“Hic sunt dracones” (Here Be Dragons)

Once upon a time, early map-makers included illustrations of dragons in unexplored areas of the world to show where unknown dangers were thought to exist…or so the legend goes.

Navigating the commercial launch for a new drug can feel like you’re in similarly uncharted waters. How do you find the patients that could most benefit from your drug? Which doctors are receptive to learning more about your therapy? How and when are competing therapeutics being used in your targeted disease? The stakes are high: successfully taking a drug from the lab bench to commercial launch takes an average of 12 years and $1.5 billion, dotted with many failures along the way. And time is of the essence. From the moment you launch, you’re sailing towards the edge of the world. Patents have a limited shelf life before you reach the dreaded “patent cliff” (when key patents expire, generics arrive, and sales plummet). So launch trajectory matters enormously—how high you aim and how fast you move determines how far you’ll go. Capturing full value from every commercialized product over a few precious years, in order to recoup and generate a return on those steep R&D investments, is an absolute strategic imperative.

But these waters are full of dragons. Commercial launches for new drugs fail all the time; only about a third actually meet or exceed expectations. Why is it so difficult for commercial leaders to chart a successful course? It’s because most are navigating in the dark. For many reasons—structural, regulatory, competitive, technological—high-resolution market data sets are very hard to come by. When I was part of the commercial team managing a billion-dollar therapy at a biotech company, I was always struck at the lack of visibility we had into our own market. We had a blockbuster drug franchise on the line and were more than willing to invest as needed to protect and expand it—but it was never clear where to place our sales and marketing dollars for the most impact.

We were far from the only ones to struggle with this problem. Historically, biopharma companies have tackled this challenge by acquiring raw, aggregate data sets (prescriptions, medical claims, etc) and then hiring expensive consultants to wade through oceans of data and fish out critical insights. Just like traditional drug discovery, commercial planning was a very bespoke process—each and every drug launch or market study its own custom job. Biopharma’s R&D engine consumes over $90bn a year, for dozens of new drug launches targeting hundreds of different diseases; an aggregate $30bn is plowed into marketing to find and educate both patients and physicians. This is a massive market opportunity for better data and analytics—and an opportunity to create a better biopharmaceutical market.

As former healthcare consultants themselves, used to manually mining raw datasets for elusive insights, Arif Nathoo and Web Sun became frustrated with the status quo. They founded Komodo Health to modernize how the biopharmaceutical industry develops and commercializes novel drugs. These two co-founders bring deep knowledge to the space: Arif is a Harvard-educated physician and former McKinsey consultant; Web is an entrepreneur and a seasoned healthcare consultant as well (funnily enough, one of those consultants that worked on my previous company’s drug franchise). They are the products of the very system they are helping transform.

Named after our modern-day dragons (technically, giant lizards!), Komodo Health has quietly used technology to create a “living map” of the healthcare system. They have built a massive healthcare analytics and data platform which ingests information from more than 15 million new patient encounters each day, capturing the anonymized experiences of more than 320 million Americans through disparate medical claims, diagnostic labs, and prescription data sets (all the while safeguarding individual patients’ privacy). The company has essentially verticalized data, data management, and analytics into a full-stack technology offering. Today, Komodo sells software-as-a-service subscriptions for these data and analytics tools to 19 of the top 20 biopharmaceutical companies.

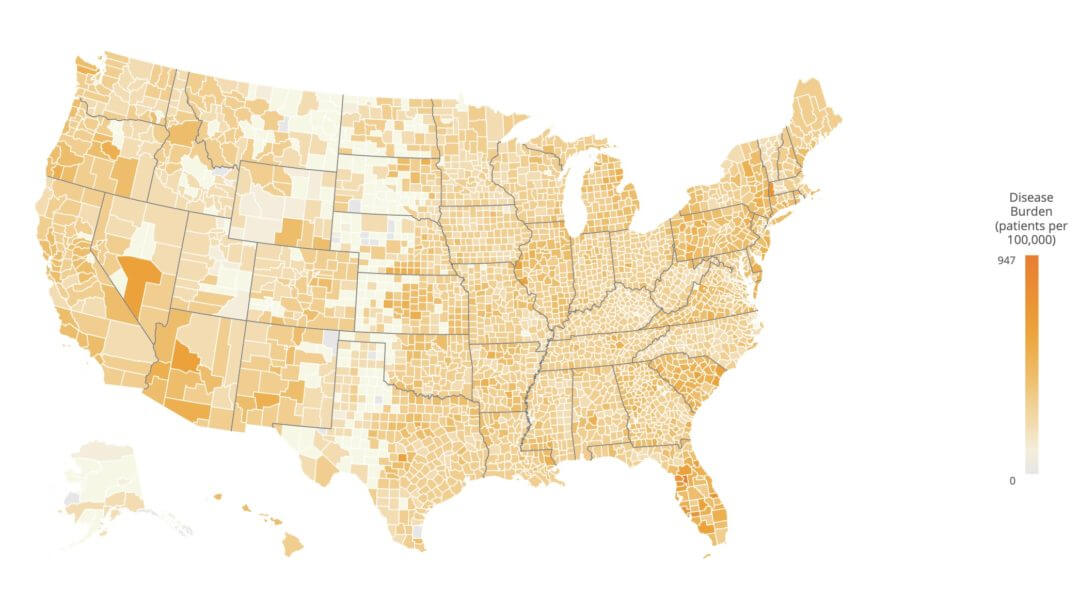

Komodo’s technology enables its users to navigate the healthcare landscape in unprecedented ways. Through Komodo’s healthcare map, biopharma companies can discover patient populations that would benefit from their therapy; pinpoint patients that are not being treated at the standard of care; identify medical centers most likely to recruit patients for clinical trials; or identify physicians with unmet needs in their markets in order to optimize their salesforces.

But a living map of the healthcare system is valuable to much more than just pharma. It means payors and employers can better understand referral patterns and patient flows, more effectively manage risk pools, and offer their members better care. It means local and national government officials can track outbreaks in real time, better estimate disease burden, and act more swiftly on behalf of the public. And maybe most importantly, Komodo’s map can help route patients swiftly through the byzantine US healthcare system—the company has already partnered with various non-profit patient advocacy groups like the Cholangiocarcinoma Foundation and PSC Partners Seeking a Cure to help patients find specialists nationwide and improve care.

This is software eating healthcare access and analytics. The same way all of us now use Google Maps to get from point A to B, Komodo can help all healthcare stakeholders—pharma, payors, providers and patients—find their way. I am thrilled to announce a16z is leading the Series C investment in Komodo Health and are joined by new investor Oak HC/FT and existing investors IA Ventures and Felicis Ventures. We’re honored to support Komodo’s amazing team as they take our collective healthcare journeys and transform them into a true understanding of our healthcare system—creating a future of health that is “fueled by data, transformed by insights, and driven by outcomes.”

Some dragons are harbingers of danger. But, fortunately, others are watchful guardians over our shared treasures.