For many enterprise startups, the predominant initial go to market (GTM) strategy has been “growth + sales”, which relies on a bottom up, product-led approach to acquiring and retaining users and customers. But after successfully executing on this strategy and getting to their first $20M of annual recurring revenue (ARR), these startups inevitably face a new set of strategic questions about when and how to layer in top down sales.

As growth investors, we’ve often found ourselves having the conversation about scaling ARR 10x+ beyond $20M, including the frequently asked question of why change the strategy that’s been working so well. If the GTM ain’t broke, why fix it? But a bottom up GTM is not enough to unlock the full potential of a market; while a product-led innovation strategy certainly gives startups an advantage in winning initial users, it doesn’t fully unleash the market because enterprise-wide adoption often hits a wall without the approval of centralized, cross-functional decision-makers like executive leadership or procurement.

The introduction of top down sales is one of the most important inflection points in many enterprise companies — decisions made during this time have an enormous impact on the overall growth trajectory of the company — and yet only an elite few companies have trodden this path successfully in the past 5-10 years. To help the next generation of bottom up startups learn and scale, we culled insights from the pioneering sales and business leaders at Atlassian, Dropbox, Github, SendGrid, Slack, Stripe, Twilio, Zendesk, and Gainsight. We identified common themes around must-haves and pitfalls, timing for the transition and what needs to change, implications for talent and culture, and finally, advice for navigating the tensions between product, engineering, customer success, and sales.

Thank you to the many leaders who offered their insights, particularly: Jeanne DeWitt Grosser, Head of Americas Revenue and Growth, Stripe; Robert Frati, SVP of Sales and Customer Success, Slack; Sujay Jaswa, formerly Business Founder, VP of Business and CFO, Dropbox; Amanda Kleha, formerly SVP Marketing and Sales Strategy, Zendesk, and currently Chief Customer Officer, Figma; Nick Mehta, CEO, Gainsight; Jay Simons, formerly President, Atlassian; Yancey Spruill, formerly CFO/COO, SendGrid; Paul St. John, formerly VP of Worldwide Sales, Github; AJ Tennant, Senior Director of Enterprise GTM, Slack; Zeeshan “Zee” Yoonas, formerly Head of Sales, Twilio; and Peter Levine, General Partner, a16z.

Do we even need top down sales to scale?

The first question we often hear is: “Do we need top down sales at all?” And the answer is yes! The pushback we then get: “But didn’t Atlassian build a big business bottom up with no sales reps?” Yes and no. Even Atlassian — frequently touted for its incredibly successful and high velocity bottom up motion — added channel partners to facilitate top down sales before eventually building its own direct sales team. Because Atlassian product has a large services component, Jay Simons explained that, “it was ideal for a third-party channel network to help us sell the higher value and more complex enterprise deals,” further adding that the channel selling mechanism “found additional opportunities for our products to expand in enterprises, where the early sale of our products was complemented with a real value add — consulting and services.” The key here is that to expand the sale to the full enterprise, Atlassian needed a sales and support model that went beyond individual users or small teams to go after the broader and more complex deployments.

Initial growth at successful early stage bottom up companies is often the result of a product-driven flywheel: The product’s value and appeal drive individual user adoption, which in turn drive viral momentum through word of mouth, while product upgrades and individual usage often lead to team adoption. However, as products proliferate through an enterprise customer, there’s a limit to the users who want to or are able to discover, use, and pay for it on their own. As the company starts to scale, relying purely on self-serve often results in an asymptotic flattening of the growth curve, resulting in linear or worse, declining growth.

In contrast, enterprise-wide deployment creates new users and use cases (especially among those not naturally early adopters); enables features across the broader organization that aren’t compelling at an individual level but are in aggregate (such as access control); and makes key features visible to different parts of the organization where they may be most relevant — particularly for IT, management, or larger group collaboration features. As a product proliferates through a company, a16z general partner Peter Levine observed that, “there’s a limited cohort of users who can ascribe perfect value to the bottom up product”: only enterprise sales teams can expose, recognize, and create the market for the product in the whole enterprise. And when top down sales acceleration is combined with bottom-up driven momentum, “it’s worth all the money”, argued Paul St. John, former VP of Worldwide Sales at GitHub: “Personal and team accounts were steady eddy, but enterprise growth was 100% a year.”

