Raising debt is an important financial tool for startups, and in particular, as more and more companies become fintech companies, debt, and in particular asset-backed debt, can provide a critical vehicle for embedding financial products that can be financed—most commonly loans, but also insurance, credit cards, factoring (i.e., selling accounts receivables), banking.

However, for founders who have not secured debt financing before, the sheer number of debt options can be daunting. While founders are equipped with the Secrets of Sand Hill Road to navigate equity term sheets, there has not been an equivalent resource for the role of debt in building a company.

We work with a16z’s fintech companies and have advised numerous startups from seed to pre-IPO on how and when to raise debt. In this post, we cover the most common questions we hear, starting with the basics of how debt works, before breaking down the different debt options available at different stages and the current ecosystem of lenders.

A note on terminology: In this piece, we are talking about debt for startups.

While others refer to this as venture debt, in this piece, we use the term private debt to mean debt extended to privately held companies (by both banks and non-banks) and classify it into two broad buckets: 1.) corporate debt (which is generally referred to as venture debt) and 2.) asset-backed debt. Within these two categories of debt, different types of specific debt arrangements are referred to as debt facilities (e.g., warehouse facility, term loans, lines of credit).

TABLE OF CONTENTS

Debt basics

TABLE OF CONTENTS

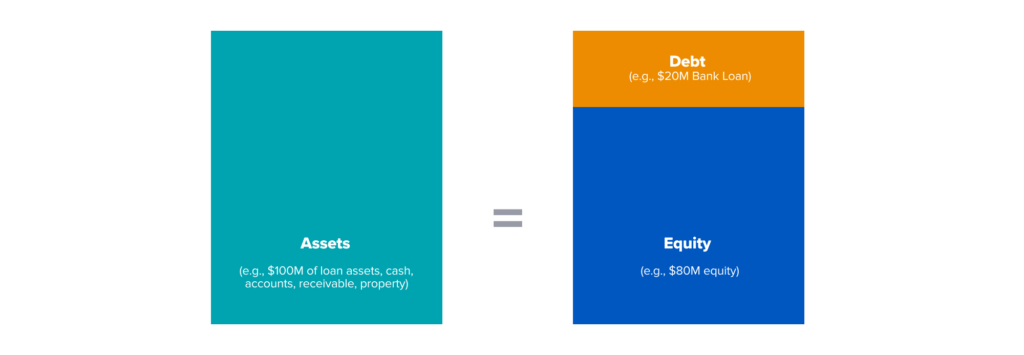

1. The role of debt (and how it’s different from equity)

Debt is not a replacement for equity. In fact, venture lenders often use equity as a primary form of validation for underwriting early stage startups. As a result, many founders raise debt after they raise an equity round.

There are multiple tradeoffs to consider when thinking about raising debt, particularly as it relates to complementing equity. For example, a founder might raise a $50M equity round at 10% dilution and have the option to increase the round to $60M at a 12% dilution or raise a $10M debt facility to complement the $50M equity round. In this case, the founder would consider the fees, interest, warrant dilution, and repayment from $10M of debt against the additional 2% of dilution from $10M of equity.

At a high level, debt can provide more flexibility, less dilution, and faster access to capital than equity, making debt the better option to finance a predictable future, such as when there’s a predictable return on debt capital (e.g., a lending product or a merger), while equity is better to finance uncertainty, such as when you’re still building a product and monetization roadmap.

The right mix of debt and equity will vary with a company’s specific circumstances. Generally, though, the more debt you take on, the more accurate your prediction of the future and clearer your plans for the capital need to be, or you risk net-net losing capital in the long term to interest and fees.

More specifically, these are some of the key differences to consider between equity and debt:

- Priority: Debt is senior to equity in the capital structure, and debt lenders have priority in claims on a company’s assets, such as in the event of bankruptcy.

- Cost of capital/dilution: Debt is non-permanent capital whose cost primarily comes from annual interest and one-time expenses that allow lenders to receive a return on the capital. Equity, on the other hand, is permanent ownership for new investors, which dilutes ownership for founders and transfers some decision-making power to new investors. While some debt arrangements can include warrants, which provide the lender with an option to buy equity shares at a future date, compared to an equity round of financing, you give up significantly less ownership. (i.e., debt is minimally dilutive to ownership).

- Flexibility: Debt offers a wider range of solutions that can be prepaid or refinanced. However, it’s worth noting that debt arrangements may limit flexibility with covenants and interest payments.

- Timing: Raising corporate debt is typically faster than raising equity. Corporate debt typically ranges from 4-12 weeks (though asset-backed debt can take 3-6 months). Equity financing, on the other hand, can take 2-3 months.

- Covenants: Debt, unlike equity, may include covenants—certain conditions the borrower has to fulfill to maintain good standing with the lender such as minimum liquidity or debt to equity ratios. A breach of a covenant, or an inability to pay interest or principal payments, may give the lender the right to push the company to file for bankruptcy. While such cases are rare, and most lenders are in the business of helping startups, it’s important to understand the risks and obligations that come from covenants and other debt terms.

