This is an abbreviated version of a presentation I gave live at the a16z Summit in November 2019. You can watch a video version on YouTube. Download the slide deck here.

Lee este artículo en Español. / Leia esse artigo em Português.

In the not-too-distant future, I believe nearly every company will derive a significant portion of its revenue from financial services. In this post, I’ll delve into the infrastructure that’s enabling this transformation and, more importantly, how that’s going to fundamentally change banking as we know it. Every company, even those that have nothing to do with financial services, will have the opportunity to benefit from fintech for the first time.

Startups will be able to launch companies faster and more cheaply. Existing financial services institutions will be able to introduce new products quickly—and spend less on IT maintenance. And most importantly, this means more choices, better products, and lower prices for consumers.

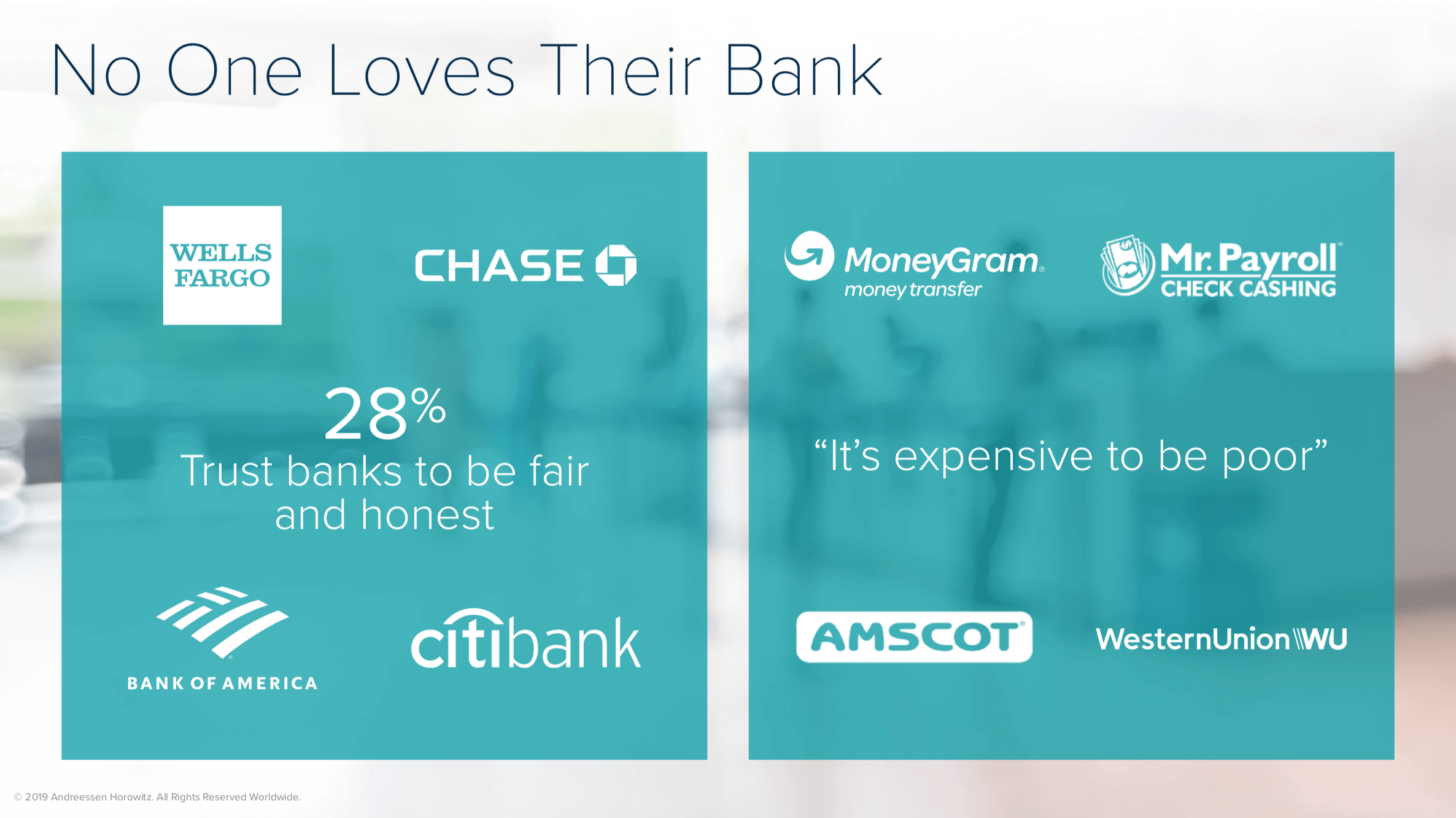

First, let’s take a brief look at the state of the banking industry today. A survey by the World Economic Forum found that just 28 percent of the millennial and Gen Z generations trust their banks to be fair and honest. That is a far cry from providing delightful products.

Meanwhile, the more than 50 percent of Americans who live paycheck to paycheck often experience an entirely different financial services system. Though they’re likely to need financial services more, they have fewer options, and those offerings are much more expensive. Collectively, the majority of us definitely don’t love our banks.