When should we start to scale our top down motion?

The topic of timing is tricky and unique to each particular business. While it is possible to layer in top down sales too early, putting it off can be even more detrimental to the business. One sales executive said, “If we had operationalized the sales funnel earlier, we would be a billion dollar company already.” Moving too slowly can also result in ceding ground to competitors — one company noted that a competitor made “3-year [long] deals that cut off a segment of the market we just weren’t able to chase yet” due to the lack of top down sales in place. Another business leader went so far as to say: “We layered in top down sales too late. It was the single biggest mistake at the company.”

Sales leaders agreed, however, on two conditions that every company should meet before layering in top down sales:

- The bottom up flywheel is working

- The business is demanding a top down solution

The bottom up flywheel is working

The clearest evidence that the product-driven flywheel works is the company’s overall topline traction: a best-in-class product drives viral adoption and early monetization, which in turn continues to expand the user base, often with limited dollars spent on marketing and sales.

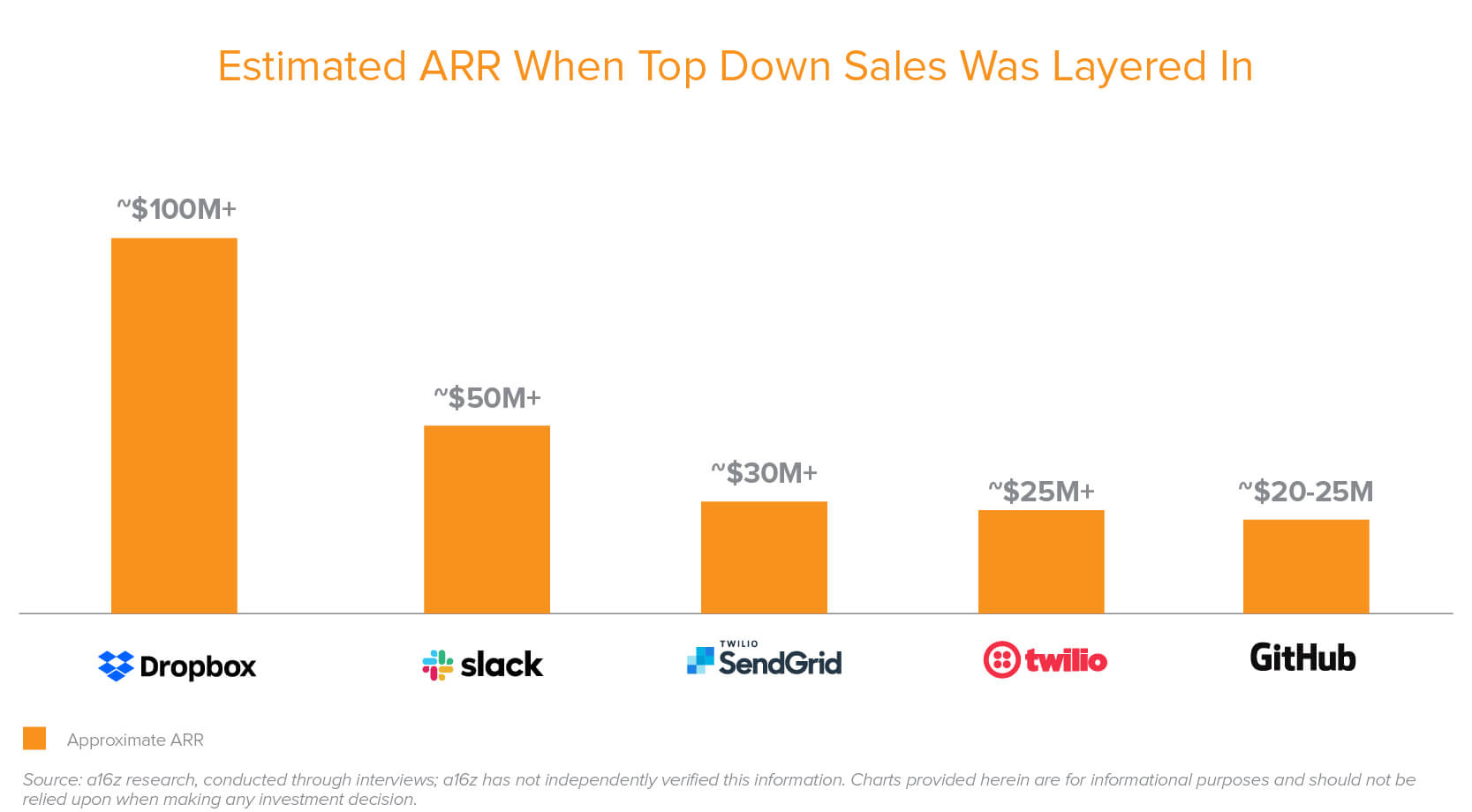

While the exact threshold will vary by company, there is a surprising amount of convergence that achieving between $20M to $30M ARR in bottom up-driven sales is a strong leading signal. GitHub, Twilio, and SendGrid all started investing in their top down sales teams between $20M and $30M of ARR (see chart below). Peter Levine confirms that this is often the point at which “there is enough critical mass for top down sales to be effective.”

The more subtle indicator is penetration within individual accounts. The most successful top down motions arose in companies where clear usage lines were crossed before top down sales were successful. As Zee Yoonas explained, bottom up momentum is leverage for the top down sale: “When you’re in an emerging technology company, it’s hard to go to an executive and say ‘here’s a new piece of technology, sign a seven-figure contract.’” He and his team at Twilio discovered that crossing the threshold of two to three departments utilizing the product was the best indicator of winning that top down mandate, as it gave the sales team “a story to take to other departments and tie themselves to the top down motion.” At Dropbox, 3-10% employee penetration was often the tipping point. For companies looking to layer in top down sales, it’s important to develop your own penetration threshold for critical mass, based on existing customer behavior.

