Teldar Paper, Mr. Cromwell, Teldar Paper has 33 different vice presidents, each earning over 200 thousand dollars a year. Now, I have spent the last two months analyzing what all these guys do, and I still can't figure it out. One thing I do know is that our paper company lost 110 million dollars last year, and I'll bet that half of that was spent in all the paperwork going back and forth between all these vice presidents.Gordon Gekko, played by Michael Douglas Wall Street (1987)

Leveraged Buyouts became “a thing” in the 1980s thanks to a form of financial engineering called junk debt. Popularized by Michael Milken at Drexel Burnham Lambert, the invention wasn’t all that complicated: issue bonds with very high interest rates and correspondingly high risk, and use that capital to finance the wholesale acquisition of mismanaged, inefficient, and sclerotic companies. (For those that don’t know, the title of this post is a play on the book Barbarians at the Gate, by Bryan Burrough and John Helyar, which chronicles the battle to buy RJR Nabisco in 1988.)

In the background, there was also a profoundly impactful technological revolution called the spreadsheet. Released in 1979, VisiCalc was the first “killer app” of finance (on the Apple IIe!), and one of the things that allowed KKR and other early firms to model outcomes and make so much money. With this faster method of calculating, what might have taken weeks could now take seconds. Milken himself is said to have credited (or blamed) VisiCalc and spreadsheets for the growth of the Private Equity (PE) industry, since cash flows vs. debt payments could be easily monitored, and a formerly complex net present value calculation now just involved a formula for a cell. Early KKR executive Donald Herdrich is said to have bought an Apple IIe in 1980 for his children, got a demo of VisiCalc at the electronics store, and that turned into a decisive advantage for KKR going forward. Eventually, this all became table stakes, with every PE firm employing the same analytical tools and analytical minds to find potentially upgradable or fixable companies. PE is now a giant industry—from its humble beginnings with spreadsheets and junk debt to almost $5 trillion of assets.

Generative AI is likely going to usher in a far more profound method of company transformation. Instead of financial engineering and the improved management techniques that PE promotes, we’ll start seeing AI cut costs and make existing companies vastly more profitable…while also enabling new business models to emerge.

TABLE OF CONTENTS

Bits v atoms

TABLE OF CONTENTS

It’s important to recognize that while the impact that generative AI can have on “bits” is substantial—since generative AI can “manipulate” those bits very easily—we’re probably too early to see a massive opportunity in “atoms” businesses. Lockheed Martin makes F-35s by assembling atoms, and has a 13% gross margin; Salesforce makes software by assembling bits, and has a 74% gross margin.

Consequently, AI’s impact on business depends on what type of operation a company is running—not just whether a company is a “bits” or “atoms” business, but also what percentage of a company’s operating costs are driven by people manipulating bits. Writing? Bits. Mining? Atoms. Analysis? Bits. Shipping? Atoms. Inside sales? Bits. There are plenty of “non-tech” companies that purely manipulate bits; as an example, virtually every financial services company is “atom free” in terms of ultimate products sold. Your mortgage, loan or insurance policy is underwritten by receiving, manipulating, and routing bits back and forth. AI has previously had a role in “decisioning” these products, but not in the external back and forth with customers or the internal back and forth for approvals.

With that overview, it’s probably most helpful to think about three kinds of opportunities: Known Knowns, Known Unknowns, and Unknown Unknowns.

TABLE OF CONTENTS

Known knowns

TABLE OF CONTENTS

Known knowns are companies/products/ideas that exist today, and that have clear demand from customers. Can costs be reduced, customer support improved, NPS increased, new, previously unprofitable sales opportunities be unlocked? As technology continues to improve, the answer is an unequivocal “yes.” United Airlines can’t simply hire and train 10,000 new call center reps in 12 hours when terrible weather shows up, but dynamic compute can solve this. What about complicated corner cases? Delta has a bereavement policy for discounted fares, but requires interaction with a representative, ostensibly to prevent abuse. Apple will sometimes escalate something to a “Level 2” technician if the front-line can’t figure it out, but this can sometimes take hours or days. Verification, validation, obscure corner cases, automation of tedious tasks—all of these can be done by AI.