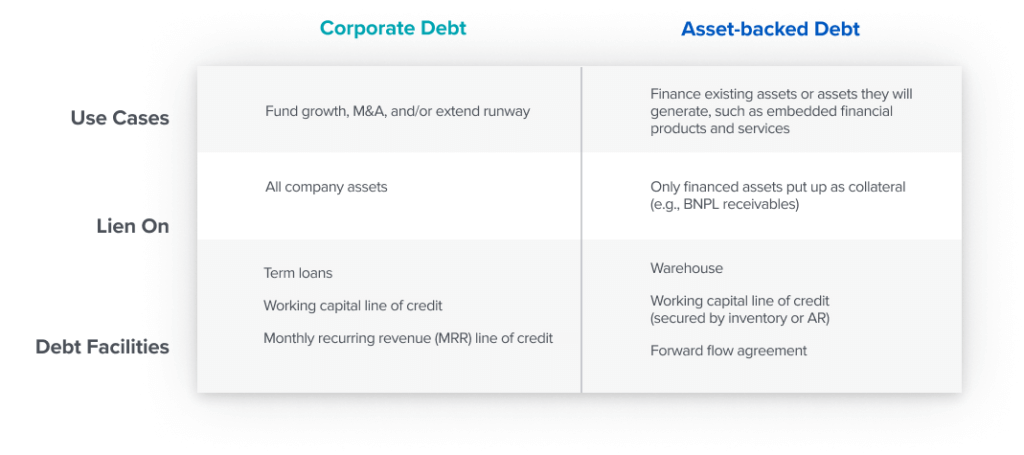

2. Corporate and asset-backed debt (and when to use each)

When startups think of debt, they’re usually thinking about corporate debt (often used interchangeably with venture debt). Corporate debt is used to fund growth, including M&A, and extend runway. However, as more companies become fintech companies, startups have another growing use case for debt: embedding financial services as an ancillary product or building financial services as a core product.

For a new fintech lending platform, capital is akin to inventory, since it is used to originate loans that then generate revenue. In this case, asset-backed debt is usually preferable because, though it can be more expensive than corporate debt, the financier only has a claim on a set pool of assets rather than on all company assets.

Further, having asset-backed debt that is off-balance sheet, such as in a warehouse special purpose vehicle (SPV), protects the company from losses in the event that a particular pool of assets don’t perform, since the risk lies within a separate entity. For instance, if a fintech platform used buy now, pay later (BNPL) receivables as collateral, those BNPL receivables are held in a special purpose vehicle. If customers don’t pay back their BNPL installment loans, then the asset-backed financier can only claim the assets in the SPV.

Within both corporate debt and asset-backed debt are a variety of debt facilities (we cover these in more detail in a later section).

Lenders

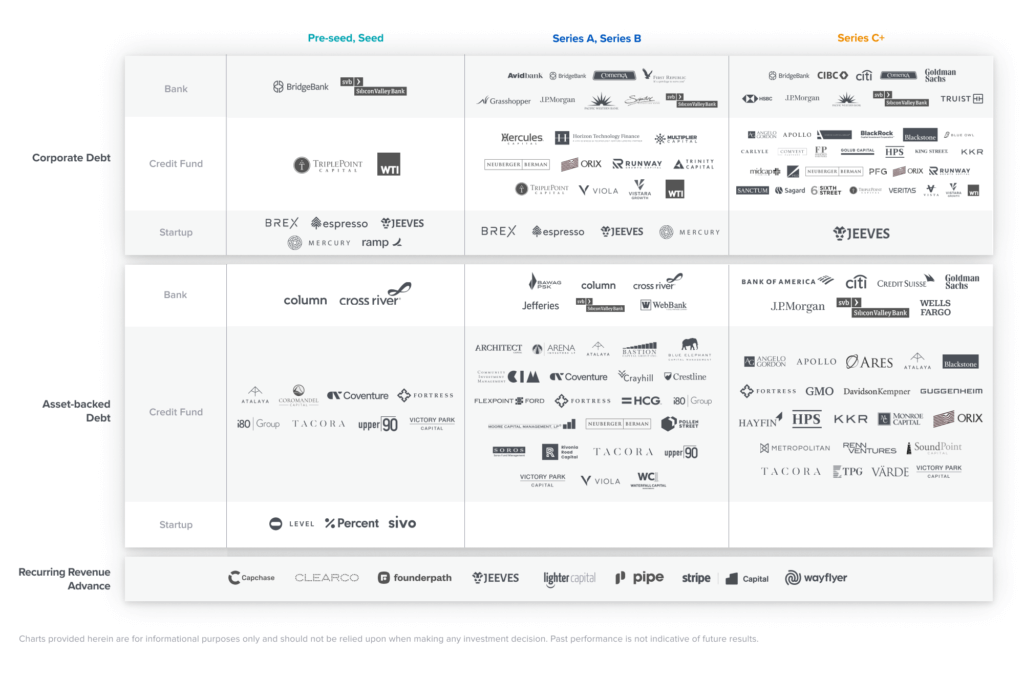

3. Lender landscape

Private debt is now the third largest private market in terms of assets under management (AUM)—after venture capital and private equity. Private debt includes credit funds focused on term loans and lines of credit (over $190B globally), asset based financiers who offer warehouse facilities and forward flow agreements, and new recurring revenue advance who provide direct financing to SaaS startups with recurring revenue streams.