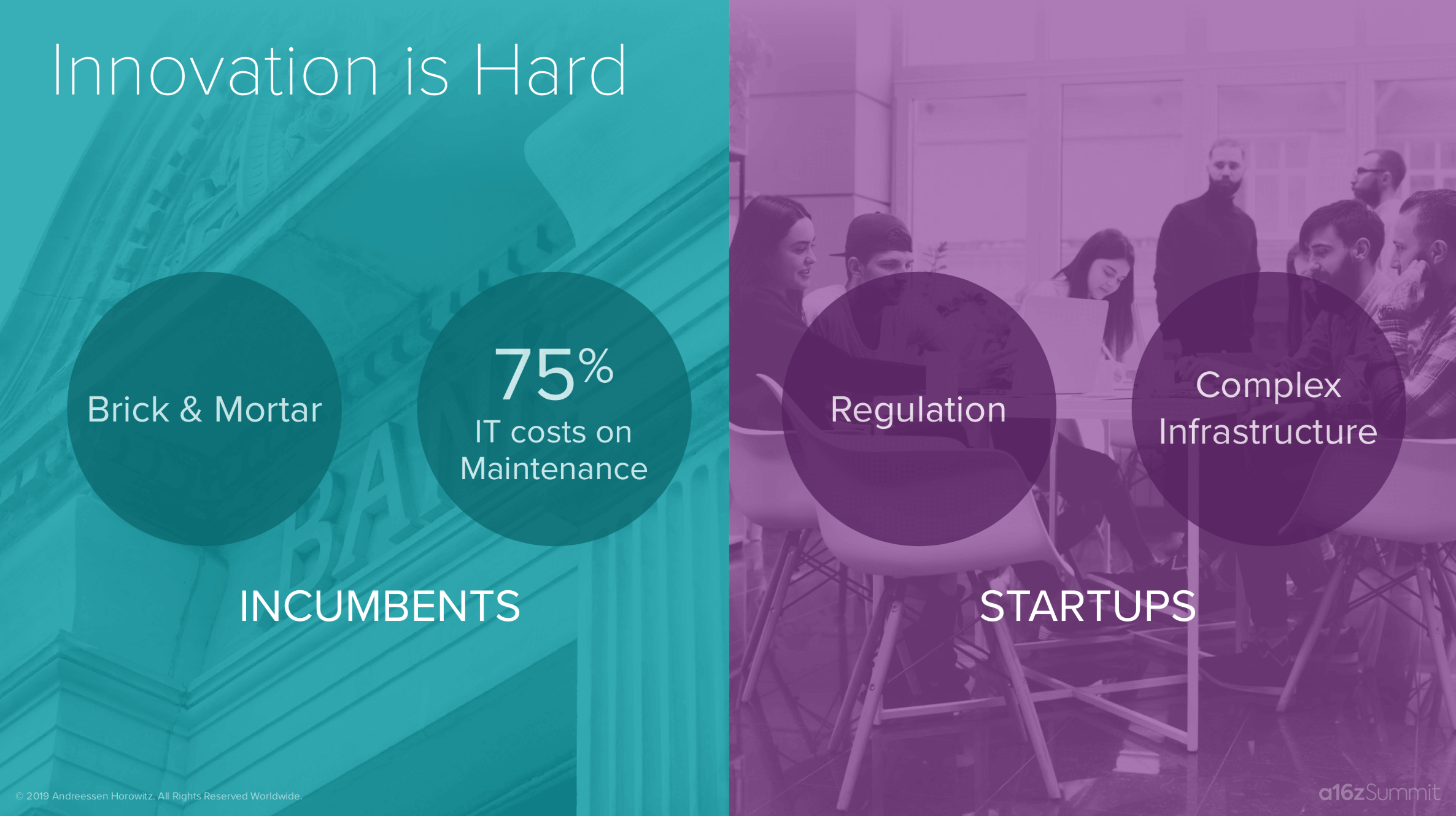

Why has the status quo persisted for so long, despite extreme levels of customer dissatisfaction? While innovation in any industry is hard, innovation in financial services is particularly difficult. Many of these existing institutions have been around for more than 100 years and have a large brick and mortar retail footprint. As a result, it’s hard to cut costs and roll out new products quickly—think about the many long-term leases and thousands of employees that need to be trained across the country.

While many of these institutions may have billion-dollar-plus IT budgets, at some of the larger banks, 75 percent of those dollars is spent solely on maintaining existing products. This is a highly regulated industry, with multiple regulators across state and federal. It has a very complex infrastructure. So while this is a big opportunity for startups, there are huge challenges, too.

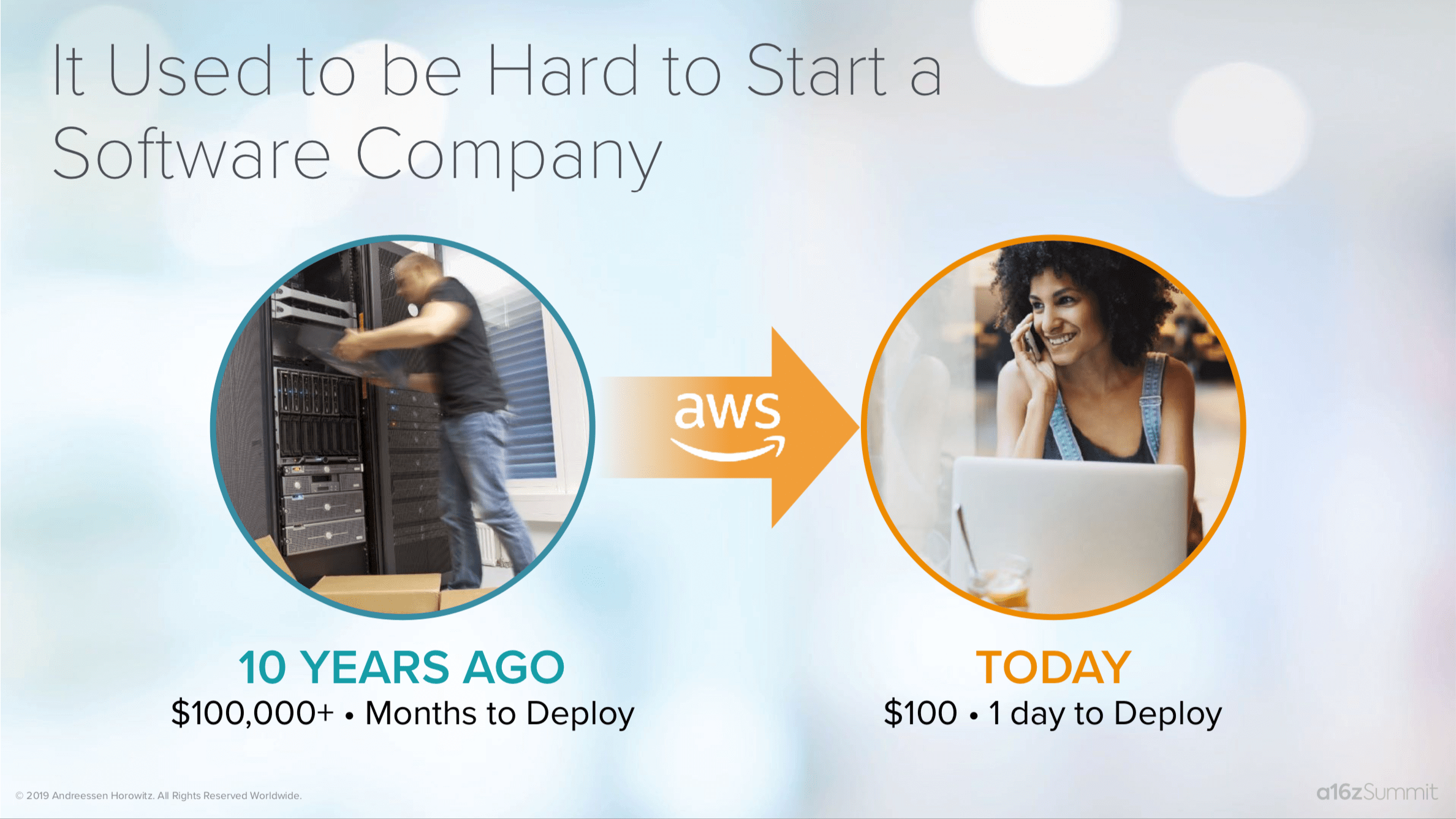

Given all of these challenges, why am I so optimistic about the future? There’s a parallel here: It used to be really hard to start a software company. Ten to 15 years ago, your first step would be driving to a computer store. You’d buy physical servers, maybe load them into the back of a borrowed truck, then drive them back to your office and rack them in a server room. You’d buy some software licenses, write some code for a database, and hundreds of thousands of dollars—if not millions—later, you could finally start building the product that you wanted to bring to market.

If this sounds totally anachronistic, that’s because it is. Today, anybody can start a software company with a credit card and a laptop. Why? Amazon Web Services brought all of this infrastructure as a service. AWS dramatically reduced cost and complexity and unleashed thousands of experiments.

Think of a company like Airbnb. Imagine if the founders had had to go to investors and convince them to give the company millions of dollars just to build the infrastructure to prove that yes, there’s a massive market where we all want to stay in strangers’ homes. It might have turned out differently.

The “Amazon Web Services” era for financial services

This same monumental change—infrastructure “as a service”—is coming to financial services. And it’s not just one company, it’s multiple companies, because financial services infrastructure is so complex. This transformation will reduce the cost and complexity to become a financial services company, and importantly, it will unleash thousands of experiments that will pave the way for the future of banking.

