Eroom’s Law (the backwards Moore) is the often cited, and arguably inaccurate, observation that drug discovery gets slower and more expensive over time. It’s certainly a slog, but R&D efforts have yielded 378 new FDA-approved drugs between 2010 and 2019, almost double the previous decade. As a metric, even FDA approvals underemphasize the astounding advances that come from biotech innovation–like printing a COVID vaccine in 48 hours that has reached billions.

When the term “biotech” entered the mainstream in the 1970s, the then-referenced “tech” was recombinant DNA, a technique to splice genes from one organism to another. Cohen and Boyer used this approach at their fledgling startup Genentech to coax bacteria to pump out human insulin; it helped birth an entire industry. This “tech” now includes sophisticated biological engineering tools that underpin an expanding arsenal of programmable medicines.

Beyond tools for engineering biology, the biotech industry has also embraced the “mainstream” definition of tech: software. We’ve long been big believers in what the intersection of AI and biological engineering means for the future of biotech: artificial intelligence will transform how we deconvolute disease biology and design new-to-the-world molecules. Up next (and this is just the beginning): ChatGPT for biology!

But it’s not just AI. As it has for so many industries, software-as-a-service (SaaS) has the potential to dramatically transform biotech. From the molecular to the mundane, the biotech industry’s wide-ranging appetite for science-native SaaS tools is accelerating and will modernize how medicines are discovered, developed, and distributed.

Read the Eroom

America’s biopharmaceutical R&D engine consumes over $100 billion every year. The volume of biomedical data generated is massive and increasingly dense and complex. Drug discovery is now a multi-team sport with various stakeholders collaborating in unprecedented ways. Bench scientists turn to bioinformaticians to analyze data. Novel medicines can consist of multiple components from different companies that need to be assembled and manufactured by third-parties. Biotech companies need more technology to keep pace with all this innovation.

New technologies are embraced and advanced by nimble startups. The tools most disruptive to an industry tend to be built and deployed internally by “full-stack” companies as a core competitive advantage. Eventually, incumbents adopt them. Tesla pioneered software-first electric vehicles; today, every major carmaker offers them too. Similarly, Dyno and Insitro were built with proprietary AI embedded throughout; these “AI-native” biotechs are on the bleeding edge. But the availability of tools like AlphaFold, Deepmind’s tool for protein structure prediction, will help make AI accessible to all.

The modern biotech tech stack

For biotech companies, software is a means to an end—it’s science, not software, they seek to advance. As the need to analyze complex, large-scale data sets and to coordinate across multiple stakeholders becomes increasingly universal, a robust ecosystem of cloud-first, data-centric software solutions has begun to emerge.

We see a bright future for novel SaaS tools that are purpose-built by multi-lingual founders fluent in both tech and biotech. The best of these tools will be actively managed, enhanced, and expanded. They will benefit from network effects, offering incrementally more value as they add new users and ingest more data. For most biotechs, it will be too inefficient to build tools internally that effectively compare to (or compete with) these specialized SaaS offerings.

From providing core infrastructure, to powering applications that enable enhanced capabilities, to establishing new systems of record for managing complex information, these new SaaS tools build on each other to form a new technology stack for biotech that will modernize how novel medicines are discovered, developed, and distributed.

