Consider this: most healthcare providers are flying blind when it comes to their finances.

Once a medical provider treats patients, they don’t really know how much they’ll get paid, when they’ll get paid, and if that payment is more or less than they’re owed. In many cases, providers lack insight into whether they will be able to make payroll based on the expected inflows of cash from insurance and patients. This is true for the majority of independent medical practices, and even many larger hospital systems.

This is particularly tragic after what was arguably one of the toughest years in recent history for providers in terms of financial performance. In 2022, even the most prestigious hospitals were severely unprofitable, and overall visit volumes and payment rates exhibited volatility that has been detrimental to the majority of traditional medical practices.

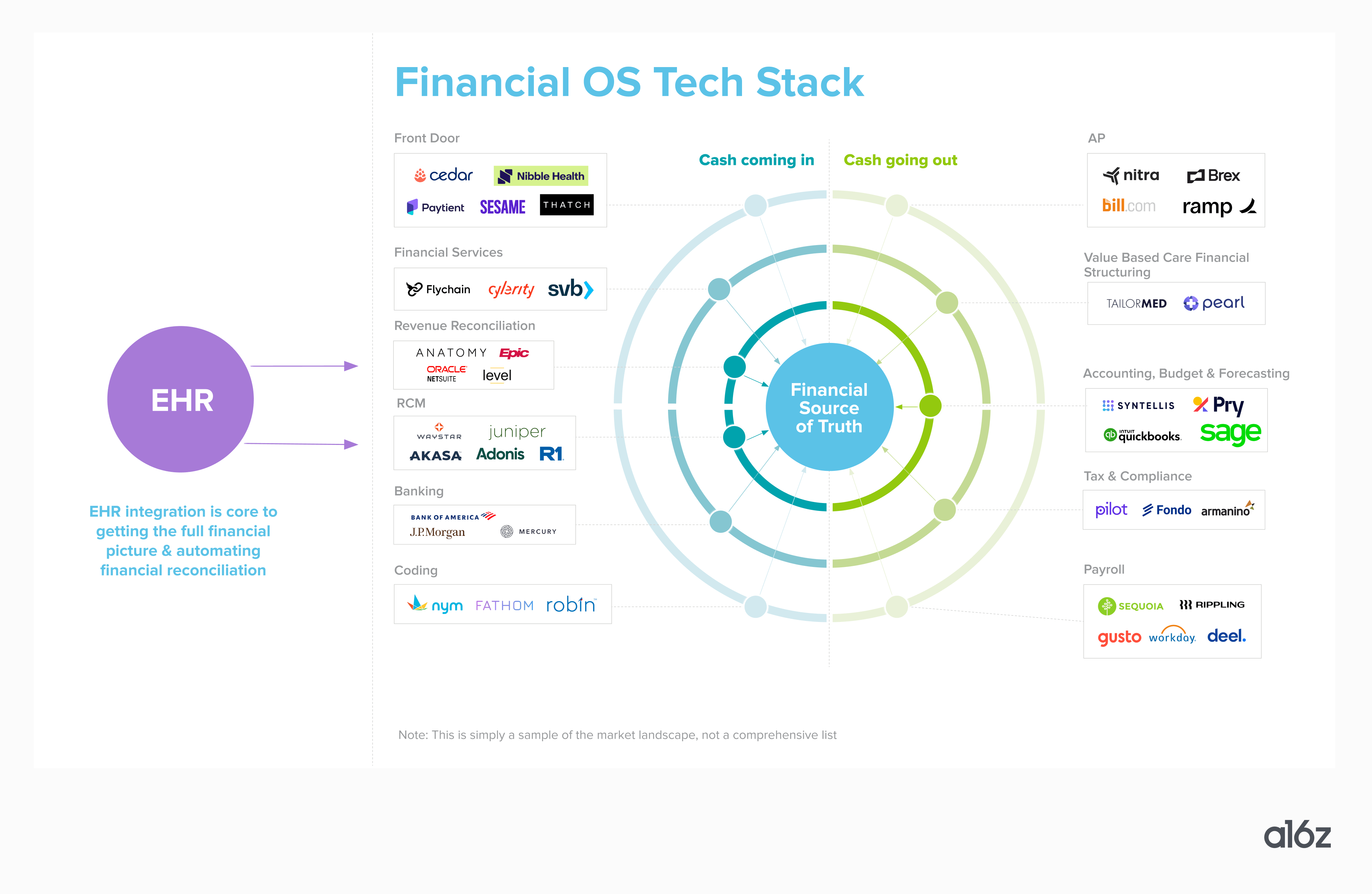

For healthcare providers, the electronic health records (EHR) system serves as the clinical source of truth, but a financial source of truth doesn’t yet exist. Most industries (let alone $4 trillion industries) do not work this way!

For healthcare providers, the electronic health records (EHR) system serves as the clinical source of truth, but a financial source of truth doesn’t yet exist. Most industries (let alone $4 trillion industries) do not work this way!

