To receive this monthly update from the a16z fintech team, sign up here.

Cash-strapped boomers; Big tech does fintech; Schwab launches zero-fee trading, and more

Angela StrangeOK Boomer…ready to retire?

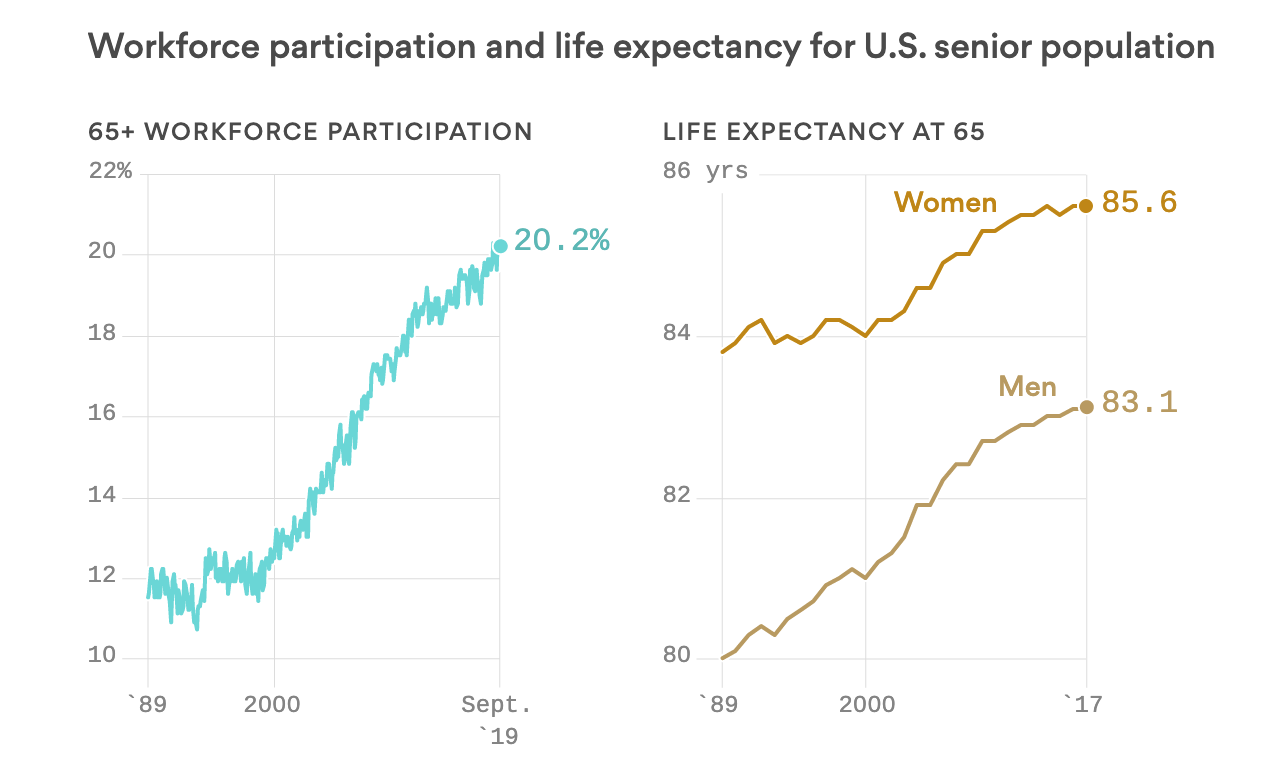

The catchphrase “OK Boomer” has been sweeping social media—a tongue-in-cheek retort to what many millennials and Gen-Z’ers consider baby boomers’ condescending attitude toward financial inequality. But in fact, that meme belies a stark reality: Boomers are less financially secure than you might think. There are now three times as many workers over the age of 64 than there were 30 years ago. That circumstance is sometimes a matter of choice, but more often it’s born out of necessity.

According to a recent Axios poll, more than half of those aged 35 to 54 expect to outlive their retirement savings.

Source: Axios

Managing one’s finances on a day-to-day basis is already a high source of anxiety; saving enough for retirement is even harder. At firms with fewer than 100 people, 53 percent of employees do not have access to an employer sponsored retirement plan. Boomers with debt report an average of $120,000 in debt, much higher than the previous generation. Some of this increased debt burden can be attributed to the housing bubble burst of 2008 (and the resulting loss of equity), but the data also indicates that boomers have less savings and higher debt overall. That has been compounded by a steady rise in the cost of living: since 1995, healthcare costs are up 30 percent; housing is up 50 percent; and education is up 80 percent. Meanwhile, median income has grown only 20 percent.

Nearly 2,000 fintech companies were founded worldwide last year, but very few were targeted at boomers. Despite the stereotype that they’re coasting into their sunset years, that generation is working longer, often self-sponsoring their retirement plans, and seeking ways to make their money last longer into retirement. To date, most fintech companies have focused on wealth accumulation. That presents a big opportunity for new financial services companies to help boomers’ decumulation planning.

Will zero-fee trading pay off?

