“A nickel ain’t worth a dime anymore” –Yogi Berra

Most innovations in financial technology have revolved around new modalities — take something we’ve done for decades and just “put it on the internet”. The paper credit card statement begot the web credit card statement, which begot the mobile-app-with-your-statement-in-it.

Technology can enable far more, though, especially if we rethink the way underlying products function. Today I am excited to announce that we are leading the Series A round for Point, which fundamentally rethinks the largest asset class in the United States — owner-occupied residential real estate (> $10 trillion!).

For the longest time, there have been two ways of “living” somewhere:

- Renting, in which case you own 0% of your residence

- Owning, in which case you own 100% (typically using a bank mortgage as a 30-year crutch to owning all 100%)

But why not own 91% of your house? 95%? 87%? Home ownership rates have been falling, partially because millennials can’t afford to buy homes — and when/if they can, they might find 300% of their net worth concentrated in a single asset class (i.e., the exact opposite of diversification) — their house.

Moreover, unlike the “financial weapons of mass destruction” and shady mortgages that brought down the economy in 2008, this is precisely the opposite. This is the elimination of primary debt, not the creation of it.

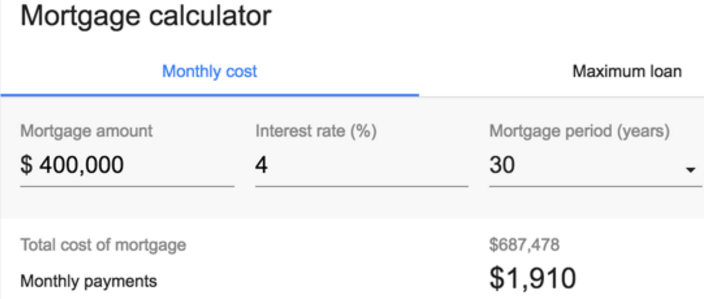

Here’s an example — You are buying a $500,000 house, where you put $100,000 down with a $400,000, 30-year mortgage. This is what it might look like without Point:

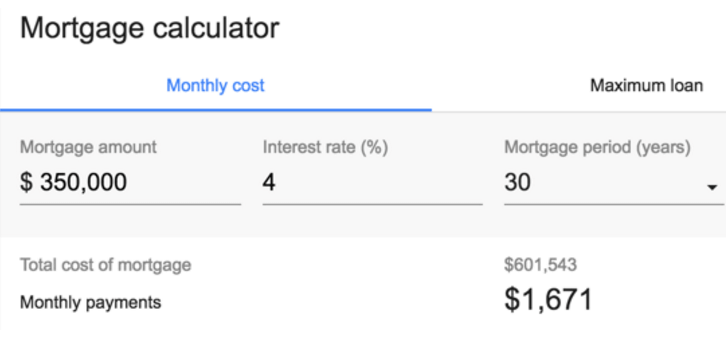

Or with Point, where 10% of the property ($50,000) is effectively owned by Point and consequently the mortgage goes down to $350,000:

There’s no such thing as a free lunch, and in this case Point’s lunch comes in the form of capital appreciation (more on the historical magnitude of this in a bit). If the house appreciates in value, Point shares in that upside. If the house depreciates in value, Point gets paid back after the bank, but before the homeowner, in the event of a sale. If the property depreciates enough, Point may lose some of its money, without the homeowner being in default; on the flip side, if the house greatly appreciates in value, Point will make far more than a traditional “coupon” from a mortgage. This type of equity-like exposure creates alignment between the homeowner and investor. There’s a terrific article on this subject in this Wharton article, “Don’t Reform Housing Finance — Reinvent It“.

On the opposite side, imagine you’re a big investor looking for capital protection and appreciation. There are few asset classes that have outperformed super-prime real estate in the last 60 years. Consider that the median home in Palo Alto sold for less than $20,000 in 1956, versus $2.5 million today — an appreciation rate of 12,500%. Compare that to an approximate 5000% return for the S&P 500 over the same period (much higher with dividend reinvestment, but you’d need to pay taxes on said dividends, making this calculation challenging).

Of course, for an investor to invest passively not in a single house but in a broad basket of homes would have been challenging, if not impossible. The investor would need to deal with finding and serving tenants, paying annual real estate taxes, and fixing toilets (maintenance) … across many, many properties.

Using technology, Point brings diversification to residential homeowners (diversify out) and investors (diversify in). It’s not like a home equity line of credit (HELOC) or a mortgage with monthly payments; it’s an aligned investment — that is, equity. It’s rethinking the fundamentals of residential real estate ownership — making single-family residential real estate a liquid, tradeable asset class.

a16z led a seed round for Point in 2015, and the team has made tremendous progress since then — taking this from concept to transactions across dozens of properties and millions of dollars in value. We’re thrilled to lead this round alongside many other financial visionaries, including Laurence Tosi, CFO of Airbnb and former CFO of Blackstone; Vikram Pandit, CEO of Orogen and former CEO of Citi; and many others who are as excited about Point as we are.

- The Greenfield Strategy: AI-native startup Bingo James da Costa and Alex Rampell

- Fruits of the Walled Garden Marc Andrusko and Alex Rampell

- AI x Commerce Justine Moore and Alex Rampell

- Investing in Rillet Seema Amble, Marc Andrusko, and Alex Rampell

- How Big Bank Fees Could Kill Fintech Competition (July 2025 Fintech Newsletter) James da Costa, Alex Rampell, Angela Strange, and David Haber