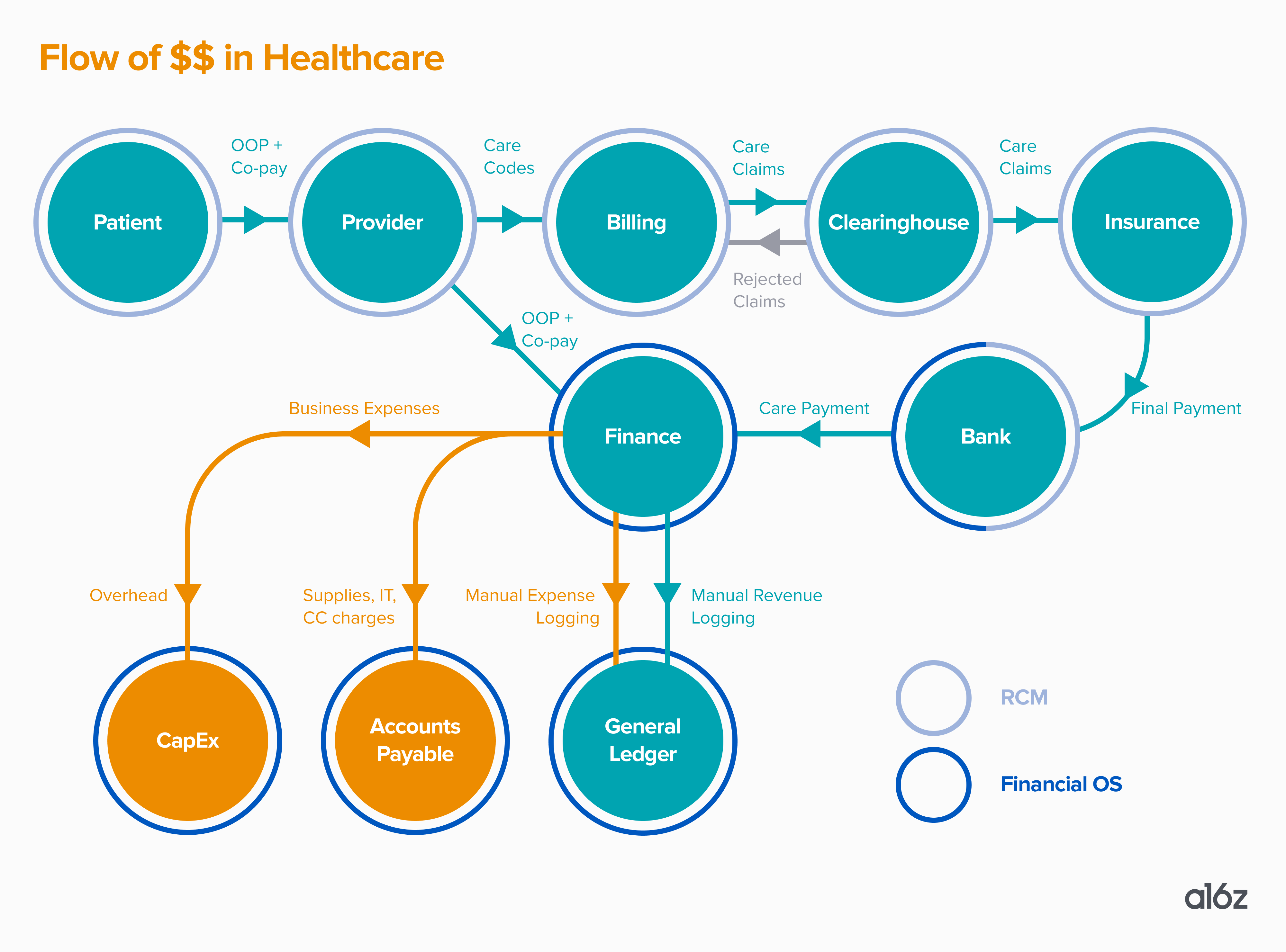

Why is this the case in healthcare? It has to do with the flow of funds, and the lack of healthcare-specific systems for accounting and financial planning that track that flow of funds. Here’s a typical example of how money moves when a patient visits a provider:

A patient visits a healthcare provider. They’re asked to share their insurance information and, according to that, they’ll pay their copay and—if the provider runs an eligibility check—the portion of the bill insurance does not cover. Or, the patient will pay out-of-pocket or be sent a direct bill if not using insurance.

Then, the provider delivers care and sends a summary of that care to an internal or external medical biller. That person converts that documentation to billing codes (known as “CPT codes” and “ICD codes”) and figures out how to format the claim to be accepted by the insurance company. Each insurance company and plan product may have slightly different forms and submission requirements.

Then, the biller generally doesn’t send the claim to an insurance company (like one might think). They send it to something called a clearinghouse, which is an intermediary between the provider and the insurance company. The clearinghouse reviews the claim, and could subsequently reject it (if, say, the CPT code doesn’t match the services rendered), or send it along to the insurance company if all appears to be in order.

Once the claim is with an insurance company, the insurance company will adjust the claim based on factors like contractual agreements, secondary payors, benefits coverage, and expected copays and insurance, sending this information back to the clearinghouse. Then, the insurance company will pay the doctor whatever they determine they should.

Next, up to 90 days after they submitted the claim, the provider will receive this money (in most cases via a paper check in the mail) and try to understand why they were paid that amount by manually scouring their bank account, EHR, RCM, and unique payer contracts. If they are able to catch the payment discrepancies, the provider could try to fight for more money, or go to the patient and try to collect what insurance didn’t pay.

