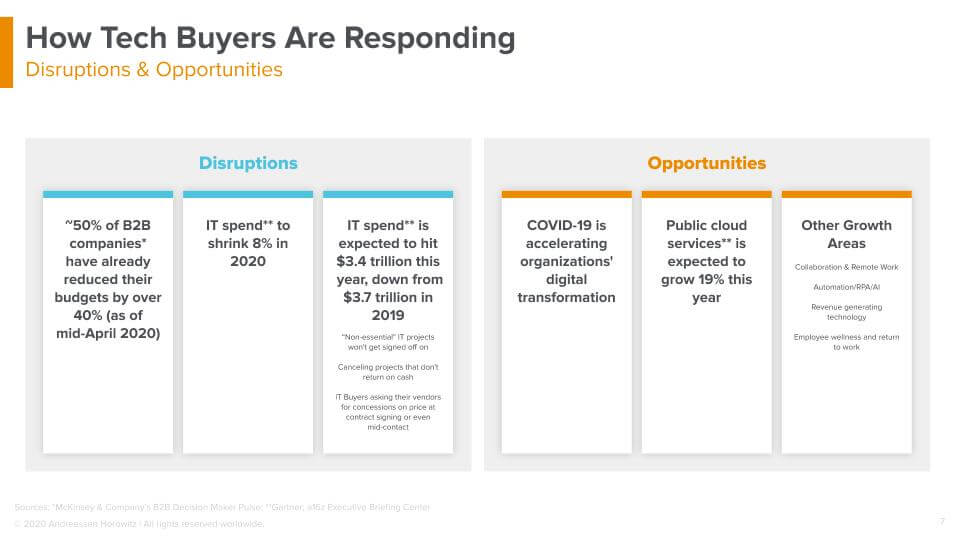

During COVID-19, sales teams face a set of twin challenges – reduced IT budgets in an uncertain market and selling when business is virtual. Already half of B2B companies have reduced their budgets by over 40%. Overall, IT spend is predicted to drop 8% in 2020 – as enterprises spend roughly $300B less than they did in 2019.

But there is a silver lining: downturns are typically when the most dramatic changes in relative market share happen. The 2008 recession allowed many SaaS challengers to become the new incumbents. Today, more businesses are accelerating digital transformations to reduce costs, improve customer experience, and remain competitive. While budgets are overall smaller, public cloud services are expected to grow 19% this year, and many companies are investing in automation and remote collaboration tools.

Over the past three months, we have met with enterprise executives and startup founders to understand what is happening on both sides of the market. In this post, we round up 16 key questions to help you sell and survive. We start with the different stages of the sales funnel, then look at adjusting sales quota and compensation, and finish with go-to-market strategy around channel, geographies, and verticals.

In short, for B2B startups, a downturn can be a boon – the trick is to survive.

For B2B startups, a downturn can be a boon – the trick is to survive.Of course, there is no one-size-fits-all guide for selling in COVID-19, and what is right for you will depend on your market position and product relevance, but we hope this provides a starting framework for charting your course.

TABLE OF CONTENTS

1. What trends are you seeing in the sales funnel?

2. What are the funnel metrics and signals to watch right now?

3. How do you build funnel and do demand generation when you can’t hold in-person events?

4. Especially for early stage startups, how should you think about finding product-market fit during COVID-19?

5. How do you know if your pipeline is accurate? Does it require a different qualification process?

6. What is the role of BDRs (business development representatives) right now? Should we be prospecting for new deals in this environment?

7. How do I do a proof of concept if previously it involved going onsite?

8. How should I balance holding customers accountable to contracted commitments versus being understanding that the customer context has changed (e.g. projects are on hold, applicable users are reduced) and taking a loss on anticipated revenues and ACB (adjusted cost base)?

9. If a company had a pre-COVID forecast of $100 million dollars, and now they’re forecasting $80 million. Do you adjust the quotas to match the $80 million? Do you keep the $100 million as the Salesforce number? How do you adjust quotas after you adjust down on your forecast?

10. What about sales compensation? Should we put our sales reps on a draw?

11. Should I move from a quarterly to monthly quota to better monitor things?

12. If we are reducing headcount, how should we realign the sales force?

13. How should I be thinking about channels? Do you foresee a particular segment of channel partners performing better than others over the next few quarters, such as low margin corporate resellers versus value-added resellers (VARs) with higher margins and professional services?