This penetration metric can also prevent your team from trying to sell top down too early, as one sales leader shared. When the company had sold two small deployments to Walmart, the sales team attempted a larger scale, top down sale. The limited penetration made it difficult to triangulate the value of the use cases, and even though they were able to land the initial deal with great selling execution, Walmart ultimately churned as a customer.

When paired with the right penetration heuristic, the bottom up motion serves as an important pipeline generator for the most successful top down sales. For products that introduce new use cases and are built on emerging technology, the top down sale is particularly challenging without the benefit of a value proposition built on existing bottom up momentum.

The business (not the user) is demanding more

Customer demand is another important precondition. While individual users may not appreciate or value features such as improved security, nuanced access control, and enhanced transactional support, these features become naturally requested at the enterprise level and as centralized procurement gets involved.

At this stage, customer demands begin to shift beyond the capabilities of self-serve products geared toward individuals and smaller teams. When weighing whether to add certain enterprise features, it’s critical to remember that individuals don’t buy enterprise features, businesses buy them. At Zendesk, Amanda Kleha observed that as the number of users and complexity per account grew, “our customers were pushing us to add more and more enterprise features — the requests weren’t driven by the sales people.”

Building features for the business buyer, instead of just the individual, can be a big mindset and cultural shift for product-led companies. In the early days of Github, the strong market demand for enterprise features initially clashed with a developer-first product and engineering organization, leading to lost deals. When a large financial institution requested direct customer support and access controls on the ability to push code, Github initially resisted, due to the fear that sales-driven enterprise product changes would erode the strong developer culture that was at the core of the platform’s viral growth in the first place. They lost the deal. When Paul St. John convinced the company to make the requisite product access adaptations and enable sales and support teams to speak directly with customers, GitHub won its first enterprise deal and never looked back.

Who do you hire and how do you pay them?