Anish AcharyaIn the economic process known as creative destruction, new technologies displace—and eventually destroy—old structures. Nowhere is this more evident in financial services than recent structural shifts in brokerage firms, largely catalyzed by the rise of free trading apps like Robinhood.

Last month, Charles Schwab announced that it would no longer charge commission fees—then $4.95 per trade—for US stocks, ETFs, and options trades. (A number of other brokerage firms followed suit.) Amid fears of revenue loss, the company’s stock fell nearly 15 percent. But in fact, Schwab added 142,000 new brokerage accounts in October—that’s 31 percent more than the month prior and 7 percent more than October 2018.

Does this mean an incumbent managed to “disrupt itself”? Not quite.

Continue reading here.

Big tech does fintech

Seema AmbleUS tech giants are exploring fintech in earnest. Within the past month, Uber Money launched a wallet, debit, and credit card; Google introduced checking accounts; Facebook rolled out Facebook Pay; and Amazon announced BillPay by Alexa. Given these companies’ scale and distribution potential, are they aiming to become banks?

Big tech has been trying to launch financial products for some time. Facebook started offering peer-to-peer payments in March 2015. Google unveiled Google Compare, a financial product comparison site, in 2012—it was shuttered four years later. Uber rolled out its first credit card in 2017. And Amazon recently withdrew plans for a checking account. These were not halfhearted experiments—because they track your purchase patterns, likes, and search queries, these tech companies know you better than your primary bank. And since you often interact with those companies daily (sometimes hourly!), they also engage with you more frequently than your bank. Theoretically, they can then package and distribute financial services that are better tailored to you.

These big tech companies also accrue benefits to their core business. In part, building financial products is a play to bolster further engagement. By launching e-wallets and checking accounts, these companies are building a closed-loop system for your money. If a user keeps their money in an Uber wallet, for instance, that money is more likely to be spent on Uber. With this set-up, the tech company doesn’t lose money on fees to the card networks. Finally, these daily-use, transactional products create a data exhaust so companies can develop other products. Facebook, for example, will be collecting your payment method, transaction date, billing, and shipping details, which will lead to better ad targeting. It can finally associate ad impressions with purchase patterns, which, for advertisers, is the best measure of ROI.

Tech companies have each partnered with existing banks to avoid the regulatory headache and capital requirements of doing it themselves: Google with Citi and Stanford Credit Union; Uber with Barclays and GreenDot’s GoBank; and Amazon (reportedly) with JPMorgan. So big tech companies don’t necessarily want to become banks themselves—yet. The real question: Who has more leverage and will capture more of the economics, the front-end distributor or the back-end balance sheet?