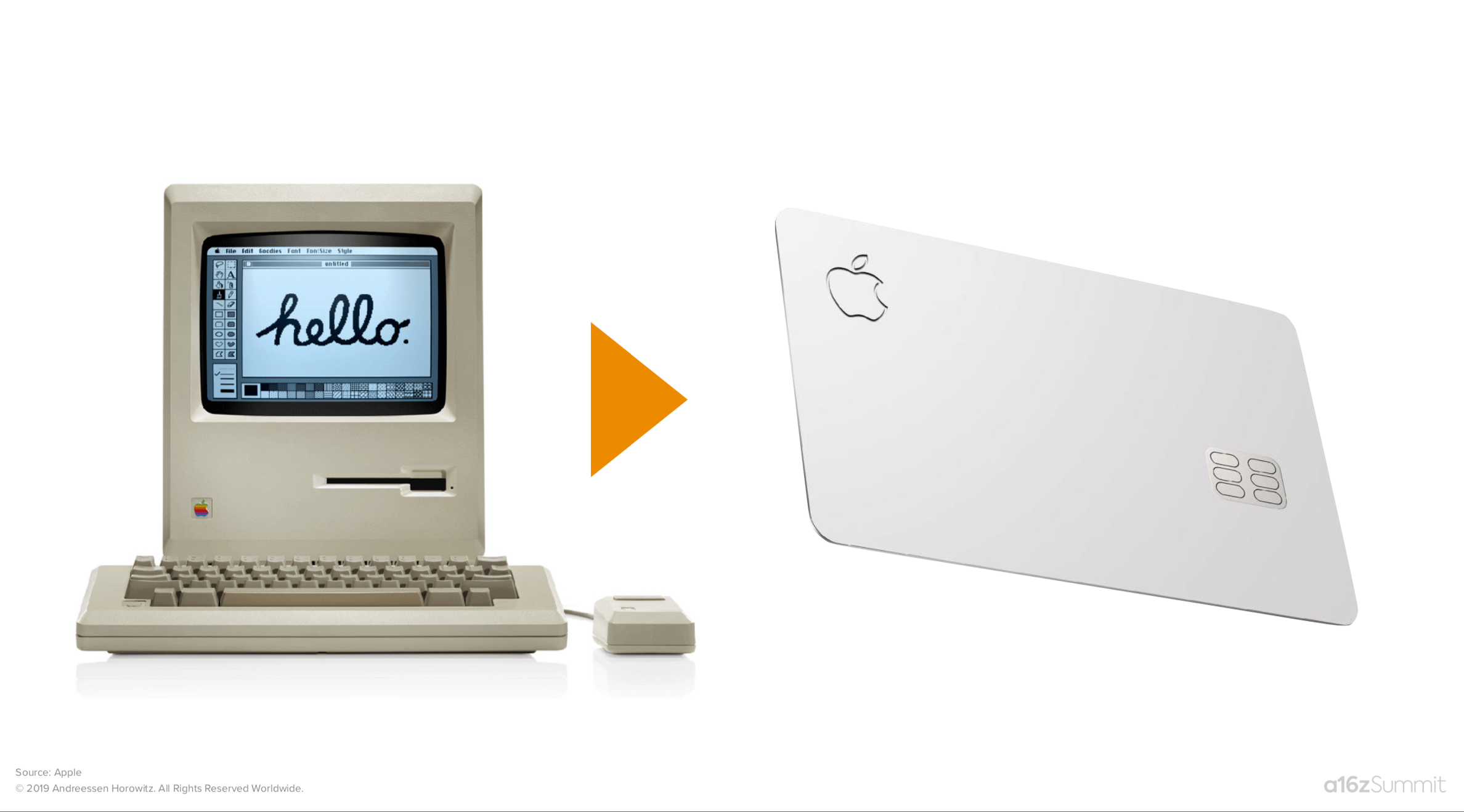

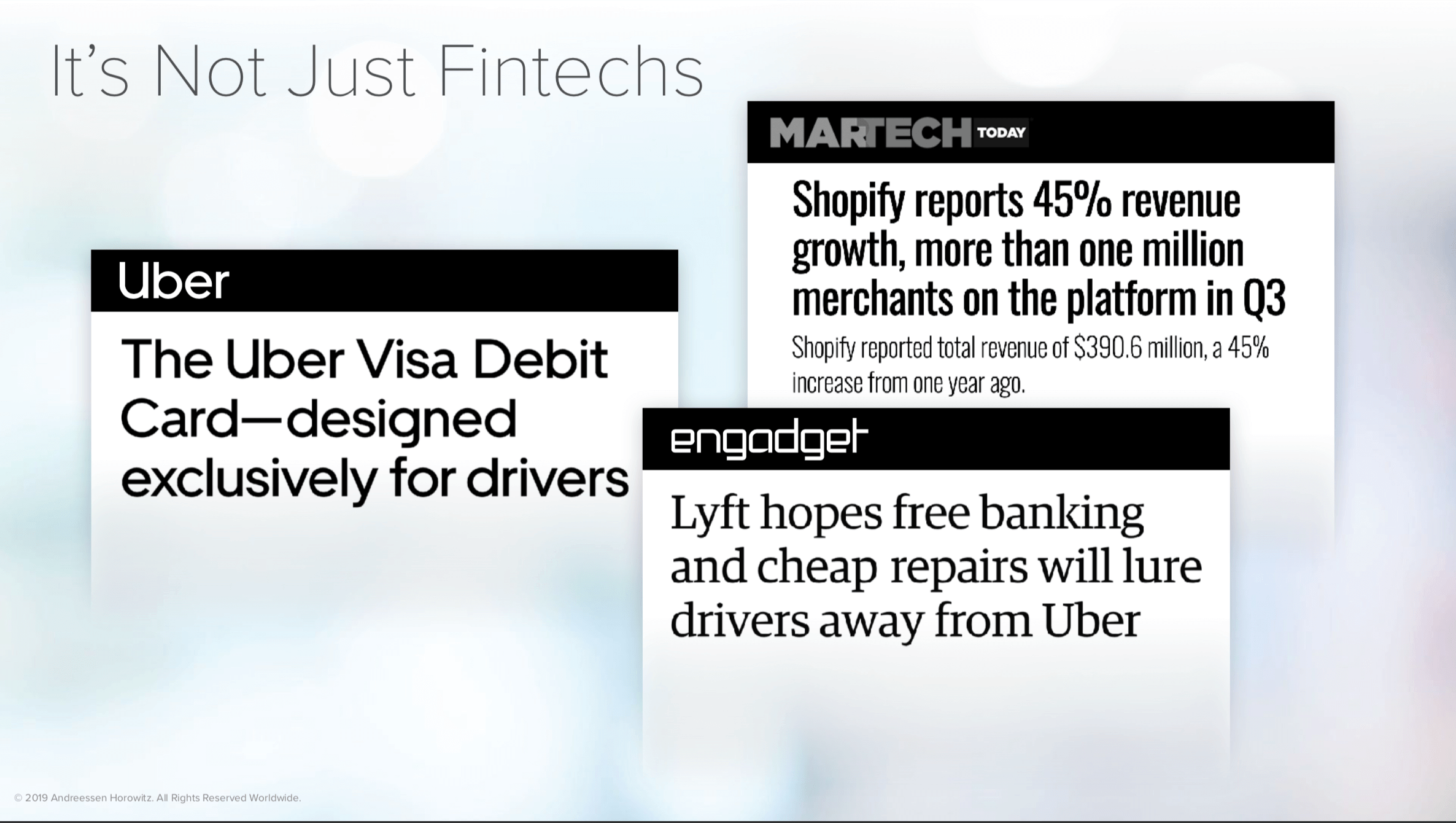

We would expect this innovation to come from startups and existing financial services institutions. But a large percentage of it will come from existing companies that are adding financial services for the very first time. It’s already happening: Apple just launched a credit card.

Now, this may have been a highly anticipated move in fintech circles, but not that long ago Apple was just your computer company. Now it’s hoping you’re going to like its credit card as much as you like your iPhone. It could be easy to dismiss Apple because it’s a company that’s both flush with cash and known for launching new products. But this trend is happening more broadly.

Take Uber and Lyft. These are ride-sharing companies, right? If you’re a driver, they might also be your bank. For Uber and Lyft, adding financial services has two benefits. The companies both spend hundreds of dollars acquiring drivers. Then they have to make up that cost through margin on rides. It’s much faster to make up that cost if they also have margin on banking services. Furthermore, if I’m a driver, I’m more likely to stay with a company that is also providing my financial services. Ultimately, if successful, Uber and Lyft might need to acquire fewer drivers, due to better retention.

