Open source will catalyze the financial services industry’s biggest evolution to date. This evolution will shift the power in this $25 trillion industry from business executives to developers, not just in fintech companies, but in centuries-old incumbents, as well.

Until very recently, financial services were notoriously hard and expensive to build. Incumbents and startups alike grappled with extensive regulation, inflexible core systems, complex payment architectures, compliance hurdles, fraud, and more.

Imagine, instead, that financial services were built with software building blocks like Lego. These blocks could be assembled flexibly to allow for hundreds of different use cases. Furthermore, each of these Lego-like blocks were the result of ongoing collaboration between the smartest minds in the world, continuously iterating and improving upon each piece. This is the potential of open source coming to financial services. Open source allows for multiple people, regardless of their geographic location, to continuously contribute to code so that it gets better and better over time and is freely available for all to use.

Just as modern architects can source the best-in-class parts from around the world to customize a home for its occupants (windows from Italy! toilets from Japan!), so fintech builders will have the ability to leverage “building blocks” from engineers, product managers, and compliance experts to experiment with entirely new combinations of code and discover solutions not before possible.

TABLE OF CONTENTS

TABLE OF CONTENTS

From mainframes to banking “as a service”

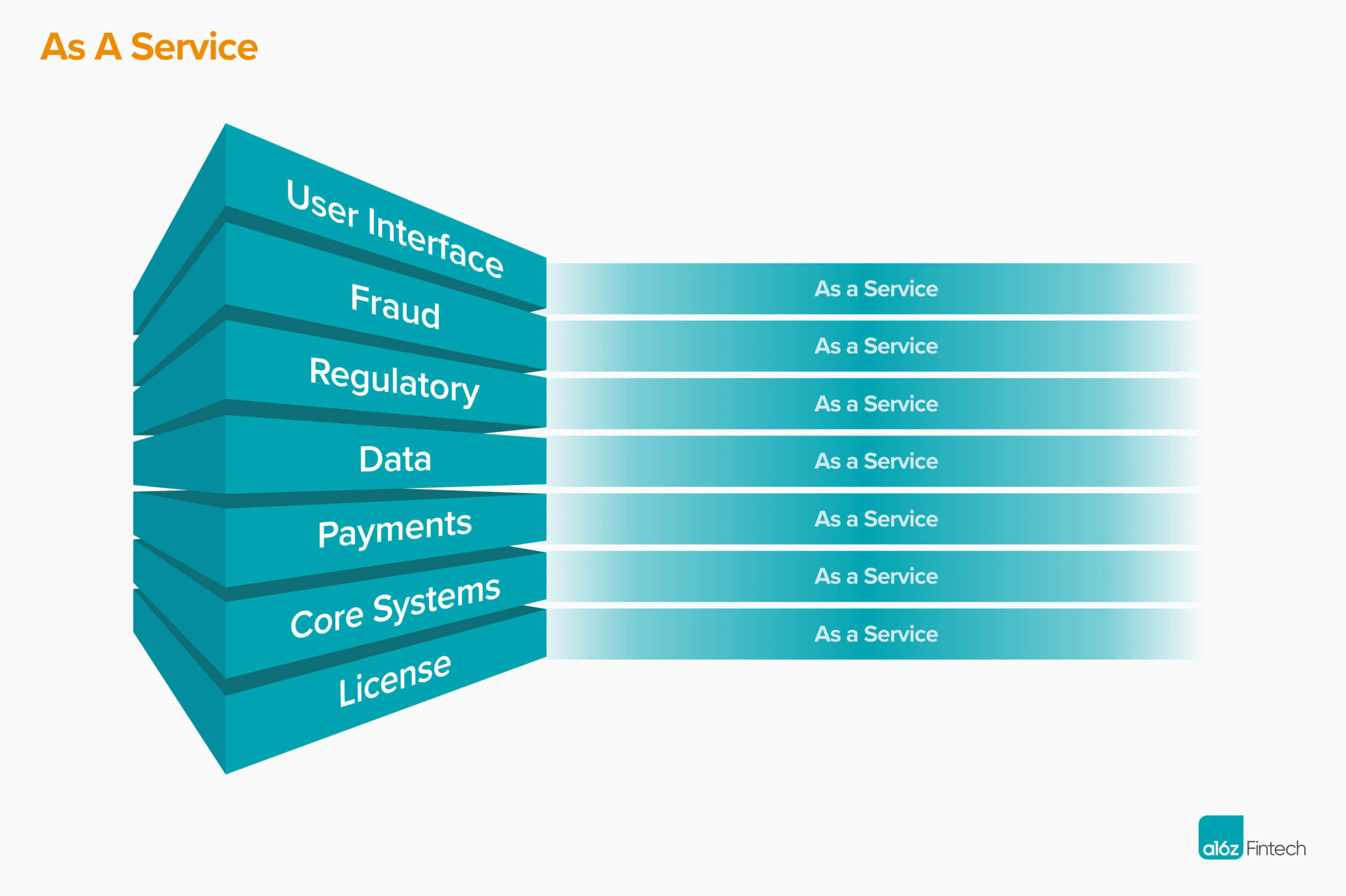

Due to a combination of the longstanding structural challenges, core banking systems have historically been monolithic, running “on-premise” at a custom and expensive data center within a bank. Today, banking systems are becoming modular layers in the cloud, enabling various components like deposit accounts, credit card issuing, and compliance to be provided “as a service.” Banking “as a service” has made building and adding financial services significantly easier today than the past. As a result, any company, not just banks, can now offer financial services: Lyft, for example, can offer bank accounts for drivers; ServiceTitan can extend lending to its contractors.

TABLE OF CONTENTS

TABLE OF CONTENTS

The impetus for further evolution

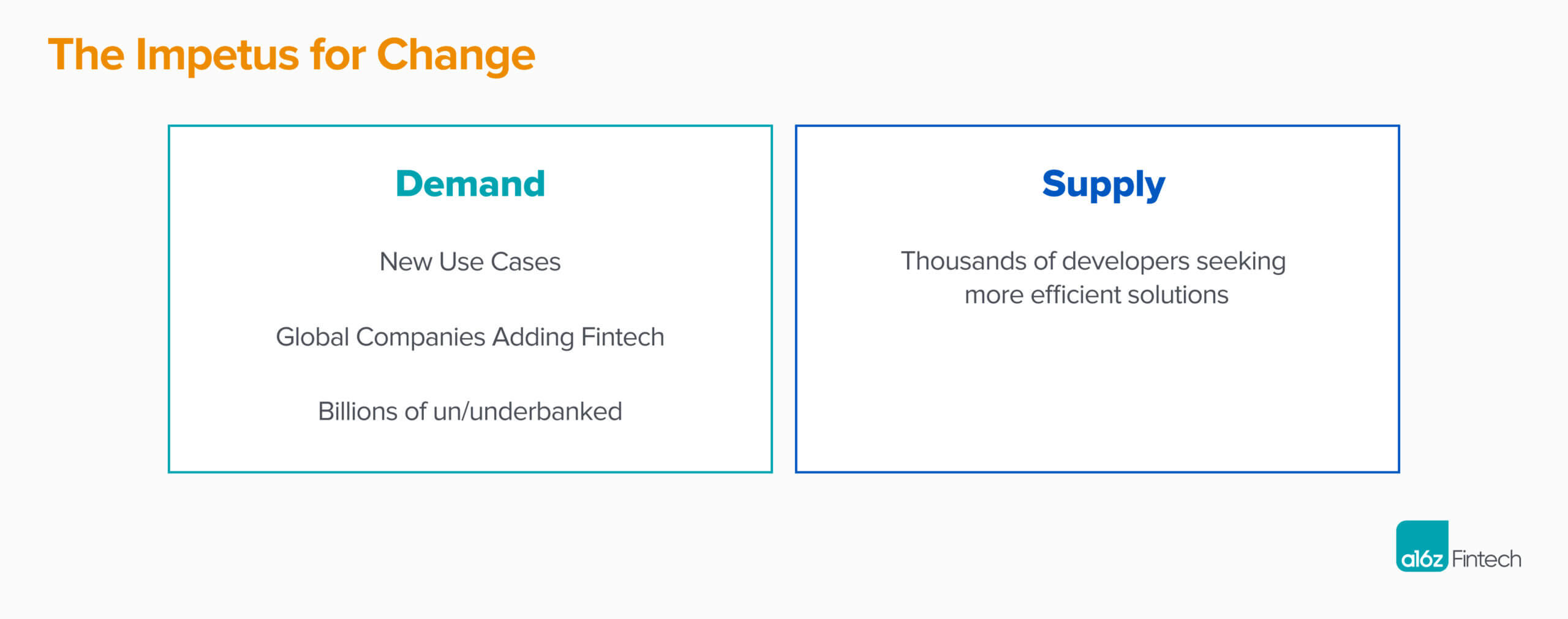

While software “as a service” has made large strides in rebuilding existing financial products, there’s both the demand from users and supply from developers to modernize banking infrastructure even further.