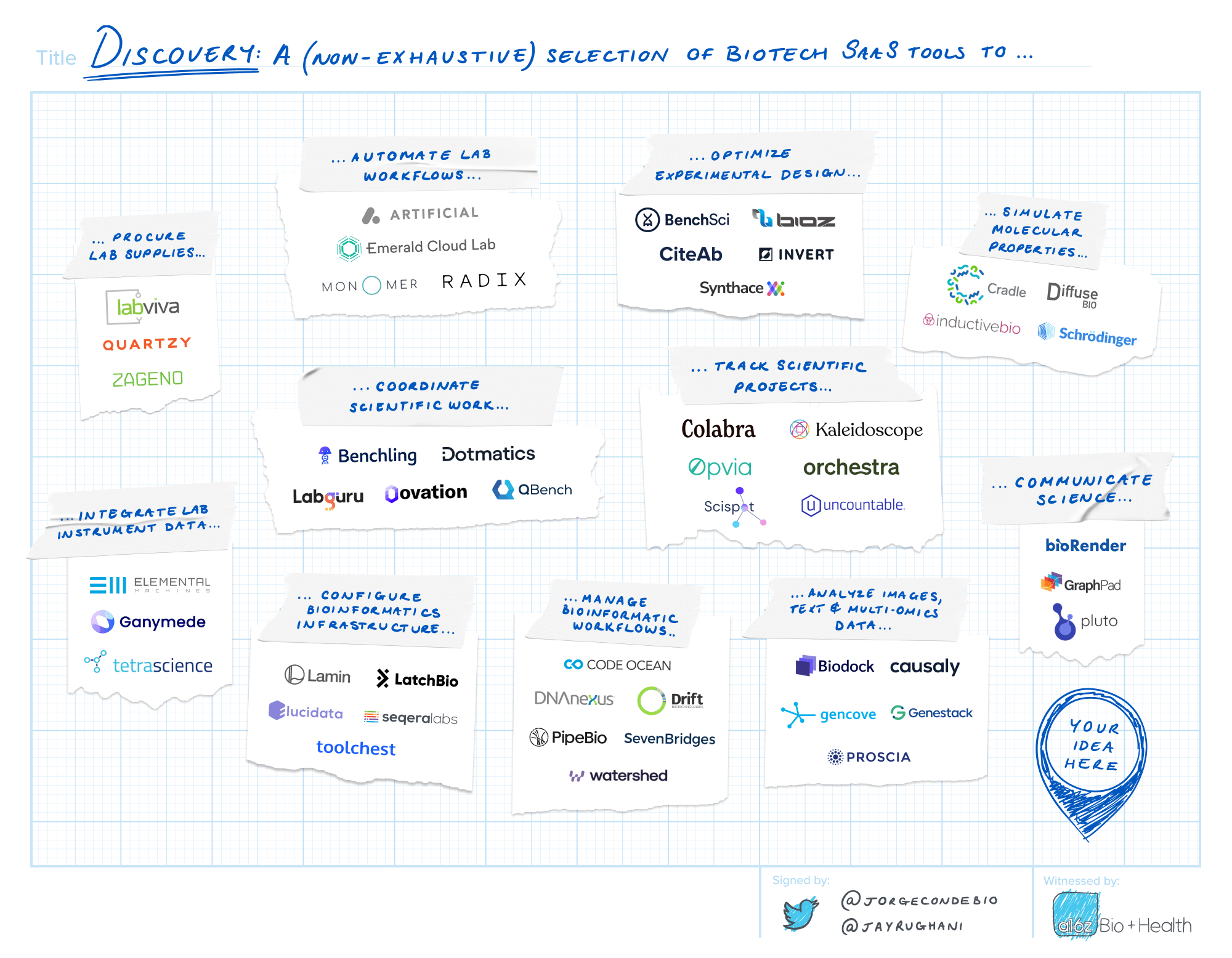

Discovery

The discovery process consists of continuous cycles of experimentation, analysis and iteration. Lab instruments are increasingly sophisticated, varied and prolific. Robots help pipette. Experiments are more complex than ever. Multi-omic, high-resolution experimental data has given rise to the wet lab’s co-equal branch: the computational dry lab. The days of jotting down protocols and results from experiments in a physical lab notebook are firmly in the past.

This current state and scale of science is one of the central drivers bringing tech to biotech. Modern infrastructure–better plumbing and connectivity–is required to direct the deluge of data. Science-fluent project management tools will organize teams. Data analysis and visualization tools help generate insights. AI platforms for biological target discovery and molecular modeling can accelerate programs. New systems of record will centrally manage it all.

