What do enterprise buyers in healthcare care about most when evaluating AI products?

To answer that question, we interviewed leaders from many of the largest healthcare providers and insurers across the country.

In Part A, we outlined the paths to generating unique value for the healthcare system and patients. Now, in Part B, we cover capturing and defending some portion of the value you generate.

We’ve designed this to mirror the thought process of an entrepreneur building an AI product with an enterprise use case. Throughout, we’ve integrated insights from the executives we interviewed at many leading healthcare organizations–including Bassett Healthcare Network, Blue Cross Blue Shield of MA, ChenMed, CommonSpirit Health, Marshfield Clinic Health System, Point32Health, Providence, UC Davis Health, and University of Pittsburgh Medical Center (UPMC)–to highlight how their decision criteria for evaluating AI solutions might inform your go-to-market strategy.

.

Positioning the product (with the enterprise buyer in mind)

Frame the problem you’re trying to solve

In a recent conversation with Daniel Barchi, CIO of CommonSpirit Health, he compared AI software purchasing to buying a car with lane assist technology. He asked: are individuals buying the lane assist technology itself, or are they buying a car that has lane assist incorporated and enjoying the enhanced experience?

In other words, buyers aren’t seeking AI for AI’s sake. They have a host of problems that they need solved, and they’re looking for the best, most cost-effective way to solve them.

Across our conversations, enterprise buyers emphasized repeatedly that their procurement decisions start with the problem in mind. Whether or not a program integrates AI is less important than quality, safety, usability, and cost.

Identify the specific champion within the organization who owns that problem, not the person who wants to buy AI

Relatedly, selling to enterprises requires identifying the specific person within the organization who owns the problem, not necessarily the person who’s most excited about AI. Because sales cycles can be long and complicated, entrepreneurs are most secure when they can find a champion who will keep the process moving through hiccups and obstacles. The ideal executive champion is the person who most acutely feels the pain of the problem remaining unsolved, is held responsible internally for solving the problem, and has the budget to solve it.

As Paul Uhrig, Chief Legal and Digital Health Officer of Bassett Healthcare Network and Executive Director of Bassett Innovation Center told us, “if we can get the ultimate user excited and to be champions about this, that I found to be very much the winning strategy.” That ultimate user could be a physician or a specific administrative team member.

Understand the buyer’s roadmap, their build vs. buy framework, and their best alternative

Once you’ve identified the buyer and, ideally, a champion for whom you’re solving a problem, the next step is to understand the buyer’s process. What is their roadmap of problems to solve, their framework for when they build internally versus buy externally, and their best alternative to working with you? Each organization’s culture around these questions is different. For example, we heard a variety of answers to the “build vs. buy” question from our interviews. Some organizations pride themselves on building their own tech stack in certain areas like patient experience, where others tend to look externally first before considering custom development.

When it comes to purchasing AI solutions specifically, some organizations have a predisposition to buying from larger incumbents, so be sure to have a crisp value proposition for why they should partner with a startup over a larger incumbent with whom they’re already working. For instance, perhaps you position your product as a best-of-breed solution that can be deployed against a specific use case with a faster implementation and time-to-ROI than others.

Finally, we heard a level of caution being applied to evaluating generative AI solutions, given that they are a relatively new capability for healthcare; Himanshu Arora, Chief Data and Analytics Officer of Blue Cross Blue Shield of Massachusetts said his organization is more likely to test AI solutions with internal use cases before getting conviction to test it with external members or providers. Be sure to demonstrate rigor around testing, validation, and safety of your generative AI solutions to engender trust before deploying such cutting edge capabilities in high-stakes settings.

Selling the product

Define the ROI case and KPIs in line with buyer’s priorities

Defining ROI and KPIs is not the moment to be vague. Defining these metrics correctly can be the difference between a successful implementation and “death by pilot.” Different buyers will define their ideal ROI differently, but it’s useful to have a conversation with them about what they prioritize and where your product can fit. For example, Jeri Koester, Chief Information & Digital Officer at Marshfield Clinic Health System, told us that she prioritizes physician satisfaction, even over more traditional metrics like revenue lift. Barchi told us that his team’s definition of ROI depends on the use case.