User demand: Financial services used to be confined to banks, but now any company has the capability to add fintech. As consumer and enterprise companies grow increasingly ambitious in their offerings, they will also require more customizability in their financial infrastructure to develop creative solutions for their customers.

While fintech has traditionally been default local — most banks are driven by country-specific regulations, infrastructure, and consumer payment preferences — many global companies are now adding financial services. Shopify, for instance, operates in many countries and must work with many different local providers for payments, lending, bank accounts, and more. As additional global companies look to add financial services, they will need to build global banking applications. Open source could help solve these multi-country woes.

Furthermore, three billion people are still shut out of the financial ecosystem altogether. Around the world, a growing set of highly talented entrepreneurs who deeply understand the needs of these unbanked and underbanked communities are exploring innovative solutions. Immediately accessible open source libraries would undoubtedly speed that progress.

Developer supply: Today, there are thousands of developers seeking off-the-shelf solutions to frustrating, recurring problems. More than 40 percent of banks’ code is built in COBOL, a 60-year-old programming language. Although the majority of fintech companies rely on more modern infrastructure, it is nearly impossible to avoid interacting with this legacy tech. Coding something tedious once is a pain, but developers are finding themselves building the same infrastructure again and again. Any time devs are building something over and over, they will find a way to automate it. Better yet, they’ll open source it, so others in the community can help make it better. Thousands of developers are currently working on challenging infrastructure problems and are poised to open source their work.

While banking “as a service” will continue to solve many problems, there’s demand and supply to further evolve our banking infrastructure. We are on the cusp of the next infrastructure evolution, driven by open source.

TABLE OF CONTENTS

TABLE OF CONTENTS

The open source evolution

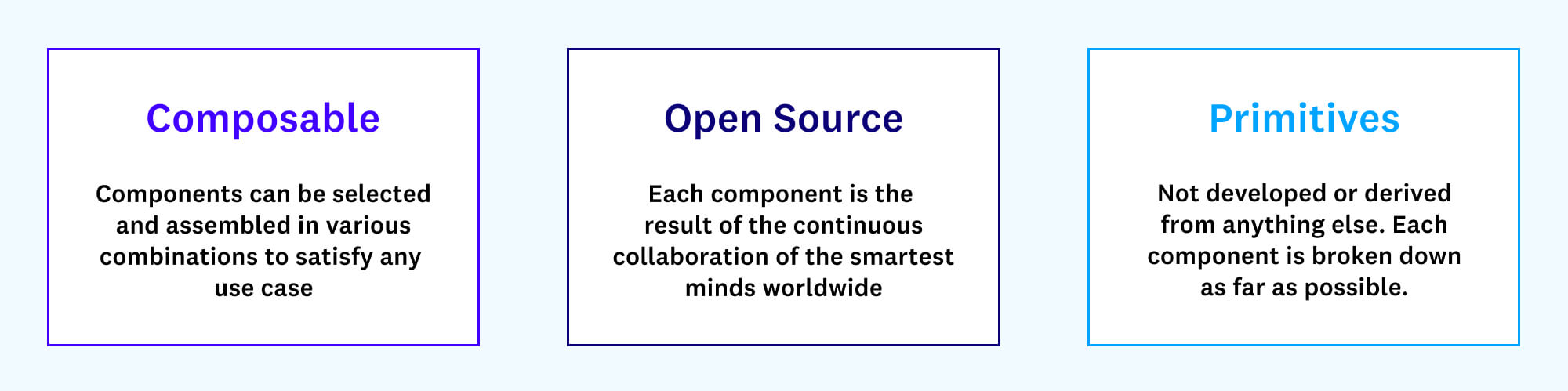

What if you sliced these “as a service” layers even further, right down to the most basic primitives? In fintech, a primitive — meaning not developed or derived from anything else — could mean a basic ledger, or a reference library for sending a payment of a particular type. These primitives would be open source: they would benefit from the continuous collaboration of the smartest minds around the world. They would be composable, meaning they could be selected and assembled in any combination to satisfy any specific user requirements.