Navigating this sometimes confusing web of lenders starts with knowing the type of facility (corporate or asset-backed) that you want. From there, you can sift through the investor universe based on how early they’re willing to play.

We’ve mapped key lenders into early-stage (pre-seed to Series B) and later stage (Series C+), as well as by the category of debt they offer and whether they are a traditional bank, credit fund, or fintech startup.

4. Lender outreach

Your relationship to debt financiers is a long-term strategic partnership—they will be with you through the good times and bad. Ideally, the lender will have a strong relationship with your existing equity investors, and often investors can recommend lenders that they have strong relationships with, as well as help you negotiate favorable terms. As you explore debt options, we recommend starting a dialogue with a mix of banks and credit funds to find a good match and achieve optimal pricing and terms.

Early stage debt (Pre-seed to Series B)

In the early stages, startups, especially fintechs, will want to focus on how capital can drive scale, potentially paying a higher cost of capital to get a larger size facility.

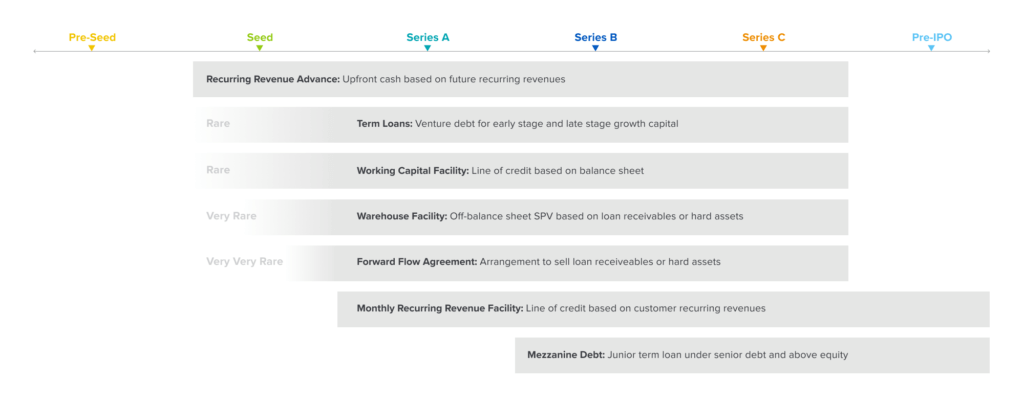

5. What debt is available

At the earliest stage (Series A, seed, and on rare occasion, even pre-seed), companies have access to a number of debt options, though they vary in cost. At a minimum, we typically encourage founders to raise a seed round before raising debt. With each subsequent equity round, the availability of debt financing and size of facility increase, and startups have more leverage to negotiate favorable debt terms.

Corporate debt from banks tends to be the lowest cost option, though there’s an expectation that the company will begin a banking relationship, and there can be limitations on the total amount that can be raised. On the other hand, asset-backed financiers will argue that they can do larger facilities and reduce the debt expense as a company scales. Some banks may have separate groups for corporate debt and asset-backed lending.

6. What lenders look for

Given the risk around seed companies, lenders will put a lot of weight on the quality of the seed investors and conviction around the founding team. For asset-backed debt, they will also want supporting evidence of the credit quality of the end customers of embedded financial products and services. At a minimum, lenders and asset-backed financiers are looking for some VC backing or other institutional capital coming into the business, especially if it’s a loss leading business (i.e. selling products at a loss to get a stronger hold in the market).

7. Early stage debt for startups with financial products

Since fintech lenders need to provide financial products—such as, loans—to generate revenue, they need access to capital as early as seed. When possible, it’s more cost effective for these early stage fintechs to use a debt facility, rather than equity, for that capital. As fintech companies scale their originations (loan origination is the process of creating a new loan), they’ll need increasing amounts of capital, making it preferable to raise debt to avoid excess dilution. However, raising debt creates a chicken and egg problem, in which early startups want to raise debt in order to extend loans, but often need at least a few months of loan origination data (i.e., “loan tape”) in order to raise debt.

In most cases, fintech startups will temporarily use a portion of their seed equity financing to prove their underwriting capabilities and build their loan tape. Once the loan tape is built out, a startup’s chances improve for raising a term loan, a line of credit, or potentially a warehouse facility. Then, after a company raises a Series A, they can refinance their debt with a larger facility.

