We live in amazing times—novel therapeutics are increasingly available for once-untreatable conditions. In some cases, new therapeutic modalities like cell and gene therapies represent potential cures for otherwise lifelong or fatal diseases. Cell therapies work by transferring engineered cells into a patient to prevent or treat a disease, while gene therapies, including genome editing technologies, alter a person’s genes to do the same.

In the process of making a medicine, drugmakers tinker with molecular structures and formulations to solve for drug delivery—to ensure a therapeutic reaches its target site inside the body. But even the best drugs only work when patients take them and, sadly, many of these “miracle drugs” remain unattainable financially and logistically—some come with price tags of up to $3.5 million per dose, and many involve very intensive clinical regimens that require everything from travel to specialized centers, to multi-week hospital stays, to heavy clinical and caregiver support. In essence, we have a different kind of “drug delivery” problem—one that has to do with patient access.

Our current healthcare delivery and insurance system—both private and public—is not designed to be able to pay for or distribute these medications at scale, leaving patients exposed to high prices and confusing logistics, providers without infrastructure to support those patients through their care journeys, payors facing unsustainable economics, and manufacturers with uncertainty around the distribution of their impactful products.

And yet, these drugs are being developed more rapidly than ever. There are 34 FDA-approved cell and gene therapies as of the writing of this piece, and an additional 50 or so are potentially up for approval in 2024. As AI augments therapeutic discovery, development, and distribution, it’s likely that these medications will become even more prevalent.

All this to say—it’s time to figure out how to access, pay for, and deliver curative therapies (amongst other high-cost, complex, specialty drugs), at scale. First, let’s dive into the specific challenges that need to be surmounted to get this right.

