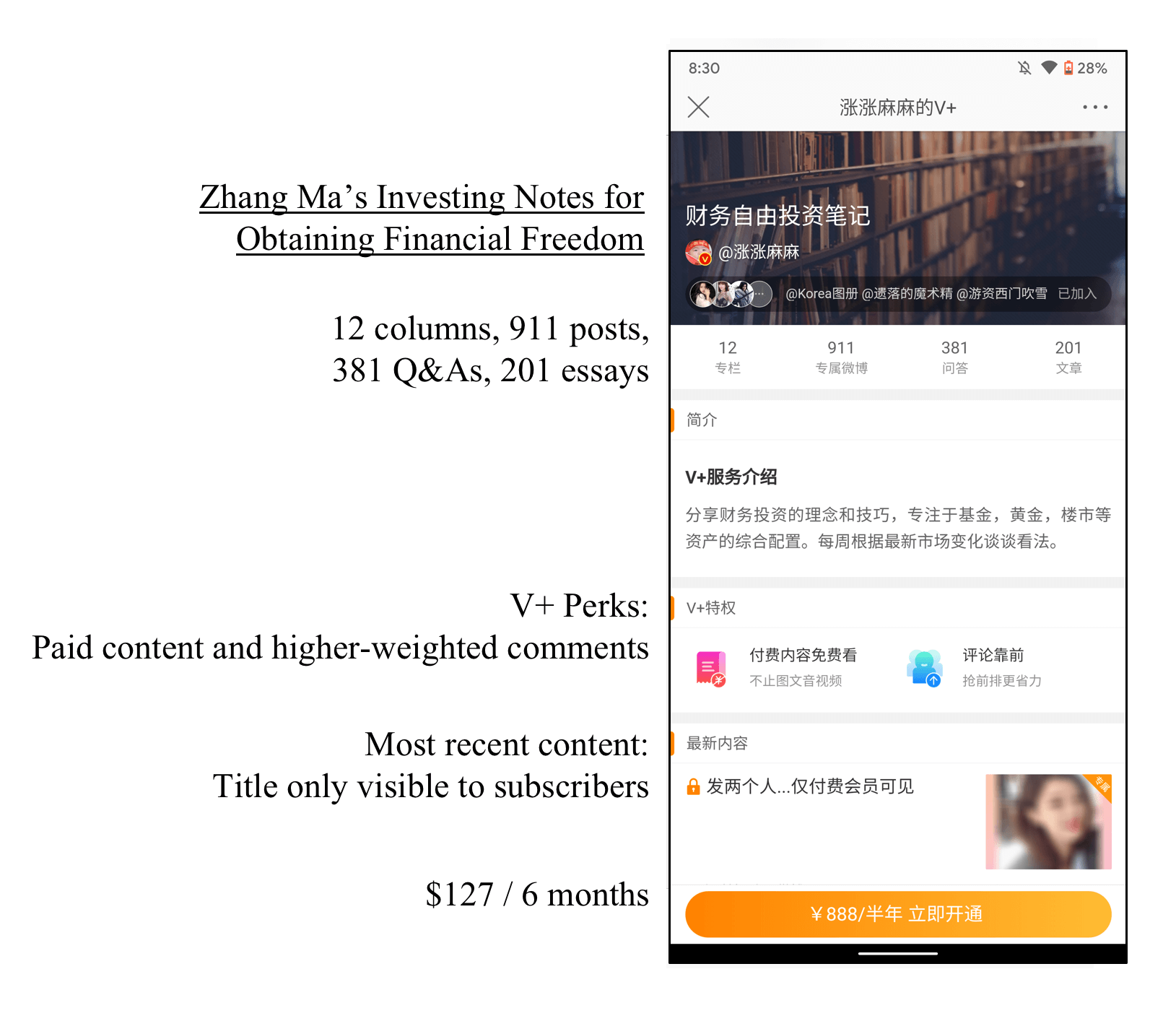

Paid content on Weibo spans the gamut from financial advice to geopolitical explainers, parenting groups to language tutorials. The top influencer on Weibo—as calculated by the average membership length, turnover, and readership—is Zhang Ma, who offers his followers investing advice for $127 per 6 months.

These subscriptions, also known as channel memberships, may include various benefits:

Private chat groups

Many platforms offer private chat groups, which encourage user interaction and drive channel subscriptions. Typically, users are asked to fill out a short survey prior to joining; groups are usually capped at either 1,000 or 5,000 members. (The only information visible to non-members is the name of the group and member count.)