The broad availability of open source primitives would motivate novel use cases we haven’t yet imagined. For instance, we will be able to combine the crypto and fiat worlds, friction-free, so users could spend, save, or lend fiat and crypto dynamically. Alternatively, there has long been talk about how software should be able to help us make better financial decisions — consider the prospect of a banking account that could make spending and saving decisions for us and fully automate our financial lives. Composable, open source primitives would unleash thousands of such experiments; it’s hard to predict which might be the next billion-dollar fintech company.

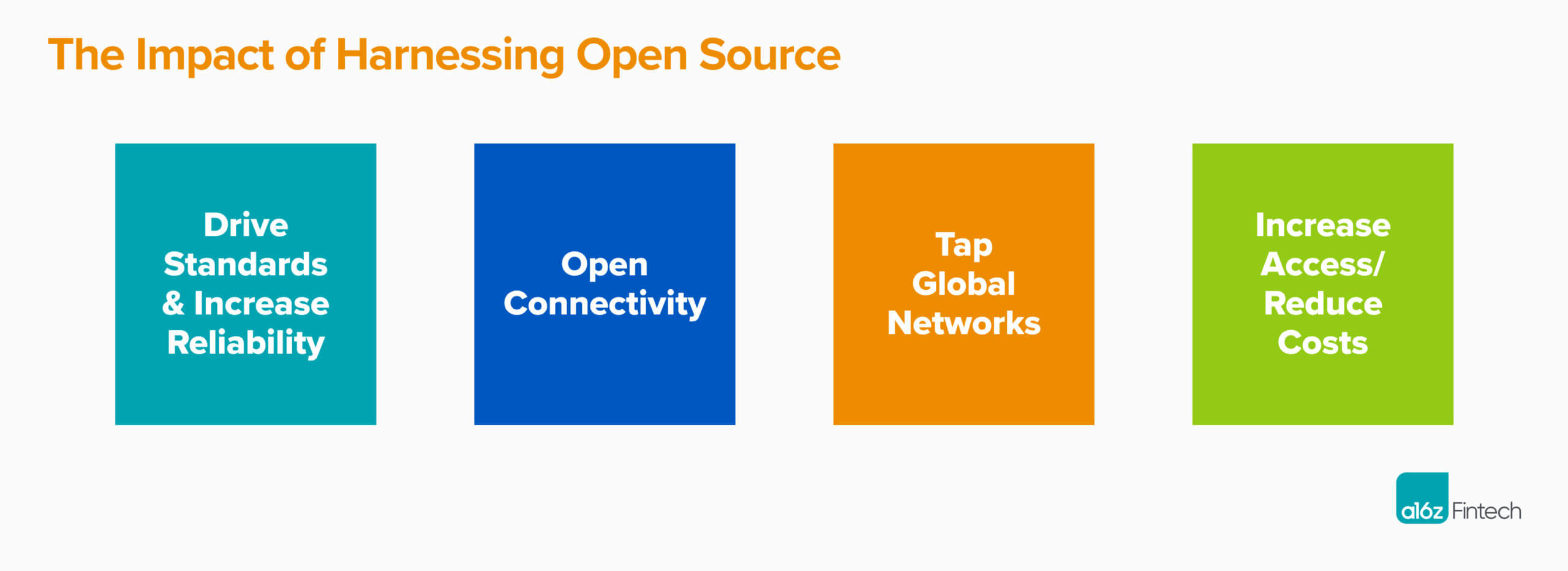

More specifically, open source could transform the financial industry in four critical ways.

TABLE OF CONTENTS

TABLE OF CONTENTS

Drive standards and increase reliability

Standards exist in payments, but they are old and tedious to build to. Last year, $55 trillion moved via ACH (a format created in 1970), for instance, and 1.3 billion trade lines were reported every month to the credit bureaus via Metro2 files (a format created in 1997). Open source libraries would not only save developers the hassle of building such standards from scratch, but would also create modern reference points.

Payments have thousands of edge cases, too many for even sizable teams to keep up with. Modern open source libraries are made more robust by the many contributors who run payments through them, fixing edge cases along the way. The open source company Moov.io, for instance, makes it easy for developers to embed functionality into their software to send, store, and receive their customers’ money, using open source primitives as the starting point.

TABLE OF CONTENTS

TABLE OF CONTENTS

Open connectivity

From the U.K. to Brazil, many countries are driving open banking regulation, in which banks are required to create and maintain APIs that enable consumers to give third-party applications access to their banking data. Open and accessible banking data can help consumers make better financial decisions. A budgeting app, for example, requires a continuous stream of the user’s banking transactions — data typically kept siloed at a bank. With the customer’s permission, this data should be available to the budgeting app and any interested third party.

