NFTs are blockchain-based records that uniquely represent pieces of media. When you purchase an NFT, it’s yours to control as you see fit, similar to when you buy a physical good. You can transfer it, sell it, collateralize it, lend it, or keep it for yourself to admire. Early use cases for NFTs include digital art, virtual land, sports, and collectibles.

When we raised our second crypto fund last year, part of our core thesis was that crypto and NFTs would catalyze new business models for creators. Today there are more than 3 million NFTs for sale, and sales volume on the top sources has grown over 400x year over year to more than $100 million per week. NFTs are breaking out to more mainstream audiences, and represent an entirely new economy based on digital ownership.

Despite the massive opportunity, NFTs had been somewhat confusing for ordinary consumers, much like the internet in the days before the browser. There was no marketplace that allowed creators and collectors to easily search for and view unique digital assets across different platforms, and no easy way to buy them. It also wasn’t straightforward to discover their origin and history. Even for those who are technically adept and know how to piece together blockchain data, few want to spend the time and energy figuring out the provenance of their unique digital asset.

OpenSea provides the link between the consumer layer and the infrastructure layer for the digital goods economy and is a key utility in this new world of digital ownership. OpenSea provides a one-stop shop to discover, buy, and sell any non-fungible digital asset that conforms to a popular standard like ERC721, and it also quickly tells you the “who, what, when, where” about a particular NFT. OpenSea shows you the provenance, trading, and sales history of digital items in a readable, trusted way.

Consider how Zillow transformed the experience of discovering and comparing homes for sale. Property ownership records exist and you could in theory go physically search them at the county recorder’s office, but it’d be complex and time consuming. Just like Zillow takes raw real estate data and makes it usable in a trusted and reliable way at your fingertips, OpenSea makes NFTs searchable, usable, and organized. But it goes further and provides a marketplace that brings all platforms together and eases transactions among all parties, the way eBay and Amazon do.

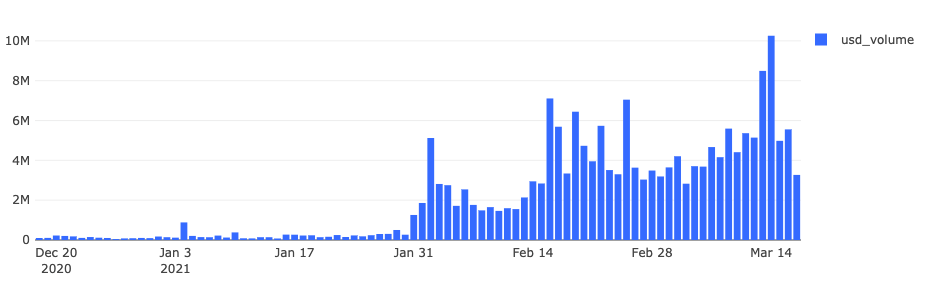

Given the importance of this consumer layer in such a fast-growing area, it’s no surprise that OpenSea’s growth has been off the charts, with transaction volume growing 100x in the last six months.

OpenSea Daily Volume

Source: Dune Analytics

Aside from phenomenal growth, the founders are what can only be described as all-star. CEO Devin Finzer was a growth engineer at Pinterest, sold his previous company to Credit Karma, and studied computer science at Brown (fun fact, he started a college business with a16z-backed Figma founder Dylan Field). His co-founder, CTO Alex Atallah, previously built cybersecurity products at Palantir, after studying computer science at Stanford and selling a music streaming company to Beatport.

Given all this, I’m excited to announce that a16z is leading OpenSea’s $23 million Series A round alongside existing investors, our Cultural Leadership Fund, and angels like Ron Conway, Mark Cuban, Tim Ferriss, Belinda Johnson, Naval Ravikant, Ben Silbermann, and many others.

I’ll be hosting a Clubhouse conversation with Devin and Alex soon, so stay tuned. In the meanwhile, learn more about OpenSea here and more about NFTs here. While you’re at it, check out my latest purchase.

###

-

Katie Haun Kathryn ("Katie") Haun is a general partner. Previously, she spent a decade as a federal prosecutor focusing on fraud, cyber, and corporate crime alongside agencies including the SEC, FBI, and Treasury. She created the government’s first cryptocurrency task force and led investigations into the Mt....