So you’re convinced that your company is ready to take the leap into building and scaling out a top down sales organization. You might have no sales team or you might have a handful of reps who are flexing into a few enterprise-level deals. What kind of sales leader do you hire, and how do you compensate your new sales team?

The first leadership hire

When it comes to bringing top down sales leadership into a product-led company and continuing to build a sales org, there’s one principle that everyone we spoke with agreed on: this isn’t a role that calls for the stereotypical enterprise sales leader persona. In fact, the product and engineering-first ethos at many bottom up startups can be a rude awakening for sales leaders expecting traditional enterprise company cultures that kowtow to sales. This culture clash can be a death knell for top down sales initiatives, and previously effective leaders who are unable to adapt to their new reality can really struggle. “This role calls for more than just executing a playbook, and a sales leader cannot be rigid in the approach,” Sujay Jaswa, who was at Dropbox, said, noting that “an entrepreneurial mindset is the most important.”

The clash is rooted in the tremendous success of the existing bottom up motion; top down sales leaders must convince both management and product teams to do something different from an already proven growth formula. So, what kind of leader thrives in this environment? Four attributes rose to the top:

- Collaborative decision-maker

- Analytical and technical orientation

- Long term relationship builder

- Enterprise sales experience

1) Collaborative decision-maker: Sales leaders who are used to top down relationships with their product teams are often surprised by the strong resistance they face when proposing customer product requests that aren’t on the near term roadmap. The most effective leaders turn the product decision-making process into a collaborative one. At Stripe, Jeanne DeWitt Grosser found the most compelling way to start these conversations was with a cost-benefit analysis of the opportunity: “You have to understand that you’re not going to dictate the roadmap. But you also need to bring the product and engineering team along so they can discover why they might want to build different features. Instead of, ‘build this,’ I start the conversation by walking the team through the why and so what. ‘This is the feature I keep getting requests for. I know it’s not on the near term roadmap, but if you build it, I think it opens up an opportunity of $X size in the next six months because we have seen good product market fit’.”

Mutual trust is further enforced when the sales teams follow through on winning those deals . Sales leaders also noted that inviting the product team to join enterprise customer calls to hear new use cases and customer rationale firsthand helps illustrate the importance of a particular feature and leads to collaboration on the final decision. For example, Slack’s AJ Tennant said: “When we had customer product issues early on, the best and simplest way to create empathy to fix the issues is to get the people who are building the product to listen to the customer. We brought the product and engineering team on the calls together.” Sales and business leaders alike agreed that humility and an open-minded approach need to lead the way. As Paul St. John shared about his time at GitHub: “I didn’t come in with any big moves. I had to earn trust over time. Longevity and consistency build trust and trust builds power.”

Over time, companies might also consider creating a separate enterprise product team to resolve sales-product team clashes and facilitate stronger alignment, a technique that was used effectively at Slack. While a collaborative sales leader is required in any kind of product-led organization, a dedicated enterprise product team can focus on enterprise features without compromising innovation on the features valued by the individual users who are critical for the self serve funnel. Again, this comes far down the road and not at the outset of the top down journey.

2) Analytical and technical orientation: Successfully converting bottom up traction into top down sales requires a more analytical approach to sales versus the stereotypical art of enterprise selling, aka long client dinners and a low golf handicap. Jay Simons emphasized that at Atlassian, “the people who were really successful in sales were more model builders than org builders, and more data-oriented and analytical than deal crafters.” Similarly, Jeanne DeWitt Grosser found that “Stripe was uncompromising in hiring sales leaders with both strategic and analytical thinking.” The most effective sales leaders mine the wealth of usage data and trends from the product itself to discover the key penetration thresholds, build the pipeline, identify the right stakeholders, communicate a targeted value proposition, and even signal when and where to launch internationally.

- At Dropbox, usage data was critical for pipeline formation, which started by identifying the top companies by current usage and the top 10 power users within each company.

- At Zendesk, when a lead wanted to purchase more than 15 seats, it made sense to switch to an enterprise sale. At that size, the complexity of the sales process was different and might include security and legal discussions.