14. Given the market power of more established channel partners, how do I evaluate the risk versus the opportunity?

15. How are different geographies responding to COVID-19?

16. How do I think about the changes in which verticals are buying versus the verticals that pre-COVID made up our primary market?

The sales funnel

1. What trends are you seeing in the sales funnel?

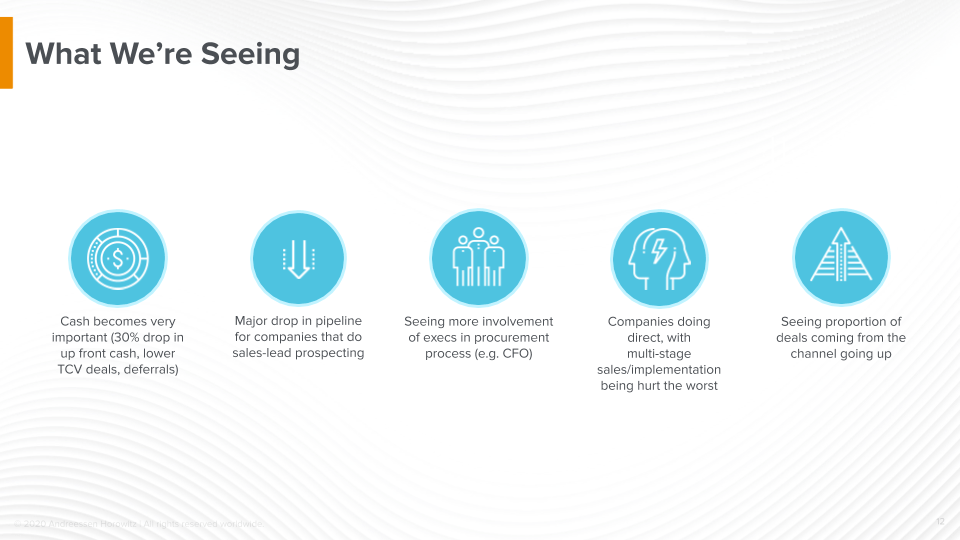

From talking with a number of CROs and founders, we estimate companies are seeing about a 30% drop in upfront cash, as actual payments are being delayed or deferred, and total contract value (TCV) is lower. Pipeline is also down dramatically, particularly in companies that have sales-led prospecting, and deals are becoming more complicated, as CFOs and other executives become more involved in procurement, even for smaller deals.

Generally, these trends correspond to an impact on annual contract value (ACV) bookings and the topline. While we see renewal rates relative to bookings and channel deals are slightly up, these typically do not make up for the drop in topline. And companies with direct, multi-stage sales are being hit the hardest. If you can do bottoms-up, product-led, inside sales selling or remote selling, now is probably the time to invest there.

Go deeper with:

-Martin Casado

2. What are the funnel metrics and signals to watch right now?

Pipeline is the leading indicator for what the rest of the year is going to look like, so you should be tracking that very closely. First and foremost, monitor the accuracy of predictions and forecasts, quarter to quarter or month to month, as a sign for how well you have a handle on what’s going on.

In many cases, Q1 numbers were still bolstered by deals in procurement as shelter-in-place orders took effect. Q2 numbers are more likely to reflect the impact of reduced budgets and shifting customer priorities, but the full picture may not emerge until the end of Q3, or even the end of the year.

First and foremost, monitor the accuracy of predictions and forecasts as a sign for how well you have a handle on what’s going on.Once you have confidence in the accuracy of your predictions and forecasts, then look at your top of funnel: What does your beginning of quarter pipeline look like? How accurate are you in predicting sales-qualified leads? How accurate are you at predicting win rate and how it converts down the funnel? While it’s worth tracking your renewal rates, that’s a lagging indicator in terms of where to invest – it’s top of funnel that tells you where your business is going.

Go deeper with:

-Kristina Shen

Top of funnel – demand generation

3. How do you build funnel and do demand generation when you can’t hold in-person events?

Lean into the fact that virtual events require less for attendees to join. A virtual conference, if well executed, can result in larger numbers and more leads. According to Charles Race, President of Worldwide Field Operations at Okta, Okta’s annual conference Oktane typically draws 4,000-5,000 attendees to San Francisco. This year, they flipped the event to virtual and had over 20,000 people attend, generating over 4,000 leads. Okta has since switched 50 planned in-person events to 70 virtual events.