Projecting ROI for an AI co-pilot or autonomous AI solution might involve both a cost savings and revenue lift argument. While you might assume that revenue lift-based arguments win the day in all cases, some organizations may put more weight on cost savings, especially if the organization has a strategic initiative around cost reduction. For example, Arora talked about the four-legged stool of cost, quality, experience, and equity that drives their priorities.

In short, every buyer defines success differently. Especially early on, it’s important to take the time to understand the buyer’s priorities and carefully align your ROI case and KPIs accordingly.

Scope initial engagement in context of user workflow

Because so many buyers (understandably) place a high priority on ease-of-use, it’s essential to understand where your solution fits within the workflow of the organization. If providers are going to use it, how does it fit into their day-to-day? If the solution is targeted at administrators, which ones? Is it replacing an existing tool or layering on top? How much of an upfront user learning curve will there be? These are just a few of the questions that you should think through when scoping your initial engagement.

Koester warned us that standalone solutions, without being integrated into the existing workflow, often go unused. Uhrig emphasized that staff augmentation is critical—the solution should be a distinct value-add over the status quo. Rob Bart, Chief Medical Information Officer of UPMC, noted that clinician excitement stems from eliminating burdensome steps, not adding new ones. In other words, our interviewees almost unanimously expressed the need for thoughtful engagement within the user workflow.

This is where AI solutions might have a leg up, because AI-driven automation can reduce the number of workflow steps required for a human to perform if integrated correctly with the right input and output systems. Uhrig also points out that AI solutions appear to have the benefit of requiring relatively less training than traditional software products.

Manage data requirements in line with project scope, security, and privacy considerations

High-quality data is an essential ingredient for building high-performance AI products. However, buyers have important considerations around privacy and security, and must balance the risks against the potential utility of your product. As Arora noted, the more data you ask for, the more friction you add to the buying process.

Several buyers emphasized that the best vendors clearly articulate why they need each data element requested, and frame the ROI from the customer’s perspective on what they get for sharing it. You must be able to explain precisely why you need the data and what performance improvements the customer will realize by providing it. For AI products especially, buyers apply additional risk evaluation criteria. Bart shared an anecdote of a company that wasn’t upfront with how data would be used; as he noted, health systems must be protective of their patients’ safety and security, even as they want to help AI tools develop. Transparency is critical.

Packaging and pricing

We’ve seen a range of packaging and pricing strategies from companies selling AI solutions into the enterprise, largely driven by the nature of the job-to-be-done (JTBD), and how buyers have paid for services in that domain historically. Some examples include:

- Traditional surrogate pricing: some companies implement pricing that mirrors a surrogate solution that the buyer is paying for already. For instance, an AI payments collections company might implement a take rate-based pricing model to mirror how traditional billing outsourcing shops charge for their services. We’re also seeing some AI care management and therapy companies exploring billing insurance using established CPT codes for asynchronous care.

- API based pricing (platform + utilization-based fees): others are selling access to an API atop their AI model that enables the enterprise customer to build their own custom applications. This might look like some combination of a platform subscription, specific endpoint subscriptions, and utilization-based fees.

- SaaS subscription: if the AI is being packaged as software products to be used by employees or customers of the enterprise, pricing might look more like a straight SaaS subscription.

- AI staff “wage”: the most cutting edge pricing model is to have customers hire “AI staff” as if they were hiring workers, but at a fraction of the effective wages they would be paying for human staff. This is most likely to apply to non-clinical, sub-clinical, or administrative jobs where the organization is experiencing staffing shortages, and where it’s likely that an AI product could operate autonomously with minimal oversight (and programmed to escalate to humans when necessary). While it’s unlikely we’ll see W-2s or 1099’s being filed by AI staff in the immediate future, the framing could be a straightforward way for buyers to justify the budget.

These strategies are not mutually exclusive, and we see some startups implementing multiple forms of pricing and packaging.