In some cases, seed startups with experienced teams and strong investors are able to secure corporate debt, such as a term loan or a line of credit, if they can find a way to demonstrate the creditworthiness of their customers. These facilities are typically provided at ~30% of the equity raised. Startups will use this capital temporarily to help demonstrate their origination programs before raising another round and/or taking on a larger facility.

In more rare cases, seed startups are able to raise warehouse facilities. These companies also have experienced teams and strong investors, but find more compelling ways to demonstrate the creditworthiness of their customers and show a path toward significant origination volume. For example, a fintech lending platform may provide financial analytics and operational software to businesses with strong credit profiles, so the platform has unique insights into the financial health of its customers and is therefore well equipped to provide lending products. Because asset-backed facilities are typically advanced at 80-95% of a loan amount, the startup needs to fill the gap in capital with equity. As companies scale and originate more loans to their customers, they’ll need to raise more equity to fill the gap.

Companies often speak to multiple early stage debt investors to win favorable terms on their first facility. Based on our conversations with lenders, we believe a general rule of thumb is that projected origination volumes should be at $20M+ within the first 12 months, though warehouse facility groups at banks are typically more risk averse and may need a few months of data to underwrite the underlying assets. Banks will likely need the most data for setting up an asset-backed facility, but they often can also provide a smaller amount of corporate debt, which can be applied to origination in the early stages.

Late stage debt (Series C+)

As startups scale, lenders can do more in-depth analysis, opening the door to more debt financing options.

8. Late stage corporate debt

As companies scale, the use of corporate debt becomes more attractive because it allows them to take on larger facilities and a lower cost of capital. In the late stages, corporate debt becomes a key source of capital for larger M&A transactions and pre-IPO strengthening of the balance sheet.

Late stage lending comes primarily from credit funds and banks. Credit funds provide flexible solutions that are fairly bespoke, often including term loans, convertible notes (short-term debt that can convert into equity), convertible / structured preferred equity (hybrid security between senior debt and common stock). Banks provide lower cost of capital solutions including credit that is renewed as debt is paid off, known as revolving credit facilities, and term loans.

While profitability is not required for late stage corporate debt, profitability opens the door to an even broader universe of private credit. Lenders begin underwriting on the basis of implied enterprise value, which utilizes more conventional metrics such as a multiple on EBITDA. For example, a profitable late stage startup with $50M EBITDA could receive a debt quantum (size of facility) of 3-4x EBITDA, or $150M- $200M.

For late stage companies that haven’t reached profitability, lenders will look at the investor syndicate, revenue scale, growth metrics, customer base and retention, and market position. Corporate debt is then commonly monitored via financial covenants, which can come in various forms of liquidity (e.g., interest coverage ratios) and operating tests such as those that track revenue, EBITDA, or cash flow performance. Based on a company’s credit strengths, it’s not uncommon for a group of lenders to commit $100M to $500M as part of a syndicated loan that is then structured, arranged, and administered by one of several banks known as a lead arranger.

If a company is preparing for an IPO, it becomes important to leverage investment banking and other relationships to establish a pre-IPO facility with the most favorable terms. Once a company is of a certain scale or is a publicly traded company, it has additional debt options available in the credit market such as high yield debt offerings or public convertible debt. These options offer scale, flexibility, speed of execution, and access to a different set of debt investors.

9. Late stage asset-backed lending

As loan origination data becomes more predictable, more competitive options become available and late stage companies can expand their range of potential lenders and graduate to cheaper asset-backed debt solutions. In particular, securitization, the process of packaging debt from multiple sources into a security that can be sold, becomes an attractive option at this stage, especially if a company’s performance data allows for ratings from rating agencies, such as Moody’s or S&P. Private credit lenders, including insurance companies, can look to ratings guidance and comparable public companies to bring in capital from banks and insurance companies at a lower cost of capital. While not depicted in our market map, insurance companies that provide asset-backed facilities and/or can purchase securitized assets include AIG, Hartford, Liberty Mutual, MassMutual, and Metlife.

The securitization market typically offers the lowest cost of capital and allow companies to sell loan assets, thereby transitioning balance sheet risk to financial institutions. However, securitizations usually come with more restrictions, such as increased eligibility criteria, deleveraging requirements, and other restrictive performance covenants. In addition, the securitization process typically requires advisors to go out and “build a book” of demand (basically, determining pricing based on a list of institutions who will purchase the security) and can require a large amount of time to undertake a roadshow and money for legal and advisory fees.

In general, startups that are first time securitization issuers should seek a receivables portfolio of at least $150 million (with run-rate originations to support and grow to that level), though that figure depends on macroeconomic factors as well as on the duration of assets. For instance, if you have a BNPL product that is paid back in four weeks rather than six months, you can recycle capital more quickly. Shorter duration assets where capital can be paid back more quickly usually require a larger book and / or may require that the structure is revolving so investors can keep their capital deployed.