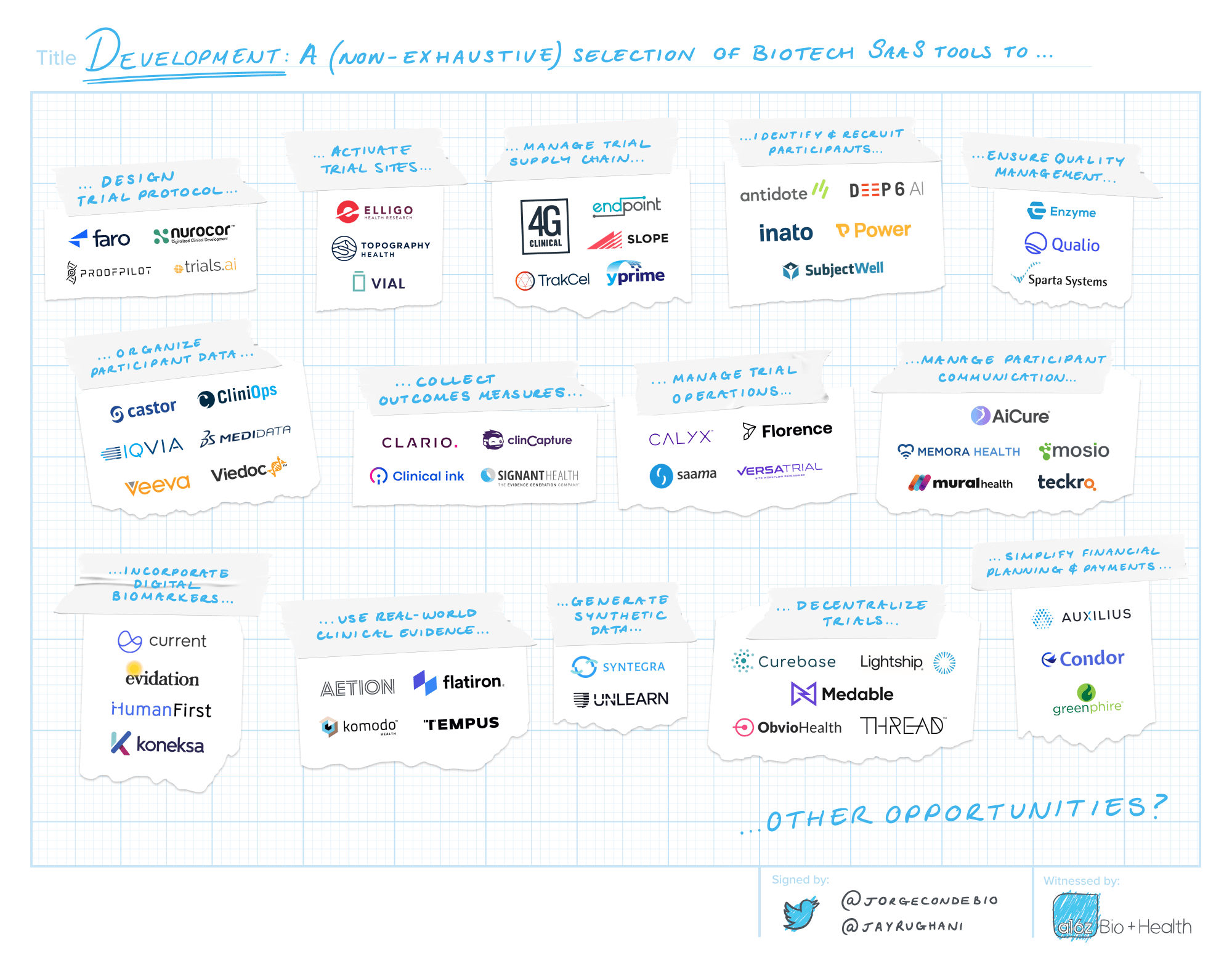

Development

The biotech industry’s highest obligation is to ensure new medicines are safe and effective. Yet our clinical trial infrastructure is antiquated. While the number of clinical trials continues to rise, too few of them fully enroll. Most patients and physicians lack awareness of or access to trials. Too many trial participants drop out due to financial or logistical burdens. Very few studies have the necessary demographic representation. Nearly 85% of trials are delayed and each lost day can cost millions in lost revenue.