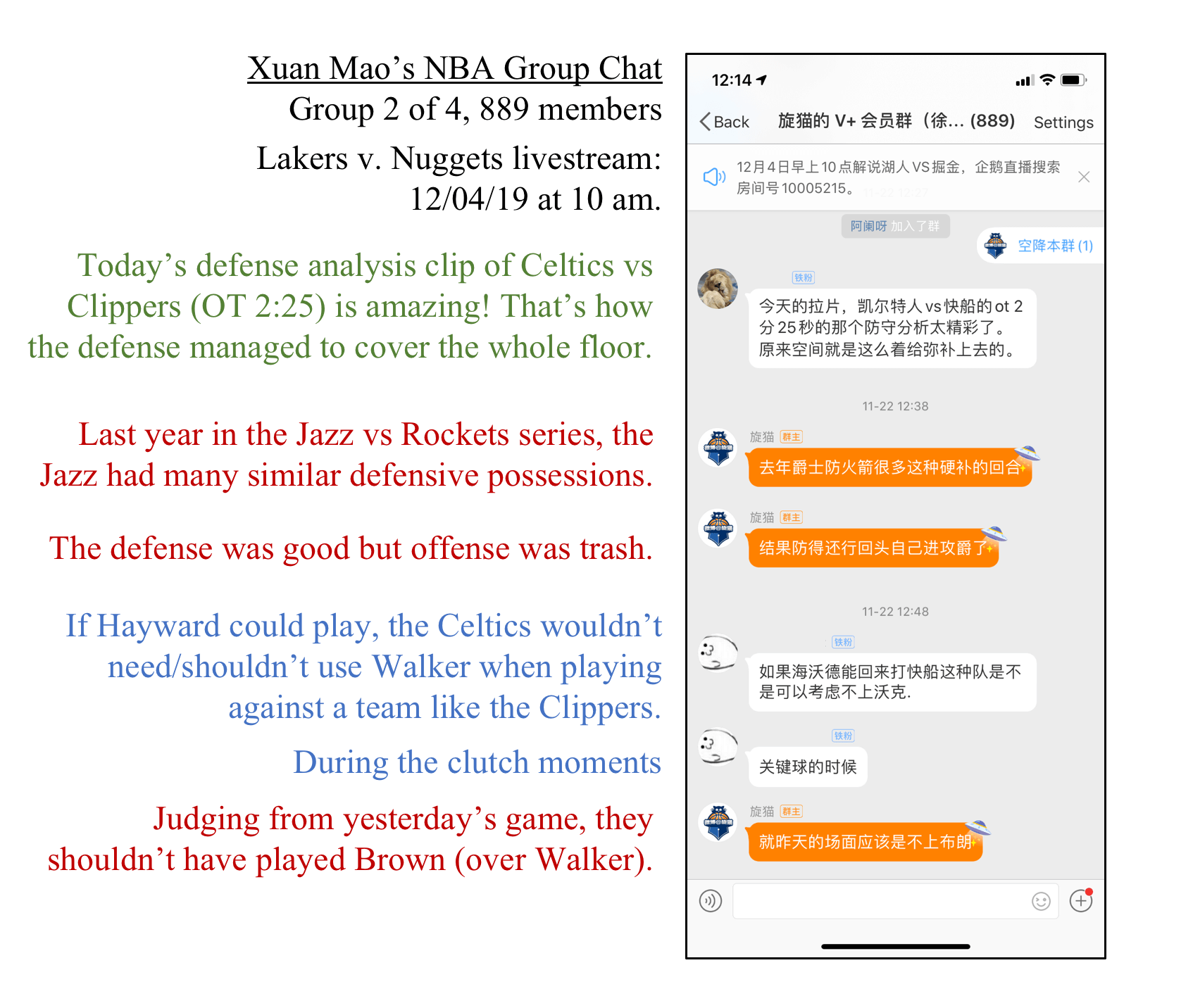

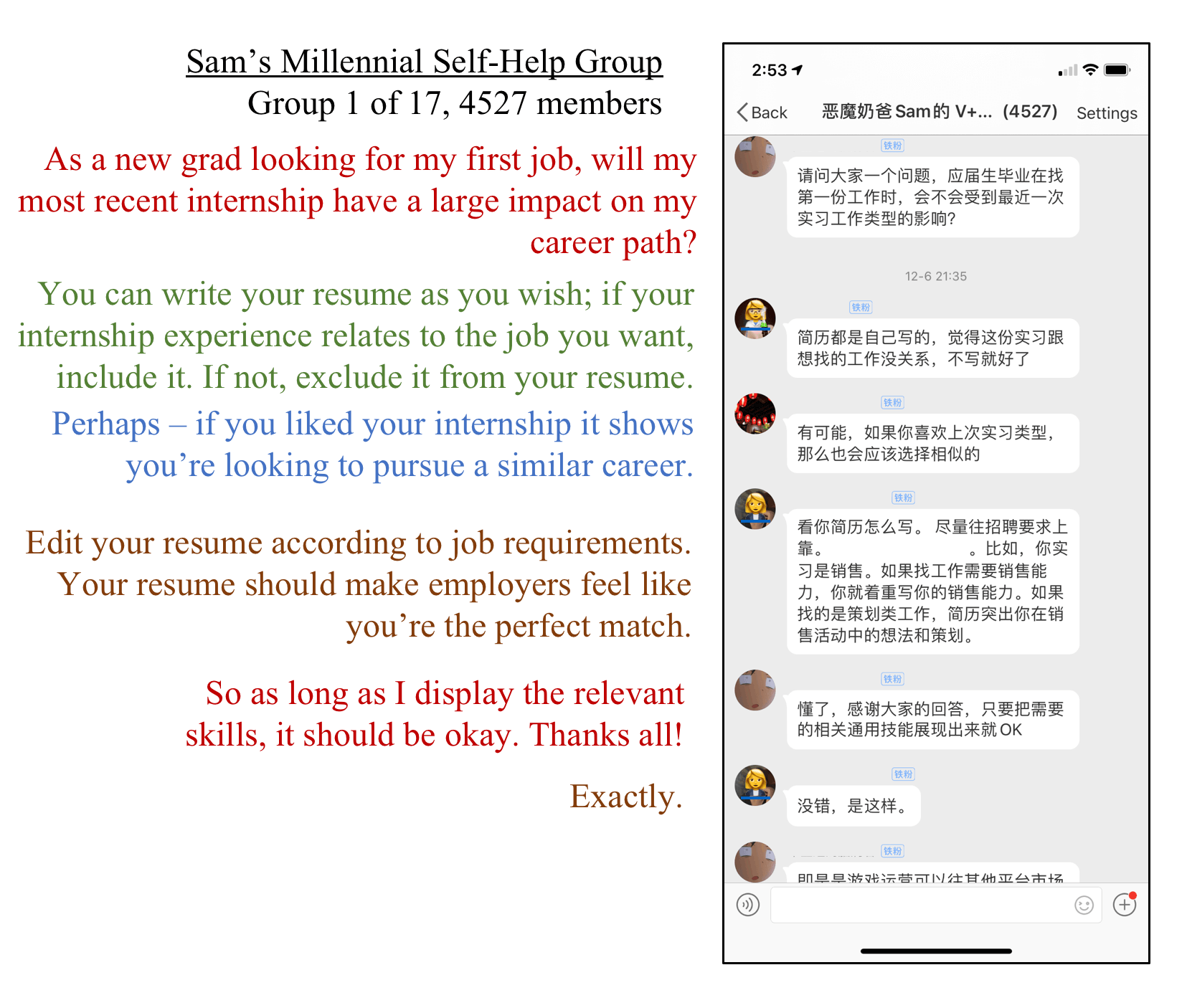

For example, Xuan Mao’s NBA group ($24 per 6 months) provides a casual outlet for fans to chat about player performance and game events with hundreds of members. His subscribers also receive premium analysis, exclusive live streams, and the chance to participate in Q&A.

Another example is Sam’s (恶魔奶爸) Millennial Self-Help Group ($33 per year). The group’s creator is a popular educational columnist who has more than 15 paid Weibo groups—each group has thousands of followers. Upwards of 1,000 messages might be sent in a single group each day. Though Sam occasionally responds to messages, the conversations are mostly between members of his audience—millennials chatting about popular topics like employment, love, and their personal finances. Here’s a sample conversation based on a resume question:

Expert paid content

Financial analysts like Zhang Ma offer longform analysis as well as exclusive charts and graphs only to paid subscribers. In particular, his channel (screenshot below) grants readers access to a library of more than 1,500 pieces of content, including more than 900 short-form pieces, over 200 essays, and nearly 400 Q&As. A tip button at the bottom of each article gives subscribers the ability to reward authors for particularly insightful articles.