Race points out though, that the pipeline from virtual events may not progress the same as a traditional pipeline. You may be getting more tire kicking because people have time at home to look at online events and gather knowledge, so understand and monitor the conversion rates.

The pipeline from virtual events may not progress the same as a traditional pipeline, so understand and monitor the conversion rates. - @CharlesMRace @oktaFor smaller events, executives are working from home and easier to schedule, so rather than large webinars, plan smaller events that get your CEO or CTO in front of targeted buyers around specific topics of interest. In particular, community relationships will drive word-of-mouth marketing typically and accelerate product-led growth. Amanda Kleha, Chief Customer Officer at Figma, suggests asking, “Who are the important people in the market I’m interested in, and how can I gain their trust to help me later win over the broader community? Your customers want to talk to each other, so how do you create a platform or a place for them to talk to each other?” In Figma’s case, they facilitate customer-hosted virtual meetups, maintain Slack channels with key evangelists, and listen to customer feedback for how to keep the community engaged.

Go deeper with:

-Peter Levine

4. Especially for early stage startups, how should you think about finding product-market fit during COVID-19?

The first questions that you have to ask: Is customer behavior the way it is because of COVID-19? Will that behavior change when shelter-in-place orders lift? If so, then you’re looking for product-market fit in an environment that is not the actual market.

That said, if customer behavior will remain consistent, early sales is really about qualification, and the downturn can actually assist with finding product-market fit because customers almost qualify for you. When times are good, everyone wants to talk to you, but you may only see a few of those conversations convert to deals, making it hard to know what is repeatable. In a downturn, the people that talk to you likely have a burning need for your product.

This is a great time to go find product-market fit, with the caveat that you want to make sure the customer behavior will endure after COVID-19. @martin_casadoThe bottom line: this is a great time to go find product-market fit, with the caveat that you want to make sure the customer behavior will endure after COVID-19.

Go deeper with:

-Martin Casado

Mid-funnel – prospecting & qualifying

5. How do you know if your pipeline is accurate? Does it require a different qualification process?

Now is definitely the time to scrub the pipeline. Deals that were certain two months ago may have evaporated as budgets have been frozen or different signatory authorities are needed. In particular, many large companies are now requiring CFO sign-off for deals. To better qualify accounts, ask customers and prospects, even those that seemed certain a month ago, if they still have budget. Kaushik Shirhatti, VP Sales at NVIDIA (formerly VP Sales as Cumulus Networks, which was acquired by NVIDIA), says, “For all major projects, we ask: ‘How is COVID affecting our project?’ and then track responses in three buckets – no change, project delayed, TBD.”

Until you are confident in the accuracy of your forecasts and pipeline, stay close to your front-line account managers and ask what they are seeing. The sentiment from the field will likely be the best leading indicator of what is going on.

Go deeper with:

-Peter Levine

6. What is the role of BDRs (business development representatives) right now? Should we be prospecting for new deals in this environment?

This will depend on your business model and where your leads come from. If customers can self-serve initially, that will provide marketing qualified leads for BDRs to follow up on.

If you don’t have enough warm leads for your BDRs, consider switching BDRs to customer success managers (CSMs) to focus on adoption, retention, and renewal, since the two talent pools often overlap. Especially in a SaaS business, the CSM role comes to the fore because customer success drives adoption, and adoption reduces churn and drives up renewal rates. In the 2008-9 recession, many SaaS businesses used this tactic, and it had the added bonus of helping BDRs better understand customers.

If you don’t have enough warm leads for your BDRs, consider switching BDRs to CSMs to focus on adoption, retention, and renewal. -@kshensterGo deeper with:

-Kristina Shen

7. How do I do a proof of concept if previously it involved going onsite?

Ideally, you can switch from in-person to a remote installation, or if it requires someone on premise, you can enlist the customer to help with the install. If neither of those are options, then it is probably a sign that you need to do engineering or product work to make remote installations more seamless.

-Peter Levine

Bottom of funnel – closing & renewals

8. How should I balance holding customers accountable to contracted commitments versus being understanding that the customer context has changed (e.g. projects are on hold, applicable users are reduced) and taking a loss on anticipated revenues and ACB (adjusted cost base)?

