The best general counsels do more than keep costs low by avoiding risks: they give you direct, continuous, and time-sensitive advice on key decisions before you’ve committed significant resources, thereby helping to unlock more revenue. Instead of merely processing deal contracts, for instance, a great general counsel will strategically partner with the sales and finance teams to help you win bigger deals in the first place.

Hiring a great general counsel fluent in the ins and outs of your company will also help you proactively identify issues and address them, instead of consulting an outside counsel only when something has gone wrong and risks mushrooming into a crisis. This is critical when you’re developing new, highly disruptive business models (e.g., Airbnb, Square), creating new categories (e.g., Groupon, Twitter, crypto), navigating highly fragmented regulatory environments, fighting aggressive and established large competitors, or working in patent-dense markets. In these instances, the right general counsel will understand your industry, operations, products, and sales model to help you and your executive team devise business plans, mitigate risks, and find creative and cost-effective solutions to legal issues. They’ll also often act as an ambassador for your company and proactively create legal frameworks for technologies emerging in your space.

TABLE OF CONTENTS

When to hire

TABLE OF CONTENTS

When outside counsel fees start to balloon, many CEOs start to bring counsels in-house. In the vast majority of cases, bringing on a general counsel also marks the moment when you shift from working with an execution-oriented external party to partnering with a strategically minded executive who can help shape the company.

That said, the catalysts for hiring a general counsel are more dependent on the type, scale, and complexity of your company than other executive hires:

- If you’re running an enterprise SaaS company, you’ll likely bring on a general counsel when the pace of customer contract negotiations accelerates, or the complexity and strategic nature of customer and business development relationships grow. When you start trying to close deals with companies like Microsoft, for instance, you’ll want to work with a general counsel who both helps you win those deals and ensures the terms serve your company in the long run.

- Companies reliant on patent portfolios as a core product differentiator should bring on a general counsel early to embed that process into your strategy.

- If a significant part of your strategy involves international expansion, a general counsel can help direct and coordinate legal functions across countries. Once you’ve reached a critical mass of employees outside the US, for instance, you’ll need to navigate more compliance- and HR-related legal risks. Some countries are also more stringent than others with respect to their regulatory regimes. European countries, for example, may have stricter data privacy laws but may be less strict about other areas, such as crypto.

- If you have an IPO on the horizon, you’ll want an experienced go-public general counsel on your executive team by at least the financing round prior to filing, in order to help prepare the company’s governance and legal functions to operate as a public company.

- If you’re building in a highly regulated industry like crypto, fintech, biotech, space, or defense, or a nascent and fast-moving industry like AI, chances are you’ll want to bring on a general counsel much earlier in your company’s life cycle because your company’s strategy will be inextricably tied up with legal, regulatory, and compliance issues.

- Consumer companies often bring on a general counsel earlier in the life cycle to help them think proactively about laws and regulations relating to consumer protection, data privacy, and international compliance.

2022–2023 trends

Increased demand for regulated industry experts in earlier stages. As we mentioned earlier, many entrepreneurs from largely unregulated tech companies have started companies in highly regulated spaces, like crypto, fintech, biotech, space, or defense. We’re seeing more of these companies bring on general counsels earlier in their life cycles to collaboratively build long-term strategies.

Engaging with experts in a capital-constrained environment. As the market contracted over the past year and companies started to prioritize cost savings, many companies have begun moving away from working with a big, brand-name firm for all their legal issues and toward contracting certain issues out to sole proprietors and smaller legal shops. This helps them conserve cash and often benefit from more focused service.

