In the late 2010s, customer success (CS) gained a lot of traction as an emerging category, and many companies created big CS teams made up of customer success managers (CSMs), renewals, support, and services. But as tougher macro climates invite more scrutiny on budgets, many companies are realizing they don’t know what unique outcomes CS should drive in the first place. Does CS manage renewals and support? Or do they chase late payments? Should services report into success? Or companies might realize CS looks like it’s working, but the CS team is bloated and company margins are taking a big hit. Others have pointed out that CS is broken, and many companies—including Red Hat, Salesforce, and Twilio—are scrutinizing or eliminating their CS departments because they aren’t delivering measurable and distinct results.

But cutting CS isn’t necessarily the answer. Once you’ve reached a certain level of growth—typically around $100M ARR—you’ll generate much more revenue from your post-sales org than from landing net-new logos. If you configure your CS org correctly, you’ll unlock the easy momentum of that post-sales org and continue to grow more quickly and efficiently.

So how do we fix CS?

By keeping it laser-focused on customer health as a leading indicator for the revenue and product orgs.

What does this look like?

Ensuring that customers are on track to realize the positive business outcomes everyone agreed on in the presale.

Your CSM team should be the only team that can provide you with a data-driven perspective on the overall health of your accounts: whether they’re inoculated against churn, good to renew, or set up to expand.

TABLE OF CONTENTS

Telltale signs your CS org is broken

TABLE OF CONTENTS

CS orgs often wind up operating as a remedial team that fixes problems that originate in other departments. Because of this, it can be difficult to tell whether your CS org in particular is causing problems with your revenue. In our experience, however, there are three clear CS failure modes. Though the root causes of each of these issues warrant their own posts, suffice it to say: if your CS team is operating in one of the below modes, they’re focused on the wrong problem set.

- A CS team filling in for an AE team. Your CSMs own renewals and expansion. This can incentivize your AE team to oversell, which then puts your CSMs in the position of re-selling poorly-sized deals. If your CSMs were great sellers, they’d be AEs.

- A CS team filling in for a support team. Your CSMs handle ticket escalations, provide long-running context for biggest customers, run incident communications, and chase root cause analyses (RCAs). If your CSMs were great support engineers, they’d be premium support engineers.

- A CS team filling in for a services team. Your CSMs create project plans and scope services. If your CSMs were great at delivering professional services, they’d be solutions architects.

Refocus your CS org on your customers’ hierarchy of needs

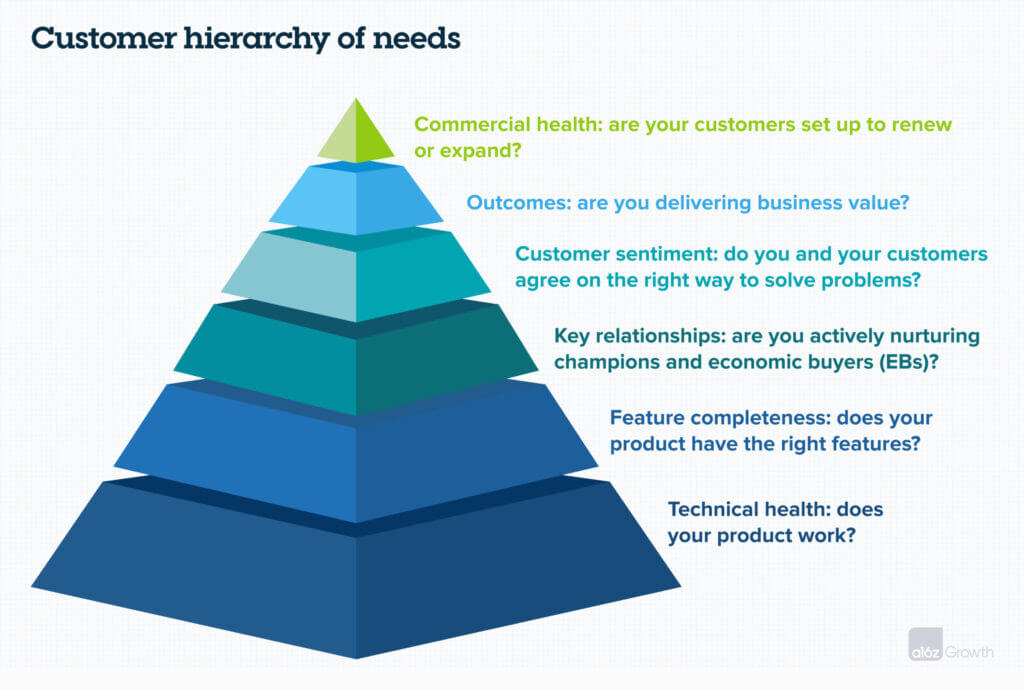

If you address the problems that originate in other departments and reorient your CS team to focus on customer health, however, your CSMs’ outputs can not only inform how you solve the problems caused in other parts of your org, but also give you an accurate signal into what’s going on in your customer base. And in order to do this, your CS org needs to quarterback the entire hierarchy of your customer’s needs.

