This first appeared in the monthly a16z fintech newsletter. Subscribe to stay on top of the latest fintech news.

Who will build consumers a debt dashboard?

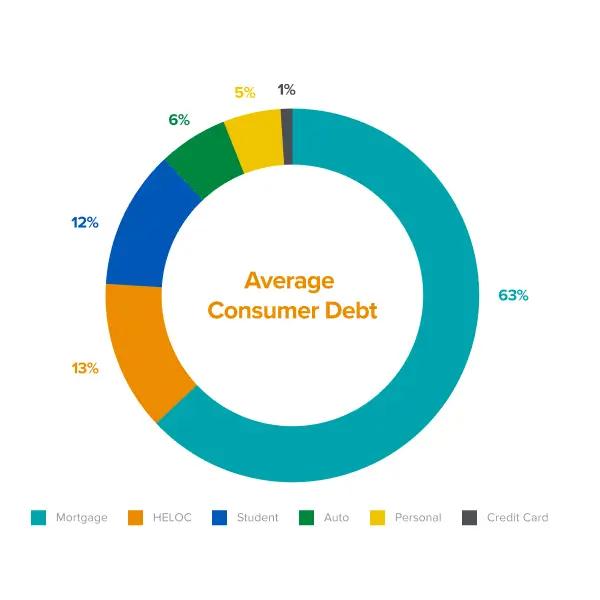

Seema AmbleThis month, President Biden cancelled nearly $3B of student debt for specific categories of students, in an effort to provide relief for the growing burden of student debt. But the $3B cancelled is a tiny portion — less than 0.2% of the $1.7T total student debt held by 43M Americans. And the average American’s student debt balance is only 12% of total outstanding consumer debt. On average, Americans are holding $208,185 in primary mortgage debt, a home equity loan of $41,954, $38,792 in student debt, $19,703 in auto loans, $16,458 in personal loans, and $5,315 in outstanding credit card balances.

This highlights a broader opportunity in fintech to manage consumer debt holistically. Student debt tools may provide a starting point because it can be so complicated to manage: individuals often have multiple loans from different lenders and servicers, unlike mortgage or auto, and there are special federal forgiveness programs and employee benefit programs to navigate. A number of student debt-focused companies have emerged to address this complexity, such as refinance-focused lenders, like SoFi, and companies, like Payitoff, that aggregate loan data, surface relief and refinance opportunities, and help automate payments.

But we don’t yet have tools to put this in the context of all outstanding debt across mortgage, auto, personal, and credit card. Consumers don’t know what order to pay in, where to prepay, how much to revolve on their credit card, or how to think about consolidation. Consumers need to log into each servicer portal and initiate a bank ACH (or mail a check!) to pay each of these loans separately. Higher income consumers may be able to put it on autopay, but even then, they may not be optimizing their cash flow relative to new refinance opportunities and changing rates, or new federal programs.

Automating the physical act of repayment — putting all those various monthly payments on some sort of intelligent set-and-forget — is missing. And there’s nothing that lets consumers assess the impact of a new loan relative to their existing debt.

Several years ago, we wrote about automated consumer finance, but for that vision to be fully realized, consumer fintech applications and neobanks need a debt intelligence infrastructure layer that helps consumers understand and optimize their overall financial profile. But creating a holistic debt optimization layer is complex. For example, each debt servicer needs to be connected to, and loans are offered from thousands of institutions with different and changing terms. Several startups have started to chip away at this problem, with different entry points: Spinwheel, Rightfoot, and Method have started with repaying and optimizing student debt; Solve, with mortgage, Tally, with refinancing credit card debt.

The bottom line: Even if student debt becomes a moot point with a future cancellation, there’s still tens — and hundreds of thousands — in individual debt holdings across home, auto and credit with no streamlined infrastructure layer or dashboard (yet) to help consumers optimize and pay.

Will neobanks be winner take many?

Anish AcharyaOne of the dynamics of internet businesses has been aggregation of fringe audiences and a tendency towards winner-take-all dynamics. It’s curious that so far neobanks (and internet banking more generally) has tended towards “the rise of many,” with a number of neobanks targeting similar audiences achieving significant scale (i.e. Chime, Upgrade, Credit Karma, Current, Greenlight, and more). That leaves an open question of what the long-term market structure looks like — will this market tend towards monopolistic outcomes, or will it mirror the existing market structure of consumer banking?

I believe that the future internet banking market will largely reflect the existing market in the presence of margin and market share for more than one player. However, unlike the traditional markets where audiences were aggregated by geography or profession, we’ll increasingly see audience aggregation by the kinds of software products that can be built to address their specific needs.

Today the world of consumer banking is highly fragmented. The top four banks are worth $1.1T, while the next 95 are worth $1.4T. Though these banks offer largely commodity products, they have protected both margin and market share by focusing on various credit score segments (e.g., Capital One on subprime, American Express on super prime), various geographic footprints (e.g., community and regional banks), and a focus on specific affinity groups (e.g., Mechanics Bank or Christian Community Credit Union). Though overlapping, many of these groups have historically been distinct enough to support many competitors. What will be the impact of fintech products on this structure?