Developers at banks around the world are developing similar infrastructure (connections into legacy core systems, APIs to expose data) to comply with these open banking regulations. This is a repetitive process across banks and countries – where banks would benefit from open source libraries as a starting point.

For instance, Berlin-based Tesobe, creators of the open source Open Banking Project, helps banks in Europe comply with the Payment Services Directive (PSD2), legislation that creates a more integrated payment market in Europe. Tesobe’s libraries provide code to connect to legacy systems and provide a starting point for the base-level APIs required. Those libraries are continuously updated according to the latest regulatory changes, streamlining important work typically left to individual developer and policy teams. Tesobe makes complying with open banking regulation much easier.

If banks used a common set of open source projects to develop their APIs and these projects also maintained connections into the thousands of banks worldwide, our global financial ecosystem would be much more accessible and connected.

TABLE OF CONTENTS

TABLE OF CONTENTS

Tap global networks

Two trillion dollars are laundered every year globally, often financing drug trafficking and terrorist activities. In 2019, banks spent $30 billion to combat money laundering; their efforts were effective at stopping just 3 percent of such crime. That same year, banks paid $10 billion for non-compliance with federal authorities, despite software systems that continuously alerted compliance teams of potential issues. (95% of those alerts turned out to be false positives.) Clearly, the system is not effective.

Each bank is independently monitoring hundreds of sanctions lists around the world, developing logic to match entities (i.e., John Smith, law-abiding citizen vs. John Smith, money launderer), and evolving rulesets to flag suspicious transactions — all in isolation. In addition, when a bank does improve its detection and execution efforts, it inadvertently transfers the problem to another bank: money launderers know to launder at the weaker links in the system.

With open source libraries, banks could contribute their hard-won algorithmic intelligence to benefit the system as a whole. When one bank gets smarter at solving a particular pain point — say, entity matching — it would contribute to the collective good. We’re starting to see some movement in this direction, such as early projects that allow for intelligent search across sanctions lists. Similarly, Red Hat has open sourced rules to identify risky transactions and improve entity matching.

TABLE OF CONTENTS

TABLE OF CONTENTS

Increase access and reduce costs

Open source can also make what was previously prohibitively expensive proprietary software, much more accessible.

There are three billion unbanked or underbanked people worldwide. Why don’t banks around the world serve lower-income customers? One reason is that they are making too much money. Latin American banks, for example, have some of the highest ROE (return on equity) in the world. Another factor, however, is banks’ underlying cost structure: If it costs $20 per month in software fees to keep an account open, the economics simply don’t work for account holders with low balances who will never take out a profitable lending product.

The Mifos Initiative, leaders of the Mifos X platform, now an Apache project, is an open source banking core. Developers can access free open source libraries and benefit from the expertise of a global community to build cost-effective banking applications for microfinance institutions and QR-based payments for micro merchants. These new solutions focus on the underserved bottom of the socioeconomic pyramid.

TABLE OF CONTENTS

TABLE OF CONTENTS

The impact of the open source evolution

Open source will catalyze even more company creation in financial services while also enabling incumbents to innovate faster.

In particular, it will impact the way developers build software in financial services. Developers at companies of all sizes are beginning to contribute to the collective good of the industry via existing open source projects. More likely, since we are in the earliest of innings of this change, developers will find themselves building a piece of infrastructure, realizing how many other companies might need that same thing, and discovering how their tool could be a new open source project — maybe a new infrastructure company.

Developers will not only be the creators and sellers of these primitives, they will also be the buyers. With a robust ecosystem of open source libraries, product management and development teams will no longer have to seek large budget approval to buy proprietary software from the C-suite. They will be able to experiment with solutions to existing issues, as well as entirely new use cases, for free (or very low cost).

The ramifications of this shift will be felt far beyond startups. As open source breaks down the barriers to independent product experimentation and innovation, incumbent financial institutions will need to redouble their efforts in hiring, retaining, and empowering engineering teams.

Consumers will accrue the biggest benefits from this movement. Open source financial primitives will provide the building blocks to create financial services for brand new use cases, at lower cost, and serve a global audience across the full socioeconomic spectrum.

A version of this op-ed was presented at Fintech DevCon in September 2021. Watch a video of the presentation here.