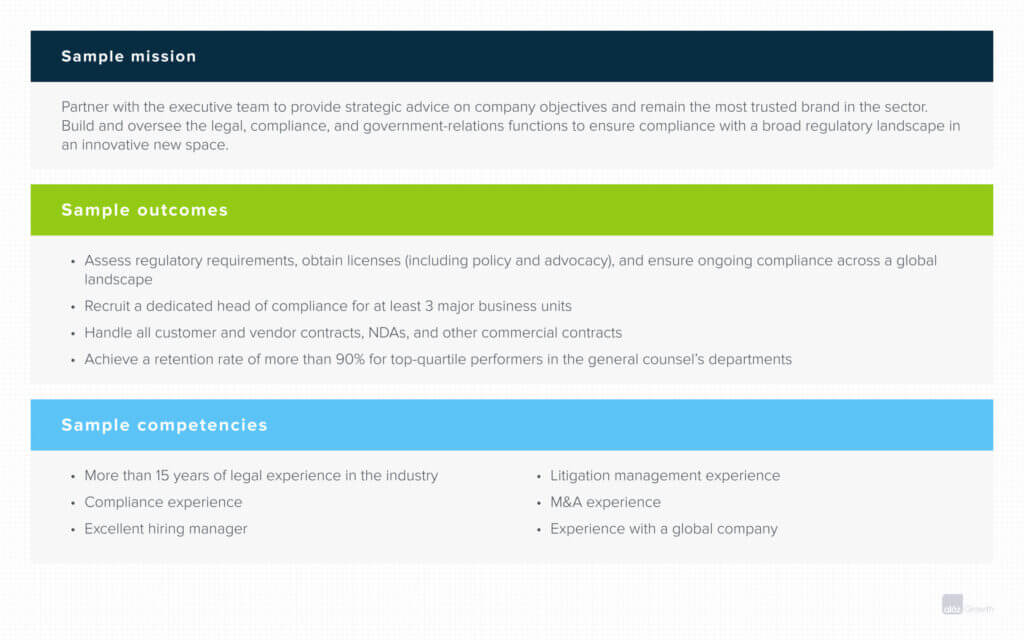

Writing the MOC

We discuss writing a mission–outcomes–competencies (MOC) document in greater detail in The Hiring Process.

Any all-star general counsel will:

- Be appropriately pragmatic and have the right risk tolerance for working at an early-stage company

- Become a trusted adviser to the CEO and leadership team

- Fit with a product-driven company and culture

- Have a bias toward action in situations where decisions need to be made with incomplete information

- Have a track record of hiring, training, and developing great teams

They’ll also have fluency in, or connections to professionals who are fluent in, many of the key issues below:

- Intellectual property, including patent prosecution, licensing, and litigation

- Debt and equity financing

- Privacy

- Labor and employment law

- Executive compensation

- Contracts and product licensing

- Litigation

- Tax

- Antitrust

- M&A

- IPO

- Securities law and SEC reporting and disclosure

- Corporate governance

Archetypes and backgrounds

Once you have a clear idea of your specific needs, you’ll want to focus on hiring a general counsel with the background and skill set to best address those needs. Below, we break down 3 broad types of general counsel that we see in the market: the pre-IPO corporate governance and securities counsel, the commercial counsel, and the regulated industry expert.

Remember, these general counsel archetypes are helpful ways to pattern-match your needs with a candidate’s skill set. They’re not hard-and-fast rules, however, and it’s highly unlikely that you’ll find a candidate with just one of these backgrounds.

The pre-IPO corporate governance and securities counsel

This counsel prepares your company to go public by working with internal departments and external counsel to manage the registration process, ensuring compliance with SEC regulations and securities laws, establishing and maintaining necessary corporate governance, and other matters. The closer your company is to a public offering, the greater chance you’ll be looking for a pre-IPO counsel who understands what your team, process, and infrastructure need to look like to become a public company.

Most counsels don’t have the opportunity to build out the securities and corporate governance capacity at a private company, so this type of general counsel will typically already have public company experience and preferably experience taking a company public.

The commercial counsel

This counsel ensures your company is compliant with all existing regulations and manages risk appropriately. Enterprise companies tend to hire this type of counsel because most of the legal issues they encounter are related to scaling the company, processing significant commercial deal flow and licenses, and getting the commercial side of the company humming.

The best commercial counsels bring “game footage” on how to structure certain deals to benefit the company over the long term and, more broadly, have experience building a robust deal process and deal desk in partnership with finance teams.