This is not just a consumer phenomenon. It’s also happening in B2B. Take Shopify, for example, which provides website services for any merchant for a monthly subscription fee. Or Mindbody, a company that helps fitness studios like yoga studios manage their businesses, also for a monthly fee. Turns out both of these companies make nearly 50 percent of their revenue through financial services.

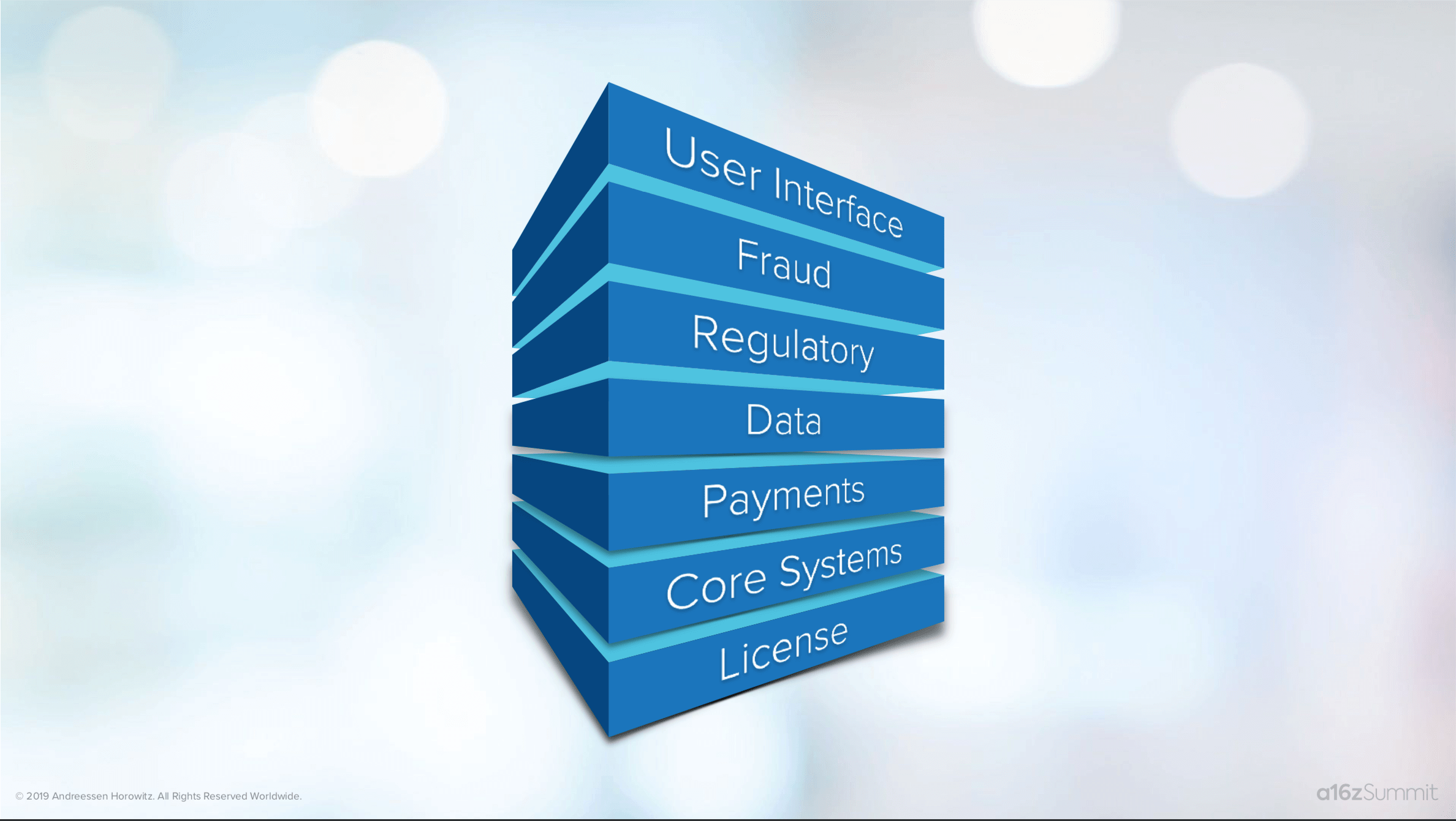

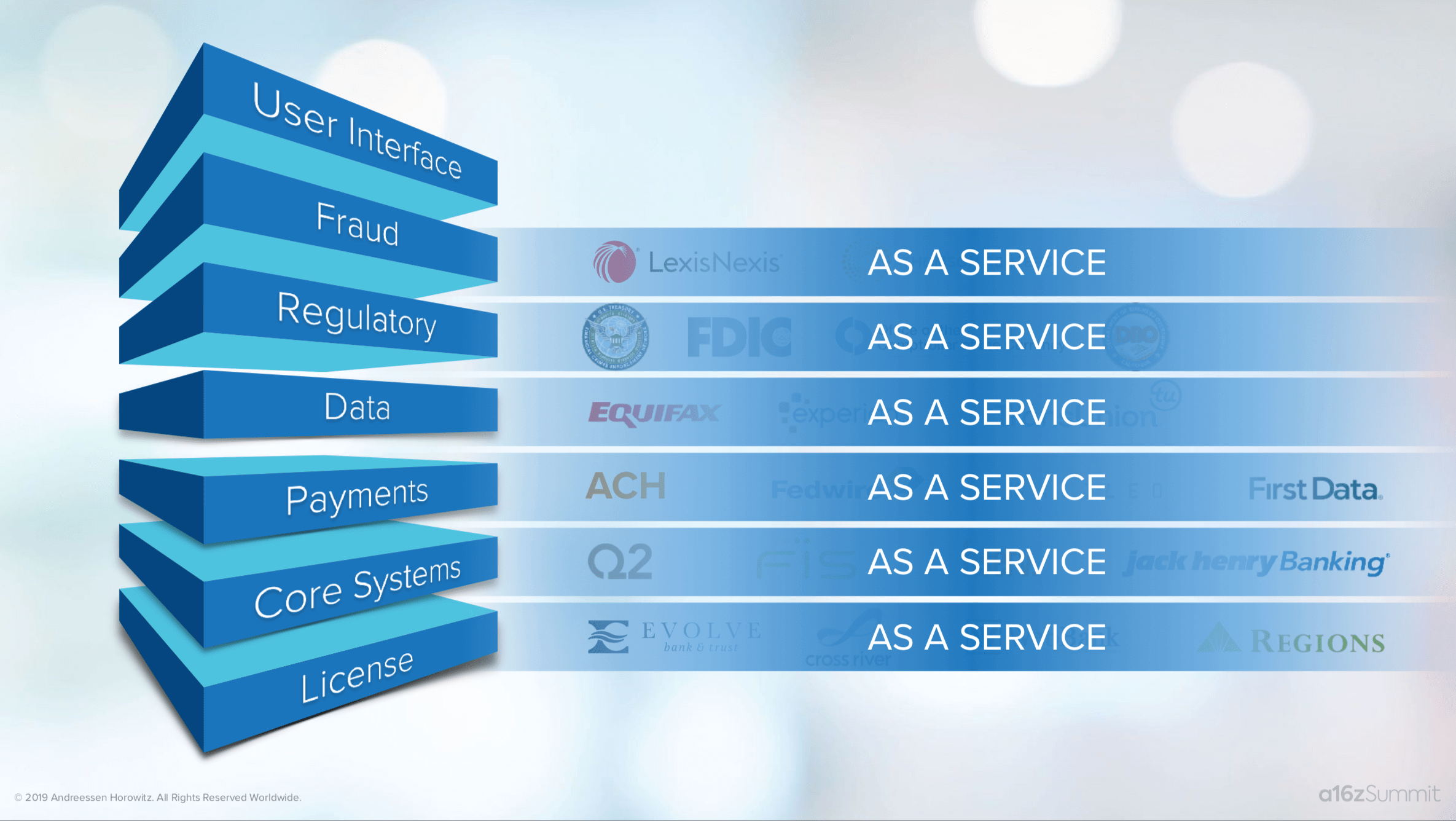

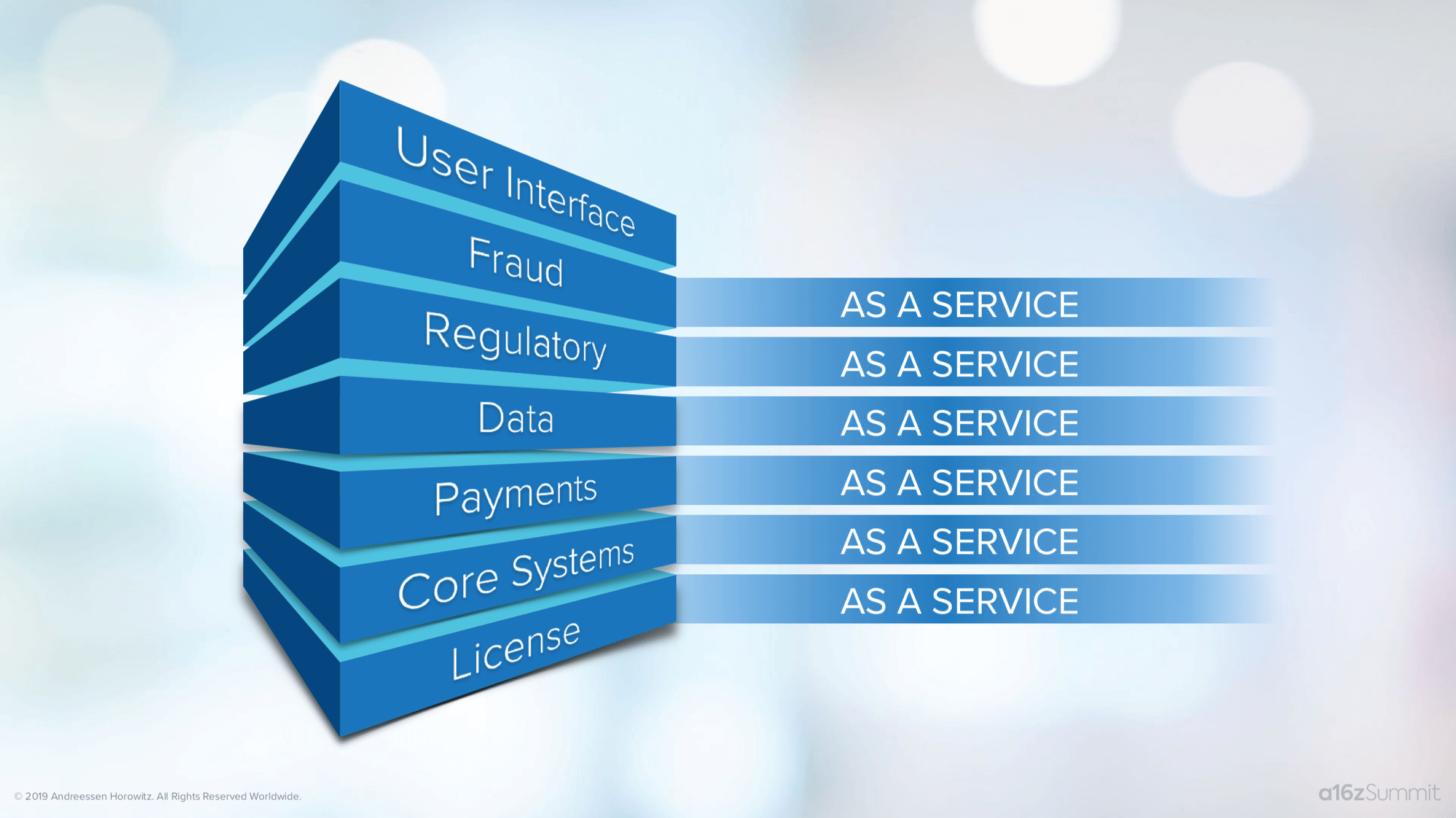

So, why is this fintech explosion happening now? The “as a service” infrastructure is coming to banking. To understand why this is such a big deal, we need to look at how complex the banking stack is today.

Ever wondered what it takes to start a bank? Here’s a simplified version of what it looks like on the consumer side. In this highly regulated industry, first you need to apply for a license, which could take years. Instead, most of the new companies are finding a sponsor bank (effectively borrowing a license). But that’s just your first required partnership.

Then you need a core system (analogous to a large database) that logs where your customers’ money is and how it is moving around. You need to integrate with a series of payment systems so customers can take money out of their accounts. To make loans, you would need to know information about your customers via the credit bureaus. There are multiple regulatory agencies that you need to comply with, likely driving more partnerships for KYC (know your customer) and AML (anti money laundering). And because we’re dealing with money, you need to guard against fraud, which requires more software. So now we’re looking at over a dozen partnerships. Even after the two years it typically takes to ink those deals, you still haven’t built the new product that you wanted to bring to market!

But what if, similar to what Amazon did to compute and storage, companies focused on each layer of this complex stack and provided that step as a service? That’s exactly what’s happening.