Defending the product

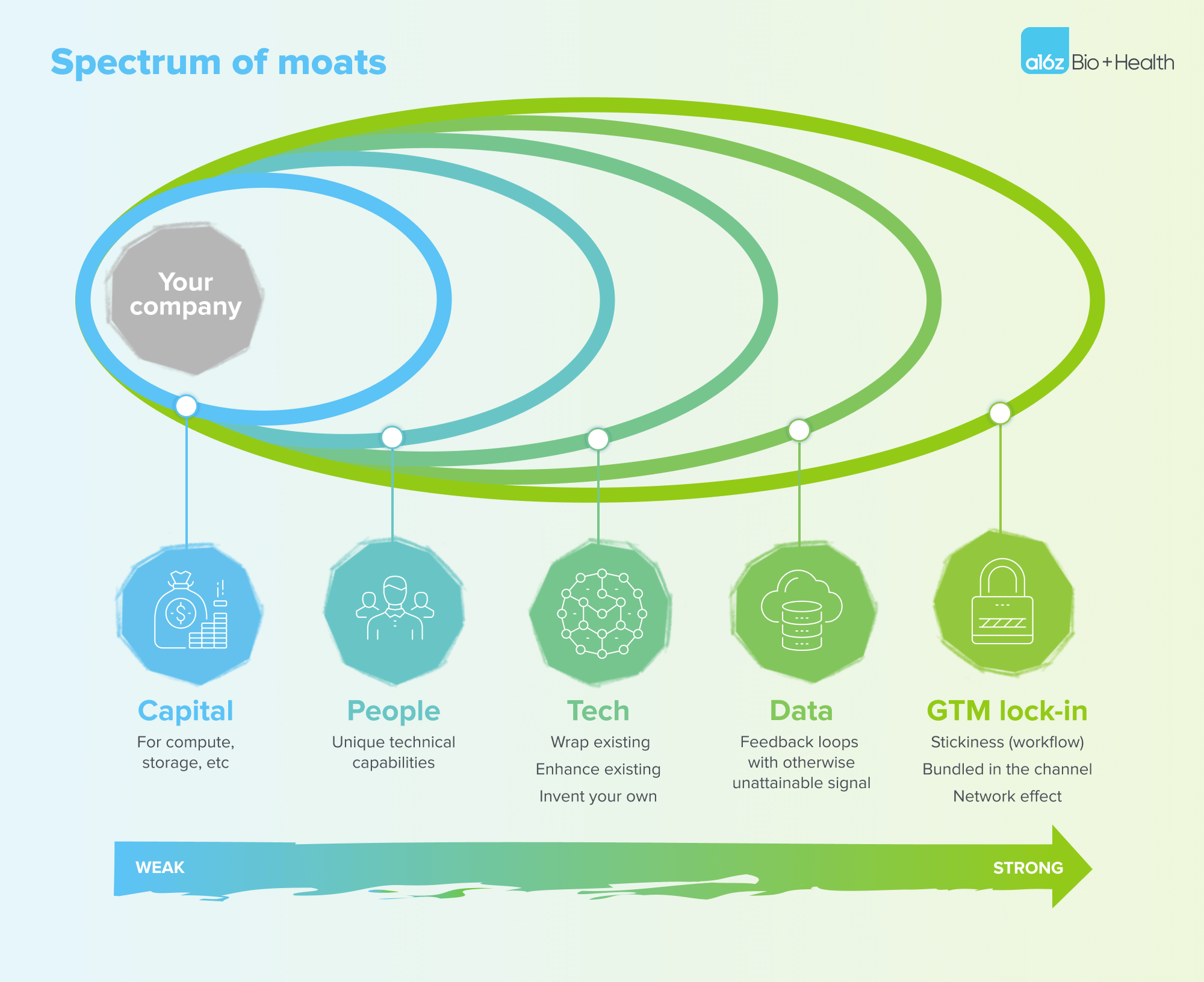

Even once you’ve identified where you can uniquely generate value for your customer and established how to capture an attractive portion of that value, you still won’t have a business for very long without a moat to sustainably defend your business model from competition over time. For AI products in healthcare, we see a spectrum of moats, ranging from the most easily breached to the most fortified:

Capital

Generative AI foundational model development requires an unprecedented amount of compute resources. They have a unique property of continuing to improve in performance with more training and inference time, even at a massive scale of compute. As a result, the upfront product development costs are much higher than for most traditional enterprise software products, with compute being the primary bottleneck.

