Supply-demand mismatch problems in healthcare

Healthcare is plagued by many vexing supply-demand mismatch problems, e.g. patients waiting weeks to see a well-established doctor, while newly minted providers sit idle; critical medical supplies in abundance at some facilities, while in short supply at others; and more and more life-saving drugs being approved every year, while many rightful beneficiaries never get access.

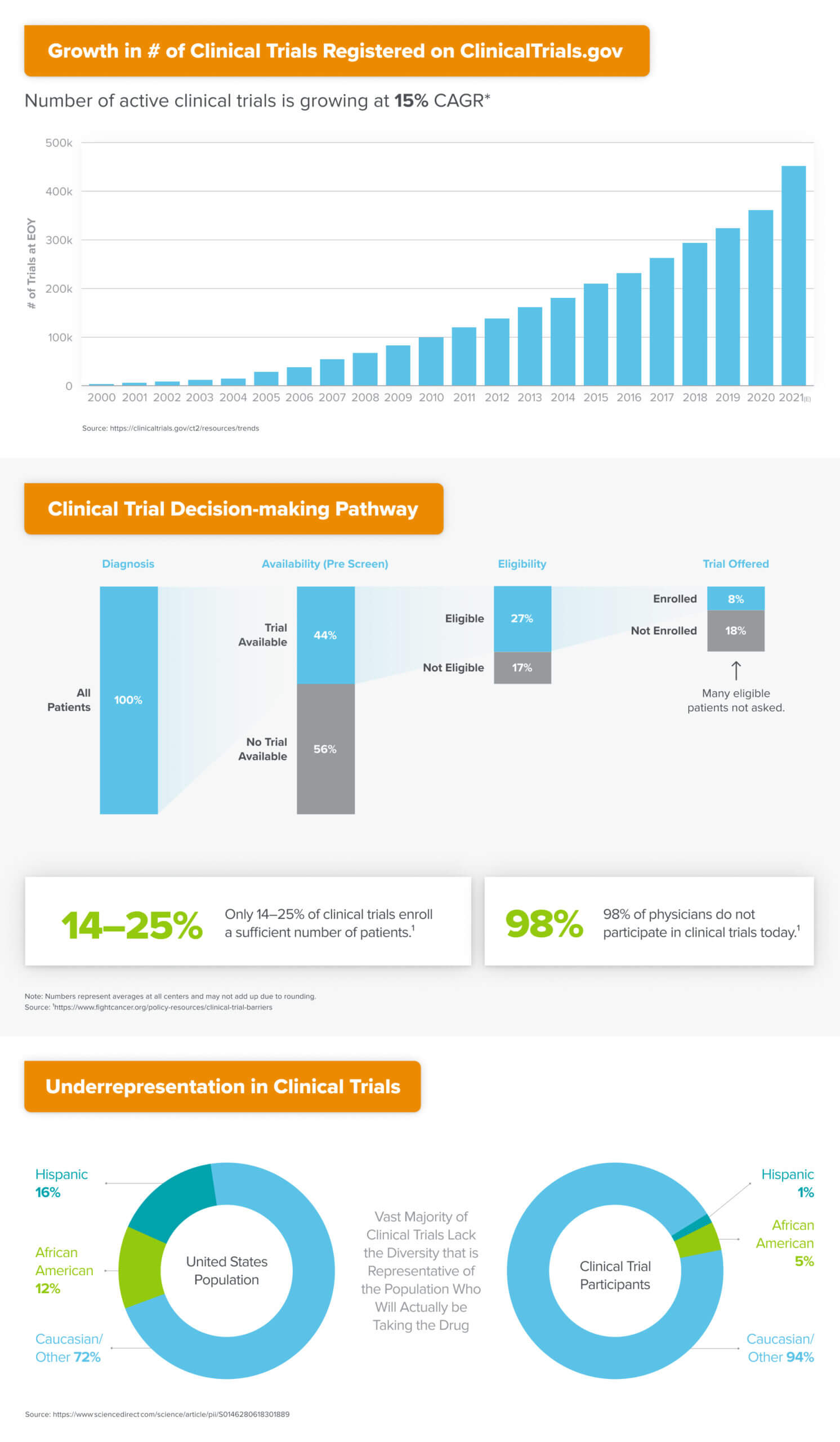

A similar conundrum exists in the world of clinical trials, which are the research studies by which novel drugs and other health interventions are tested for safety and effectiveness before being approved for use in everyday medical care. The majority of studies fail to enroll a sufficient number of patients, resulting in delays to the process of making potentially life-changing therapies available to the market. Most trials also lack a diverse enough panel of patients to be representative of the actual population who will receive the intervention once approved, meaning potentially meaningful therapeutic effects could either be artificially amplified or dampened in the study results.

Meanwhile, 98% of physicians don’t participate in clinical trials at all, leaving significant untapped capacity for the execution of research studies. Even amongst those practices that do participate, upwards of 50% fail to recruit even a single patient for the studies to which they aim to contribute. All this as the total number of active studies continues to grow at 15% CAGR globally.

Unlocking clinical trial investigator capacity

One of the reasons for low clinical trials participation rates amongst physicians is that serving as a clinical investigator, or “trialist”, is a non-trivial undertaking. Many physicians cite the uncompensated costs of performing research and the lack of specialized operational support needed to actually run the trial in one’s practice as reasons for not opting in. A practice might be underwater financially for years before generating profit from running clinical trials.

On the flip side, physicians who do participate in research report finding fulfillment of their intellectual curiosities around medical research, and the satisfaction of being able to deliver frontier care to their patients [1,2]. Many provider practices are also seeking alternative revenue streams in light of falling visit volumes and new competitive dynamics stemming from the pandemic, including difficulties remaining independent as the ability to compete with larger health systems and avoid consolidation becomes increasingly untenable. In this sense, research revenue can help providers mitigate the risks of reliance on fee-for-service revenue streams in their core clinical practice.

