Collectibles are exploding. From trading cards to NFTs to virtual goods in video games, collectibles have seen massive growth over the past decade. For many, collecting is about story and emotion. A LeBron James rookie card recalls the NBA star’s meteoric early career. Fortnite’s rare Black Knight skin was awarded only to an early cohort of Battle Pass graduates in 2017.

Over time, collectibles have evolved from stores of emotion to stores of value as well. Limited-run goods such as fine art and sneakers have become popular alternative assets. Rare sneakers such as the Air Jordan 12 “Flu Game” can sell for $100,000. A piece of digital art by Beeple recently sold for a record breaking $69 million.

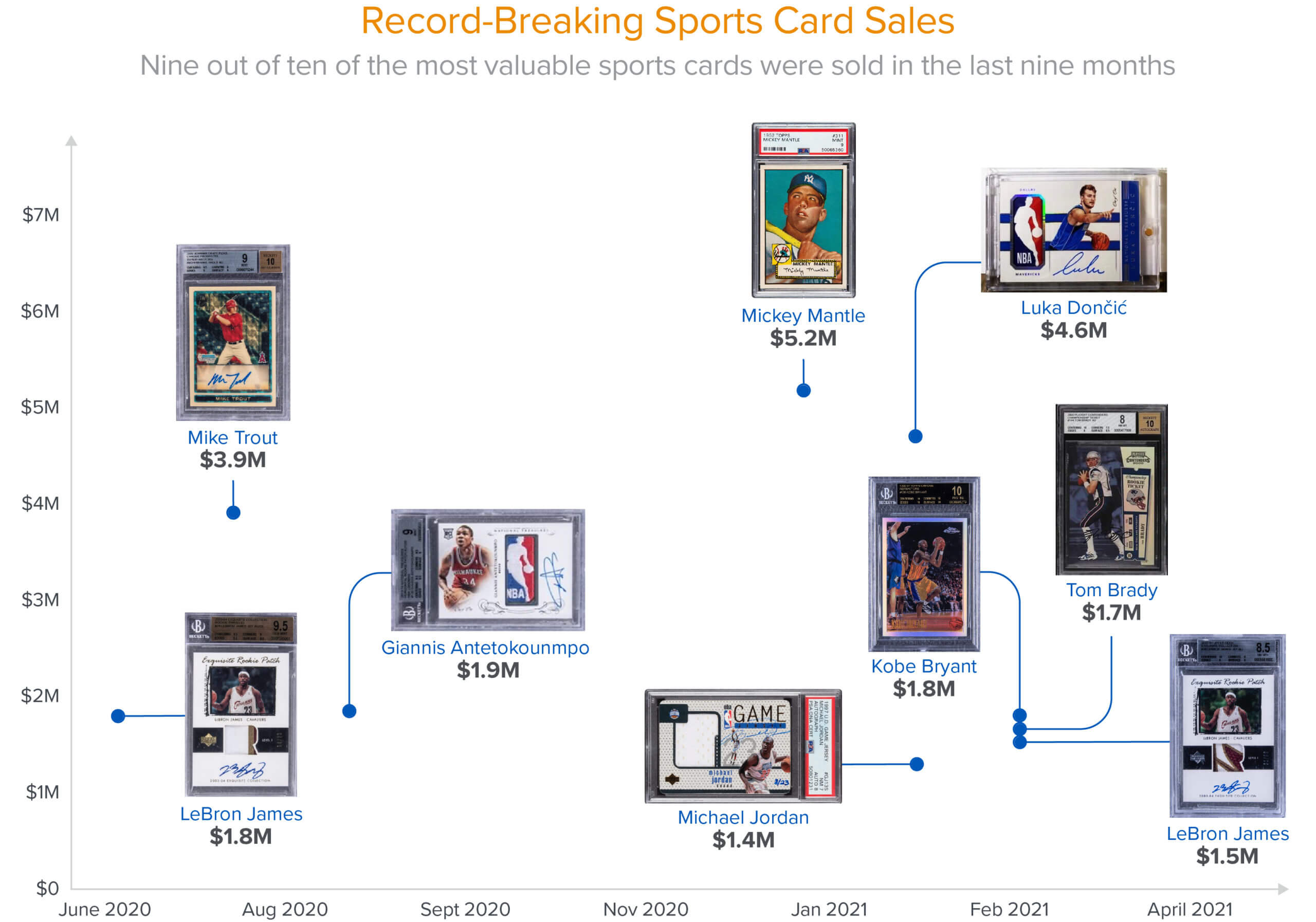

Sports cards are the latest segment to be propelled by this broader trend. The first baseball cards were created in the 1880s as protective inserts in cigarette cartons. Today, sports cards are a huge business. eBay sold over 45 million trading cards in 2020, with sales growing by almost 300 percent over the last 5 years. In January, a 1952 Mickey Mantle card shattered all-time records by selling for $5.2 million. Momentum is accelerating—nine out of ten of the most valuable sports cards were sold in the last nine months.

Yet despite the popularity of sports cards, challenges abound. Card authentication and grading is difficult—a backlog of over 1 million cards awaits processing at grading agency PSA. Listings are fragmented across the web and discovery is poor. Shipping and transaction costs can eat the majority of profits in a sale. Only a tiny fraction of the addressable market, mostly high-value vintage cards, are traded online today.

It’s clear there needs to be a better way to trade sports cards. Against this backdrop, I’m excited to announce that Andreessen Horowitz is leading the Series A for StarStock and I’m joining the board. We’re excited to partner with founders Scott Greenberg, Nigel Eccles, and Mike Kuchera to revolutionize the way sports cards are traded.

StarStock is building the stock market for sports cards. Sellers send cards to a secure vault managed by StarStock. At the vault, the StarStock team authenticates, grades, and uploads cards to an online marketplace where cards are traded digitally. Buyers take instant ownership without shipping delays or processing fees. And with a single click, buyers can purchase in bulk across multiple cards to create portfolios.

By substantially reducing transaction fees and enabling trading at scale, StarStock’s business model opens up trading to a much wider universe of cards. For example, $10 to $20 rookie cards are among the most popular cards on StarStock for their appreciation potential—cards that would be largely unprofitable to trade on eBay. Since launch last year, over 600,000 cards have been traded on StarStock. Over 50,000 cards are added to the marketplace weekly.

Long-term, StarStock aspires to become the stock market for not just sports cards, but the athletes themselves. With prices that move in real-time based on game results and athlete brands, sports cards have become a proxy for the athletes themselves. Buying cards on StarStock is a way to invest in a favorite athlete without the complexity of daily fantasy sports or the opaque odds of betting in casinos.

The founding team is uniquely well-suited for this mission. CEO Scott Greenberg grew up immersed in sports cards. His father built the machinery that Topps used to package sports cards and taught him the joys of card collecting from an early age. A serial entrepreneur, Scott started his first company while still in college. While attempting to trade sports cards online as a side-hustle, Scott became frustrated by the pain points of eBay and set out to build StarStock.

Scott is joined in this effort by an all-star team including Chairman Nigel Eccles, who previously co-founded and served as CEO of FanDuel, an early pioneer in daily fantasy sports. Scott and Nigel are longtime friends who live a few blocks away from one another in New York. Together with ex-FanDuel head of customer experience Mike Kuchera, the founding team epitomizes the convergence of technology, sports, and collectibles.

In getting to know teams, I look for founders who are doing their “life’s work”—it was clear to me from the start that Scott, Nigel, and Mike are incredibly passionate about sports and deeply understand trading cards as both customers and industry veterans. We couldn’t be more excited to partner with them on a journey to build the stock market for athletes.

* * *