The financial services industry is undergoing one of the largest transformations in its history. Like many seismic changes, initially change is slow and incremental and then a shift happens dramatically in a short time. We are at one such moment.

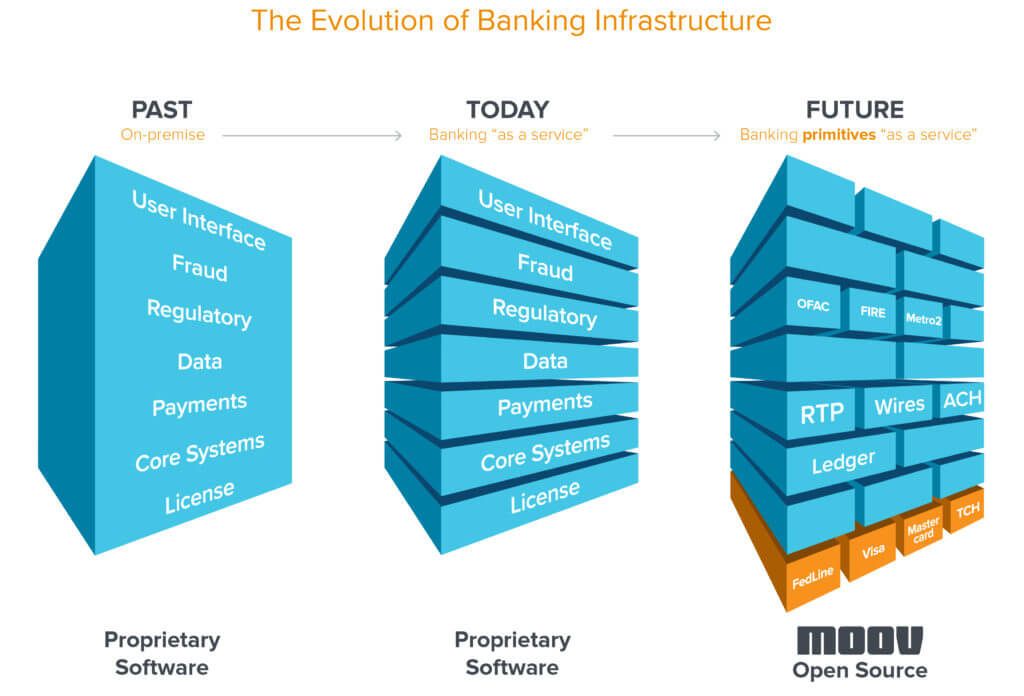

Financial services have experienced very little change for a century. However, within the past decade, an explosion of fintechs began unbundling the bank with best-in-class point solutions (e.g., a no-fee checking account where one can get their paycheck early or a point of sale lending solution). This change is powered by a wave of companies that are simultaneously unbundling the underlying banking operations. These “banking as a service” (BaaS) companies typically choose a layer of the banking stack (e.g., compliance, card issuing or payments), and provide that layer “as a service.” They make launching new fintechs faster and cheaper and have enabled non-fintech companies to add common financial services such as payments, loans, and bank accounts. These BaaS players are and will continue to provide tremendous value and serve a large segment of the market. Yet significant limitations remain.

In a perfect world, any company should be able to compose a customized financial solution to meet the unique needs of its customers. With today’s BaaS players we are only part way towards this vision. Today’s BaaS services are full-stack applications which are bundled and often coarse-grained. They support standard use cases but do not allow customization, modular development or an ability to plug into legacy environments. This is similar to building houses faster and cheaper while choosing from a small set of pre-configured floor plans. The perfect world requires a programmable inventory of every type of brick, tile and fixture that may be combined in any permutation seamlessly. The same transformation has occurred in cloud computing with the introduction and use of programmatic, open source building blocks (microservices for applications, or infrastructure as a service for compute resources) providing maximum flexibility in building modern applications.

Enter Moov, the provider of open source financial services building blocks (or open source banking primitives-as-a-service). Moov makes sending, receiving, and storing money modular, composable, extensible, and highly reliable.

What do Moov’s open source building blocks unlock?

- For banks: modular modernization: Reduce infrastructure costs by modernizing their banking core one step at a time (e.g., just replace the ACH module) vs. “rip and replace”, or rationalize overlapping systems to reduce operating costs, or launch new services on Moov’s flexible stack (e.g., support for Real Time Payments).

- For vertical SaaS & marketplaces: customizability: Companies may wish to build with Moov primitives to enhance customizability and control. For example, a company like Lyft, that offers its drivers bank accounts, may eventually want to own its own ledger and payment processor. This would allow it to add new features to these accounts such as a more granular points rewards system or dynamic discounts by merchant i.e., features not yet supported by their BaaS provider. BaaS providers themselves may want to augment their capabilities using Moov! Moov’s building blocks can also be repackaged to support vertically specific use cases, such as payouts by general contractors to subcontractors across multiple payment types.