Our initial theory was that the market structure would tend towards a single winner per credit score segment — like a Chime or Earnin for subprime, Upgrade or Credit Karma for nearprime, and a fast growing player like HMBradley in prime. The size of audiences in the US (34% subprime, 21% nearprime, 45% prime) implies the potential for $100B+ outcomes as these players consolidate market share across geographies and affinity groups. However, this theory has been challenged as we’ve seen the rapid rise of players like Current, who are focusing on younger, underserved consumers with a purpose-built product and strong marketing approach, and emerging as formidable competitors to players like Chime.

And notably, the subprime customers of today won’t be the subprime customers of tomorrow. Companies like SoFi have invented terms like HENRY (High Earner, Not Rich Yet) to delineate segments within broad credit bands like “subprime” with very specific needs. After all, a subprime student with a thin file is very different from a subprime individual that’s made a “credit fumble” and is now working to restore their score. These sub-segments demand purpose-built products, and a company like Current can consolidate market share and achieve deep economics alongside Chime. The market size is enormous (130M US adults that earn $75k or less), and the opportunity for product-led growth (rather than economic subsidies to the user) makes this a tractable strategy for emerging players.

Choosing the right partner bank

Sumeet SinghFor every company to become a fintech company, 99% of these companies will need to select a partner bank to power the “fin” side of things.

While several large fintech companies have obtained (or have attempted to obtain) their own bank charters (e.g., Varo, Square, Figure), this is far from a common occurrence, given the amount of regulatory hurdles — FDIC approval, OCC approval, Federal Reserve approval. Most of the companies who have applied for their own bank charters have hit scale by partnering with existing banks.

As we’ve noted previously, there has been a partner bank boom, with 30+ partner banks representing hundreds of fintech relationships. While it’s become easier than ever to launch financial services products by partnering with one of these banks, or with a BaaS (banking as a service) provider, such as Synapse, picking the right bank partner for your specific needs and growth prospects is still challenging for companies.

Here are some of the key criteria to think through when selecting a partner bank:

- Speed/Time to Market vs. Cost/Margins: If your main priority is time to market, a BaaS provider can save time on finding, selecting, and negotiating with a bank partner. BaaS providers can also help with compliance and processing. In general, BaaS providers provide speed to market at the expense of margins. So, if healthy margins are the top priority, it may make sense to do price discovery with multiple banks and to spend time negotiating with a bank directly (not for the faint of heart) rather than going through a BaaS provider.

- Product Capabilities: Different banks offer different financial services products — some may be comfortable and have experience with debit (checking accounts, debit cards, prepaid cards, etc.) and credit (loans, credit cards, charge cards, etc.), whereas many are only focused on one capability. The state in which the partner bank is located also has implications around credit-related fees one can charge (i.e., the max APR allowed in the state is the max a fintech company can charge customers across the country, assuming the bank is federally chartered).

- Culture and Customer Validation: Given how critical your bank partner will be to your future, it’s important to understand how they are supporting other clients at scale, including how they’ve handled edge cases in the past — you don’t want to be a guinea pig with your customers’ finances and your business’s credibility at stake. And your team will be spending a lot of time with your partner bank so make sure you share similar principles, working styles, and priorities.

Fintech must-reads on Future.com

Future — a new media site by a16z — explores the tech that drives the future, as told by the people building it. Here are some of the must-reads on real estate, capital markets, and more:

How the Great Zoom Migration Upended the Housing Market

By Alex Rampell

COVID is spurring one of the most profound changes in commercial and residential real estate in the last 100 years by decoupling employment from location. And the effect won’t just be real estate prices; it will likely have far-reaching second-order effects on families, education, wealth inequality, salaries, and more.

A Quick Pulse Check on Direct Listings

By Scott Kupor

There’s been significant buzz around the idea of direct listings, yet in the past three years only six companies have gone public via direct listing (less than 1% of IPOs in that timeframe). a16z’s Scott Kupor demystifies the data and takes a closer look at what’s working and what we’ve learned so far.

Speculation is Necessary. Governments Can Help.

By Jamie Catherwood

From transatlantic cables to railroads to modern day crypto, Jamie Catherwood argues that the act of speculation is key for driving economic growth and prosperity at the national level.

More fintech news

Zillow Taps AI to Improve Its Home Value Estimates (WIRED)

During the pandemic, millions of Americans bought new houses, driving inventory down to record lows and prices to record highs. Zillow rolled out a new product to make cash offers using an algorithm to predict and price homes and extend cash offers to home buyers without ever sending someone into appraise.

Uruguay Gets Its First Billionaires with U.S. Fintech IPO (Bloomberg)

The cross-border payments company DLocal becomes Uruguay’s first “unicorn” as it makes its public debut on the NASDAQ.

Deutsche Bank Jumps Back into Payments With Fiserv Deal (WSJ)

After giving up its payments ambitions a decade ago, the largest lender in Germany inked a deal with US-based Fiserv to offer payment services via Clover to its 800,000 small business customers.

Visa, the Original Protocol Business (Business Breakdowns)

Listen to a16z’s Alex Rampell in conversation with Patrick O’Shaughnessy as they cover Visa’s business model, unique history, and potential threats from other businesses and macroeconomic forces.

Bonus: Listen to Plaid CEO Zach Perret talk about seed stage survival, the abandoned M&A with Visa, and the fintech trends behind Plaid’s success on this episode of The Good Time Show.

Recent a16z fintech announcements and investments

David Haber becomes a16z’s newest general partner on the fintech investing team

Jeeves global expense management

SpotOn full-stack point of sale and business management