Later stage companies may also be expanding to multiple products and geographies. For a company with a large portfolio of receivables, asset-backed lenders can offer small test buckets that allow for the company to utilize a portion of their asset-backed facility to build performance data in new products and geographies. With enough data, these new products can be incorporated into the broader facility without additional restrictions. Additionally, for companies looking to expand into different countries, they can set up a master special purpose vehicle in a warehouse facility to cover all their needs or separate vehicles to handle different currencies.

It can be complicated and expensive to figure out the right structure for your specific needs, and it’s important to have counsel who both understands your unique circumstances and has expertise structuring asset-backed debt.

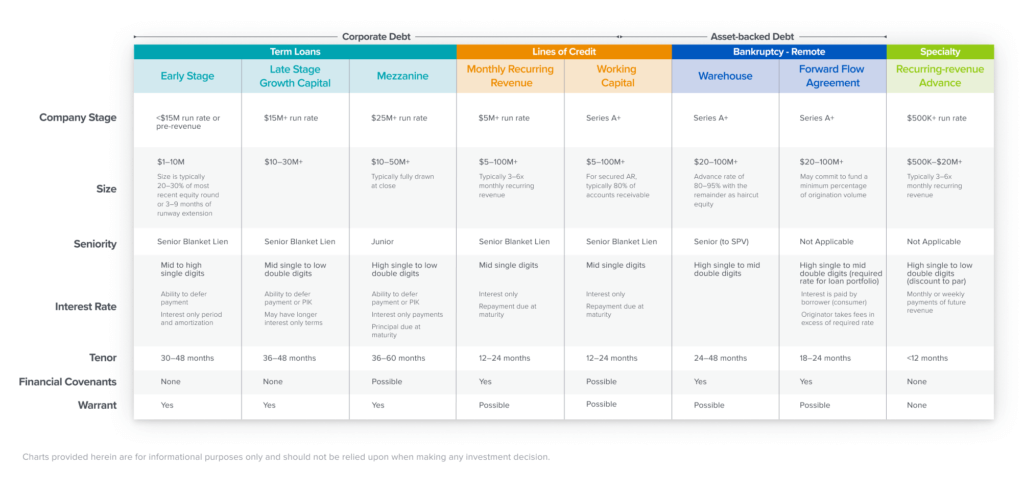

Facility deep dives

There are a number of debt options available for startups at various stages, but we’ve condensed a side-by-side list of the most common debt structures, particularly for early stage startups. The right option for your startup will depend on your business model needs. Common criteria include the debt quantum (size of facility), the cost of debt (interest, fees, and warrants), and flexibility (amortization, interest only period).

10. Debt terms to pay attention to

The following debt terms represent criteria that are often key considerations when thinking through and negotiating different debt facilities. During negotiation, lenders will often view these terms as different levers they can pull, which will affect their own internal threshold for returns. For example, if a founder is looking to minimize interest rates or maximize size, then the lender may negotiate by increasing other costs such as fees or warrants. Our advice for founders is to solve for whatever tradeoff is most important to you, whether it’s size or interest, speak with multiple lenders, and leverage your VC investors to gain negotiating power.

- Size: This represents the total amount of capital that can be drawn from the facility. It’s common for lenders to unlock various amounts of capital based on certain business milestones, which will be laid out in term sheets. Committed capital, defined as the amount of capital contractually and readily available for a company at closing, will represent how many dollars you can readily draw down from.

- Fees: There are multiple ways fees can be associated or embedded in the overall cost of debt. The three most common types of fees are: 1.) facility fee / commitment fee: a one time fee for using the debt that can be anywhere from 0.5%-2.0% of the committed capital; 2.) Prepayment Fee: a 0.0%-1.5% fee that can decrease over the duration of the facility and is owed if you pay off the debt before it comes due, or refinance with a new larger facility; and 3.) Unused Fee: a fee of 0.0%-1.0% if you do not draw down and use the debt, more typical in lines of credit than for term loans.)

- Interest Rate: The interest rate can be set at a fixed percentage (e.g., 5.25%) or it can be floating (e.g., prime + 2%). The interest can be paid in the form of cash payments or paid-in-kind (“PIK”). PIK interest defers cash payments and instead adds the cash interest amount to principal, which compounds through the duration of the facility. For early stage term loans, paying cash interest is more common than PIK interest. Further, it’s important to note that interest is only paid on the amount of outstanding principal, or capital drawn. So if you have a $10 million facility and only draw $4 million, then you will be paying interest only on the $4 million drawn.

- Interest Only (IO): A specified period of time (6 months, 12 months, or 18 months) where the company pays accrued interest and doesn’t pay principal (no amortization). When the IO period is over, the company will pay down the principal balance. Note that the longer the IO period is, the more interest you will be paying since you won’t be paying down your principal.