Clinical development is in desperate need of a tech overhaul. Clipboards and binders will give way to SaaS for electronic data capture, trial management, study coordination, financial planning and regulatory submissions. Software helps organize inventory and supply chains. It also enables new models like decentralized or virtual trials, helps identify new patients, and powers continuous monitoring with digital biomarkers and wearables. And all of this data exhaust can be captured by real world evidence tools to provide additional clinical insights.

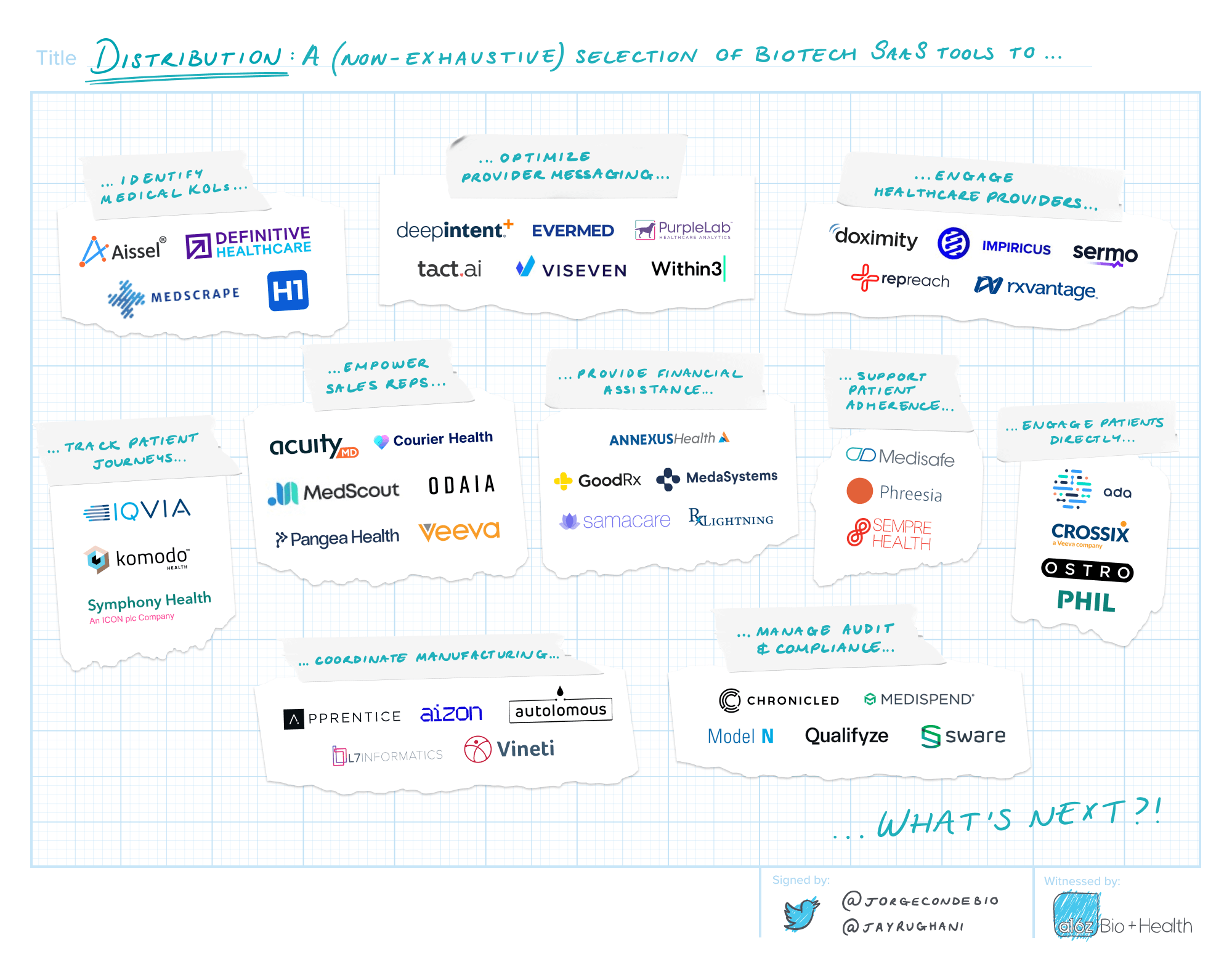

Distribution

The ultimate purpose for any medicine is to reach the people that need it. Every year, the industry spends billions to find and educate patients and physicians, and yet both groups are hard to reach. Access to and affordability of prescription medicine is impacted by middlemen; pricing is opaque, approvals are cumbersome and reimbursement is unpredictable. The manufacture and distribution of commercial drug supply has to be carefully monitored and controlled.

Commercialization and distribution was an early wedge for biotech SaaS. The first customer relationship management (CRM) for biotech is a billion dollar business. Modern data and analytics tools offer real-time insights into patients’ clinical encounters. SaaS can provide targeted physician engagement, patient education and tools for financial assistance. Modern infrastructure can also remove frictions. Manufacturers can manage complex supply chains and meet their regulatory, quality control, compliance and audit requirements.

It’s time to build for biotech*

*some assembly required

Companies like Veeva, Benchling and Komodo pioneered biotech SaaS and they remain key anchors in the biotech tech stack. The diaspora of their alumni are striking out on their own to become the next generation of bio SaaS founders. New blood is coming too: a large and growing community of software engineers and technologists, as represented by groups like Bits in Bio, seek to build software for science.

For those newer arrivals, a warm welcome and a warning: biotech is hard. Efforts to intervene against disease have proven, time and again, to be humbling endeavors–intricacies, edge cases and exceptions bedevil the most valiant attempts. Biology needs better software engineers, yes, but software engineers also need to better appreciate biology’s complexity.