- At Slack, the sales team expanded to Japan when they saw healthy growth from the self service motion: “one of the beauties of usage-based products is that you can see the trends in usage and you can see where your population is growing.” Before taking the leap internationally, make sure your bottom up usage is already pointing to an existing opportunity abroad.

A technical orientation is also beneficial. While sales is traditionally viewed as an externally-oriented role, the ability to speak the language of product earns important credibility with the product team and key internal stakeholders. At GitHub, Paul St. John and his team even used GitHub to run the sales team: “We would act like developers, so they would see us working like they were.” Jeanne DeWitt Grosser espoused similar practices at Stripe, where she and her team became “extreme product experts, wrote their emails in plain text, and applied engineering frameworks to deal reviews.” At Slack, the top sales people had “a strong grasp and competency in the technology, with the ability to translate that into solving business problems.”

3) Long term relationship builder: Given the typically low ticket value of the original bottom up sale, account expansion is an even larger component of growth at successful bottom up companies. Landing the first sale marks only the beginning of a strong customer relationship, and it’s not uncommon to see net revenue retention over 150% in top companies. Hiring sales leaders that can build sales teams with a longer term orientation pays off.

Given Twilio’s consumption-based growth model, the sales team quickly realized that “we needed to hire reps that had to understand that to get paid, you have to have a longer term view, one that’s aligned to the customer’s success. It’s a different profile.” In many cases, aspects of the skillset more closely resembles successful account management or what is typically known as the “farming” or growing of existing accounts versus hunting for new logos.

4) Enterprise sales experience: Given the distinct go to market approach of a bottom up company, does traditional sales experience still bring value? Yes! Jeanne DeWitt Grosser warned that, “a common mistake in engineering-oriented companies is that you assume sales isn’t a skill.” Many aspects of the enterprise sales playbook are still critical, such as managing a forecast, qualifying opportunities properly, continual front line coaching, sales enablement, and rallying the team. Slack’s AJ Tennant noted that it’s key to bring on a global sales leader “who knows how to build systems, processes, and scale.” However, it’s important not to conflate field sales experience with enterprise sales experience, as the top down sale can increasingly be accomplished via inside sales, instead of hitting the road to sell in person (aka, field sales). Still, across nearly all companies, sales leaders agreed that the most successful models for compensation, pricing, and customer success followed many elements of traditional enterprise sales, and that deviation in some cases led to adverse selection and competitive losses.

How do you compensate your team?

Case in point: the vast majority of the sales leaders we spoke with unequivocally recommend approaching sales compensation with a traditional 50/50 split (50% base pay, 50% commission). As a16z’s Ben Horowitz has emphasized, the old boxing saying holds in sales compensation: “This is prize fighting. No prize, no fight.” While great entrepreneurs love to innovate, he warns that “before you innovate on sales compensation, make sure you understand the strengths of the old system.”

Engineering-led bottom up companies have a tendency toward comp plans weighted more heavily toward a higher percentage of base pay or even team-based quota structures. One sales leader noted: “In our early days, we settled on 70/30, with the 30% tied to the entire team hitting the quota. This structure was driven by our vision of creating a different type of sales team where everyone would collaboratively help each other. What really happened is that the best reps carried the worst reps, and we demotivated everyone.” When an organization devalues a salesperson’s contribution, it can lead to an adverse selection problem and hiring a roster of subpar salespeople.

Unsurprisingly, in bottom up companies, where the first revenue generated is product-, and not sales-led, sales leaders often receive pushback on their comp plans to the tune of “sales teams don’t sell the product. The product sells the product. Why are we overpaying the sales team?” At Dropbox, the team addressed this concern by comping sales team results relative to their contribution above the self-serve baseline.

Another common complicating factor is the importance of account expansion, as reps need to be properly incentivized to grow this side of revenue. In its early days, Twilio compensated its reps based on both the initial committed bookings as well as the eventual consumption, to ensure that reps onboarded their customers properly and to encourage the longer term view. Slack similarly tied their AEs tightly to farming existing accounts, in addition to building new business.