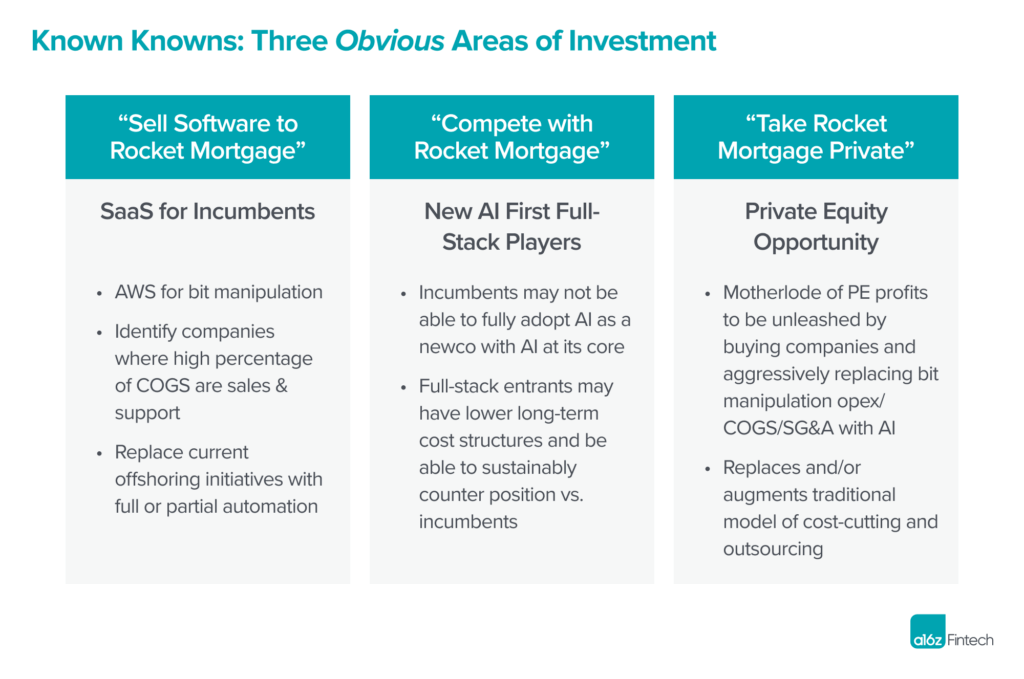

There are really three investable opportunities in the category of “known knowns”:

- Sell software to incumbents

- Compete with incumbents, with generative AI at the core

- Buy incumbents and remake them with AI—what a “generative AI” KKR would be doing

Think about Rocket Mortgage, with thousands of mortgage brokers and 2022 net revenues of $5.8 billion, against almost $2.8 billion of “salaries, commissions, and team member benefits.”

Somebody will likely start a company/build a product to either supercharge Rocket’s existing workforce or replace more of their workforce with software. It’s clear Rocket could pay a lot for it, as would other companies that compete with Rocket.

Somebody will likely start a net new company that does mortgage origination and refinance with virtually no human interaction—think vertical integration of the prior software example.

And lastly, somebody might even acquire Rocket Mortgage—a $20 billion company as it is today—if its average EBITDA margin of 40% from 2019-2022 could be changed to 60% or more through generative AI.

Of course, there are very high odds that Rocket Mortgage prioritizes all of this internally. Virtually every Fortune 500 company is focused on an AI strategy today. This is distinct from platform shifts in mobile, cloud, or the original internet, where most companies were slow to adapt. “My BlackBerry works fine” or “can’t trust hosted software” or “customers won’t buy this over the internet” were all regular CEO refrains during the previous eras, which permitted upstarts to displace incumbents. But today, every Fortune 500 boardroom I’ve seen is focused on AI.