- For fintechs: cost and control: Moov’s libraries and open source approach present an attractive solution for fintechs of scale that are considering bringing some of their infrastructure in-house, either for cost reasons or to gain additional control.

- For large incumbents: infrastructure modernization: Moov’s primitives can be bundled and extended to create solutions that integrate with legacy software. For example, Insurance companies paying claims (now often done by check!).

- For all companies: monetize via financial services: The availability of Moov’s primitives, open data enabled by companies like Plaid and real-time payments by The Clearing House and eventually FedNow will continue to fuel the creativity of entrepreneurs at companies of all sizes who will package these core primitives into original solutions.

Fintech infrastructure companies to date have approached the inflexible, outdated legacy banking infrastructure from the outside in. They’ve largely taken the underlying protocols as fixed, and focused instead on providing well-documented APIs and customizable UIs. In contrast to most BaaS companies, Moov is taking an inside-out approach, rebuilding the most fundamental primitives in modern Go libraries and wrapped in REST—including ACH, wires, RTP, OFAC, and a ledger for stored balance—and open sourcing them.

Why open source? Who would you trust more: thousands of experienced people working on a code base, finding edge cases, and writing test cases? Or a small group? The Moov community has attracted hundreds of payments engineers, including those at the top five banks who ran $4Trillion of previously cleared transactions through Moov’s ACH library to test its fraud models. These payments represented bill payments, mortgages, car loans, and direct payroll deposits that were previously processed on a mainframe running COBOL. As a result, Moov was able to collaborate with the community to discover and fix 1600 edge cases and write test cases against them, thus hardening the code base for all to benefit. The power of open source will become even more important as the use cases become more diverse and customers of all sizes become more reliant on Moov’s infrastructure. Customers who build with “Moov inside” can feel confident that their infrastructure is battle-tested and extensible.

To illustrate the power of this approach, let’s look at the outdated and cumbersome primitives currently used in money movement. Last year, $55 Trillion moved via ACH, (a format created in 1970), 1.3 billion trade lines are reported every month to the credit bureaus via Metro2 files (a format created in 1997), and over 15 million workers reported 1099s (a format created 1918). Banks, consumer and enterprise software companies, and fintechs are all building based on the 497 page PDF spec on how to construct NACHA files for ACH. (For more color on the cumbersome engineering workloads, read about Gusto’s past experience).

Moov’s open source strategy has automated all the complexity in these archaic formats and provided simple building blocks.

Why Moov? Behind these open source libraries and this fast-growing developer community is a uniquely talented team of financial infrastructure experts. Moov co-founders Wade Arnold and Bob Smith met while working at Banno, a white label digital banking platform founded by Wade that they eventually sold to Jack Henry. Wade continued to build his expertise and reputation in the payments community, spending his entire career as a software builder serving financial institutions. He originally created Moov and started contributing code to its open source library as a side project because it was something he wished he’d had at his prior companies. Wade and Bob have surrounded themselves with a team of industry veterans. We know there’s something special about a founding team when former colleagues quickly and unwaveringly join the journey under its leadership. The “Moovment” has already attracted more than a thousand payments engineers to an active community, and they are just getting started.

We are excited to announce our investment in Moov! These open source building blocks are powering the greatest shift in financial services of our time. It’s increasingly evident that eventually, “every company will be a fintech company.”

Thank you to our partner Seema Amble for her hustle, diligence, insight, and support of our Moov partnership.

***

- Investing in FurtherAI Joe Schmidt and Angela Strange

- Oil Wells vs. Pipelines: Two Strategies for Building AI Companies Joe Schmidt and Angela Strange

- How Big Bank Fees Could Kill Fintech Competition (July 2025 Fintech Newsletter) James da Costa, Alex Rampell, Angela Strange, and David Haber

- How Will My Agent Pay for Things? (May 2025 Fintech Newsletter) James da Costa, Angela Strange, Seema Amble, and Gabriel Vasquez

- What’s Working in AI, Rebuilding Core Banking (March 2025 Fintech Newsletter) James da Costa and Angela Strange

Peter Levine

is an advisor at Andreessen Horowitz where he focuses on enterprise investing.

- Investing in FurtherAI Joe Schmidt and Angela Strange

- Oil Wells vs. Pipelines: Two Strategies for Building AI Companies Joe Schmidt and Angela Strange

- How Big Bank Fees Could Kill Fintech Competition (July 2025 Fintech Newsletter) James da Costa, Alex Rampell, Angela Strange, and David Haber

- How Will My Agent Pay for Things? (May 2025 Fintech Newsletter) James da Costa, Angela Strange, Seema Amble, and Gabriel Vasquez

- What’s Working in AI, Rebuilding Core Banking (March 2025 Fintech Newsletter) James da Costa and Angela Strange