In other words, it’s no wonder medical practices have no idea how much money they’ll make and when!

The above process is called revenue cycle management (RCM), and there are countless vendors that handle this (it’s a multi-$100 billion industry today). But most of them don’t comprehensively track accounts receivable relative to accounts payable and the practice’s actual cash balance. As such, we’ve found that healthcare providers are rife with financial pain points, including but not limited to:

- Disconnect between clinical and financial data: Most doctors’ offices think of the EHR and/or Practice Management System (PMS) as the operating system (OS) that runs the practice. These tools include some billing data but are far from being sources of financial truth. The fullest (though rarely complete) financial picture often exists in general ledger (GL) tools, like Quickbooks and Sage, or enterprise resource planning tools (ERPs), none of which are purpose built for healthcare’s intricacies. GLs and ERPs are rarely integrated with a practice’s EHR or RCM, but if they are, it’s usually a hacky plug-in that breaks whenever payor contracts or CPT codes update. This leads to inaccurate revenue figures and…

- Shockingly manual revenue reconciliation: Given the lack of EHR integration, accounting departments export spreadsheets and manually compare EHR codes, RCM data, and final insurance payments at the end of the month or quarter. This leaves significant room for error and makes proactive cash flow adjustments nearly impossible. We’ve heard numerous anecdotes from practice and hospital CFOs about learning of millions of dollars they found were owed many months after the fact due to errors in accounting.

- Rudimentary business forecasting: Most strategic planning is done via exporting historical financials (which are often inaccurate) from the general ledger, and using that data to build ad-hoc models in spreadsheets. In addition, most practices do not have a great sense of how much they expect to get paid by each payor and on what timelines, which makes cash flow management a challenge.