Bottom up companies benefit from a plethora of easily tracked metrics, and the strongest sales managers find the metrics that matter to sales performance and create comp plans that:

- Align their team’s activities with the goals of the business

- Tie these plans to the work that the individual sales rep is actually in control of

- Incentivize the team to ensure that both the initial landing and net expansion are successful.

What are the key GTM changes needed in a transition to top down sales?

The right sales leader is critical, but without the right sales infrastructure in place, these leaders are set up to fail. Adapting a top down sales model to fit a bottom up culture can require a full systems shift, from pricing to customer success. As Yancey Spruill, who was at SendGrid, noted: “You’re investing in an entirely different set of competencies across the company to drive top down sales. It’s a massive opportunity and requires a massive shift to realize.”

These topics require their own fully developed articles to do them justice, but where there was overwhelming consensus across the board on what worked, we wanted to share these insights as a starting point.

How do you reconcile top down with bottom up pricing?

The pricing transparency of bottom up, self-serve sales complicates top down sales, where negotiation and custom discounting often drive the sale over the finish line. Amanda Kleha described this tension as, “when you lead with your best transparent price online to drive online SMB sales but then have enterprises want to negotiate that best price down further.” Depriving the sales team of these tools can mean life or death for the deal. Rather than subscribe to a particular dogma, the best fit pricing model should reflect your particular competitive landscape and nature of the product. Here are two common ones.

Hybrid model: Full transparency for smaller self-serve customers, paired with the ability to negotiate custom enterprise pricing.

Who does this work for? Products with larger ASPs and/or intense competitive environments. Pricing models may include usage-based plans or value tied to more complex activities difficult to self calculate. The vast majority of sales leaders we spoke with found that a hybrid pricing model inclusive of discounting worked best for their companies. Sujay Jaswa noted that Dropbox initially tried a no discounting strategy and “realized that for some customers, they just wouldn’t buy without it. You’re screwing the sales team with a policy like this.”

Self serve applied to enterprise sales: This approach entails full pricing transparency and a zero exceptions approach to discounting.

Who does this work for? Products with low ASPs, limited competition, and newer use cases or budgets tapped. Simplicity, such as straightforward user-based pricing, and transparency via clearly published prices are key for driving conversion. Companies such as Atlassian are known for drawing hard lines in the sand on discounting. Jay Simons tied this decision back to Atlassian’s specific strategic decisions and competitive landscape: “We entered organizations of all sizes from the bottom up. Early on, we were competing with free open source at a price point just above free. We chose to be able to sell to a company of ten or the Fortune 10 by entering at a frictionless price point. We didn’t have any meaningful competition at the commercial layer at this price point. Had we faced five competitors with comparable products and price points, we probably would have had to modulate our strategy.”

When do you start focusing on customer retention?

Product-driven companies often expect feature innovation and velocity to not only sell but also retain customers. As the organization and customer contracts scale, retention not only becomes harder but also more important than ever, as a barometer for the health and growth of the business. In addition to product features that drive retention at the user level, a customer success organization is critical for account-level retention.

One of the worst mistakes that any organization, particularly ones that start bottom up, can make is neglecting customer retention until it snowballs into a massive churn problem. Nearly all sales leaders we spoke with wished they had focused on retention sooner. Instead of treating customer success as an afterthought, the function should be built up alongside the sales effort. Zee Yoonas described the benefits of doing so as Twilio scaled: “If you think about new revenue growth as you scale, a material percentage starts to come from existing customers when you do customer success and product iteration the right way.”

While there was universal agreement on its importance, there’s no single right way to build an organization focused on customer retention and success. We encountered a broad range of approaches to answering the key tactical questions of who owns the customer, the ideal time for hand-off, and the assignment of quota relief. That said, many agreed that the traditional customer success model of handing over the customer account immediately after landing the deal doesn’t work in a bottom up-driven organization, where net expansion is a critical driver of growth. At GitHub, the right time to flip the account was two to three years, though Paul St. John noted “that there is no hard and fast rule, other than you don’t want to flip the enterprise rep off the account too soon.” Gainsight’s Nick Mehta also emphasized that “the traditional hand-off model doesn’t make sense in a bottom up business. You need the sales rep involved to continue to incentivize retention and growth within the enterprise. However, if the product has complexity in the integration and deeper usage across the company, you may also need a product-oriented customer success manager (CSM) right away.”