If you can’t connect your CSMs’ activities to a layer in this hierarchy, then they shouldn’t do it. Generally, this means that services, support, and renewals should be distinct sibling teams that report into a common success, customer, or revenue leader.

It’s also critical that your CSMs don’t just report on customer health—they build systems that improve it. So if your customers are stalled out at a certain layer of this hierarchy, your CSMs need to actively build the right processes to get feedback to the right teams and ultimately help customers realize those positive business outcomes.

Technical health: does your product work?

At the bare minimum, your product has to work. By picking up on both aggregated and customer-specific signals, your CSMs should tell you what about your product isn’t working, why, and the effect it’s having on your customers. Where are your customers tripping up? How’s your product availability? How many outages are you having?

Process fix: Poor technical health could be caused by a host of issues, including poor implementation and poor product quality. In these cases, your CSM should bring in the services team to scope out a solution and then bring in sales to close deals.

Feature completeness: does your product have the right features?

If quarterbacking customers’ technical health is about asking is this feature broken?, quarterbacking feature completeness is about asking is this feature missing? Having the right product can get customers 80% of the way to realizing the outcomes they agreed on in the presale, but your product needs to reach feature completeness in order for your customers to fully realize those outcomes.

Process fix: drawing on customer-specific signals, your CSMs should be able to identify the gap between how your product is working as-is and how it should be working, then deliver this information to your product team.

Key relationships: are you actively nurturing champions and economic buyers (EBs)?

You could have the best product on the market, but if your relationship with the customer sours, your renewals are at risk, you have no opportunities for expansion, and your customers aren’t advocating for you to help you expand your addressable market. One of the keys to nurturing these relationships is clarifying the division of labor between sales and CS. Whereas account executives (AEs) are responsible for identifying and building champion relationships, CSMs are responsible for maintaining and nurturing those relationships.

Process fix: your CSMs should be regularly running different types of business reviews for different customer audiences; you can’t have good expansion momentum without a good QBR cadence. If you do lose a champion, your CSMs should reengage an AE, whose core skill set is identifying and building up champion relationships from scratch.

Customer sentiment: do you and your customers agree on the right way to solve problems?

Customers want to know that you’re both aligned on the best way to address their pain points. Your CSMs should be key partners in creating executive briefing centers or customer advisory boards to align your higher-order vision with your customers’. They should then report on the sentiment from these sessions in order to offer insight into how customers want to solve their own problems long term. For instance, let’s say your company sells a support platform and one of your key accounts is telling you that ticketing is dead and they’re interested in AI chatbots instead. The CSM on that account should step in and, based on their interactions with the market and your other customers, clearly articulate why your product is still key in solving that account’s pain points and delivers the business outcomes they need.

Process fix: though CSMs won’t be responsible for shifting the overarching mission or strategy for a company, they must help broker important conversations in EBCs or customer advisory boards as soon as they detect strategic misalignment between you and your customers. To continue the previous example, as soon as your CSM realizes some accounts’ strategic visions for support platforms are diverging from yours, they should bring in your head of product or CEO into an EBC to talk to those customers specifically about how your platform’s existing capabilities, roadmap, and vision can help those customers solve their pain points.

Outcomes: are you delivering business value?

At this point in the hierarchy, your CSM should be able to draw up a report that qualitatively and quantitatively articulates how your company is delivering on the agreed-upon business outcomes for any given account.

Process fix: if you’re not delivering those positive business outcomes, your CSM should sound the alarm and build a success plan to take your customer from their current state to an improved state.

Commercial health: are your customers set up to renew or expand?

This is the perspective on the overall commercial health of the customer and their forecast. At this point in the hierarchy, your CSM should be able to tell you whether a given customer will churn, renew, or expand. Note that there can be a gap between meeting a customer’s positive business outcomes and other external factors that might cause them not to renew, and vice versa. For instance, you might be meeting your customers’ PBOs, but they’re navigating RIFs and a tough fundraising market and won’t renew.

Process fix: if a customer is set to expand, your CSM can generate a customer success–qualified lead (CSQL), which should feed directly into your sales funnel. If your CSM is forecasting contraction or churn in a given customer, they should involve sales so the full account team can start mitigating that risk. Your revenue forecast is based on an aligned forecast between your CS and AE teams, so if your CSM is forecasting flat, contraction, or churn and your sales team is forecasting something different, your CSMs and sales teams need to dig into this misalignment.

What’s next?

Once you’ve retrained your CS org’s focus on the customer needs hierarchy, you’ll need to operationalize this framework. If you don’t have a data-driven approach to measure the implementation of this hierarchy—like a customer health scorecard—you’ll likely have a very difficult time getting your CS org to actively improve customer health. If you don’t have plans to monetize any functions in your CS org, you’re leaving money on the table. (And when you do monetize these functions, customers are effectively signing up to be part of their own success and health, which has its own virtuous flywheel.) And if you don’t size your CS org appropriately, you’re probably tanking your gross margins.

Identifying when your CS org is broken and refocusing it on driving the right outcomes is a critical first step in revitalizing your post sales org—and unlocking significant and efficient growth for your company.