Since DeFi emerged several years ago, a broad range of web3 financial services have been created and widely adopted, but a crucial one was notably absent: undercollateralized lending. Most web3 lending protocols only support overcollateralized loans, which lend against existing assets, because it’s much easier to manage that risk at scale. However, borrowers with collateral tend to be margin traders and crypto holders who don’t want to sell their positions. Nearly everyone else across the globe seeks to borrow money because they don’t have what they need.

What makes undercollateralized lending so difficult? It boils down to assessing the creditworthiness of a given borrower: in other words, determining whether they are likely to repay the loan. The result is that borrowers who need access to credit the most – namely, those who don’t already have substantial assets to lend against – are unable to benefit from most DeFi lenders. This limitation has especially hindered the adoption of DeFi lending in emerging markets.

Enter Goldfinch. Goldfinch is a decentralized credit platform that broadens the pool of potential lenders beyond just banks. The protocol operates as an open marketplace for loans without collateral, and decentralizes the loan underwriting process. It also makes off-chain sources of yield available and composable on DeFi.

The protocol works by extending credit lines to lending businesses, which can then draw down stablecoins from the pool and deploy them on the ground in their local markets. In this way, the protocol provides the utility of crypto — specifically, its global access to capital — while leaving the actual loan origination and servicing to the businesses best equipped to handle it.

Investors can utilize Goldfinch by depositing crypto into the pool to earn yield. As the lending businesses make their interest payments back to the protocol, they’re immediately disbursed to all investors.

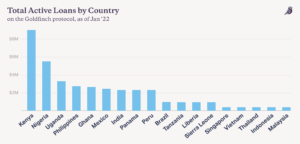

In just a few months, Goldfinch has shown there’s a huge global need for access to capital, growing from $250,000 in outstanding loan volume to over $38M. The protocol is already serving over 200,000 borrowers in 18 countries around the world. The protocol-supplied capital is being used for a wide range of productive uses from motorcycle taxis in Kenya, to small businesses in Brazil, to eco-friendly cookstoves for low-income households in India, among others.

By removing the need for crypto collateral and providing a means for passive yield, Goldfinch is dramatically expanding lending to more potential borrowers and capital providers. We’re thrilled to lead Goldfinch’s Series A, and excited to support the team in putting capital to work for the people who need it most.

By removing the need for crypto collateral and providing a means for passive yield, Goldfinch is dramatically expanding lending to more potential borrowers and capital providers. We’re thrilled to lead Goldfinch’s Series A, and excited to support the team in putting capital to work for the people who need it most.

***