Access and affordability

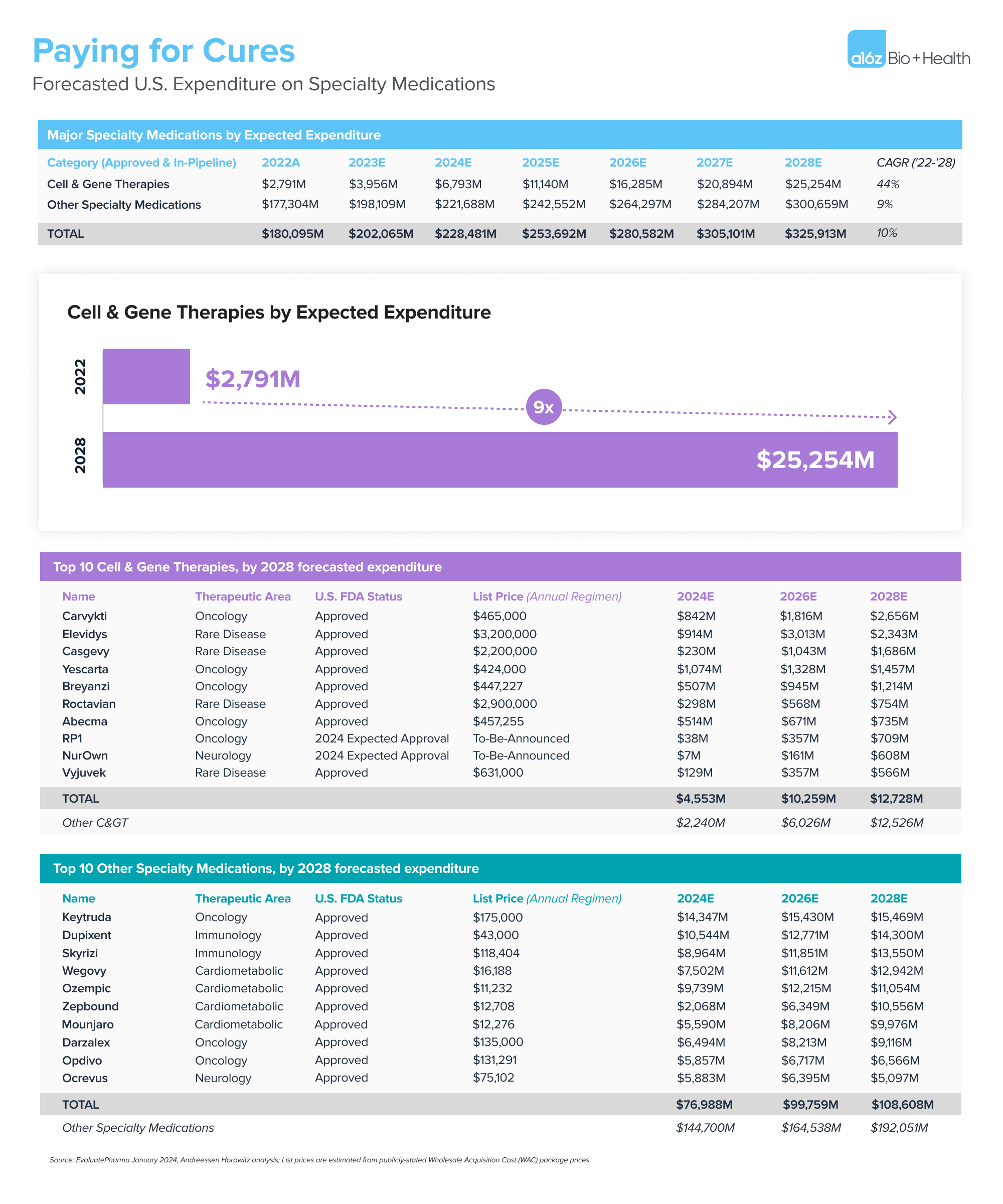

Specialty medications are broadly defined as high-cost drugs used to treat complex conditions that often require special handling, dosing supervision, and monitoring. Cell and gene therapies are a cutting-edge subset of those products that come with particularly high ticket prices—list prices range from approximately $300,000 to $3,500,000 per one-time, potentially curative dose. Our healthcare system is expected to spend over $25 billion on cell and gene therapies by 2028, according to EvaluatePharma and as shown in the figure below. So, while these therapies have the potential to change patients’ lives, they could also lead to ballooning healthcare costs.

.

Insurance limitations

When thinking about price implications in reimbursed healthcare, the rub is not just the net price of the drug itself, but the time horizon over which the insurance plan achieves payback for that investment. Similar to the concept of LTV:CAC (lifetime value-to-customer acquisition cost) in consumer tech, an insurance company justifies approval of big ticket reimbursements on the basis of conviction that they will be able to realize the financial benefit within the “lifetime” of the members in their health plan.

But health insurance churn rates can be relatively high. 2023 was a particularly challenging year for churn in Medicaid populations (due to redeterminations) as well as commercially-insured populations (33% of employees left their job within the first year). Even Medicare Advantage churn rates can reach as high as 13-14% annually. As such, health plans, unfortunately, have little incentive to make significant upfront investments into preventive or curative interventions that accrue over many years, since the likelihood that the members who receive that intervention are still paying premiums to the health plan after a few years is low.

Even putting time horizons aside, the objective price tags are hard to swallow for smaller employers, which comprise the vast majority of our economy (97.5% of companies have fewer than 100 employees). A 500-employee, self-insured employer might spend approximately $7 million per year on health benefits for their employees. Covering just one member’s $3 million therapy could devastate the company’s financials by driving health insurance costs nearly 50% higher than expected in that year. While reinsurance and stop-loss coverage handle some of those cases, those plans can be expensive, and they are increasingly “lasering out” (denying) coverage of cell and gene therapies specifically because they break traditional underwriting models.

Barriers to patient access

Patients feel these burdens directly, too. Under the current system, they’re forced into rounds of prior authorizations and negotiation with their insurance providers to get coverage under their health benefits. While drug manufacturers typically provide patient access and financial assistance programs, the current mode of coverage tends to be very ad hoc.