Some advice from how we’ve seen the best do it:

Go native. Immerse yourself in the science. Learn the language and the landscape. Palpate the pain points. Traverse the idea maze to know if you’re solving a problem that is both valuable and broadly applicable across the industry. Adding services can help validate that your solution is useful and ensure that your customer will use it. When engaging prospective biotech buyers, be wary of the ”other” MVP–are you working towards a “minimally viable product” or on “my vague project”? Pilotitis is endemic in biotech.

Find your Goldilocks zone. Is your initial target customer a startup, mid-cap or top 20 biotech? Free open-source-for-science tools abound and general-use SaaS tools from established enterprise giants can be adapted for biotech use cases. Many companies will be tempted to “roll their own” solutions. You’ll need to assemble “just-right” science-native enterprise-level tools to win. But just imagine if you could replace PowerPoint and Excel as the shadow systems of record for the entire biotech industry…

Know your frenemy. These aren’t easy businesses to build. Your customer may have internal teams that view you as competition. Network effects are difficult to protect and maintain. There is a finite number of large biotech buyers to sell into. Large annual contracts are challenging to secure. You’ll need to expand your product’s surface area and add use cases to fuel growth. Sales cycles can be longer than most startups’ cash runway. Stock prices, budget cuts and restructurings have dampened appetites for SaaS spending. And you’ll undoubtedly encounter “is the TAM big enough?” skepticism from employees, partners and investors.

But if you break through, you’ll benefit from the winner-takes-most dynamics of vertical SaaS businesses. The prize? The potential to anchor the modern biotech tech stack that powers the next wave of medicines and brings them to the patients that desperately need them.

This is a moment. If you’re building here, whether you’re already up and running or just thinking about getting started, please reach out to us. We, too, would like to do more.

We’d like to thank Andy Coravos, Bryan Faust, Hylton Kalvaria, Dave Light, Cody Mowery, Adam Tong, Marc Watrous, Brandon White, and many more for their contributions to this blog post.