You want to solve for long-term customer success. In a subscription business, it isn’t recurring revenue until the revenue actually recurs, and in a downturn, it’s easier to retain a customer and renew and expand an existing account than to acquire a new customer. Extending flexibility to customers, when you can, will win you customer loyalty and referrals in the long-term, assuming you can deliver successfully.

When renegotiating or changing contract terms, factor in that most subscription businesses are priced on a perceived basis, and whatever perceived price you hold will dictate what prices you can charge in the future and determine your total addressable market (TAM). If possible, look to other levers beyond price – flexible payment terms of additional professional services – rather than change the perceived price. As customers tighten budgets, we’re seeing a number of cases where customers simply can’t pay, particularly in hard hit sectors like travel and retail. In some cases, we are seeing cash deferrals of up to nine months.

Once one sales person gives something away to close a deal, an incentive for a specific deal can quickly become the new standard for all deals. We recommend implementing a deal desk, usually in the form of a mailing list or a chain of sign-off for deals over a certain threshold, to maintain deal structure around incentives and discounts to prevent reps giving away too much.

Go deeper with:

- 16 Sales Contract Clauses to Balance Risk & Reward

- The SaaS Go-to-Upmarket

- The Case for Services in Enterprise Software Startups

-Martin Casado, Peter Levine, and Kristina Shen

Sales Quotas & Comp

9. If a company had a pre-COVID forecast of $100 million dollars, and now they’re forecasting $80 million. Do you adjust the quotas to match the $80 million? Do you keep the $100 million as the Salesforce number? How do you adjust quotas after you adjust down on your forecast?

You want to set expectations that are achievable and realistic, not only because people need to get paid, but because great salespeople need to win. For great sales people, much like for a top athlete or prize fighter, confidence is a big part of your game. And the way you get confidence is you win and you have an attitude: “I never miss a number. I usually blow it out. I never lose to a competitor.”

For great sales people, much like for a top athlete or prize fighter, confidence is a big part of your game. And the way you get confidence is you win. -@bhorowitzSales numbers feed that psychology, so what you don’t want to do is have a number based on life before the pandemic, and now, all of a sudden, you are not getting paid and you are losing confidence. Eventually, your psychology will get to the point where you start making silly mistakes. You don’t listen carefully. You’re not patient. You press too hard.

You need to support your sales team in keeping their confidence high and that starts with a reasonable plan and then having an understanding of what’s going on in these cycles. It’s a fluid situation, and it’s not something anyone is able to predict, so focus on keeping your team in a place where they’re going to be effective.

Charles Race at Okta suggests not lowering quotas to the same extent as the forecast. “Look for around 90% delivery of quota. If quotas are too low and everyone is making 300% of their number, it will cost you a fortune, but if you set quotas too high, then you’ll see attrition. If you do feel that attainment is low and attrition could peak, you can always put quota reduction spiffs in place to help mitigate the actual risk on the individual earning money, but you don’t want to put yourself in a position where A) it becomes a self-fulfilling prophecy because you lowered the number, you’re never going to get it back up again, or B) that things do pick up, and you have to increase the quotas again.”

And COVID-19 aside, there is never going to be a year where the plan that you set out three to six months before the year started still holds true 18 months later. If you are still doing annual planning, this is the time to shift to a four-quarter rolling plan, where every quarter you project four quarters out. This will allow you to scale territories and capacity up or down, based on where you are seeing opportunity and where you are seeing pain.

Go deeper with:

-Ben Horowitz

10. What about sales compensation? Should we put our sales reps on a draw?

A draw functions almost as a forgivable loan for sales reps, so in a downturn, reps on a draw receive their on-target earnings (i.e. full base plus commission), even if they don’t hit their quota. The upside of a draw is that sales reps have a steadier income stream, and when the market recovers, they can pay it off with a good quarter.

However, a draw only works if you are confident your business is going to recover. So, before moving to a draw, do the cash planning to figure out, for the worst case scenario, what makes sense as a comp plan for reps.

And if you do a draw, you can still tie it to objectives. While organizations are used to paying for revenue or bookings, during COVID-19, it may make more sense to pay for other activities – how many people did a rep contact, how many new pipeline prospects did they generate. You can even align your comp structure to bolster your cash position by paying reps for accounts receivable rather than bookings.

Go deeper with:

- Why Must You Pay Sales People Commissions?