Banking infrastructure as a service

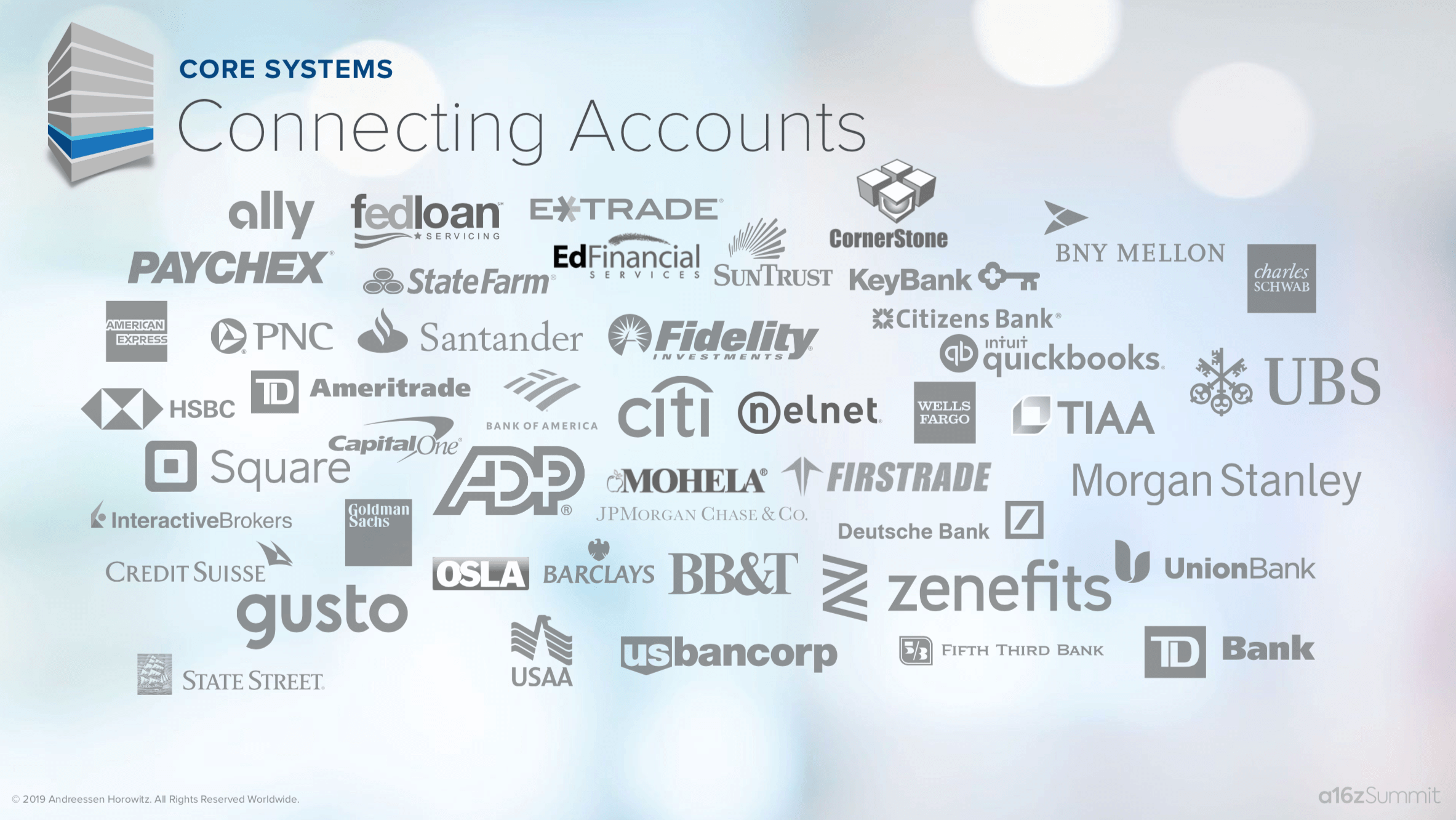

Let’s take a look at a few examples. To start, let’s say I want to build a simple budgeting or financial planning application. I’m not trying to rebuild the stack, I’m just trying to get data out of the stack. Sounds easy, right? Not really, when you dive into it.

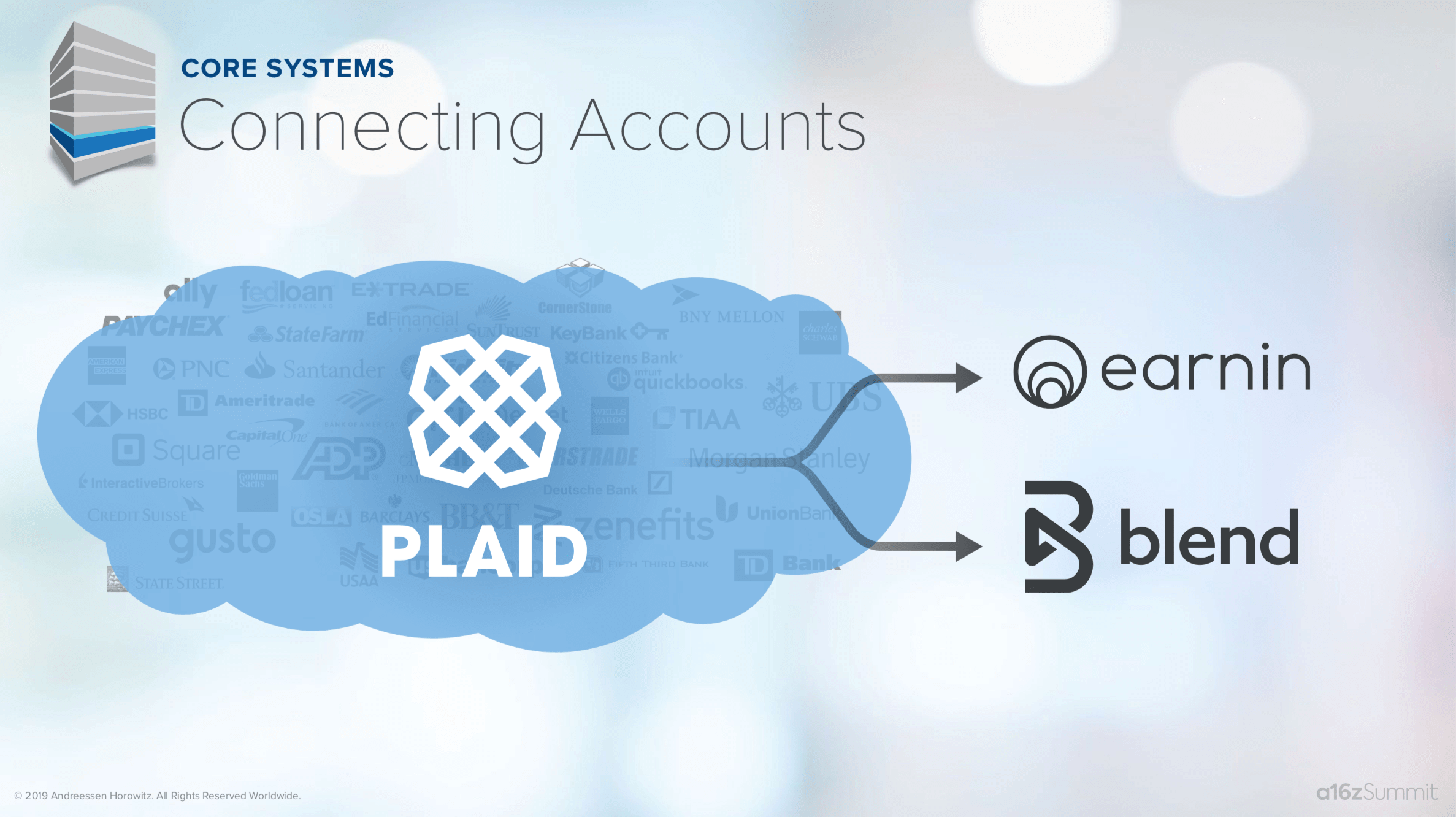

First, I would need to know everything about my customers’ finances. Start with the banks. There are thousands across the US. To make things more complex, many of these banks have different core systems and, hence, different data formats. There are at least dozens of integrations I’d need to build and maintain to have even mediocre coverage. I would also need to know about my customers’ brokerage accounts, and maybe payroll. If they have student loans, that’s an entirely different set of integrations. You can easily see how I can spend all of my time building infrastructure—and I haven’t even built the great financial planning application that I wanted to bring to market.

Now, however, there’s a company like Plaid that builds and maintains all of those integrations “as a service.” Importantly, Plaid also translates the data into a usable format.

This pre-build infrastructure layer has helped accelerate companies like Earnin, which allows users to get early access early to their paycheck for money that they’ve already earned, or Blend, which is a streamlined mortgage application. Instead of faxing in months of bank statements and brokerage statements, you can simply link your bank accounts. New connections are being built, like those into student loan servicers. In the near future, we’re likely to see much-needed improvements to the student lending experience.