Paid Q&As

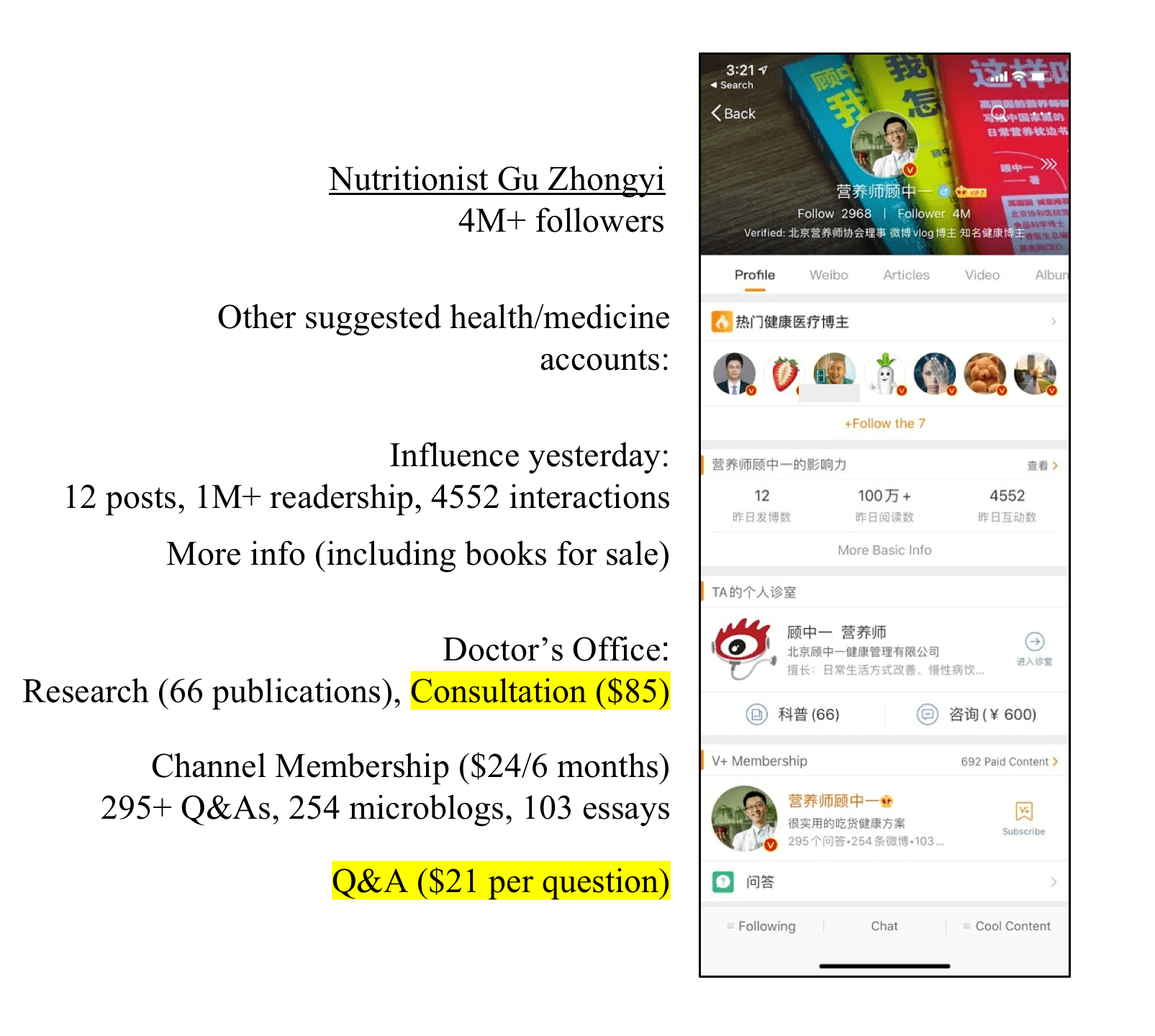

Through Weibo’s Q&A feature, users can ask questions to influencers through their profile pages—and even offer cash for answers. Nutritionist Gu Zhongyi, for instance, provides 6-month channel memberships for $24 that include chat groups and the ability to view all paid content. But to ask him a question directly, Dr. Gu charges $21; the user is only billed if he answers. (After building a following on Weibo, Gu quit his job at a top Beijing hospital.)

Native ecommerce

Weibo influencers have been selling physical goods since shortly after Alibaba purchased a stake in the company in 2013. And here in the US, platforms such as YouTube and Instagram are starting to release native ecommerce tools. This is a huge business for Weibo influencers—much larger than digital memberships—particularly for clothing and cosmetics.

Influencers can create shoppable posts where clicking on embedded links opens up an overlay for Taobao—often dubbed the eBay of China—where readers can complete the transaction. Imagine if Shopify or Amazon were strategic partners of Twitter or Instagram. While some influencers sell their own branded items, oftentimes they will work with multi-channel networks (that connect influencers with third-party brands) to facilitate sponsored posts. A secondary benefit of in-app ecommerce is collaborating brands are able to attribute revenue directly to individual influencers.

In addition to selling merchandise, influencers also use Weibo as testing grounds: some poll users on outfits that are destined to be mass-produced; others take preorders to ensure demand before making orders.

All of the monetization products mentioned above—channel memberships with paid chat groups, paid content, Q&As, and ecommerce—have helped Chinese social networks keep influencers engaged, on-platform, and compensated. In part 2 of this series, we’ll share another avenue for paid social in Asia: platform memberships sold directly to users.

Read more about the future of short video and livestreaming ecommerce.