Barriers to access also raise questions around health equity and the ethical code for distributing innovations to society evenly. Many genetic diseases disproportionately impact vulnerable populations who are uninsured or underinsured, and the ability to access these therapies may require distant travel and long-term stays in a hospital, which could be out of reach financially and logistically for those patients.

Production and delivery

These curative therapies are expensive to make and complex to administer, requiring heavy oversight from clinicians both pre- and post-administration. Provider organizations also have to manage the complex payor negotiation process highlighted above, which amplifies the care delivery challenge.

Manufacturing infrastructure

To illustrate the complexity of production of these therapies, some cell therapies require removing cells from the patient’s body, transporting them to the manufacturer to reprogram and regrow the cells, and sending the cells back to the provider to infuse into the patient. Each step of this process requires careful calibration; as our partner Jorge wrote, “when editing DNA, we can’t make any typos.” And that doesn’t even encompass the logistical challenges of safely shipping live cells.

For these therapies to be manufactured and distributed to the patients who need them, manufacturers will need to build new facilities, and health systems will need to develop a scalable workflow for collection, shipping, and infusion. All parties will need transparent data and high degrees of collaboration to continue to improve the process over time.

Care delivery infrastructure

Today, a select set of hospitals have built out specialized capabilities to deliver cell and gene therapies. These programs may involve unique training for clinicians, clinical logistics, patient support, and data collection and reporting capabilities per FDA, manufacturer, and payor requirements. We’ve even seen hospitals hiring software engineers to custom-build technology to manage these end-to-end processes.

But the number of organizations that are capable of investing the time, training, and capital to do this is finite—so solutions are needed to ensure that patient access isn’t limited by geography or site of care. And if even the sophisticated hospitals are struggling to find market-based solutions, there’s little hope for smaller hospitals and outpatient clinics to get into the game without a lot of help.

