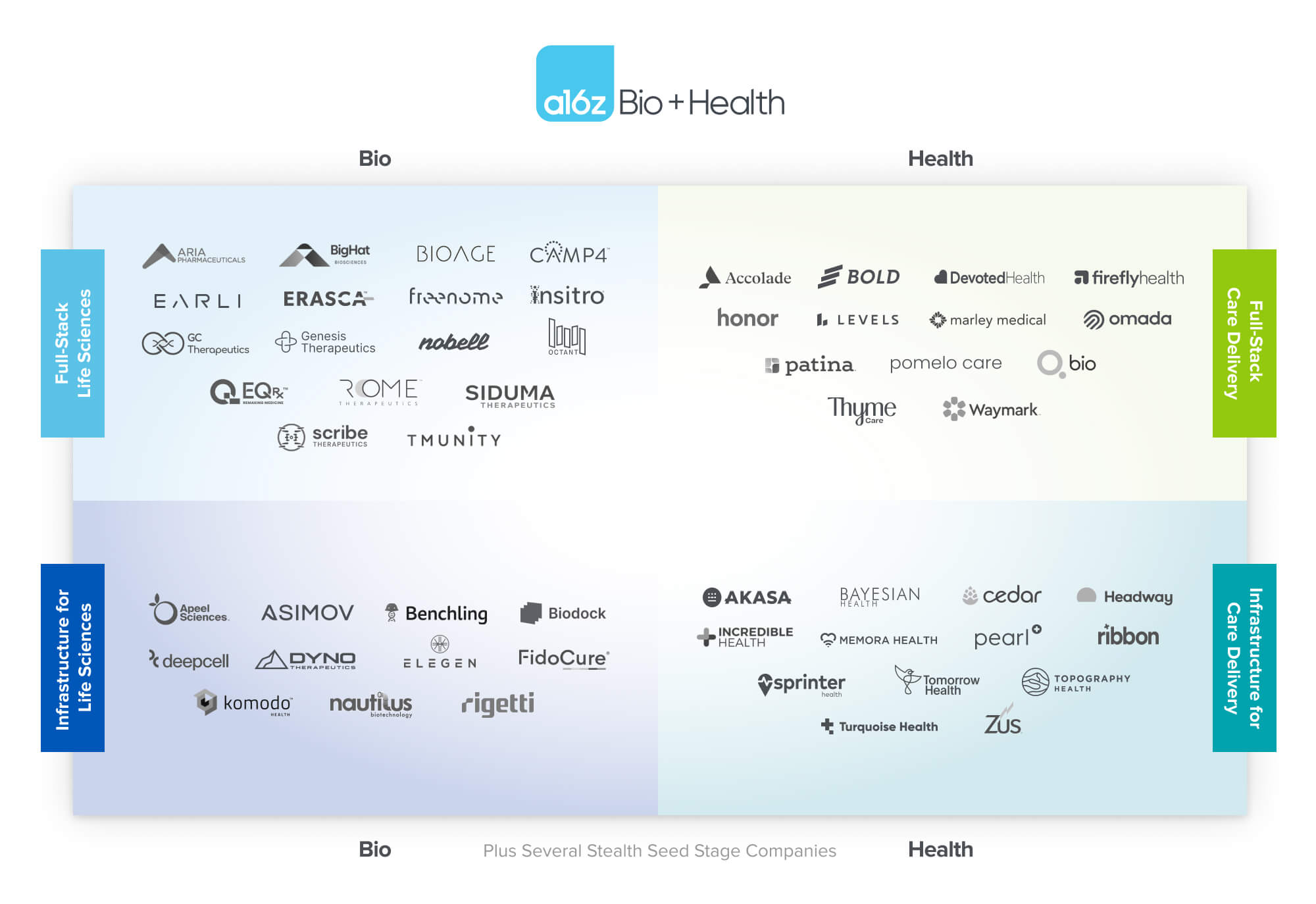

2021 saw higher than ever funding of startups, continued maturation of the tech-enabled bio and healthcare landscape, and new platforms and business models that propelled growing levels of adoption and scale amongst both upstarts and traditional players. Accordingly, we nearly doubled the size of our portfolio across life sciences and care delivery last year, investing at the seed through growth stage into over two dozen incredible founding teams.

The magnitude of our newly raised fund is evidence that the surface area of opportunity around our investment theses is even bigger (and more accelerated) than we had anticipated. Hence, we’ve also decided to give our franchise a bigger name – “a16z Bio + Health” — to signal our conviction that both Bio (life sciences) and Health (care delivery) are necessary pillars of durable innovation in this space. We also believe that the intersection of bio and health is where some of the most important companies will get built over the next few decades.

Here are some of the key areas where we have already backed founders, and where we see many additional opportunities to build iconic, category-defining products and services that reenginer our society’s bio + health experiences in 2022 and beyond.