- Amortization: In addition to scheduled interest payments, you are paying down principal on a regular basis, often in equal payments. So the faster you amortize your principal, the less interest you’ll be paying on your outstanding principal.

- Tenor: The length that you are borrowing for before having to pay back your full principal. The longer the tenor, the more time you have before you need to pay back your principal. If you have uncertainty about your future liquidity, it may make sense to lengthen the tenor, though the tradeoff is that you will be paying more in interest over an extended period of time.

- Covenants: Within the terms of a loan agreement, depending on the lender, you may have certain restrictions or obligations that you need to abide by. These covenants are used to create alignment between the borrower and lender. They often come in the form of metrics, such as managing to certain financial ratios, and potentially limit future issuance of additional debt or prohibit certain company actions. When debt facilities don’t have covenants, they’re considered to be cov-lite. Currently, most term loans are structured as cov-lite. It’s important to consider how covenants will affect your operations if certain requirements need to be maintained.

- Warrants: Warrants are another way the terms in a debt offer that provide a “sweetener” to the lender (considered as part of the overall cost). These provide the lender with an option to buy equity in the company at a future date. There will be a strike price at which the stock can be bought and time frame (e.g., 7 years) for exercising the option to buy at that price. Generally, term loan warrants can make up 20-100 bps of FDSO (though we’ve seen as low as 5-10bps), depending on stage of the company, and can be higher for asset-backed facilities. Typically, founders will want to limit or exclude warrants from term sheets as they will increase dilution in the company.

11. Term loans

One of the most common structures for corporate debt, term loans are issued as a defined amount and repaid within a specified duration.

Typical time to close: 1-2 months

Common Fees: Facility fee/commitment fee, prepayment fee, unused fee

Mandatory draw-down: There can sometimes be a mandatory draw-down feature that requires the borrower to borrow money by a certain date or different tranches issued at different timeframes.

Advantages:

- Usually comes with multi-year maturity, giving time for the startup to scale before paying off the principal.

Disadvantages:

- Interest payments can increase burn for early companies.

- Has a fixed ceiling and doesn’t have the ability to “refill” like a line of credit, which is more favorable for asset-based businesses.

12. Lines of credit—monthly recurring revenue

A monthly recurring revenue line of credit is a loan that has a maximum credit limit (similar to a credit card) that is tied to the monthly recurring revenue of the borrower, usually a SaaS company. The borrower can draw and repay on the loan multiple times, so that it is “revolving,” and has a specified timeframe under which the line can be drawn and repaid. Lenders will typically provide up to 3-6x monthly recurring revenue, adjusted for your retention rate. For example, if your trailing three month MRR is $1M and your customer retention is 96%, then your maximum loan amount, if approved for 3x MRR, would be $2.88M ($1M * 3 * 96%).

Typical time to close: 2-3 months

Typical fees: facility fee / commitment fee and unused fee

Advantages:

- Flexibility to scale borrowing capacity as revenue grows.

- Typically access more capital than a traditional line of credit based on annual revenue and inventory.

- Interest is paid only on utilized capital (often a de minimis rate will be paid on unused capital as well).

Disadvantages:

- Only for recurring revenue business models that have at least $3M ARR.

- Requires a low churn rate.

13. Lines of credit—working capital

Usually referred to as a revolving credit facility (RCF), a working capital line of credit is a loan that also has a revolving structure and can be used for general corporate purposes. Rather than having a limit based on recurring revenue, it can be set as a specific amount of committed size or based on assets such as a percentage of inventory or accounts receivable (known as an AR Line of Credit). An AR Line of Credit can either be a senior lien on the company or be secured by a specific pool of collateral in the form of asset-backed lending.

Typical fees: facility fee / commitment fee and unused fee

Typical time to close: 1-2 months (2-3 months for AR line of credit)

Advantages:

- Similar to a warehouse facility, an AR Line of Credit can be collateralized by receivables and is usually faster to set up.

- Interest is paid only on utilized capital (often a de minimis rate will be paid on unused capital as well).

Disadvantages:

- Usually cannot scale to cover all growth needs and the total size of capital is typically less than a term loan due to its flexibility.

- Can be more expensive than a term loan when fully drawn.

Note: Working capital line of credit that is backed by inventory or accounts receivables generally have advance rates (see description of advanced rates in Warehouse Facility below).