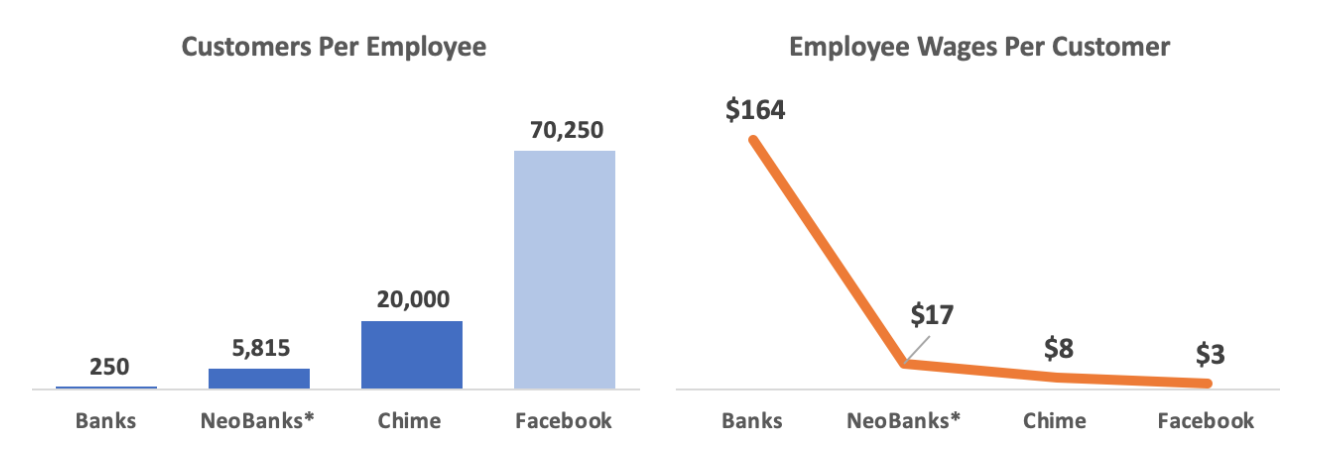

The consumer-based model behind neobanks

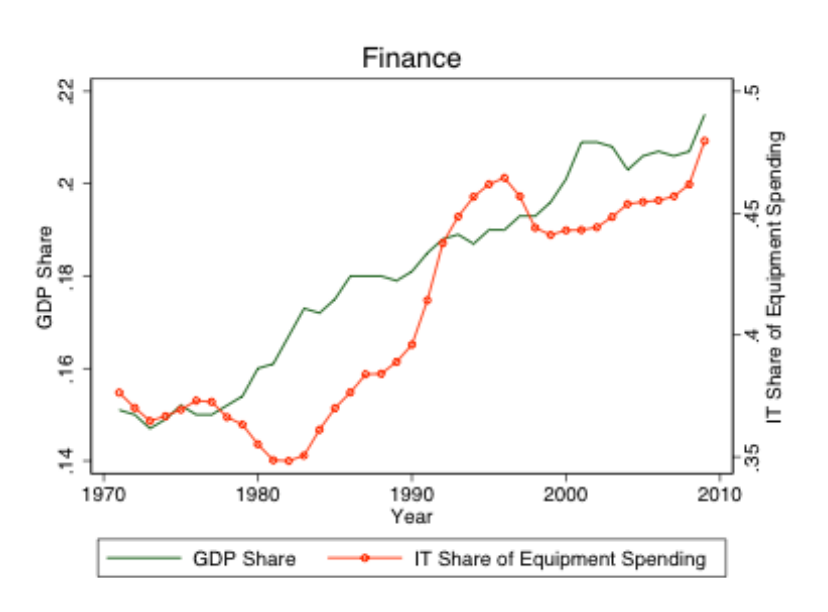

In 2009, former Federal Reserve chairman Paul Volcker quipped that the only financial innovation to date that had actually benefited consumers was the ATM. He had a point. Between 1970 to 2010, the amount of money spent on technology increased in nearly every sector. And while in most cases that hike resulted in lower costs and better products for consumers, in financial services, the opposite was true.

In finance, as technology spending grew, so did its share of GDP. For comparison’s sake, the trend in retail over the same time period looks quite different. As IT spending increased, its share of GDP decreased significantly. The takeaway: historically, bankers captured gains from productivity, rather than passing those gains along to consumers.

Source: Thomas Philippon, New York University

Now, through the rise of fintech, technology is finally delivering gains for consumers. The first indication of this shift came with the rise of alternative lenders like LendingClub and SoFi in the aughts. Both companies used technology to underwrite consumers more efficiently, then passed those savings along to customers in the form of lower rates. What’s happening today around neobanks is even more exciting. As autonomous finance advances, these companies are able to offer not only better products and services, but also algorithm-driven advice.

Sources: Company press releases, LinkedIn data, and market surveys

Because financial services are less constrained by the cost of human labor than ever before, the upside is that consumers receive better, faster products and greater savings. Neobanks have already abandoned traditional banking expenses like overdraft fees and monthly maintenance charges. But the real promise of fintech is not only in making banking more affordable, but also more accessible. By serving customers more efficiently, neobanks can offer access to an entirely new class of people who were unprofitable under the old model. With fintech, innovation in finance will finally benefit customers, not just the bankers.

The lure of a loans-first strategy for startups

Kabbage is one of the original small and medium business online lenders in the US, offering lines of credit up to $250,000, with flexible terms, through its website. Since launching in 2008, Kabbage has grown to more than 200,000 customers and has disbursed more than $8 billion in loans.

Recently, the company announced a new value proposition: Kabbage Payments. Where previously customers often had to wait more than two weeks to receive payments, this service allows users to get paid in as little as 24 hours through a custom pay link sent via email or text. This marks an important milestone for Kabbage—becoming more than a pure lender.

In the fintech world, loans are a high-margin product that is easily converted into revenue and customers. But though loans offer strong monetization incentives, lending-first businesses often face difficulty growing into multi-product companies. Online lenders such as LendingClub and Prosper, for example, have struggled to offer new products to customers. That’s because they mainly compete on costs—of capital, customer acquisition, and interest rates. As such, many lenders start with a sticky, high-use product (like an operating system), then leverage the resulting data into a loan offering. Square famously started as a point-of-sale system for merchants. After collecting payment data, it followed up with Square Capital to issue loans to its captive merchants. Similarly, the restaurant management platform Toast recently introduced Toast Capital, a loan solution that offers its restaurant partners lines of credit of up to $250,000.

For consumer lenders, expanding beyond loans is even more difficult. Because consumers are primarily concerned with convenience and cost, they don’t typically develop an affinity for their lenders. (Quite the opposite: it’s likely most people would prefer to see their lenders—and their loans—disappear.) In contrast, consumers are much more attuned to reputation and trust when it comes to fintech platforms like digital banks and saving products: places they deposit their hard-earned dollars. In recent years, companies that started out offering loans, such as SoFi and Affirm, are now expanding into products like high-yield savings and bank accounts in an attempt to diversify.

More from the a16z fintech team

Banking on the Future: Why our most hated institutions will become our most beloved

Tech is remaking the banking system from the inside out.

By Angela Strange

The Housing Market is Killing the American Dream

Skyrocketing home prices are driving people away from opportunity. Now startups are attempting to reverse the trend through software.

By Rex Salisbury

Fintech Can Save Us From Ourselves

Deep down, we’re all illogical spendthrifts. Now fintech entrepreneurs are developing new approaches to address our irrational behavior around money.

By Anish Acharya

To receive this monthly update from the a16z fintech team, sign up here.