We’ve seen many companies spend more than 80% of their total capital raised on compute resources alone. As a result, having both access to capital and preferred relationships with compute providers to access scarce GPUs/TPUs can provide a near-term moat.

The level of investment scales based on product development approach. There are several main approaches to building a generative AI product, ranging from building a wrapper around an existing foundational model (the cheapest) to building a domain-specific specialist model (requiring orders of magnitude greater amounts of data and compute).

In addition, if you are building against clinical use cases you may need to pursue FDA clearance (510k or SAMD), which requires additional resources to get your product to market and also may provide an additional form of defensibility.

Consider all of these when designing your initial fundraising strategy, and what product and commercial milestones on which you could base your financing tranches–particularly if you believe there is a durable advantage to being first to market in your problem space.

People & tech

At the time of the writing of this piece, there is a relatively finite number of people on the planet who have built and trained foundational large language models at scale. As such, aggregating a high density of these individuals on your team can provide a real competitive advantage. This is especially true if you are building a domain-specific specialist model.

Related to talent is whether you’ll differentiate through a technical advantage (e.g. building a breakthrough model architecture) and/or through integrating with openly available models (e.g. GPT-4, etc.). It also matters how durable that differentiation remains as new models are released in the future (e.g. GPT-4V, GPT-X, etc.).

Data

The performance of an AI product on a given task is partly a function of the data on which it was trained. So, having access to proprietary data with which to generate otherwise unattainable performance can provide a moat.

The leading foundation models have been trained on massive bodies of text–essentially the entire internet–and they are continuing to train on human feedback through their explosive user engagement, raising important questions around where value will accrue for generative AI platforms.

When building specialist AI models for healthcare, however, there is still only so far one can go with publicly available data sources. A proprietary data sourcing strategy, for now, remains essential to driving state-of-the-art performance.

We’ve seen early versions of model tuning approaches that enable customers to maintain ownership of their internal data assets, while still allowing the builder to align models to enterprise-specific rules and norms. As AI becomes more integrated into enterprise healthcare, this is also an area where business model innovation can help align data suppliers (providers, payors, patients, etc) with data consumers (model developers), whether it be through equity arrangements, revenue share models, or multi-sided networks.

GTM lock-in

We believe the strongest moats in healthcare come from achieving go-to-market lock-in with your customers.

The best enterprise software products are sticky because of how embedded they become in the core user’s workflow and overall enterprise IT environment. Customers become reluctant to rip these products out as they become core operating systems, locked into long-term contracts with high organizational switching costs. This can also be why incumbent software providers can have a distribution advantage over startups by already having their products deployed at their customer organizations. For example, incumbent EHR vendors such as Epic and Oracle Cerner are incorporating LLMs into their current product deployments and bundling them into their existing products pushed through their well-established customer bases.

Ultimately though, all of the go-to-market strategies we’ve written about in healthcare–from B2C2B to channel partnerships to vertical integration to networks–can be used to drive defensibility for AI products.

Conclusion

At the end of the day, even the best AI models will fail without broad distribution and profitable monetization, so it’s important to understand the psyche of the buyers and decision makers who will determine the fate of your products. Per our healthcare AI thesis, we believe that the best builders of enterprise healthcare AI solutions will both understand how to exploit the latest advancements in AI tech, and, more importantly, how to commercialize a product with a durable go-to-market strategy.

We hope these frameworks will help entrepreneurs point their arrows in the right direction as they build their businesses, because, as we heard from these executives, the healthcare industry desperately needs solutions to the scalability and cost structure problems that can be addressed by AI.

Thank you to everyone who agreed to speak with us and share their perspective on this topic, including: Ashish Atreja, Daniel Barchi, Himanshu Arora, Jack O’Hara, Jeri Koester, Paul Uhrig, Rob Bart, Sara Vaezy, and Selma Ferhatbegovic-Fede.