- How to Compensate Sales Reps

- Simplifying Sales Compensation

-Martin Casado & Peter Levine

11. Should I move from a quarterly to monthly quota to better monitor things?

This really depends on the size of deals and how long it generally takes to close deals. Monthly quotas typically work well if you are doing $20k or $30k deals over the phone. But if you are doing $500k deals that can take months to close, and that deal slips out of this month, there’s no incentive to go after it. In that case, a monthly quota is likely to create chaos.

-Peter Levine

12. If we are reducing headcount, how should we realign the sales force?

Generally, you want to consolidate or remap territories to eliminate underperforming geographies and better group accounts. The key questions to ask: What sort of pipeline coverage do different reps have? What stages of the pipeline are different accounts in? Is there any clustering of accounts where it would make sense to combine territories? Are there territories that naturally align by vertical? Does it make sense to switch some geographies from direct sales to channel sales because a partner has existing relationships with prospects?

And again, a rolling plan will allow for flexibility in staffing. Okta, for instance, releases headcount two quarters out so they have the flexibility to put it where they need it, rather than just backfilling the same role in the same place.

Go deeper with:

-Peter Levine

Verticals, Channels, and Territories

13. How should I be thinking about channels? Do you foresee a particular segment of channel partners performing better than others over the next few quarters, such as low margin corporate resellers versus value-added resellers (VARs) with higher margins and professional services?

You need a partner who has the customer relationship. For those early in the market, you may have been working with the scrappier, more boutique channel partners who can do lead gen and who understand your business. However, these smaller partners are often fighting to acquire customers in much the same way that you are. Partners who don’t have to do prospecting but can pull you into existing relationships are typically the better partners, and this may mean shifting your channel strategy to more established players who have the relationship and account control to actually help you establish the relationship.

Go deeper with:

-Martin Casado

14. Given the market power of more established channel partners, how do I evaluate the risk versus the opportunity?

Behavior follows business, so look for pull from the field sales team to evaluate a partnership and know that it is strategic. Do not go talk to the partner product manager and give him all your secrets.

Behavior follows business, so look for pull from the field sales team to evaluate a partnership and know that it is strategic. -@daviduIf it is strategic, it will likely kick-off a build versus buy decision. If it doesn’t, it probably doesn’t have support in the field, and you are unlikely to get the resources and priority for it to be successful. Once you see that pull from the field, you can match up your sellers with their sellers, identify the accounts they’re in that want your functionality, and then do the integration that the sales people want.

When negotiating the terms of the partnership, avoid entering into an exclusive arrangement. Larger partners will likely demand this, but to the extent that you have more partnerships, you can mitigate the risk of working with a larger partner.

-David Ulevitch

15. How are different geographies responding to COVID-19?

How geographies are responding is very situationally dependent, and the performance relevant to your business is probably more of an indication of the mix of channel and go to market than of the actual market conditions. For instance, I have seen a number of companies do better in Europe, not because the European market is in a better place than the U.S., but because they use partner channel sales in Europe. Similarly, I have seen companies do better in Latin America because they have a lower annual contract value and are using inside sales, while in North America, direct sales is chasing larger deals.

-Martin Casado

16. How do I think about the changes in which verticals are buying versus the verticals that pre-COVID made up our primary market?

Think about it as vertical discovery. As new opportunities come in – and if you have incoming right now, you should absolutely take it – use that to inform your vertical strategy and learn where there is good product-market fit and the best way to sell into new verticals.

Overall, my impression has been that higher margin businesses with more comfort in their cash position are more likely to still be buying. Financial services and gaming sectors seem to still be buying pretty aggressively. Media is still buying, but more flat, whereas retail, hospitality, advertising are just really rough right now. In the health and life sciences sectors, hospitals are under tremendous pressure because their profits come from elective care, and that’s gone very quickly to zero, so if it isn’t directly related to COVID-19, it will probably be hard to sell there. But in life sciences and research, there is still a lot of buying going on.

-Ben Horowitz

The bottom line is that COVID-19 is a health crisis, and the timeline for economic recovery will depend on the timeline for a vaccine. For B2B companies, this means preparing for the worst case scenario and planning what you will do if that happens, while also recognizing that with this disruption comes the opportunity for new incumbents, new technology, and new ways of working.

ACKNOWLEDGEMENTS: Special thanks to Charles Race of Okta, Amanda Kleha of Figma, and Kaushik Shirhatti of NVIDIA for contributing their experience and expertise.

image: Unsplash | @timmossholder