TABLE OF CONTENTS

Known unknowns

TABLE OF CONTENTS

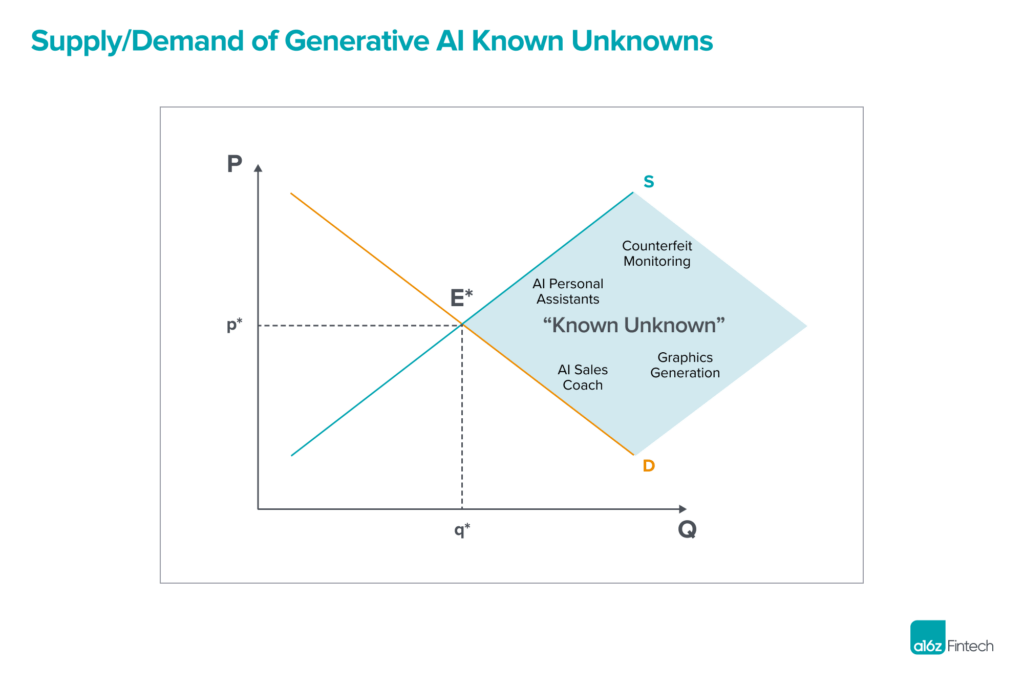

Known unknowns can be best illustrated with a simple Economics 101 Supply/Demand graph. There are some products where there’s massive supply at a very high price point, and massive demand at a very low price point…but there is no intersection. The curves simply do not meet.

Upwork and Fiverr both have extensive marketplaces for custom images and artwork, but it seems Midjourney has demonstrably more revenue than both of their graphics categories combined. Why? Because $20/month unlocks a tremendous amount of demand that simply did not exist at $500/image. It’s not always about cost—it’s also about speed. A Midjourney image takes less than 30 seconds to create, unlocking demand that was literally impossible with a human artist as a bottleneck—no matter what the cost.

LVMH likely spends tens of millions of dollars a year fighting counterfeit goods, sending cease and desist letters, cooperating with law enforcement, etc. How many small Shopify merchants might want the exact same service? All of them! How many could spend $50M/year? None of them. How many might spend $1,000/year? Maybe all of them?

TABLE OF CONTENTS

Unknown unknowns

TABLE OF CONTENTS

By definition, an unknown unknown is just…unmodelable. There’s no mental model for finding them, except: once it happens, it’s clear. Will entirely new behaviors emerge that nobody thought possible? But once they emerge, they can easily be observed. Students stop going to school, given AI personalized tutoring? Fewer marriages, given AI companionship? Employee Avatars, preserving employee personalities and ongoing interactions, seeded from email inboxes?

TABLE OF CONTENTS

Nobody doubts that AI will change the world—at the limit, artificial intelligence may exceed the importance of the wheel, fire, and electricity for the human species. But for the economic impact, the changes will likely be shepherded by incumbents and a new era of “corporate raider” for known knowns and an exciting number of yet-to-be-imagined startups for known unknowns and unknown unknowns. The BarbAIrians are at the gates.