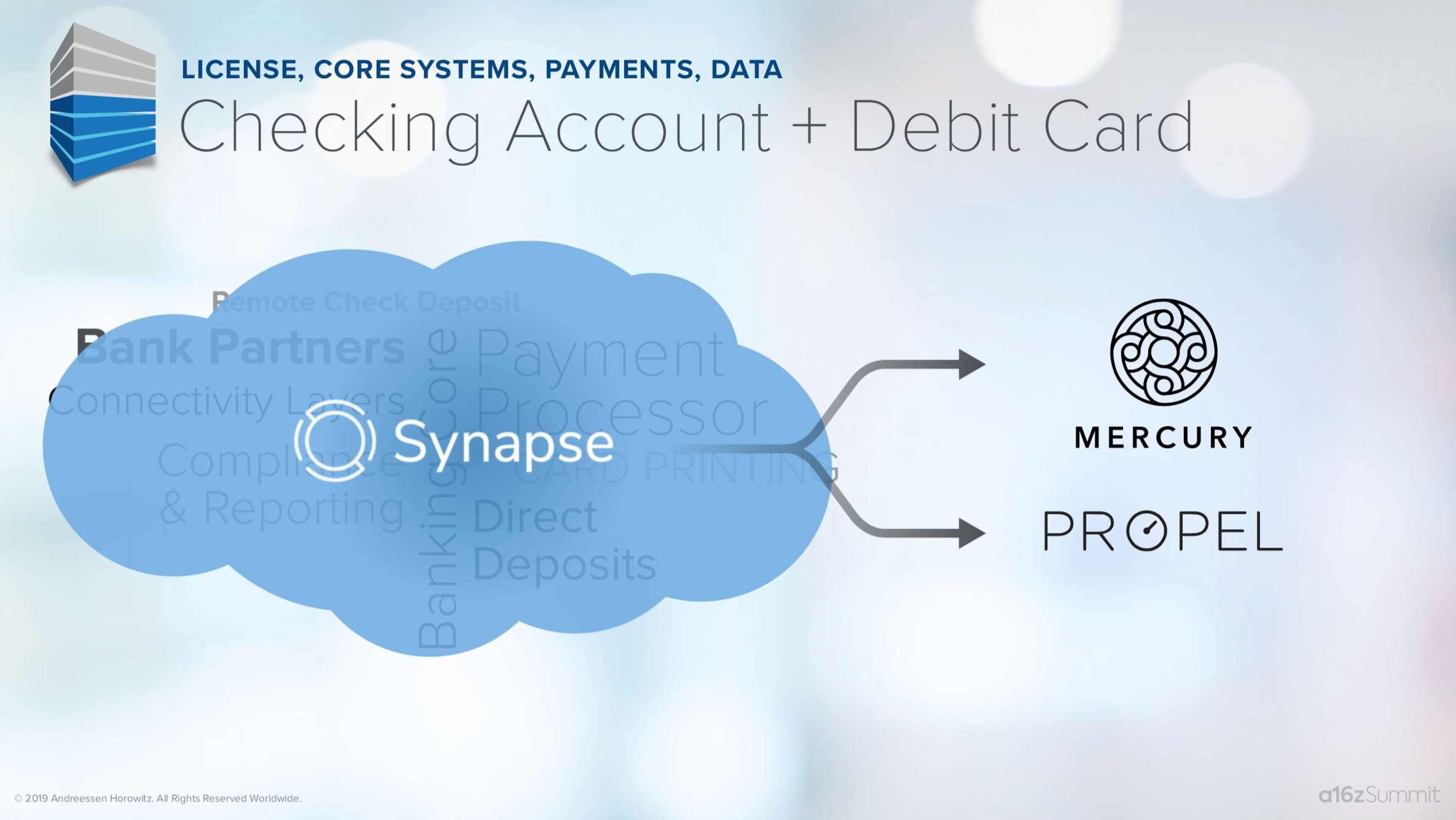

Here’s another example: say you have a great idea for a new consumer banking service that includes a checking account and debit card. You’d need more partnerships than I mentioned above—for example, an ATM network for cash withdrawal and, perhaps, remote check deposit. And since a lot of these systems were built in the 1960s, you’d need to write a lot of code to stitch these partnerships together.

But now we have a company like Synapse that provides all of this “as a service.” In addition to dramatically reducing time to launch, this does two things: First, it enables the entrepreneur to focus on bringing a new product to market. So, for instance, Mercury is a small business or startup bank. It focuses on ease of use and providing great cash flow visibility, which is number one reason a lot of companies go out of business. Second, Synapse allows businesses to prioritize a customer understanding and distribution strategy, rather than banking infrastructure and payments expertise.

Propel is a company that serves some of the 40 million families that are on Electronic Benefits (e.g., food stamps). One of the company’s founders grew up on food stamps and had deep insights into this market. Propel started by offering budgeting services and is now layering on financial services.

Combating fraud and money laundering with fintech

Many industries are regulated—typically, if you don’t comply, you’ll get fined. But if you don’t comply with regulation in the financial services industry, you’ll go to jail. (Anyone who’s seen Ozark on Netflix knows the lengths criminals go to move illegal money, for instance, from the drug trade into the legal system.)

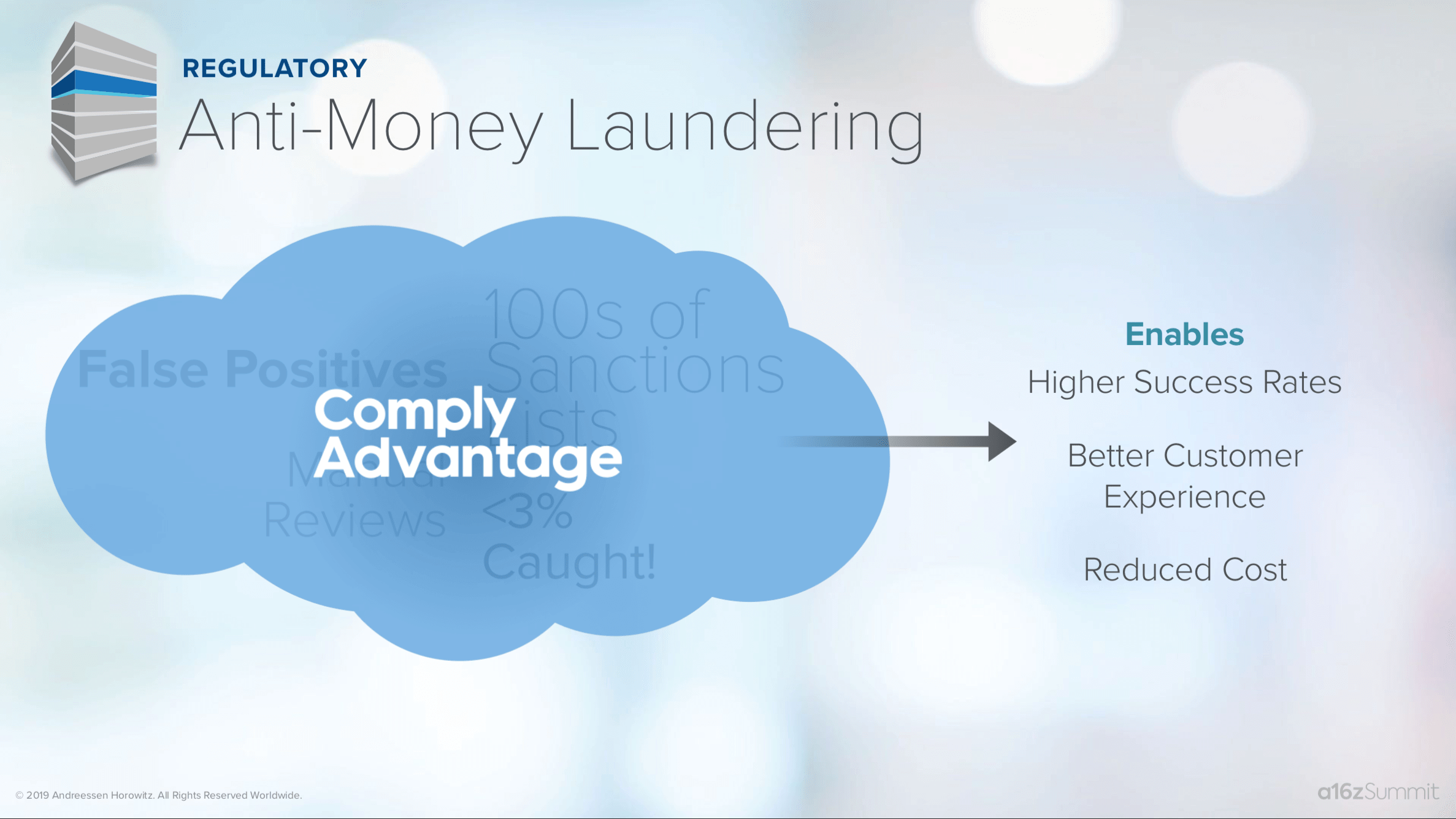

Banks are required to comply with a set of laws that’s intended to prevent money laundering. They monitor hundreds of sanctions and terrorists lists around the world——as well as all of our transactions. As you might imagine, this results in many false positives (legitimate customers getting blocked), as well as a ton of manual reviews. It’s a cumbersome process: At one of the large banks, 30,000 of 210,000 employees work solely in compliance. The vast majority of those workers are assessing suspicious activity and filing suspicious activity reports as a result of anti- money laundering regulations.