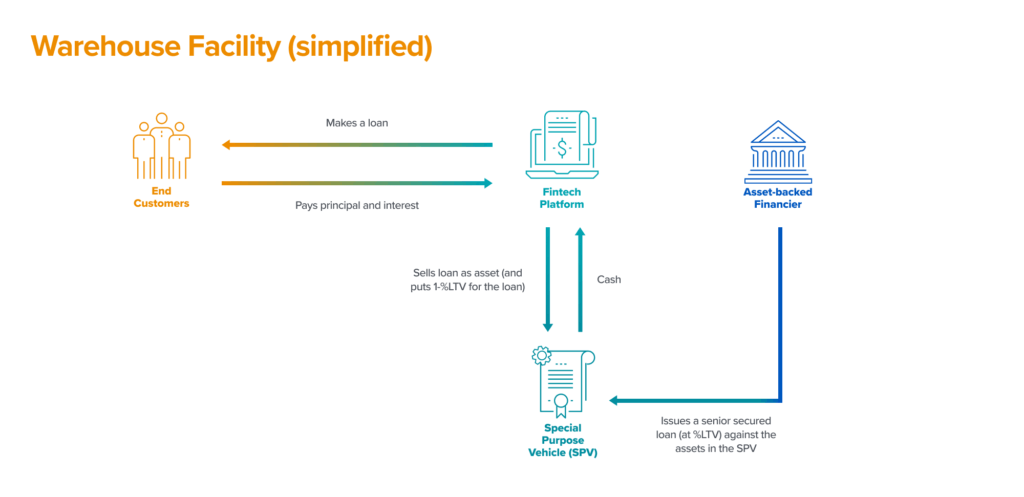

14. Warehouse facility

A warehouse facility is a bankruptcy remote special purpose vehicle (SPV) that is effectively a new entity that an asset-backed financier will lend money into, usually in the form of an RCF. The originator (shown as a fintech platform in the diagram below) will sell loan assets into the SPV, thereby taking money out of the entity. As an entity, the SPV sits under the originator and is consolidated onto their balance sheet, so the assets still sit on the balance sheet of the company. However, the asset-backed financier can only have a claim on the assets that sit in the SPV, not all assets of the originator.

Warehouse facilities are a good option for startups adding financial products that require shorter duration loans (e.g., credit cards, factoring, MCAs, lines of credit) because they can turn through multiple capital cycles per year and more efficiently utilize their equity contribution on loans. Notably, the borrowing base is done at <100% advance rate, which represents the percentage amount of collateral that a lender is willing to provide, also known as the loan to value (%LTV). This leaves the fintech platform originator to fund the remaining loan amount, also known as haircut capital, with equity (calculated as 1-%LTV). For example, a 70% advance rate on $10M of assets requires $3M of cash contribution (equity) from the originator to the SPV.

There are a number of considerations, particularly for fintech companies, when thinking through both warehouse facilities and forward flow agreements, such as concentration limits, eligibility criteria, cumulative delinquency, default rates, and other criteria that affect the underwriting and reporting of the facility.

Advance rate: 80-95%. Lenders (shown as asset-backed financier in the diagram above) may provide step ups in advance rate and decreases in cost based on certain milestones, such as origination volume.

Typical fees: facility fee/commitment fee and unused fee

Typical time to close: 4-6 months

Advantages:

- Allows the originator to optimize across different pools of assets by financing through different SPVs.

- The originator can take loan origination and servicing fees as a source of revenue.

- There is no recourse to other assets of the originator.

Disadvantages:

- Often takes multiple months to set up and requires equity (to make up for the haircut) to be posted to the SPV.

- The originator also remains the first loss provider on the assets because of the equity they put into the facility. The worse assets perform, the more equity is eaten away, which lowers the return on equity (ROE) of the company.

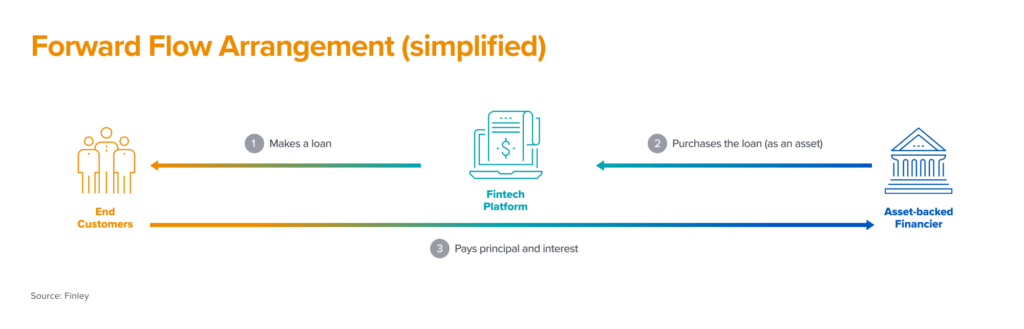

15. Forward flow arrangement

A forward flow arrangement is a contractual arrangement where the asset-backed financier agrees to periodically purchase a quantity of assets (e.g., loans or receivables) from the originator (shown in the diagram below as a fintech platform) at an agreed price. The frequency of purchase can be as often as daily, and the assets being purchased must fit certain key eligibility criteria, such as a minimum FICO score. This is often a central negotiating point as lenders don’t want to purchase assets, such as loans, without being confident in how they might perform. The fintech platform then generates revenue through loan origination fees, servicing fees, and interest rates that are in excess of the lender’s required rate of return.