The opportunity for builders

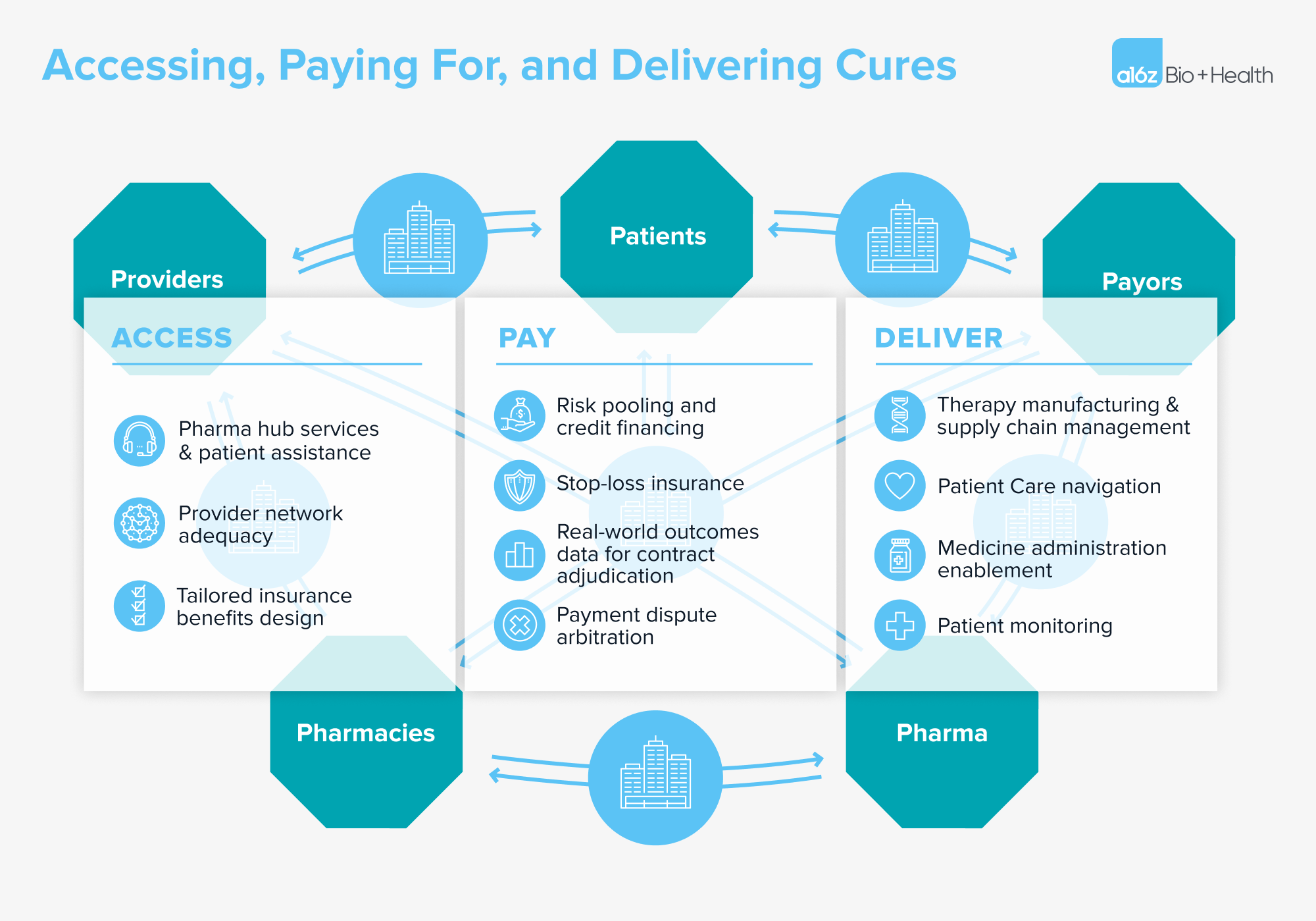

The “why now” moment has come for a specialized, tech-enabled benefit manager that enables systematic access, payments, and delivery of cell and gene therapies. The components of a holistic solution might include:

- Accessing cures: Ensuring that supply can meet demand will require collaboration across providers, payors, specialty pharmacies, and pharmaceutical manufacturers. Patients and their caregivers will also require specialized financial, operational, and reporting support. And manufacturers have an interest in developing scalable payor contracting, provider network management, and patient financial assistance capabilities that can help streamline the last mile of distribution of their products.

- Paying for cures: We need a different insurance coverage model for “one-and-done” therapies that create undue burden in traditional benefit designs. We’ve previously described alternative models for aligning the timing of payments with the realization of benefit, and some examples of subscription-based models have been implemented in the wild. These alternative payment models need to be backed by solid real-world data platforms to provision trusted, high-fidelity outcomes data with which to arbitrate those payment contracts.

- Delivering cures: Manufacturers will need to continue to develop the specialized supply chain to be able to reliably produce these complex drugs at scale. Providers will need operational, technical, clinical, and financial support to be able to stand up and run these programs in a sustainable fashion, including infrastructure to reliably scale them into lower-cost, community-based settings.

.

We look forward to hearing from any and all builders who are addressing the new drug delivery problem by developing sustainable ways to deliver miracle drugs to the patients who need them.

***

We would like to thank Jeff Marrazzo, John Maraganore, Will Shrank, and others for their contributions in reviewing, shaping, and pushing our thoughts here.

-

Jay Rughani Jay Rughani is a partner at Andreessen Horowitz, where he invests in AI across healthcare and life sciences.

-

Annie Collins is an investing partner on the Bio + Health team, focused on healthtech.

-

Jorge Conde is a general partner on the Bio + Health team at Andreessen Horowitz, focused on therapeutics, diagnostics, life sciences tools, and software.

-

Julie Yoo is a general partner on the Bio + Health team at Andreessen Horowitz, focused on transforming how we access, pay for, and experience healthcare.