More surprising, then, is the fact that less than 3 percent of that laundered money is actually caught. This presents a big opportunity for technology to provide this function as a service. Comply Advantage, for example, does all of these sanction/terrorist watch list integrations for companies, whittling hundreds of integrations down to one. It provides more granular risk controls, so banks can spend less time monitoring transactions and more time focusing on detecting money laundering. This yields a better customer experience, lower costs, and, over time, hopefully a higher success rate. One of the big challenges in this market is that once a bank gets good at catching money launderers, the perpetrators often move to a weaker point in the system.

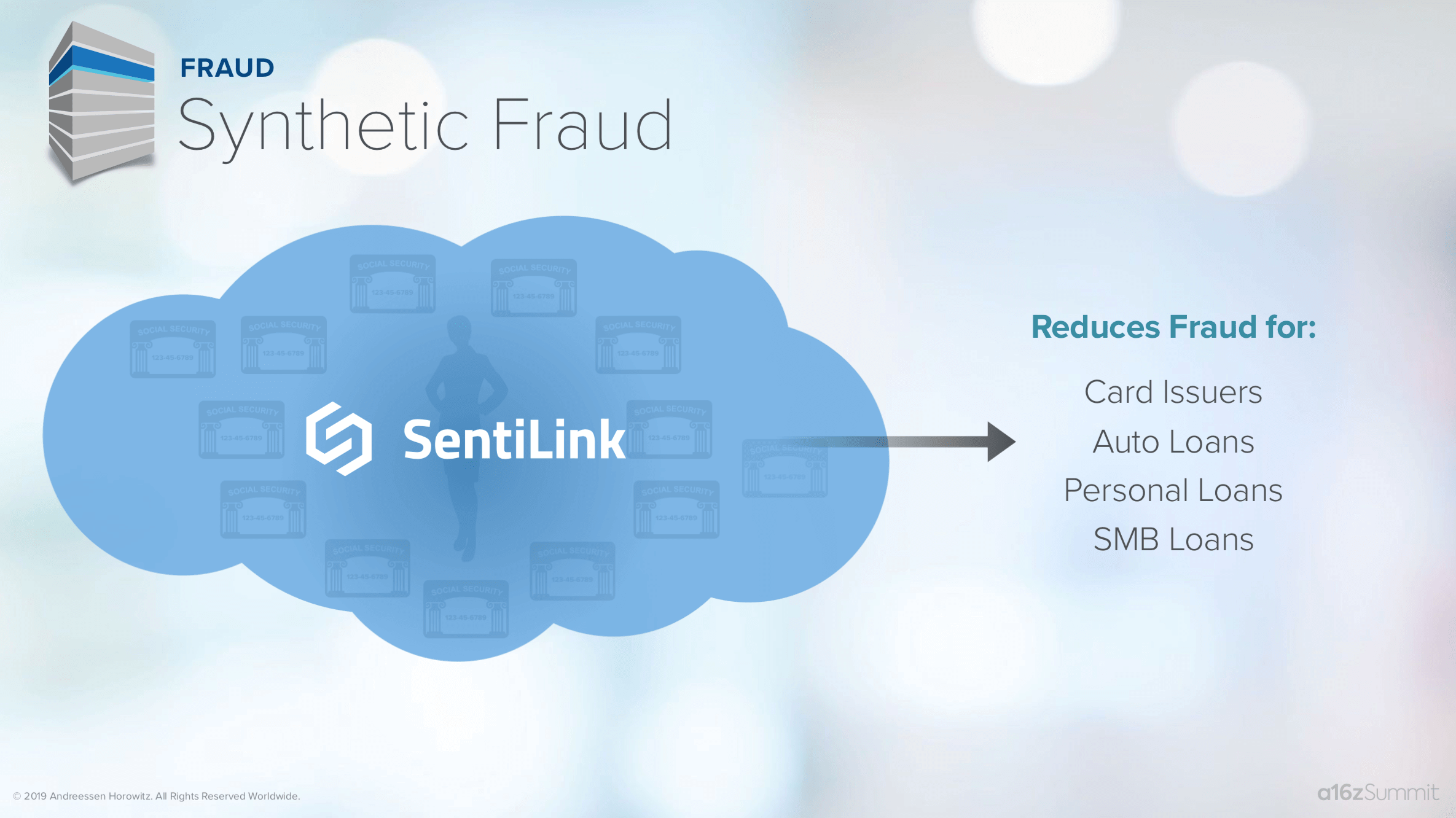

This is also the case with fraudsters. Many of us think of fraud as stolen identities, but there’s actually a much more pernicious type of fraud: completely fabricated or synthetic identities.

Here’s what the data scientists at a lending company discovered. While looking through the database one day, they noticed a rather obscure name linked to 13 different social security numbers. So they checked which of the name/SSN pairs had a credit profile. Turns out, all 13 of them had credit profiles! This is easier to do than you might think.

You can pick almost any nine-digit number that doesn’t start with nine at random and it could be a legitimate social security number. Say you then go apply for a loan. The first time, the lender will ping the credit bureau who will return “No, we’ve never seen this person.” But the next time you apply for a loan, the lender will ping the credit bureau, and the credit bureau will recognize that yes, there’s been an inquiry. Chances are, you can find a lender that, for a high enough cost and a low enough dollar rate, will give you a loan. These synthetic, made-up people pay back the loan, ladder up, and borrow more and more money until they bust out.

This is a very difficult type of fraud to catch. But now we have a company like Sentilink, which does it as a service. Turns out that fake people take out loans at much different rates than real people. And if you’re focused on it, you can stop this kind of fraud much more effectively. Sentilink has been able to significantly reduce fraud across all categories, from auto to personal to small businesses. These are just a few examples of how new infrastructure companies are completely remaking the financial stack—and providing it to all of us as a service.

This is a massive opportunity in the US, but it’s an even bigger opportunity worldwide. Regulation and payment systems differ around the world. In some cases, the financial services stack is entirely different. For example, a country like Mexico, where 80 percent of payments are in cash, needs a layer that incorporates cash payments into the online system.

What’s so unique about this disruption is that, with most large industry changes, oftentimes there’s one winner and many losers. But in this case, everyone has the opportunity to participate and improve significantly. For startups, we’ve seen some of the examples of the new infrastructure companies that are being built, and there are many more opportunities. But there are even more opportunities in the thousands of experiments that are going be unleashed on top of this infrastructure.

Close to 2,000 fintech companies were launched last year alone. Existing financial institutions might finally be able to replace some of their legacy systems and spend less on maintenance. In addition, they may be able to launch new products more quickly by partnering with some of these startups.

Every company, as we saw with Uber, Lyft, Shopify, Mindbody, should be thinking about how to leverage financial services to better serve their customers, better retain their customers, and drive more margin.

Finally, the really exciting part comes to us as consumers. With new financial services companies spinning up—and some of our favorite brands launching financial services—our existing services are getting better. I believe that in the not-too-distant future, everyone, no matter their socioeconomic demographic, no matter where they live in the world, will have access to affordable financial services, and we might even love them.

- Investing in FurtherAI

- Oil Wells vs. Pipelines: Two Strategies for Building AI Companies

- How Big Bank Fees Could Kill Fintech Competition (July 2025 Fintech Newsletter)

- How Will My Agent Pay for Things? (May 2025 Fintech Newsletter)

- What’s Working in AI, Rebuilding Core Banking (March 2025 Fintech Newsletter)