TABLE OF CONTENTS

Bio

TABLE OF CONTENTS

Data, machine learning (ML), and engineering meet bio

Since the inception of a16z bio + health, we have anticipated dramatic growth in the role of large-scale data, machine learning, and engineering in diagnostics and drug development. One signal that these tools are now starting to cement their place in the discovery process is that “traditional” biopharma companies have increased the volume and depth of both their in-house data science teams and partnerships with biotech companies who bring computation and ML expertise. Particularly exciting is the breadth of applications in which they’ve struck these partnerships: in just the last quarter of 2021, Sanofi tapped Owkin for access to clinical data and analytics relevant to research, Genentech tapped Recursion to find novel therapeutic targets, and Astellas tapped a16z portfolio company Dyno to design ML-optimized AAV delivery vectors for gene therapies.

We have invested in companies predicting small molecule properties (e.g. Genesis Therapeutics), engineering the design of protein therapeutics including antibodies (e.g. BigHat Bio), discovering new drug targets by mining large-scale perturbation datasets (e.g. Insitro), and analyzing human cohort data to prioritize drug candidates for diseases of aging (e.g. BioAge). Yet others in our portfolio are training machine learning models to detect the presence of cancer early from blood biomarkers (e.g. Freenome), understand disease-related single cell RNA signatures, identify regulatory sequences which could drive cell type-specific gene expression, and learn how the features of cells under a microscope might shed light on patient biology (e.g. DeepCell, BioDock).

And there are so many more opportunities ahead. Can we use ML to design better bifunctional small molecule drugs? To identify novel biomarkers predictive of therapeutic response? To segment and enroll patients in better designed clinical trials? To predict where model organisms do or don’t recapitulate human biology? To interpret time series data on cancer signaling pathways? To architect novel combination treatment strategies? We are excited to meet founders exploring these questions, and more.

New modalities designed to be programmable

In 2021, we saw multiple landmark approvals for drugs in novel modality classes, including genetic medicines, cell therapies, and most prominently, of course, the dramatic success of mRNA-based COVID vaccines. The FDA approved inclisiran (Novartis’ PCSK9 siRNA medicine) for hyperlipidemia; Intellia and Regeneron reported positive early ph1 clinical trial data for their in vivo gene editing therapy in ATTR amyloidosis; and multiple additional CAR-T cell products for lymphoma and multiple myeloma were approved.

We have been fortunate to back an ambitious cohort of biotech companies who are learning from these successes and developing their own pipelines of next-generation programmable medicines: CAR-T therapies for solid tumors (e.g. Tmunity); in vivo CRISPR systems engineered for greater activity, safety, and deliverability (e.g. Scribe Therapeutics); novel RNA-based therapies (e.g. CAMP4 Therapeutics); allogeneic, off-the-shelf iPSC-derived cell therapies for a range of potential indications (e.g. GC Therapeutics); and genetic tools that provoke a “synthetic biopsy” to detect cancer early (e.g. Earli). Others in our portfolio are building the horizontal infrastructure needed to make cell and gene therapy safe and scalable: ML-designed AAV capsids for diverse tissue delivery (e.g. Dyno), computer-aided, scalable manufacturing infrastructure for the industry at large (e.g. Asimov), and tools for nucleic acid synthesis and analysis (e.g. Elegen).

While each of these programmable platform technologies are steadily advancing, we are still in the early innings of realizing each modality’s full potential. The number of distinct, clinically exploited CAR-T antigen targets remains small; the range of tissues to which in vivo delivery of gene editing products is possible remains narrow (largely limited to the liver and central nervous system today); the full set of sequence determinants of optimized RNA drugs remains a work-in-progress. We can’t wait to see how both existing R&D teams – as well as new biotech startups – tackle many of these challenges.

“Old” modalities engineered for new tricks

Despite vast amounts of biotech financing supporting novel modalities, the reality is that the significant majority of new drug approvals today (41 out of 61 new FDA approvals in 2021 across CDER and CBER) still fall into the so-called “traditional” drug categories of small molecules and antibodies. This reflects deep know-how, earned expertise across the biopharma community in developing these modalities, as well as relative ease of manufacturing and patient access. But these same advantages have also created opportunities to engineer ‘old’ modalities to perform ‘new tricks’. We predict a second coming of innovation and productivity in the world of small molecules and antibodies – enabled by companies developing next-generation tools (e.g. DNA-encoded library screens with functional readouts), prosecuting novel target classes to effect novel biology (e.g. ROME Therapeutics); combining massively-parallel synthetic biology techniques with custom chemistry (e.g. Octant Bio); advancing computational chemistry methods; pioneering novel mechanisms of action such as induced proximity (e.g. Siduma Therapeutics), and much more. Many of our own investments are yet-to-be-announced in these categories, and we remain on the lookout for ways to creatively leverage existing modalities to service huge swaths of unmet need for patients.