- Lack of healthcare-specific tooling: The vendors that comprise the current financial technology stack for providers are not healthcare-specific, which means they weren’t built to easily capture the complex flow of money in this ecosystem. They also aren’t built for the forthcoming wave of increasingly complex financial structures (e.g., value based payments) and regulatory compliance with Medicare and Medicaid.

- Limited access to debt financing: With manual revenue reconciliation processes that leave the timing and magnitude of outstanding claim payments difficult to predict, healthcare practices often have trouble accessing affordable debt financing, as lenders prefer to underwrite simple and repeatable flows of funds in a business. This has many consequences for the practice, spanning from lack of ability to expand (e.g. open a new practice) all the way to insolvency (e.g. being unable to make payroll).

While the above may feel like it constitutes an insurmountable web of administrative issues, with great pain points, come great opportunities. We at a16z believe we’re in the earliest days of a great wave of healthcare fintech innovation, and the Financial OS for Healthcare could serve as the system of record for it all. A financial OS for healthcare would act as a real-time, action-oriented engine that ingests financial data from the EHR, RCM, banking and credit products, and payroll to become the financial system of record for the practice; predictive analytics to surface opportunities for proactive and reactive improvements; and a trusted source of truth for lenders, vendor partners, and insurance companies when underwriting loans or contracts. We’re looking for builders to tackle some or all of the below product features as a wedge into the broader opportunity:

- Automated budgeting and forecasting: Streamline and up-level financial planning and analysis (FP&A) by pulling in accurate, comprehensive, and real-time financial data that enables finance teams to re-focus their time on strategic financial assumptions and decisions.

- Smart revenue reconciliation: Ensure consistency across claims (EHR), submissions (RCM), and final record (GL) tools, again primarily via real-time data integrations and up-to-date chargemaster linkage.

- Financial regulation modules: Offer bespoke bookkeeping infrastructure for complex corporate structures like those in value-based care or managed service organizations (MSOs). Help customers navigate federal and state-by-state regulations and reporting compliance.

Products with these properties are well positioned to become the financial source of truth for accounts payable, accounts receivable, and other payment flows through the practice. From here, the doors open to an even broader product footprint (and higher annual contract values) by integrating adjacent financial products, such as business bank accounts, credit cards, expense management, asset-based lending, patient financing, claims coding, and even data-driven revenue cycle management and payor contracting. A financial OS of this reach and centrality to a practice’s financial state holds the promise of re-orienting the focus of the EHR (and of care) from billing to patient outcomes.

Leaning into financial services has become more possible with the widespread proliferation of fintech infrastructure, which makes it easier than ever for non-bank entities to offer their existing customers financial services, driving higher LTV with no incremental CAC. In many cases, systems of record are even better positioned than banks to underwrite said customers, since they have ongoing access to all key operating data of the business. In fact, we think either wedge—software or financial services—could be viable for an initial go-to-market approach. Having said that, we believe it’s essential that any business truly pursuing the full financial OS for healthcare vision ground itself in the platform architecture referenced above, and lay down sturdy roots in the form of core software functionality.

As healthcare increasingly takes up more of the nation’s GDP—while still relying on disconnected, outdated financial rails—building in the healthcare x fintech space becomes more critical to the health of the system as a whole. If you’re tackling any or all of the points laid out here, we would love to connect.

-

Marc Andrusko is a partner at Andreessen Horowitz, where he focuses on global early-stage fintech companies.

-

Annie Collins is an investing partner on the Bio + Health team, focused on healthtech.

-

David Haber is a general partner at Andreessen Horowitz, where he focuses on technology investments in financial services.

-

Daisy Wolf is an investing partner on the Bio + Health team, focused on consumer health, the intersection of healthcare and fintech, and healthcare software.

-

Julie Yoo is a general partner on the Bio + Health team at Andreessen Horowitz, focused on transforming how we access, pay for, and experience healthcare.

- Grand Challenges in Healthcare AI with Vijay Pande and Julie Yoo

- Behind the Buy: Payors and Providers on AI Adoption

- The Most Interesting Healthcare Companies You’ve Never Heard Of with Julie Klapstein

- Metrics for a Complex Machine with Josh Clemente

- Transitioning from Gymnast to Investor with Aly Raisman