Forward flow arrangements are a good option for young companies that: 1.) have an uncertain volume of loan originations because there’s no fixed interest it needs to pay and 2.) have longer duration loans (e.g., term loans, mortgages). Interest rates for longer duration loans are not paid by the fintech platform, but are instead representative of a required rate of return for loan assets by the asset-backed financier.

Note: forward flow agreements aren’t technically debt, but since the loan assets pass through to a traditional lender, it’s categorized as asset-backed debt for the purposes of this piece.

Typical time to close: 4-6 months

Typical fees: none

Advantages:

- Gives an originator with long duration loans the ability to scale without tying up too much equity. For example, if you’re extending 3-year term loans, then you will need to wait 3 years to recycle your equity, making it more difficult to scale. With a forward flow, you can scale more effectively by selling your loans to the asset-backed financier and recycling your equity.

- Assets are sold entirely so they do not gross up on the originator’s balance sheet. The buyer (institutional lender) purchases eligible assets typically at par and sometimes above par + accrued interest so it doesn’t require the originator to commit its own funds.

- The originator doesn’t have to incur negative carry typically associated with unused amounts on a traditional loan or warehouse SPV.

Disadvantages:

- It’s usually more expensive than traditional loans since the lender now owns a portfolio of loans whose risks and returns it needs to monitor and track, rather than simply receiving fixed interest as in a traditional loan.

- This is not favorable if the assets being purchased are short duration due to the time it takes to transfer assets back and forth between the lender.

- The lender can often include provisions that make this structure look closer to a loan with clauses that: 1.) force the originator to buy back loans that default within a certain time frame, 2.) require the originator to take first loss on a portion of the loan, and/or 3.) only allow the lender to receive revenue after a fixed return.

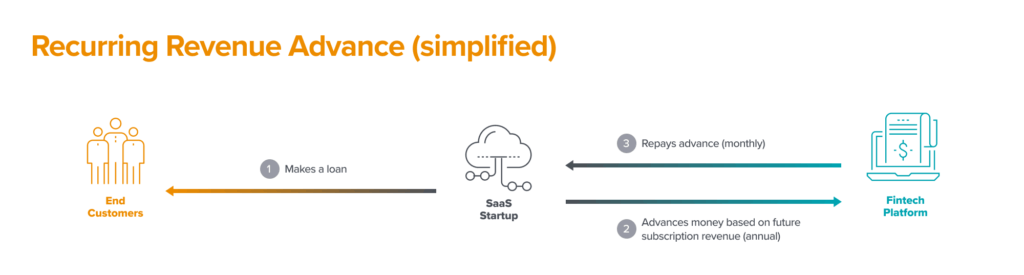

16. Recurring revenue advances

Recurring revenue advances are non-secured arrangements (like factoring) where the lender provides capital based on future revenue (e.g., recurring revenue for software companies) that is paid back periodically. The arrangement converts future cash flows into cash today, minus a small percentage, while the lender gets paid back in full over time. For example, if an enterprise software company has a contract for $1 million in MRR, the company can sell 5x those future monthly cash flows for $4.5 million in cash today, while the whole $5 million of future cash flows are paid to the investor over time. This is similar to traditional revenue-based financing, but with a more non-dilutive approach, in which the financing is provided through third party platforms. There are multiple new variations of this structure from emerging financing platforms (e.g., Pipe, Capchase, Clearco, FounderPath), but the broader concept for startups remains: get capital upfront, give more cash flow over time.

Use cases: SaaS, subscription-based startups, startups with contracted revenue

Threshold: 3 months minimum runway, 6+ months of revenue history, $500K+ ARR

Typical time to close: 24 hours

Typical fees: represent a fixed discount on capital

Advantages:

- Very quick to set up (less than 24 hours on some platforms).

- No diligence or covenants required.

- Does not need to be secured by assets.

- Non-dilutive, as this form of financing is not structured as debt.

Disadvantages:

- Cost of capital increases on an annualized basis the faster the capital is paid off. For example, a 10% fee on a 12 month advance that pays down every month comes out closer to a 20% annualized cost of capital since the average dollar is only outstanding for 6 months.

- Future capital is not guaranteed to be available.

- Companies are one-step removed from the lender and don’t have access to additional resources that lenders provide.

This report contains debt terms and market insights compiled from discussions with numerous experts. Thank you to everyone at Atalaya, Bridge Bank, Coventure, Silicon Valley Bank, Triple Point Capital, and Upper90 who contributed to this research, with special thanks to Brian Moore, Dan Allred, Ilya Klets, and Rob Freelen.

-

Nathan Yoon is a partner at Andreessen Horowitz in the Capital Network team

-

Melissa Wasser is a partner on the Capital Network team, focused on fintech companies.