Synthetic bio goes mainstream

Beyond therapeutic medicines, bioengineering and synthetic biology (“synbio”) is also capturing the imagination of consumers as they contemplate the future of their foods, fabrics, materials, and personal care products. The increased attention to ESG (environmental, social, and governance) is further driving large companies and governments to look to startups for sustainable product development. Given these tailwinds, we believe synbio companies have the opportunity to own their relationship with the customer through full-stack brands. To capitalize on this opportunity, we expect the next few years in synbio will be all about product, with new products that enable new performance characteristics and existing products made more cheaply, ethically, and sustainably, such as plant-based cheeses (e.g. Nobell).

Health

V1VBC (virtual-first, value-based care)

Telehealth is evolving from predominantly urgent care-oriented and highly skeuomorphic transactions into holistic virtual-first, value-based care models in primary care and chronic diseases (e.g. Patina, Marley Medical). During the fits and starts of the pandemic, many healthcare companies expanded their hybrid capabilities to serve patients both virtually and in-person, and/or launched care models tailored to specific patient journeys, such as maternity care (e.g. Pomelo Care) and cancer care (e.g. Thyme Care).

Looking forward, we continue to be excited about companies that leverage value-based payment schemes and tech and AI to build platforms that serve multiple clinical needs characterized by high spend and poor outcomes (e.g. MSK, cardiology, GI, autoimmune, behavioral health). We’re also keen to see continued innovation in go-to-market strategies that accelerate distribution at nationwide (and even global) scale, whether that means leaning into strategic integration with established payors and providers, and/or engaging directly with patients.

The Next MA(s)

The Medicare Advantage (MA) market has been the tip of the spear for value-based payment models, with examples of both vertically integrated “payvider” models (e.g. Devoted Health), and purpose-built care delivery and navigation models (e.g. Patina). We’re now seeing similar payvider and care delivery platforms taking root in the next logical payor segments — namely traditional Medicare (e.g. Pearl Health), Medicaid (e.g. Waymark) and commercial (e.g. Firefly Health) – each of which, notably, are larger than MA in terms of the number of addressable lives.

We’re bullish on the prospect of many of these approaches going direct-to-consumer for distribution, even if getting paid through enterprises or taking reimbursement risk on the backend. We also expect to see more fintech products that overlay these platforms to facilitate transparent and affordable payment experiences.

Digital health tech stack

A year ago, we predicted a new tech stack for virtual-first care and the rapid development of infrastructure for digital health, and the market opportunity has manifested even more quickly than we imagined. The digital health segment exploded, driving rapid demand for commodified shared services such as patient engagement workflows (e.g. Zus) and provider network management (e.g. Ribbon), and incumbents have recognized that their legacy IT infrastructure simply cannot support a future in which care delivery and triage must be “always-on” (as companies like Memora enable). Legacy software often can’t innovate quickly enough to maintain an edge against competition from startups, who are automating care delivery operations that suffered from unsustainable strain during the recent industry-wide staffing shortages (e.g. Bayesian, Sprinter, AKASA).

We’re excited to see an increasing number of companies contributing to new dimensions of the digital health tech stack, including those that empower the long tail of independent provider practices with new revenue streams, and those that build marketplaces (e.g. Turquoise, Incredible Health) to address fundamental mismatches in supply-demand at various layers of the industry.

Let’s Build in Bio + Health!

The fields of bio and healthcare are becoming increasingly industrialized, at a time when our world is in dire need of more scalable, sustainable, and efficacious ways to help people heal and live healthier lives, without devastating financial burden. Watching our founders bring efficiency, transparency, and humanity to our healthcare system this past year has been an amazing privilege, and we can’t wait to continue to support more exceptional builders across all stages with our new fund.

-

Vineeta Agarwala is a general partner on the Bio + Health team at Andreessen Horowitz, focused on biotech, digital health, and life sciences tools/diagnostics.

-

Jorge Conde is a general partner on the Bio + Health team at Andreessen Horowitz, focused on therapeutics, diagnostics, life sciences tools, and software.

-

Justin Larkin is an investing partner on the Bio + Health team, focused on healthtech, including care delivery and horizontal infrastructure.

-

Vijay Pande is a former GP and founder of the Bio + Health team at Andreessen Horowitz, focused on the cross-section of biology and computer science.

-

Becky Pferdehirt is an investing partner on the Bio + Health team, focusing on early stage companies building technology platforms for therapeutic discovery and development.

-

Jay Rughani Jay Rughani is a partner at Andreessen Horowitz, where he leads investments in health technology companies.

-

Judy Savitskaya is the cofounder of a stealth startup.

-

Daisy Wolf is an investing partner on the Bio + Health team, focused on consumer health, the intersection of healthcare and fintech, and healthcare software.

-

Julie Yoo is a general partner on the Bio + Health team, where she leads investments into companies that are transforming how we access, pay for, and experience healthcare.