As the company scales and matures, Mehta noted that the role of customer success (and its relationship with sales) will evolve with the organization, from troubleshooting the product to driving advocacy within the enterprise. To ensure alignment throughout this evolution, the whole GTM team’s compensation structure needs to support broader customer success goals, whether tied to the sales or customer success team (and often resulting in some quota relief redundancy). Until you figure out the right model, overinvest in customer success and retention early alongside growing top down sales.

Looking ahead

There is clearly no single right way to scale top down GTM operations. Yet two things stand out: the path from $20M to $200M or even $500M ARR is unquestionably different from the one that drove the company from $0M to $20M; and the introduction of top down sales will impact almost every element of the company and cannot be done in isolation.

While this article focuses predominantly on the tactics of layering in a top down sales team, a truly successful go to market transformation requires more than just sales — building the product marketing, customer success, and product infrastructure are critical, as are community and developer evangelism, particularly in companies that started out as open source projects.

Beyond tactics, the biggest obstacle along the sales learning curve is often a cultural one. Paul St. John often heard, “Sales is ruining the ethos of the company,” and one sales leader ruefully noted that “there’s often a revolving door for the head of sales because of the clash with a product-oriented founder.”

There’s an amount of culture clash that is inevitable as a new sales motion is introduced into a high-functioning product-led organization. However, founders that support, rather than resist, these changes while respecting the product roots of the company are most likely to set their sales team and companies up for success. Zee Yoonas summarized the mental preparation needed best: “The most damaging conflicts arise because the business isn’t ready for change. There’s some level-setting that needs to happen before you bring in the type of sales leader that will focus on larger top down sales…You can’t just throw in a sales team. It has to be a company-wide philosophy.”

As a new generation of exciting bottom up companies takes flight, making the right set of aggressive go to market choices at the right time is more important than ever. We are in a unique environment where increasing speed of product innovation is meeting a higher willingness from enterprises to invest in better business processes and workflows. Combined with the customers’ heavy switching costs after choosing a new tool or workflow, startups that figure out the right strategy for scaling GTM see faster and more durable results than ever before. And as faster adoption creates brand momentum and customer feedback continually improves the product, others in the ecosystem will also begin to build integrations and partnerships with the perceived winner — all driving a positive flywheel for future sales, top down and bottom up.

While the journey from $20M to $200M and beyond is difficult, it’s a worthwhile undertaking, and we hope that this article can act as a guidepost to share learnings of the first generation of iconic bottom up companies that layered in top down sales. Given the ongoing evolution in product innovation and customer demand, we believe the next generation has the potential to scale to even greater heights.

Thank you again to these leaders who shared their hard-won perspectives and strategies with us above to help the next generation of startups:

-

- Jeanne DeWitt Grosser, Head of Americas Revenue and Growth @ Stripe

- Robert Frati, SVP of Sales and Customer Success @ Slack

- Sujay Jaswa, Founder & Managing Partner @ WndrCo; Former Business Founder, VP Business and CFO @ Dropbox

- Amanda Kleha, Chief Customer Officer @ Figma; Former SVP Marketing and Sales Strategy @ Zendesk

- Nick Mehta, CEO @ Gainsight

- Jay Simons, General Partner @ Bond Capital; Former President @ Atlassian

- Yancey Spruill, CEO @ DigitalOcean; CFO/COO @ SendGrid

- Paul St. John, Former VP of Worldwide Sales @ Github

- AJ Tennant, Senior Director of Enterprise GTM @ Slack

- Zeeshan Yoonas, CRO @ Netlify; Former Head of Sales @ Twilio

- Peter Levine, General Partner @ a16z

Other acknowledgements: Thank you to Jeff Stump and David Belden (on a16z’s executive talent team) for their feedback and comments.