A bottoms-up managed marketplace for “trialists”

Given these challenges and opportunities, an urgent need exists for a new platform to creatively address the supply constraints that hinder the industry’s ability to conduct medical research in a scalable fashion. The massive, $45 billion clinical trials market has already attracted a number of upstarts seeking to improve how patients are recruited into trials. However, most companies have primarily focused on top-down approaches to acquire and refer patients to established trial sites, or help established trial sites improve their operational performance. Very little has been done to create entirely new clinical trials capacity amongst the long tail of physician practices that are “research naive” (i.e. have never participated in clinical trials), which are more likely to have diverse patient populations and to benefit economically.

Topography Health is carrying this torch by building a managed marketplace of new trialist supply to improve the throughput and diversity of clinical trials. They partner with community-based practices and provide the staffing, operational support, regulatory training, tech, working capital, and business development to match the most relevant clinical studies to the practice’s patient population. Topography has stood up both active and passive income models that allow practices to ramp into clinical research at whatever pace makes sense for them, thus opening up multiple vectors of study capacity growth to the industry.

The Founders

I’ve known Topography’s CEO and co-founder, Alexander Saint-Amand, since he advised me during the earliest days of my own startup. At the time, he was the CEO of one of the ultimate provider network companies, Gerson Lehrman Group (GLG). GLG has arguably been the world’s most robust platform for enabling providers to contribute to the commercialization of medical technologies and care delivery practices, and his earned secrets from 20 years at the helm of that business give him a massive advantage on understanding and executing the value proposition of Topography’s offering to clinicians. His co-founders Andrew and Mac are both repeat entrepreneurs who also bring extensive experience building tech-enabled marketplaces to the team.

We couldn’t be more excited to be backing Alexander, Andrew, and Mac as they unlock the supply-side of the clinical research equation and enhance the efficiency and quality of the process by which innovative new therapies are brought to market.

***