These general counsels typically come out of bigger law firms.

The regulated industry expert

This expert is typically most useful to companies in highly regulated industries, like fintech, crypto, biotech, and health. Bringing on this type of general counsel can feel like bringing on a COO that’s very fluent in legal, regulatory, and policy issues, and they’ll typically have a blend of industry and regulatory experience, along with experience at a blue-chip law firm. For example, a general counsel with prior FDA experience can be a tremendous asset to a company navigating the clinical trial regime.

Sample MOC

Setting up your general counsel for success

Your general counsel has to make it easy for your employees to comply with an ethical code of conduct by acting as a source of advice and counsel, and by helping your teams interpret and implement legal and compliance policies. You want people to naturally come to your general counsel with issues and questions and think of the legal team as a partner, rather than a roadblock, in solving problems. Because of this, it’s critical to evaluate whether the candidate can build a rapport with leaders.

We cover best practices in The Hiring Process, but we’ve included some recommendations below for what different members of your executive team may want to focus on when interviewing engineering leaders.

Make sure your candidate has the right appetite for risk

It’s critical for a general counsel at a tech company to be pragmatic and aligned with the types of risks the CEO needs to take in order to scale. CEOs are going to try to push the limits of innovation and tread into uncharted territory, and it’s the general counsel’s responsibility to parlay their legal expertise into a strategic advantage for the company and flag existential risks—even if they’re the lone voice of dissent in the room. This risk profile is very different from that of a typical general counsel at a large company, whose job is to anticipate and mitigate brand risks and maintain consumer trust.

Your general counsel should never report to your CFO

We strongly advise against having your general counsel report to your CFO. It’s important that the leaders of your finance and legal functions have direct, unfiltered access to the CEO. If your general counsel is layered below your CFO, your general counsel will have a much more difficult time flagging existential threats to the company. In such instances in the past, we have seen CEOs take bad advice from their CFOs and, as a result, face legal action from external regulators.

Make sure your board is actively involved in the search

Most CEOs don’t realize that, much like the CFO, the general counsel also works very closely with the board of directors. The general counsel will be instrumental in strategically advising the board, addressing litigation issues from either customers or employees, and, if applicable, handling activist investors once the company goes public.

The board should evaluate whether a candidate is the right person to help the company with an IPO—whether that means promoting an in-house executive or bringing in someone new. The board is typically more involved in the hiring process when the company is operating in a regulated industry, and we recommend that 1 or 2 of the most active members spend time with the candidates to make sure they bring a strong, strategic approach to the legal function to the table.

Look for connections to the right legal partners

Your general counsel should have the competency and the network to pull in the right people—both internally and externally—to address a range of legal issues at your company. There’s no hard-and-fast rule for outsourcing certain legal functions: your general counsel should be able to adjudicate which legal functions need to be developed in-house, for the sake of institutional memory, and which can be outsourced for technical execution. These are great relationships to pressure-test in your reference process.

Thanks to Andy Hill and Jeff Nagashima for contributing their hard-earned wisdom and expertise to this guide.

Further reading

We’ve drawn insights from some of our previously published content and other sources, listed below. In some instances, we’ve repurposed the most compelling or useful advice from a16z posts directly into this guide.

Why I Did Not Go to Jail, Ben Horowitz

When he transitioned Loudcloud to Opsware, Horowitz needed a new head of finance. He hired a highly regarded CFO who recommended changes to the company’s stock option program. When he ran that change by the company’s general counsel, he was met with a resounding no. That decision, and the right organizational design, saved Horowitz and Opsware from a massive legal headache and a potential jail sentence.

Where to Go After Product-Market Fit: An Interview with Marc Andreessen, Marc Andreessen and Elad Gil

Where do you go once you hit product-market fit? In an edited transcript of a conversation that appears in Gil’s book, High Growth Handbook: Scaling Startups from 10 to 10,000 People, Andreessen offers insight into when you should consider hiring certain leaders, including a general counsel.